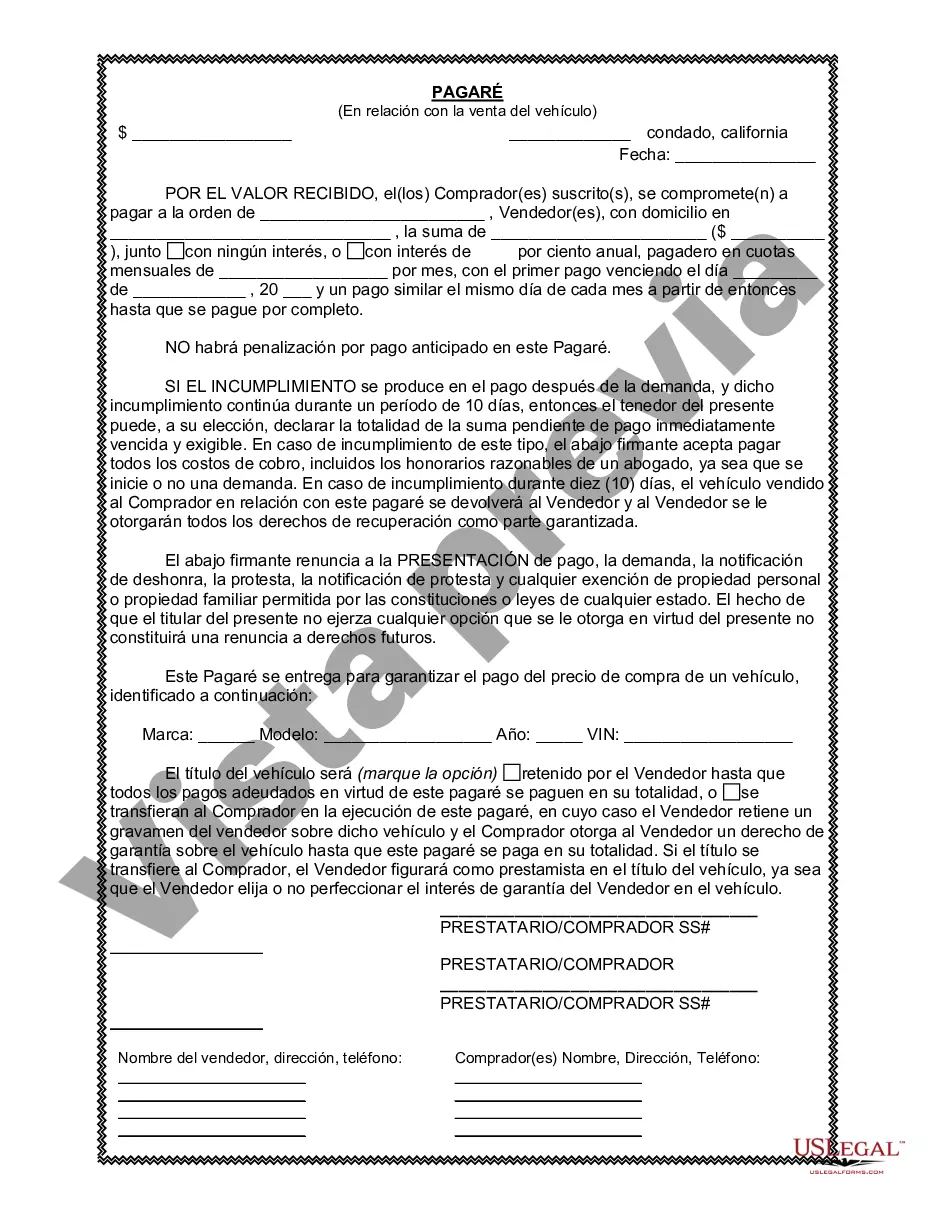

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Simi Valley California Promissory Note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a loan agreement between a buyer and a seller. This Promissory Note serves as evidence of the buyer's promise to repay the seller the agreed upon purchase price of the vehicle over a specified period of time. Keyword: Simi Valley California Promissory Note The Simi Valley California Promissory Note in connection with the sale of a vehicle or automobile ensures that both parties are protected and have a clear understanding of their responsibilities and obligations. It typically includes the following key details: 1. Identification of Parties: The Promissory Note should include the full legal names and contact information of both the buyer and the seller. 2. Vehicle Description: It is crucial to mention detailed information about the vehicle being sold, including the make, model, year, vehicle identification number (VIN), and any additional identifying characteristics. 3. Purchase Price: The Promissory Note should state the agreed purchase price for the vehicle. 4. Down Payment (if applicable): If the buyer has made an initial down payment towards the purchase, it should be clearly specified in the Promissory Note. 5. Terms of Repayment: The Promissory Note must outline the terms of repayment, such as the total amount of the loan, the interest rate (if any), the number of installments, and the amount of each installment. 6. Payment Schedule: The Promissory Note should provide a clear payment schedule, indicating the due dates for each installment. 7. Late Payments and Default: It is essential to address the consequences of late payments or default in the Promissory Note, including any penalties, additional charges, or potential repossession of the vehicle. 8. Security Agreement: If the seller retains a security interest in the vehicle until the debt is fully repaid, this should be stated in the Promissory Note. Different Types of Simi Valley California Promissory Notes in Connection with Sale of Vehicle or Automobile: 1. Secured Promissory Note: This type of Promissory Note is used when the seller retains a security interest in the vehicle until the loan is paid in full. If the buyer defaults, the seller has the right to recover the vehicle. 2. Unsecured Promissory Note: In cases where the seller does not require collateral, an unsecured Promissory Note may be used. This type of note relies solely on the buyer's promise to repay the loan and does not involve any security interest in the vehicle. 3. Installment Promissory Note: This Promissory Note divides the total purchase price into equal installments, which the buyer agrees to repay within a specified timeframe. The note may include interest charges or a finance charge. In summary, a Simi Valley California Promissory Note in connection with the sale of a vehicle or automobile is a vital legal document that protects both the buyer and the seller. It outlines the loan agreement terms, payment details, and consequences of default. Different types of Promissory Notes, such as secured, unsecured, and installment notes, depend on the specific circumstances and