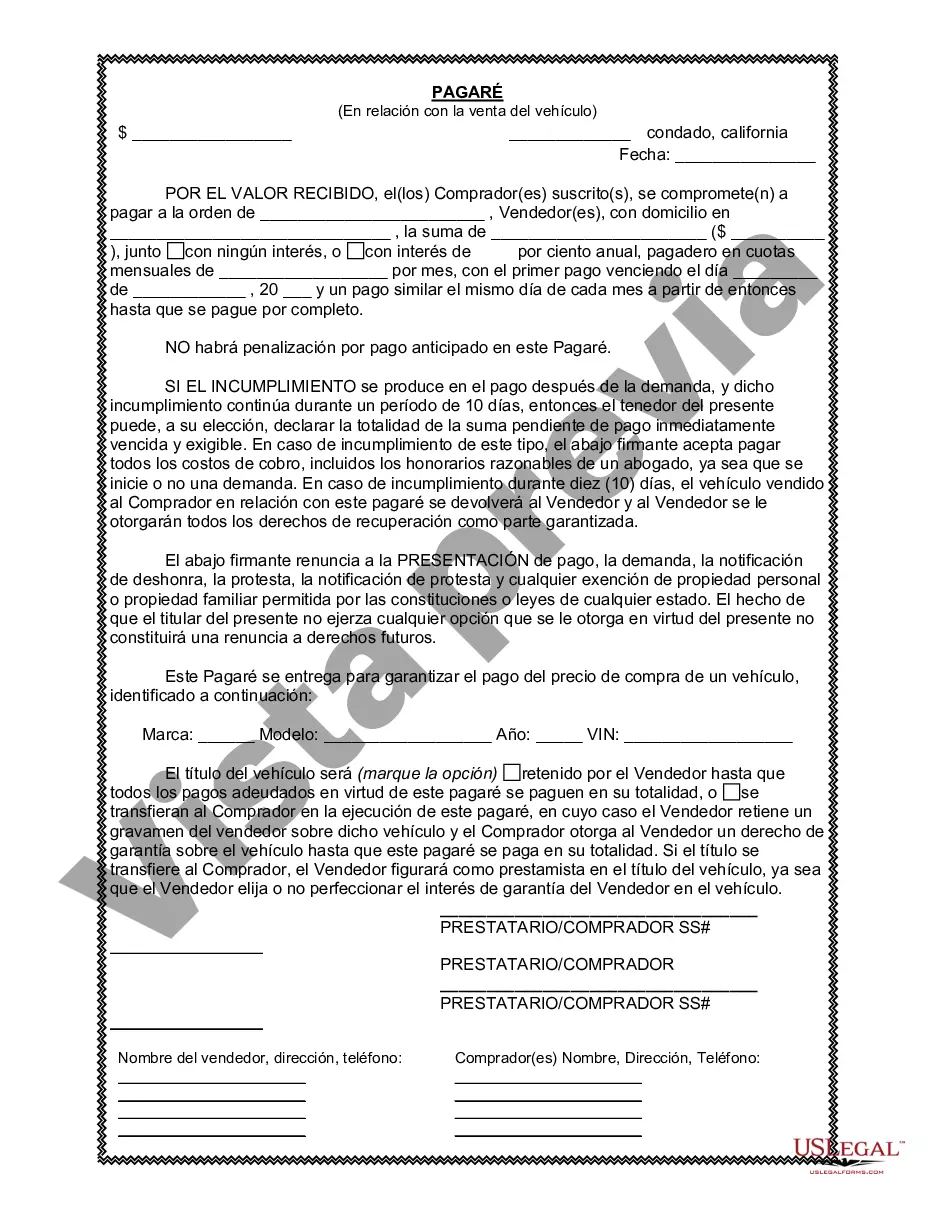

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A San Diego California Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a loan made between a buyer and a seller in the context of a vehicle sale. This promissory note serves as evidence of the loan and provides protection to both parties involved. When creating a San Diego California Promissory Note in Connection with Sale of Vehicle or Automobile, there are several key elements that should be included. These include: 1. Identification of Parties: The promissory note should clearly state the names and addresses of both the buyer (borrower) and the seller (lender). Their contact information should be provided for future communication purposes. 2. Vehicle Description: A detailed description of the vehicle being sold should be included in the promissory note. This includes the make, model, year, identification number (VIN), and any other relevant details to accurately identify the vehicle. 3. Loan Amount: The promissory note should clearly state the loan amount being provided by the seller to the buyer. This includes the total loan amount and how it will be disbursed (e.g., through cash, check, or other means). 4. Repayment Terms: The promissory note should outline the terms of repayment. This includes the agreed-upon interest rate, the number of installments, the amount of each installment, and the due date for each payment. 5. Late Payment Charges: The promissory note should specify any penalties or late payment charges that will be imposed in the event of default or late payments. This helps protect the seller's interests and encourages timely payments. 6. Collateral: In some cases, the promissory note may require the buyer to provide collateral in the form of the vehicle being purchased. This ensures that the seller has recourse if the buyer fails to make payments as agreed. 7. Governing Law: The promissory note should state that it is governed by the laws of the state of California, particularly San Diego County, to establish the jurisdiction in case of any disputes or legal proceedings. Different types of San Diego California Promissory Notes in Connection with Sale of Vehicle or Automobile may vary based on specific terms agreed upon by the buyer and seller. For example: 1. Simple Promissory Note: This is the most basic type of promissory note and includes essential elements such as loan amount, repayment terms, and identification of parties. 2. Interest-Bearing Promissory Note: This type of promissory note includes an agreed-upon interest rate that applies to the loan amount, which is additional to the principal amount. 3. Installment Promissory Note: With this type of note, the loan amount is divided into several installments with a specific due date for each payment. This is commonly used to enable the buyer to repay the loan in manageable monthly installments. By employing a San Diego California Promissory Note in Connection with Sale of Vehicle or Automobile, both the buyer and seller can have a clear and legally enforceable agreement that protects their respective rights and obligations throughout the loan repayment period. Proper documentation and adherence to the relevant legal requirements contribute to a smooth and