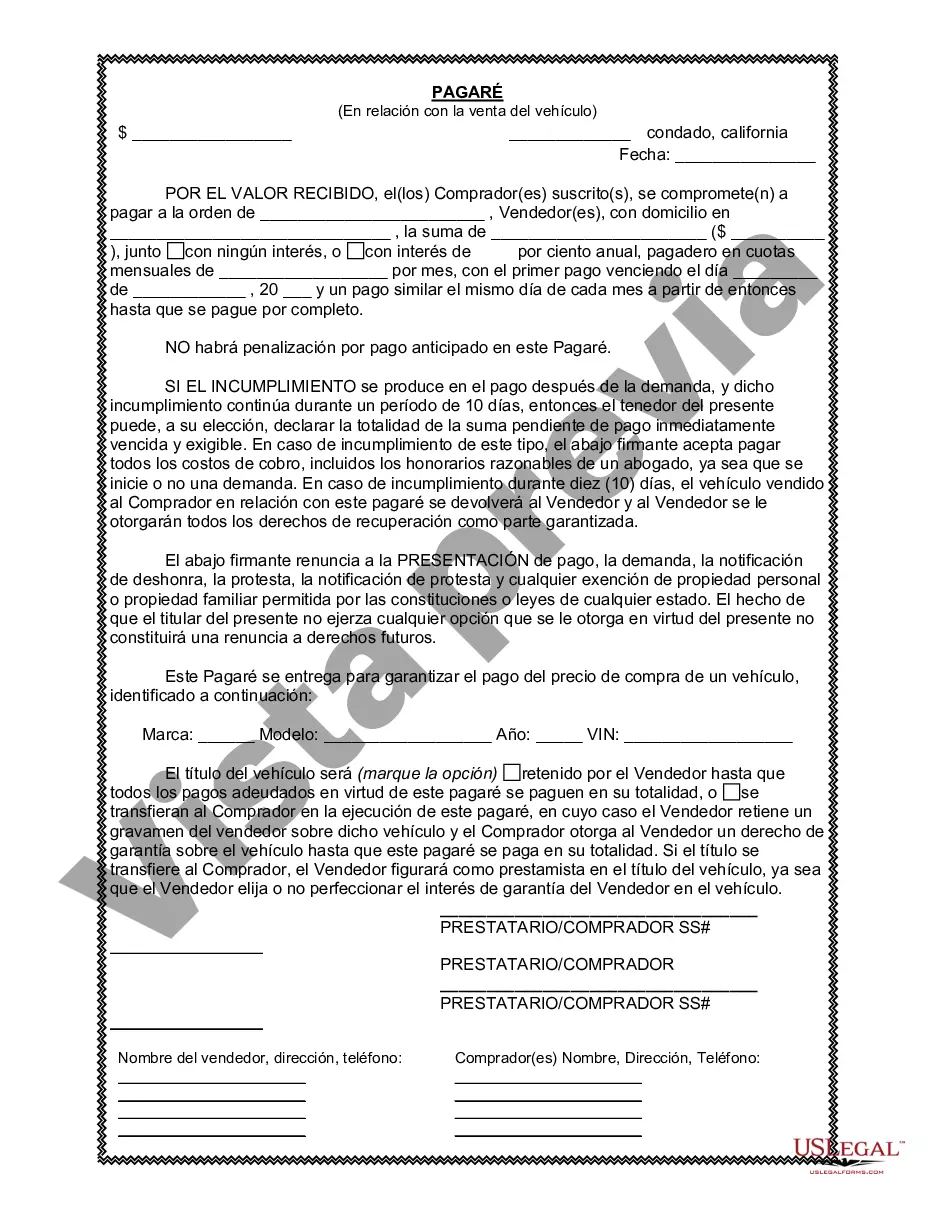

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A promissory note is a legal document that establishes a written promise to pay a specific amount of money at a determined date or over a specific period. In Santa Ana, California, a promissory note is commonly used in connection with the sale of a vehicle or automobile. It serves as a binding agreement between the seller and the buyer, outlining the terms and conditions of the sale. The Santa Ana California Promissory Note in Connection with Sale of Vehicle or Automobile typically includes several key elements. Firstly, it identifies the parties involved in the transaction, including their names, addresses, and contact information. Secondly, it provides detailed descriptions of the vehicle being sold, such as the make, model, year, color, and Vehicle Identification Number (VIN). This promissory note also incorporates the financial aspects of the sale. It specifies the total purchase price of the vehicle and the agreed-upon payment method, which can be either a lump sum or installment payments. The note further outlines the interest rate, if applicable, as well as any late fees or penalties that may incur in case of default. It is important to note that the interest rates within promissory notes in California are subject to state regulations. Additionally, the Santa Ana California Promissory Note in Connection with Sale of Vehicle or Automobile highlights the repayment terms and schedule. This includes the due date of each payment, the preferred payment method (e.g., cash, check, electronic transfer), and the location or address where the payments should be sent. The note may also clarify whether the seller retains ownership until the full payment is made or if the buyer takes immediate possession of the vehicle. It is important to understand that the state of California has specific regulations surrounding promissory notes in connection with vehicle sales. Individuals engaging in such transactions should consult with legal professionals to ensure compliance with all applicable laws. Moreover, it is crucial for both parties to thoroughly read and understand the terms stated in the promissory note before finalizing the sale, as it establishes the rights, responsibilities, and obligations of each party involved. In Santa Ana, California, different types of promissory notes may exist depending on the specifics of the sale or the preferences of the individuals involved. Some common variations may include: 1. Lump Sum Promissory Note: This type of note involves a one-time payment for the entire purchase price of the vehicle, without any installment plan or interest charges. 2. Installment Promissory Note: This note establishes a payment plan where the total purchase price is divided into regular, predetermined payments. Each payment includes a portion of the principal amount and, if applicable, interest charges. 3. Balloon Promissory Note: With this type of note, the buyer makes smaller regular payments over a period of time, but a final "balloon" payment is due at the end. This final payment is typically larger than the periodic installments, covering the remaining balance. 