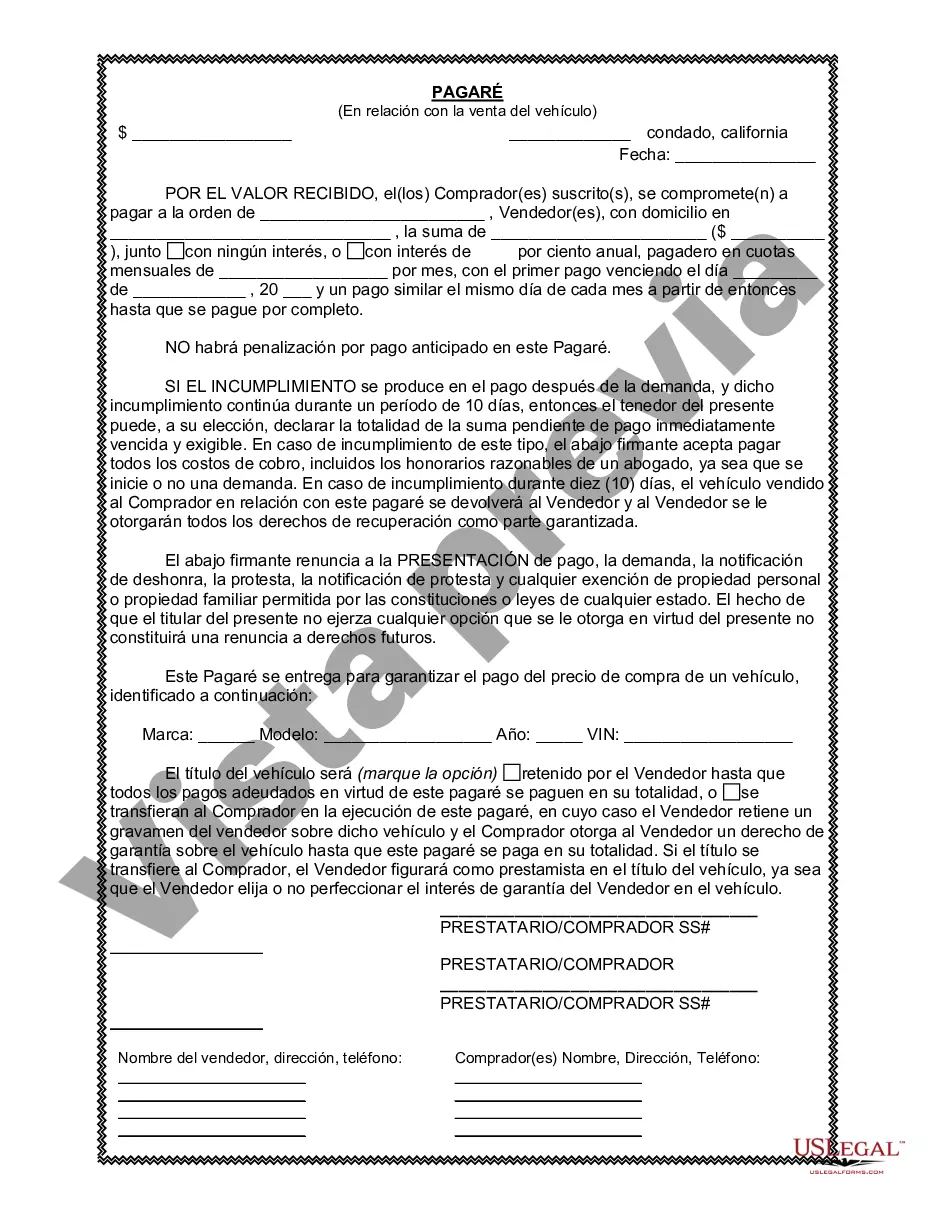

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Title: Understanding Palmdale California Promissory Note in Connection with Sale of Vehicle or Automobile Introduction: When buying or selling a vehicle or automobile in Palmdale, California, it is important to familiarize yourself with the Palmdale California Promissory Note in connection with the sale. A promissory note is a legal document that details the repayment terms and conditions when one party (the buyer) agrees to pay another party (the seller) for the purchase of a vehicle over a specified period. This article provides a detailed description of the Palmdale California Promissory Note and its different types concerning the sale of vehicles or automobiles. 1. Promissory Note Basics: In Palmdale, California, a promissory note is a written agreement that outlines the terms and conditions for the buyer's repayment of the vehicle purchase. It includes information such as the buyer and seller's names, the vehicle's description, the total purchase price, interest rates (if applicable), and the repayment schedule. 2. General Palmdale California Promissory Note: The General Palmdale California Promissory Note in connection with the sale of a vehicle is the common type used for these transactions. It covers the essential aspects of the agreement, ensuring both parties are aware of their obligations, payment due dates, and any consequences of defaulting on payments. 3. Secured Promissory Note: A Secured Promissory Note may be used when the buyer offers a security or collateral (such as the vehicle being purchased) to guarantee the repayment of the loan. In the event of default, the seller can repossess the vehicle. 4. Balloon Promissory Note: A Balloon Promissory Note involves regular payments to be made, but with a large final payment (balloon payment) at the end of the loan term. This type of note may suit buyers who anticipate refinancing or selling the vehicle before the balloon payment becomes due. 5. Installment Promissory Note: An Installment Promissory Note allows the buyer to repay their purchase in fixed installments over an agreed-upon period. Interest may be included in the agreement, and the buyer pays down both the principal and interest with each payment. 6. Simple Interest Promissory Note: A Simple Interest Promissory Note includes an agreed-upon interest rate that accrues on the unpaid principal balance. This type ensures that the buyer pays interest only on the outstanding balance, encouraging timely repayments. Conclusion: Before engaging in a vehicle purchase in Palmdale, California, understanding the Palmdale California Promissory Note in connection with the sale is crucial. It outlines the terms and conditions of the sale, repayment details, and protects the rights of both the buyer and seller. Whether it's a general promissory note, secured note, balloon note, installment note, or simple interest note, choosing the appropriate type is vital to ensure a fair and lawful