transparent transaction.A San Diego California Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a loan made between a buyer and a seller in the context of a vehicle sale. This promissory note serves as evidence of the loan and provides protection to both parties involved. When creating a San Diego California Promissory Note in Connection with Sale of Vehicle or Automobile, there are several key elements that should be included. These include: 1. Identification of Parties: The promissory note should clearly state the names and addresses of both the buyer (borrower) and the seller (lender). Their contact information should be provided for future communication purposes. 2. Vehicle Description: A detailed description of the vehicle being sold should be included in the promissory note. This includes the make, model, year, identification number (VIN), and any other relevant details to accurately identify the vehicle. 3. Loan Amount: The promissory note should clearly state the loan amount being provided by the seller to the buyer. This includes the total loan amount and how it will be disbursed (e.g., through cash, check, or other means). 4. Repayment Terms: The promissory note should outline the terms of repayment. This includes the agreed-upon interest rate, the number of installments, the amount of each installment, and the due date for each payment. 5. Late Payment Charges: The promissory note should specify any penalties or late payment charges that will be imposed in the event of default or late payments. This helps protect the seller's interests and encourages timely payments. 6. Collateral: In some cases, the promissory note may require the buyer to provide collateral in the form of the vehicle being purchased. This ensures that the seller has recourse if the buyer fails to make payments as agreed. 7. Governing Law: The promissory note should state that it is governed by the laws of the state of California, particularly San Diego County, to establish the jurisdiction in case of any disputes or legal proceedings. Different types of San Diego California Promissory Notes in Connection with Sale of Vehicle or Automobile may vary based on specific terms agreed upon by the buyer and seller. For example: 1. Simple Promissory Note: This is the most basic type of promissory note and includes essential elements such as loan amount, repayment terms, and identification of parties. 2. Interest-Bearing Promissory Note: This type of promissory note includes an agreed-upon interest rate that applies to the loan amount, which is additional to the principal amount. 3. Installment Promissory Note: With this type of note, the loan amount is divided into several installments with a specific due date for each payment. This is commonly used to enable the buyer to repay the loan in manageable monthly installments. By employing a San Diego California Promissory Note in Connection with Sale of Vehicle or Automobile, both the buyer and seller can have a clear and legally enforceable agreement that protects their respective rights and obligations throughout the loan repayment period. Proper documentation and adherence to the relevant legal requirements contribute to a smooth and transparent transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.