4. Secured Promissory Note: This note may include additional provisions where the vehicle serves as collateral or security for the loan. In case of default, the seller has the right to claim and repossess the vehicle. Remember, it is crucial to consult with professionals knowledgeable in local laws and regulations to ensure compliance with Santa Ana, California's specific requirements regarding promissory notes in connection with the sale of vehicles or automobiles.A promissory note is a legal document that establishes a written promise to pay a specific amount of money at a determined date or over a specific period. In Santa Ana, California, a promissory note is commonly used in connection with the sale of a vehicle or automobile. It serves as a binding agreement between the seller and the buyer, outlining the terms and conditions of the sale. The Santa Ana California Promissory Note in Connection with Sale of Vehicle or Automobile typically includes several key elements. Firstly, it identifies the parties involved in the transaction, including their names, addresses, and contact information. Secondly, it provides detailed descriptions of the vehicle being sold, such as the make, model, year, color, and Vehicle Identification Number (VIN). This promissory note also incorporates the financial aspects of the sale. It specifies the total purchase price of the vehicle and the agreed-upon payment method, which can be either a lump sum or installment payments. The note further outlines the interest rate, if applicable, as well as any late fees or penalties that may incur in case of default. It is important to note that the interest rates within promissory notes in California are subject to state regulations. Additionally, the Santa Ana California Promissory Note in Connection with Sale of Vehicle or Automobile highlights the repayment terms and schedule. This includes the due date of each payment, the preferred payment method (e.g., cash, check, electronic transfer), and the location or address where the payments should be sent. The note may also clarify whether the seller retains ownership until the full payment is made or if the buyer takes immediate possession of the vehicle. It is important to understand that the state of California has specific regulations surrounding promissory notes in connection with vehicle sales. Individuals engaging in such transactions should consult with legal professionals to ensure compliance with all applicable laws. Moreover, it is crucial for both parties to thoroughly read and understand the terms stated in the promissory note before finalizing the sale, as it establishes the rights, responsibilities, and obligations of each party involved. In Santa Ana, California, different types of promissory notes may exist depending on the specifics of the sale or the preferences of the individuals involved. Some common variations may include: 1. Lump Sum Promissory Note: This type of note involves a one-time payment for the entire purchase price of the vehicle, without any installment plan or interest charges. 2. Installment Promissory Note: This note establishes a payment plan where the total purchase price is divided into regular, predetermined payments. Each payment includes a portion of the principal amount and, if applicable, interest charges. 3. Balloon Promissory Note: With this type of note, the buyer makes smaller regular payments over a period of time, but a final "balloon" payment is due at the end. This final payment is typically larger than the periodic installments, covering the remaining balance. 4. Secured Promissory Note: This note may include additional provisions where the vehicle serves as collateral or security for the loan. In case of default, the seller has the right to claim and repossess the vehicle. Remember, it is crucial to consult with professionals knowledgeable in local laws and regulations to ensure compliance with Santa Ana, California's specific requirements regarding promissory notes in connection with the sale of vehicles or automobiles.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.