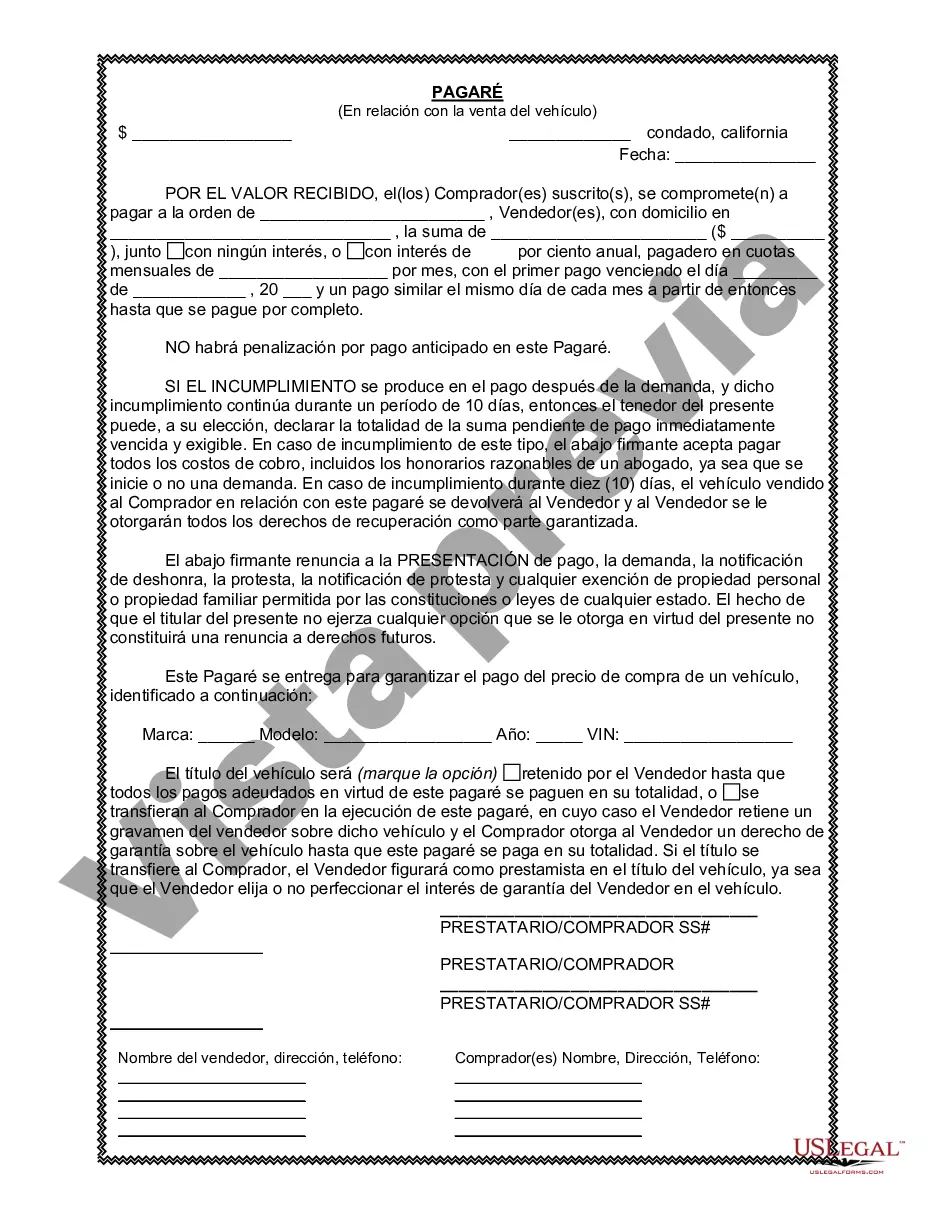

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Fullerton California Promissory Note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a borrower’s promise to repay the lender for a loan taken to finance the purchase of a vehicle. This note serves as evidence of the debt and provides protection to both parties involved in the transaction. Here are some important keywords to further understand the concept: 1. Fullerton, California: Referring to the specific location where the promissory note is being executed, in this case, Fullerton, California. 2. Promissory Note: A written promise to repay a loan, including specific terms and conditions agreed upon by both parties involved. 3. Sale of Vehicle or Automobile: This note specifically applies to transactions involving the sale of vehicles or automobiles. 4. Borrower: The individual or entity receiving the loan to purchase the vehicle, who is obligated to repay the lender. 5. Lender: The individual or entity providing the loan for the purchase of the vehicle. 6. Terms and Conditions: The specific details of the loan, including the repayment schedule, interest rate, late payment penalties, and any other agreed-upon terms. 7. Debt: The amount borrowed by the borrower and subject to repayment. 8. Evidence: The promissory note serves as legal evidence of the loan agreement between the borrower and lender. 9. Protection: The note protects both parties involved by clearly outlining the responsibilities and obligations of each. 10. Transaction: Referring to the overall sale and purchase of the vehicle, including the financial aspect covered by the promissory note. Different types of Fullerton California Promissory Notes in connection with the sale of the vehicle or automobile may include variations based on specific details, such as the amount of the loan, repayment period, interest rates, and other distinct terms. Some common types may include: 1. Fixed-term Promissory Note: This type of note specifies a predetermined repayment term, such as monthly installments over a fixed number of years. 2. Balloon Promissory Note: In this case, the borrower initially pays small monthly installments but agrees to a lump sum payment at the end of the term. 3. Secured Promissory Note: This note includes collateral, such as the vehicle being purchased or other assets as protection in case of default. 4. Unsecured Promissory Note: Unlike the secured note, this type does not include any collateral but may have higher interest rates to compensate for the increased risk. 5. Interest-only Promissory Note: In this arrangement, the borrower only pays interest for a specific period before starting to repay the principal amount. It's important to note that specific variations and additional types of promissory notes in connection with the sale of vehicles or automobiles may exist depending on the parties involved and any requirements set by the state of California or Fullerton city. Legal consultation from an attorney specializing in contracts and loan agreements is recommended to ensure compliance with applicable laws and to tailor the promissory note to fit the specific