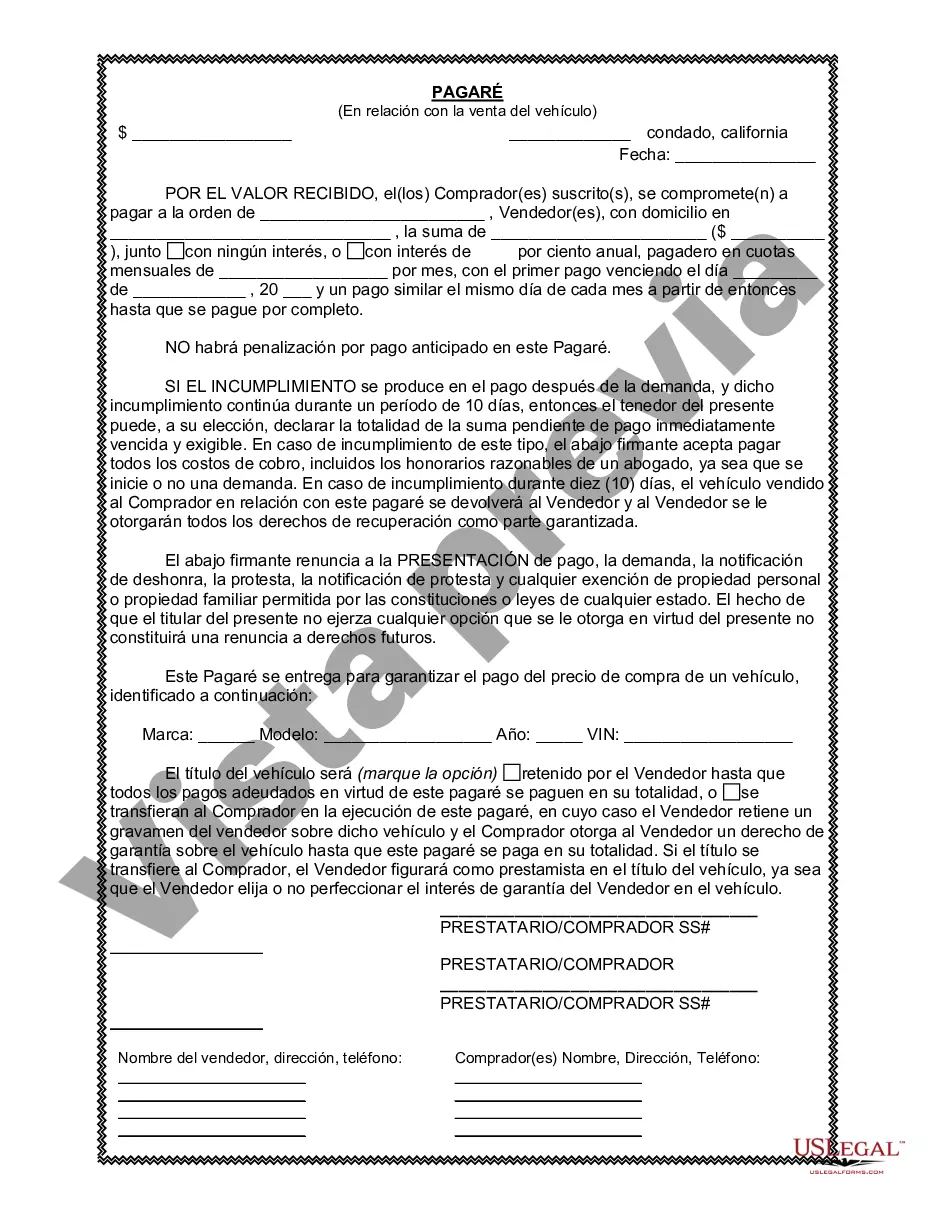

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A promissory note is a legal document that outlines the terms and conditions of a loan or financing agreement between two parties involved in the sale of a vehicle or automobile in Oceanside, California. It acts as a binding contract and provides security for the seller that the buyer will repay the agreed-upon amount with interest within a specified time frame. When it comes to Oceanside, California, there are various types of promissory notes in connection with the sale of a vehicle or automobile. Some commonly known types include: 1. Oceanside California Installment Promissory Note: This type of promissory note is used when the buyer agrees to repay the loan amount in regular installments over a specific period. The note clearly defines the repayment schedule, including the amount and frequency of payments. 2. Oceanside California Balloon Promissory Note: In this type of promissory note, the buyer initially makes smaller periodic payments, but a significant lump sum (balloon payment) is due at the end of the loan term. This allows the buyer to have lower monthly payments during the term but requires a larger payment at the end. 3. Oceanside California Secured Promissory Note: A secured promissory note in connection with the sale of a vehicle or automobile implies that the buyer offers collateral (usually the vehicle being purchased) as security for the loan. If the buyer fails to repay the loan, the seller can seize the collateral to recover the outstanding balance. 4. Oceanside California Unsecured Promissory Note: Unlike a secured promissory note, an unsecured promissory note does not require any collateral. The buyer relies solely on their creditworthiness and reputation to assure the seller that they will repay the loan. 5. Oceanside California Personal Guarantee Promissory Note: This type of promissory note involves a third-party (usually a guarantor) who promises to repay the loan if the buyer defaults. The guarantor's creditworthiness plays a significant role in the decision to grant the loan. Navigating the intricacies of promissory notes in connection with the sale of vehicles or automobiles in Oceanside, California, is essential to protect the interests of both parties involved. It is advisable to seek legal advice or consult an attorney specializing in contract and sales laws to ensure all necessary legal provisions are included in the promissory note to protect everyone's rights and avoid any potential disputes.A promissory note is a legal document that outlines the terms and conditions of a loan or financing agreement between two parties involved in the sale of a vehicle or automobile in Oceanside, California. It acts as a binding contract and provides security for the seller that the buyer will repay the agreed-upon amount with interest within a specified time frame. When it comes to Oceanside, California, there are various types of promissory notes in connection with the sale of a vehicle or automobile. Some commonly known types include: 1. Oceanside California Installment Promissory Note: This type of promissory note is used when the buyer agrees to repay the loan amount in regular installments over a specific period. The note clearly defines the repayment schedule, including the amount and frequency of payments. 2. Oceanside California Balloon Promissory Note: In this type of promissory note, the buyer initially makes smaller periodic payments, but a significant lump sum (balloon payment) is due at the end of the loan term. This allows the buyer to have lower monthly payments during the term but requires a larger payment at the end. 3. Oceanside California Secured Promissory Note: A secured promissory note in connection with the sale of a vehicle or automobile implies that the buyer offers collateral (usually the vehicle being purchased) as security for the loan. If the buyer fails to repay the loan, the seller can seize the collateral to recover the outstanding balance. 4. Oceanside California Unsecured Promissory Note: Unlike a secured promissory note, an unsecured promissory note does not require any collateral. The buyer relies solely on their creditworthiness and reputation to assure the seller that they will repay the loan. 5. Oceanside California Personal Guarantee Promissory Note: This type of promissory note involves a third-party (usually a guarantor) who promises to repay the loan if the buyer defaults. The guarantor's creditworthiness plays a significant role in the decision to grant the loan. Navigating the intricacies of promissory notes in connection with the sale of vehicles or automobiles in Oceanside, California, is essential to protect the interests of both parties involved. It is advisable to seek legal advice or consult an attorney specializing in contract and sales laws to ensure all necessary legal provisions are included in the promissory note to protect everyone's rights and avoid any potential disputes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.