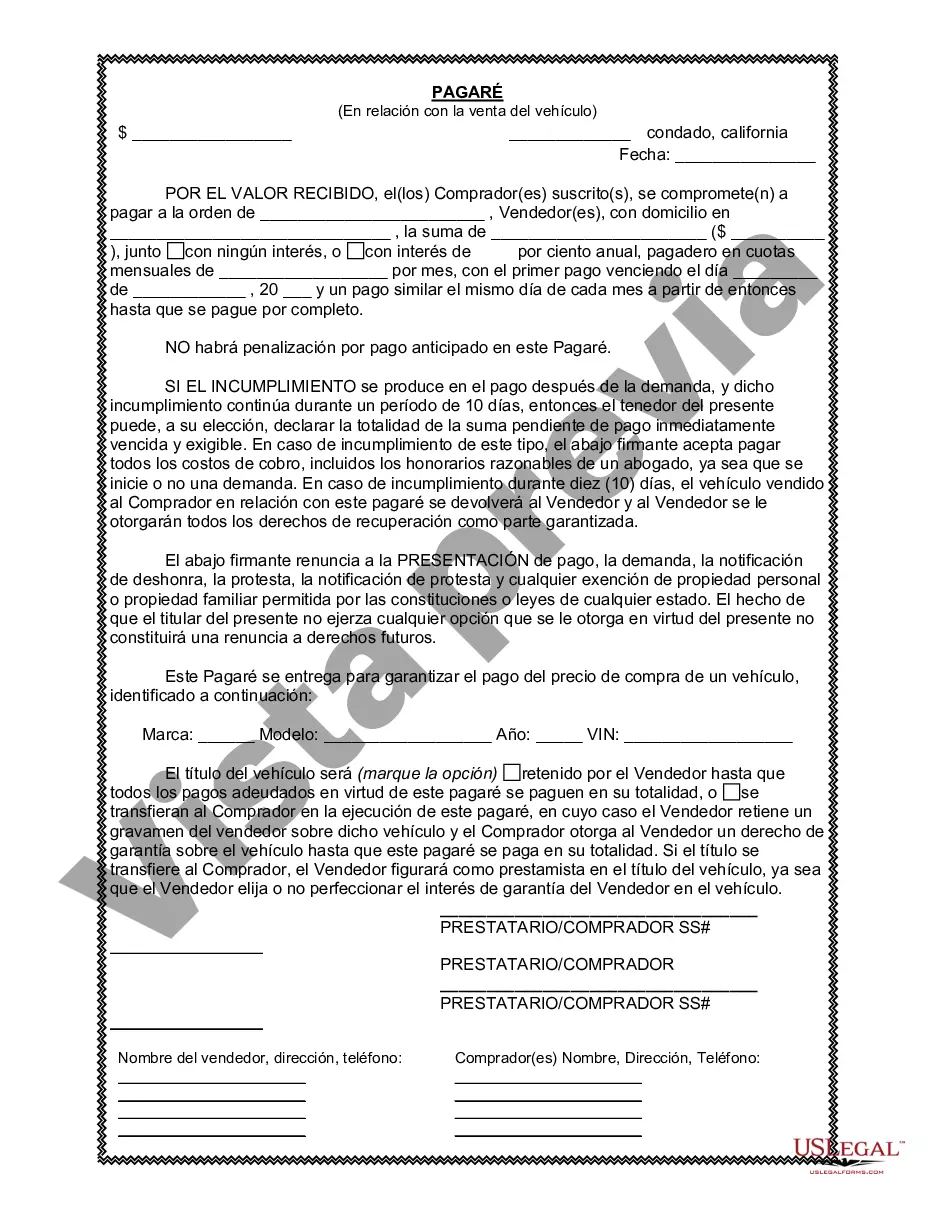

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Roseville California promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a loan agreement between a buyer and a seller. This note is commonly used when the buyer is unable to pay the full purchase price upfront and needs to make installment payments over a defined period. The Roseville California promissory note incorporates all the essential details of the sale, such as the vehicle's description, purchase price, down payment amount, interest rate (if applicable), payment schedule, and the consequences of defaulting on payment obligations. This document protects both parties by clearly defining their rights, responsibilities, and potential recourse. Different types of Roseville California promissory notes in connection with the sale of vehicles or automobiles may include: 1. Simple promissory note: This is the most basic form of a promissory note. It outlines the borrower's promise to repay the loaned amount and the agreed-upon terms for repayment. 2. Secured promissory note: In this type of promissory note, the buyer pledges the vehicle as collateral for the loan. This provides the seller with added security in case the buyer defaults on payment. 3. Unsecured promissory note: Unlike a secured promissory note, this type does not involve collateral. The buyer's promise to repay the loaned amount solely relies on their creditworthiness. 4. Balloon promissory note: This note involves the repayment of smaller monthly installments during a set period, with a final "balloon" payment due at the end. This payment is significantly larger than the monthly installments. 5. Installment promissory note: With this type of note, the buyer agrees to make equal monthly payments over a defined period until the loaned amount, including any interest, is fully repaid. 6. Interest-only promissory note: This note allows the buyer to make monthly payments covering only the interest on the loan. The principal amount is due as a lump sum at the end of the loan term. It is crucial to consult with a legal professional or utilize a standardized promissory note template specific to Roseville, California, to ensure compliance with local laws and regulations. Both parties should carefully review and understand the terms of the promissory note before signing to avoid any disputes or problems in the future.A Roseville California promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a loan agreement between a buyer and a seller. This note is commonly used when the buyer is unable to pay the full purchase price upfront and needs to make installment payments over a defined period. The Roseville California promissory note incorporates all the essential details of the sale, such as the vehicle's description, purchase price, down payment amount, interest rate (if applicable), payment schedule, and the consequences of defaulting on payment obligations. This document protects both parties by clearly defining their rights, responsibilities, and potential recourse. Different types of Roseville California promissory notes in connection with the sale of vehicles or automobiles may include: 1. Simple promissory note: This is the most basic form of a promissory note. It outlines the borrower's promise to repay the loaned amount and the agreed-upon terms for repayment. 2. Secured promissory note: In this type of promissory note, the buyer pledges the vehicle as collateral for the loan. This provides the seller with added security in case the buyer defaults on payment. 3. Unsecured promissory note: Unlike a secured promissory note, this type does not involve collateral. The buyer's promise to repay the loaned amount solely relies on their creditworthiness. 4. Balloon promissory note: This note involves the repayment of smaller monthly installments during a set period, with a final "balloon" payment due at the end. This payment is significantly larger than the monthly installments. 5. Installment promissory note: With this type of note, the buyer agrees to make equal monthly payments over a defined period until the loaned amount, including any interest, is fully repaid. 6. Interest-only promissory note: This note allows the buyer to make monthly payments covering only the interest on the loan. The principal amount is due as a lump sum at the end of the loan term. It is crucial to consult with a legal professional or utilize a standardized promissory note template specific to Roseville, California, to ensure compliance with local laws and regulations. Both parties should carefully review and understand the terms of the promissory note before signing to avoid any disputes or problems in the future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.