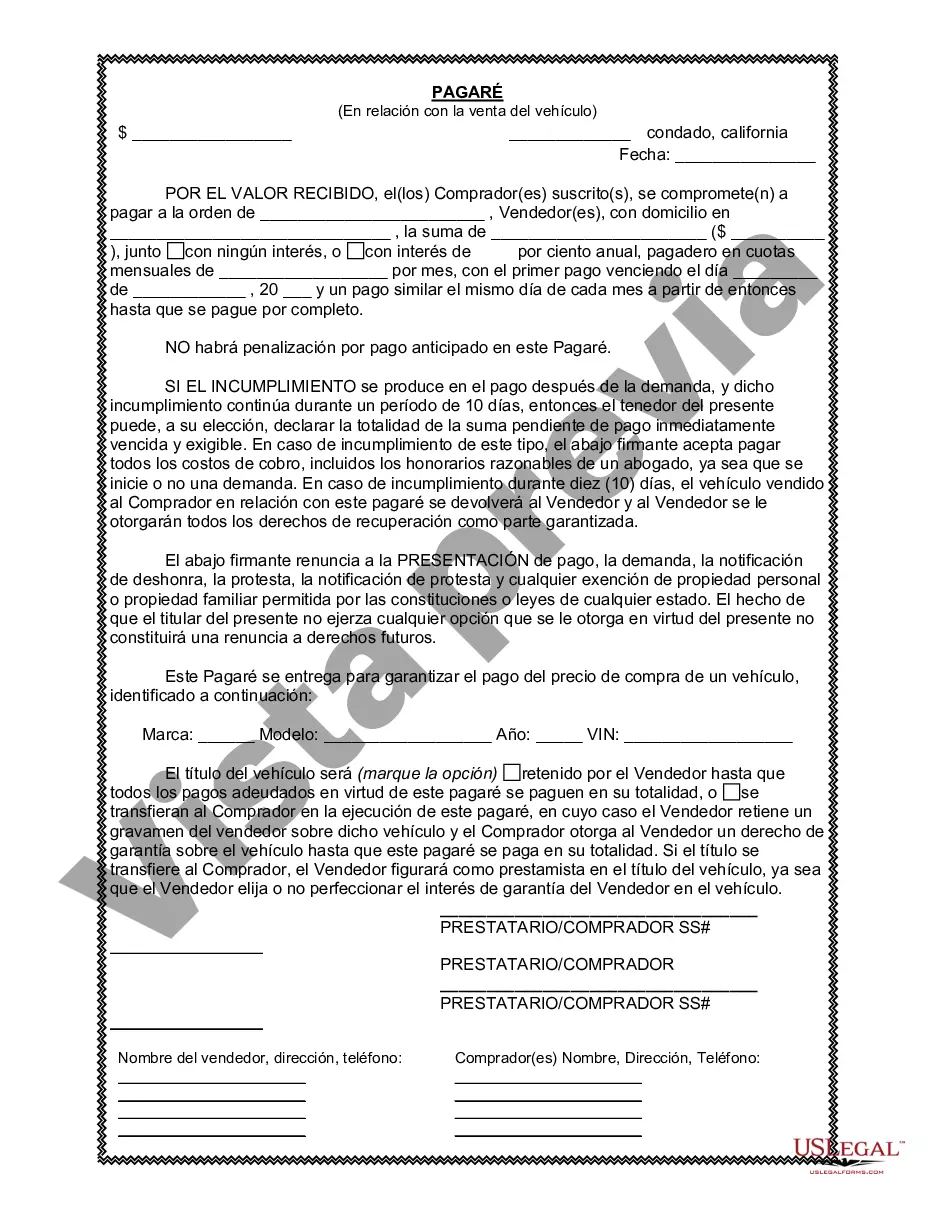

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Los Angeles California Promissory Note in connection with the sale of a vehicle or automobile is a legally binding written agreement that outlines the terms and conditions of a loan between the buyer and the seller. This promissory note is used when a vehicle or automobile is being sold, and the buyer needs financing from the seller instead of a traditional lender. The Los Angeles California Promissory Note for the sale of a vehicle typically includes essential details such as the names and addresses of both the buyer and the seller, the vehicle's make, model, and Vehicle Identification Number (VIN), the agreed-upon purchase price, and the terms of repayment. Furthermore, it outlines the interest rate, the frequency of payments, the due dates, and any penalties or fees associated with late payments or default. There are a few different types of Los Angeles California Promissory Notes in connection with the sale of a vehicle or automobile: 1. Fixed-Term Promissory Note: This type of promissory note specifies a set repayment period during which the buyer must repay the loan with interest. The note includes the exact repayment schedule, ensuring that the loan is fully paid off by the end of the predetermined term. 2. Installment Promissory Note: An installment promissory note allows the buyer to repay the loan amount, including interest, in regular installments over a specified period. Each payment covers a portion of the principal amount along with the accrued interest. 3. Balloon Promissory Note: This promissory note involves smaller installment payments for a set period, followed by one large "balloon" payment, which covers the remaining balance. The balloon payment is usually higher to ensure prompt repayment at the end of the loan term. 4. Simple Promissory Note: A simple promissory note is a basic agreement that outlines the terms of the loan without including too many complicated clauses or additional provisions. It is typically used for straightforward transactions and involves a fixed repayment schedule. Regardless of the type of Los Angeles California Promissory Note used, it is crucial to ensure that it complies with state laws and regulations regarding vehicle sales and financing. It is advisable to consult with a lawyer or legal professional to draft or review the promissory note to protect the rights and interests of both parties involved in the transaction.A Los Angeles California Promissory Note in connection with the sale of a vehicle or automobile is a legally binding written agreement that outlines the terms and conditions of a loan between the buyer and the seller. This promissory note is used when a vehicle or automobile is being sold, and the buyer needs financing from the seller instead of a traditional lender. The Los Angeles California Promissory Note for the sale of a vehicle typically includes essential details such as the names and addresses of both the buyer and the seller, the vehicle's make, model, and Vehicle Identification Number (VIN), the agreed-upon purchase price, and the terms of repayment. Furthermore, it outlines the interest rate, the frequency of payments, the due dates, and any penalties or fees associated with late payments or default. There are a few different types of Los Angeles California Promissory Notes in connection with the sale of a vehicle or automobile: 1. Fixed-Term Promissory Note: This type of promissory note specifies a set repayment period during which the buyer must repay the loan with interest. The note includes the exact repayment schedule, ensuring that the loan is fully paid off by the end of the predetermined term. 2. Installment Promissory Note: An installment promissory note allows the buyer to repay the loan amount, including interest, in regular installments over a specified period. Each payment covers a portion of the principal amount along with the accrued interest. 3. Balloon Promissory Note: This promissory note involves smaller installment payments for a set period, followed by one large "balloon" payment, which covers the remaining balance. The balloon payment is usually higher to ensure prompt repayment at the end of the loan term. 4. Simple Promissory Note: A simple promissory note is a basic agreement that outlines the terms of the loan without including too many complicated clauses or additional provisions. It is typically used for straightforward transactions and involves a fixed repayment schedule. Regardless of the type of Los Angeles California Promissory Note used, it is crucial to ensure that it complies with state laws and regulations regarding vehicle sales and financing. It is advisable to consult with a lawyer or legal professional to draft or review the promissory note to protect the rights and interests of both parties involved in the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.