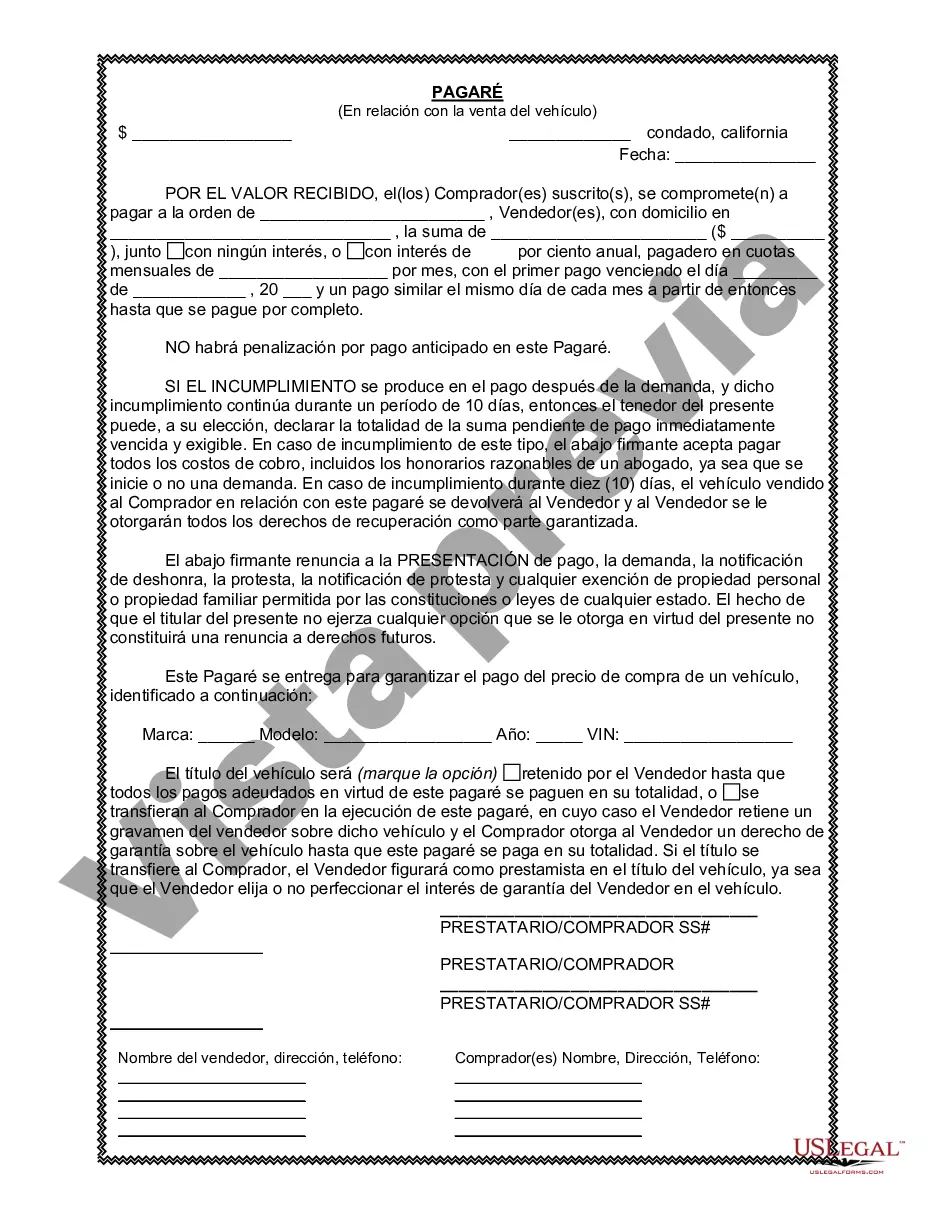

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A San Bernardino California Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a loan agreement between a seller (lender) and a buyer (borrower) for the purchase of a vehicle or automobile. It serves as a written record of the financial transaction and ensures both parties are aware of their obligations. The promissory note typically includes the following details: 1. Parties involved: Names and addresses of the seller and buyer. 2. Vehicle Description: Make, model, year, VIN (Vehicle Identification Number), and any additional relevant details. 3. Loan Amount: The agreed-upon purchase price of the vehicle. 4. Interest Rate: If applicable, the interest rate charged on the loan. 5. Repayment Terms: The schedule and method of repayment, such as monthly installments. 6. Due Date: The date by which the entire loan amount, including interest, must be repaid. 7. Late Payment Penalty: In case of default or late payments, the consequences and penalties involved. 8. Collateral: Indication of the vehicle being held as collateral until the loan is fully repaid. 9. Governing Law: The laws of the state of California, particularly San Bernardino County, that apply to the promissory note. 10. Signatures: Both parties must sign the document to acknowledge their agreement. Different types of San Bernardino California Promissory Note in Connection with Sale of Vehicle or Automobile may include: 1. Simple Promissory Note: Standard agreement with no conditions or additional clauses. 2. Secured Promissory Note: Includes specific details regarding the collateral and its valuation. 3. Installment Promissory Note: Payment terms are structured in installments over a certain period. 4. Balloon Promissory Note: The borrower initially pays smaller installments with a much larger final payment at the end of the loan term. 5. Variable Interest Rate Promissory Note: The interest rate may fluctuate based on external factors like the economy or an index. It's crucial for both parties to understand the terms of the promissory note before signing it, as non-adherence to its stipulations could lead to legal consequences. Consulting an attorney or qualified professional is advisable to ensure the agreement complies with applicable laws and protects the interests of both the lender and borrower.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.