automotive transaction.Title: Understanding Palmdale California Promissory Note in Connection with Sale of Vehicle or Automobile Introduction: When buying or selling a vehicle or automobile in Palmdale, California, it is important to familiarize yourself with the Palmdale California Promissory Note in connection with the sale. A promissory note is a legal document that details the repayment terms and conditions when one party (the buyer) agrees to pay another party (the seller) for the purchase of a vehicle over a specified period. This article provides a detailed description of the Palmdale California Promissory Note and its different types concerning the sale of vehicles or automobiles. 1. Promissory Note Basics: In Palmdale, California, a promissory note is a written agreement that outlines the terms and conditions for the buyer's repayment of the vehicle purchase. It includes information such as the buyer and seller's names, the vehicle's description, the total purchase price, interest rates (if applicable), and the repayment schedule. 2. General Palmdale California Promissory Note: The General Palmdale California Promissory Note in connection with the sale of a vehicle is the common type used for these transactions. It covers the essential aspects of the agreement, ensuring both parties are aware of their obligations, payment due dates, and any consequences of defaulting on payments. 3. Secured Promissory Note: A Secured Promissory Note may be used when the buyer offers a security or collateral (such as the vehicle being purchased) to guarantee the repayment of the loan. In the event of default, the seller can repossess the vehicle. 4. Balloon Promissory Note: A Balloon Promissory Note involves regular payments to be made, but with a large final payment (balloon payment) at the end of the loan term. This type of note may suit buyers who anticipate refinancing or selling the vehicle before the balloon payment becomes due. 5. Installment Promissory Note: An Installment Promissory Note allows the buyer to repay their purchase in fixed installments over an agreed-upon period. Interest may be included in the agreement, and the buyer pays down both the principal and interest with each payment. 6. Simple Interest Promissory Note: A Simple Interest Promissory Note includes an agreed-upon interest rate that accrues on the unpaid principal balance. This type ensures that the buyer pays interest only on the outstanding balance, encouraging timely repayments. Conclusion: Before engaging in a vehicle purchase in Palmdale, California, understanding the Palmdale California Promissory Note in connection with the sale is crucial. It outlines the terms and conditions of the sale, repayment details, and protects the rights of both the buyer and seller. Whether it's a general promissory note, secured note, balloon note, installment note, or simple interest note, choosing the appropriate type is vital to ensure a fair and lawful automotive transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.