the parties' agreement.A Simi Valley California Promissory Note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a loan agreement between a buyer and a seller. This Promissory Note serves as evidence of the buyer's promise to repay the seller the agreed upon purchase price of the vehicle over a specified period of time. Keyword: Simi Valley California Promissory Note The Simi Valley California Promissory Note in connection with the sale of a vehicle or automobile ensures that both parties are protected and have a clear understanding of their responsibilities and obligations. It typically includes the following key details: 1. Identification of Parties: The Promissory Note should include the full legal names and contact information of both the buyer and the seller. 2. Vehicle Description: It is crucial to mention detailed information about the vehicle being sold, including the make, model, year, vehicle identification number (VIN), and any additional identifying characteristics. 3. Purchase Price: The Promissory Note should state the agreed purchase price for the vehicle. 4. Down Payment (if applicable): If the buyer has made an initial down payment towards the purchase, it should be clearly specified in the Promissory Note. 5. Terms of Repayment: The Promissory Note must outline the terms of repayment, such as the total amount of the loan, the interest rate (if any), the number of installments, and the amount of each installment. 6. Payment Schedule: The Promissory Note should provide a clear payment schedule, indicating the due dates for each installment. 7. Late Payments and Default: It is essential to address the consequences of late payments or default in the Promissory Note, including any penalties, additional charges, or potential repossession of the vehicle. 8. Security Agreement: If the seller retains a security interest in the vehicle until the debt is fully repaid, this should be stated in the Promissory Note. Different Types of Simi Valley California Promissory Notes in Connection with Sale of Vehicle or Automobile: 1. Secured Promissory Note: This type of Promissory Note is used when the seller retains a security interest in the vehicle until the loan is paid in full. If the buyer defaults, the seller has the right to recover the vehicle. 2. Unsecured Promissory Note: In cases where the seller does not require collateral, an unsecured Promissory Note may be used. This type of note relies solely on the buyer's promise to repay the loan and does not involve any security interest in the vehicle. 3. Installment Promissory Note: This Promissory Note divides the total purchase price into equal installments, which the buyer agrees to repay within a specified timeframe. The note may include interest charges or a finance charge. In summary, a Simi Valley California Promissory Note in connection with the sale of a vehicle or automobile is a vital legal document that protects both the buyer and the seller. It outlines the loan agreement terms, payment details, and consequences of default. Different types of Promissory Notes, such as secured, unsecured, and installment notes, depend on the specific circumstances and the parties' agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.