needs of the transaction.A Fullerton California Promissory Note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a borrower’s promise to repay the lender for a loan taken to finance the purchase of a vehicle. This note serves as evidence of the debt and provides protection to both parties involved in the transaction. Here are some important keywords to further understand the concept: 1. Fullerton, California: Referring to the specific location where the promissory note is being executed, in this case, Fullerton, California. 2. Promissory Note: A written promise to repay a loan, including specific terms and conditions agreed upon by both parties involved. 3. Sale of Vehicle or Automobile: This note specifically applies to transactions involving the sale of vehicles or automobiles. 4. Borrower: The individual or entity receiving the loan to purchase the vehicle, who is obligated to repay the lender. 5. Lender: The individual or entity providing the loan for the purchase of the vehicle. 6. Terms and Conditions: The specific details of the loan, including the repayment schedule, interest rate, late payment penalties, and any other agreed-upon terms. 7. Debt: The amount borrowed by the borrower and subject to repayment. 8. Evidence: The promissory note serves as legal evidence of the loan agreement between the borrower and lender. 9. Protection: The note protects both parties involved by clearly outlining the responsibilities and obligations of each. 10. Transaction: Referring to the overall sale and purchase of the vehicle, including the financial aspect covered by the promissory note. Different types of Fullerton California Promissory Notes in connection with the sale of the vehicle or automobile may include variations based on specific details, such as the amount of the loan, repayment period, interest rates, and other distinct terms. Some common types may include: 1. Fixed-term Promissory Note: This type of note specifies a predetermined repayment term, such as monthly installments over a fixed number of years. 2. Balloon Promissory Note: In this case, the borrower initially pays small monthly installments but agrees to a lump sum payment at the end of the term. 3. Secured Promissory Note: This note includes collateral, such as the vehicle being purchased or other assets as protection in case of default. 4. Unsecured Promissory Note: Unlike the secured note, this type does not include any collateral but may have higher interest rates to compensate for the increased risk. 5. Interest-only Promissory Note: In this arrangement, the borrower only pays interest for a specific period before starting to repay the principal amount. It's important to note that specific variations and additional types of promissory notes in connection with the sale of vehicles or automobiles may exist depending on the parties involved and any requirements set by the state of California or Fullerton city. Legal consultation from an attorney specializing in contracts and loan agreements is recommended to ensure compliance with applicable laws and to tailor the promissory note to fit the specific needs of the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.