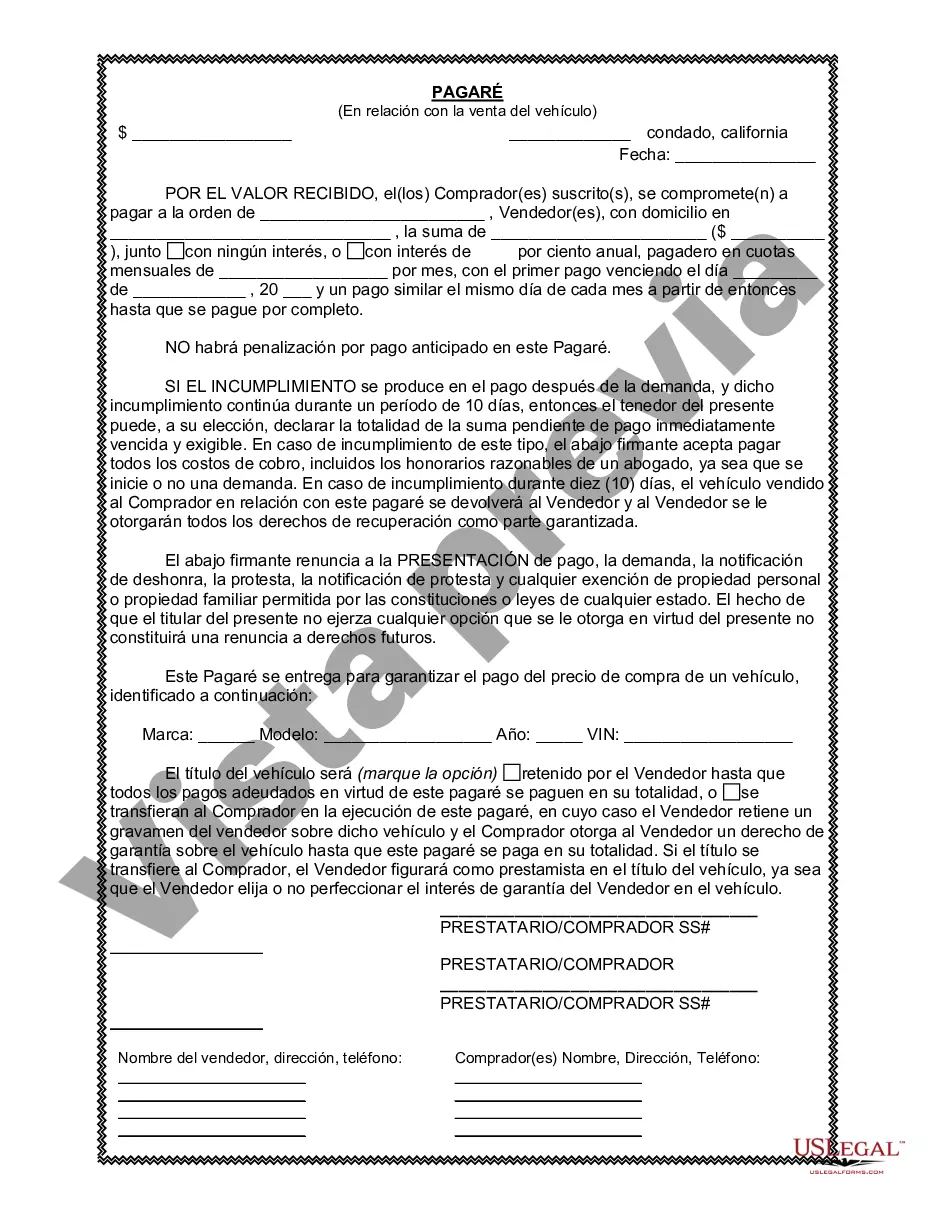

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Sunnyvale California Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that establishes an agreement between the buyer and seller of a vehicle. It outlines the terms and conditions of the transaction, including the purchase price, payment schedule, interest rates, penalties for late payments, and consequences for defaulting on the loan. Keywords: Sunnyvale California, promissory note, sale of vehicle, automobile, legal document, agreement, terms and conditions, purchase price, payment schedule, interest rates, penalties, defaulting on the loan. There are two main types of Sunnyvale California Promissory Note in Connection with Sale of Vehicle or Automobile: 1. Secured Promissory Note: A secured promissory note is backed by collateral, in this case, the vehicle being sold. The buyer pledges the vehicle as security for the loan, and in the event of default, the seller has the right to repossess the vehicle as repayment. 2. Unsecured Promissory Note: An unsecured promissory note does not involve any collateral. The buyer agrees to repay the loan based on the agreed terms, but there is no specific asset tied to the loan. In case of default, the seller may need to pursue legal action to recover the debt. When drafting a Sunnyvale California Promissory Note in Connection with Sale of Vehicle or Automobile, it is essential to include the following details: 1. Full legal names and contact information of both the buyer and seller. 2. Vehicle details, including make, model, year, and Vehicle Identification Number (VIN). 3. Purchase price and any additional charges, like taxes or fees. 4. Payment schedule, specifying the installment amounts, due dates, and duration of the loan. 5. Interest rate, if applicable. 6. Late payment penalties and any consequences for defaulting on the loan. 7. Vehicle insurance requirements during the loan term. 8. Terms for temporary possession or registration of the vehicle during the loan period. 9. Any warranties or guarantees provided by the seller. 10. Signatures of both parties, along with the date of signing. It is important to consult with a legal professional when creating a Sunnyvale California Promissory Note in Connection with Sale of Vehicle or Automobile to ensure that it complies with local laws and is enforceable in case of any disputes or default.A Sunnyvale California Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that establishes an agreement between the buyer and seller of a vehicle. It outlines the terms and conditions of the transaction, including the purchase price, payment schedule, interest rates, penalties for late payments, and consequences for defaulting on the loan. Keywords: Sunnyvale California, promissory note, sale of vehicle, automobile, legal document, agreement, terms and conditions, purchase price, payment schedule, interest rates, penalties, defaulting on the loan. There are two main types of Sunnyvale California Promissory Note in Connection with Sale of Vehicle or Automobile: 1. Secured Promissory Note: A secured promissory note is backed by collateral, in this case, the vehicle being sold. The buyer pledges the vehicle as security for the loan, and in the event of default, the seller has the right to repossess the vehicle as repayment. 2. Unsecured Promissory Note: An unsecured promissory note does not involve any collateral. The buyer agrees to repay the loan based on the agreed terms, but there is no specific asset tied to the loan. In case of default, the seller may need to pursue legal action to recover the debt. When drafting a Sunnyvale California Promissory Note in Connection with Sale of Vehicle or Automobile, it is essential to include the following details: 1. Full legal names and contact information of both the buyer and seller. 2. Vehicle details, including make, model, year, and Vehicle Identification Number (VIN). 3. Purchase price and any additional charges, like taxes or fees. 4. Payment schedule, specifying the installment amounts, due dates, and duration of the loan. 5. Interest rate, if applicable. 6. Late payment penalties and any consequences for defaulting on the loan. 7. Vehicle insurance requirements during the loan term. 8. Terms for temporary possession or registration of the vehicle during the loan period. 9. Any warranties or guarantees provided by the seller. 10. Signatures of both parties, along with the date of signing. It is important to consult with a legal professional when creating a Sunnyvale California Promissory Note in Connection with Sale of Vehicle or Automobile to ensure that it complies with local laws and is enforceable in case of any disputes or default.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.