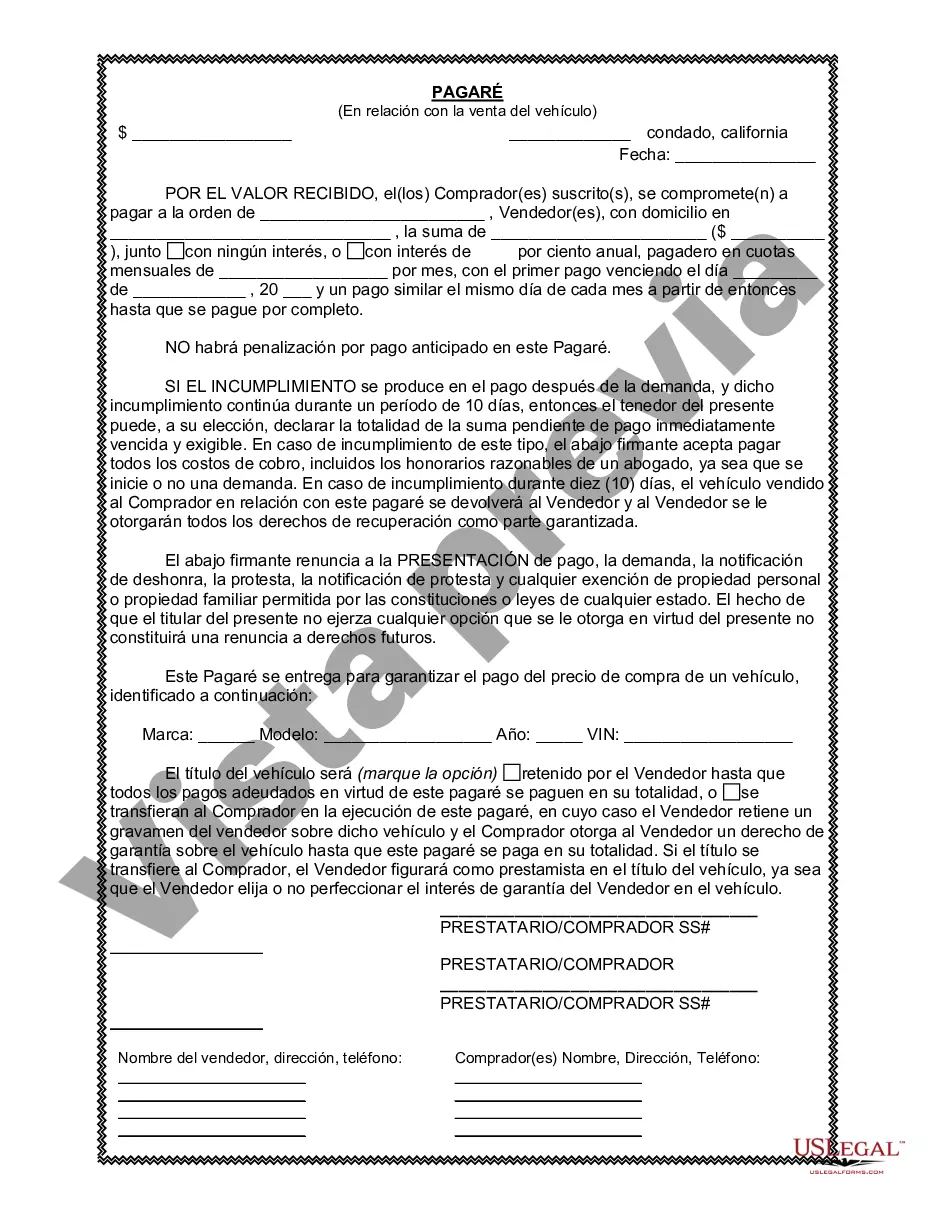

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Corona California Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a financing agreement between a buyer and seller for the purchase of a vehicle in Corona, California. It serves as a written promise from the buyer to repay the seller or financing party over a specified period of time, including the principal amount borrowed and any applicable interest. Keywords: Corona California, Promissory Note, Sale of Vehicle, Automobile, financing agreement, buyer, seller, legal document, terms and conditions, repayment, principal amount, interest. There are several types of Corona California Promissory Notes in Connection with Sale of Vehicle or Automobile based on various factors. Some of them include: 1. Fixed-Term Promissory Note: This type of promissory note establishes a specific repayment schedule, usually in the form of equal installments over a specified period of time. Both the buyer and seller agree on the duration of the loan and the amount to be repaid on each due date. 2. Balloon Promissory Note: In this type of promissory note, the borrower makes regular installment payments over a set period, but a larger final payment (balloon payment) is due at the end. This option allows for lower monthly payments initially, with a larger payment required at the end of the loan term. 3. Secured Promissory Note: A secured promissory note involves the buyer providing collateral, such as the vehicle being purchased, to secure the loan. If the borrower defaults on repayments, the seller has the right to repossess and sell the collateral to recover the outstanding debt. 4. Unsecured Promissory Note: Unlike a secured promissory note, an unsecured promissory note does not require collateral. This type of agreement relies solely on the buyer's promise to repay the debt as specified in the terms and conditions. 5. Default: A clause included in promissory notes, including those related to the sale of vehicles or automobiles, is the default provision. It outlines the consequences of failing to make timely payments or violating other terms of the agreement, such as penalties, fees, or potential legal action. It's essential to consult with a legal professional or utilize pre-existing templates specific to Corona, California, to ensure the promissory note complies with all relevant laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.