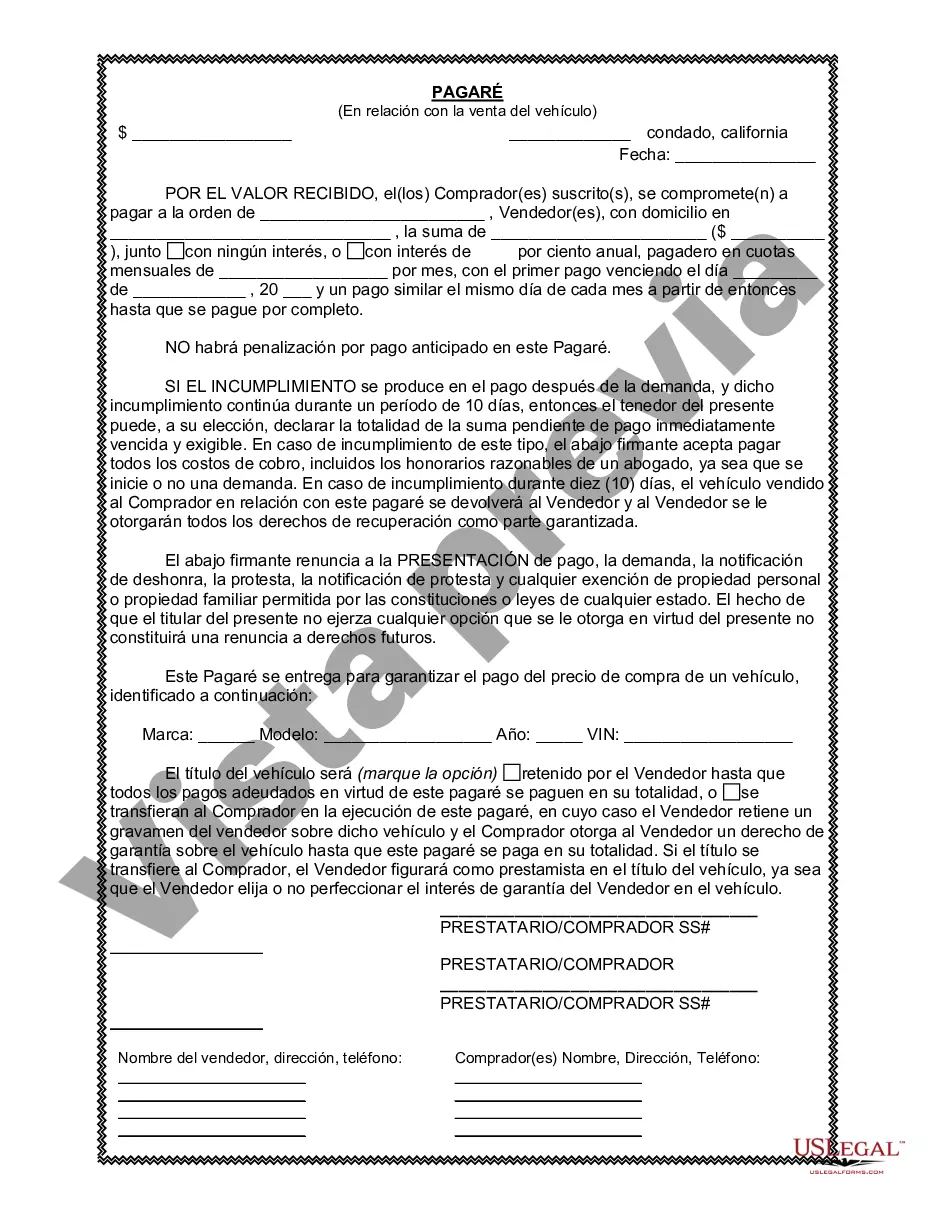

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A promissory note is a legal document that outlines the terms and conditions of a loan agreement between two parties. When purchasing a vehicle or automobile in Temecula, California, a promissory note in connection with the sale is often used to establish the payment arrangements between the buyer and the seller. This document details the loan amount, the interest rate, the repayment schedule, and any other relevant clauses that both parties agree upon. In Temecula, California, there are different types of promissory notes in connection with the sale of a vehicle or automobile. These variations may include: 1. Simple Promissory Note: This is the most common type of promissory note used in vehicle sales. It outlines the loan amount, the interest rate, the repayment terms, and the consequences for defaulting on the loan. 2. Installment Promissory Note: This type of promissory note is used when the buyer agrees to make regular installment payments over a specific period. The terms of this note include details such as the number of installments, the due dates, and any late payment penalties. 3. Balloon Payment Promissory Note: In some cases, a buyer may choose to make smaller monthly payments with a large final payment known as a "balloon payment." This type of promissory note specifies the regular payments, the date of the balloon payment, and any applicable interest. 4. Secured Promissory Note: A secured promissory note is used when the buyer offers collateral to secure the loan, such as the vehicle being purchased. This type of note includes details about the collateral, how it will be held, and the consequences if the buyer defaults. 5. Unsecured Promissory Note: Unlike a secured promissory note, an unsecured note does not require collateral. Instead, it relies solely on the buyer's promise to repay the loan. This type of note typically carries a higher interest rate to compensate for the increased risk to the seller. Regardless of the type of promissory note used, it is essential for both parties involved in the sale of a vehicle or automobile in Temecula, California, to carefully review and understand all the terms and conditions outlined in the document. Consulting with a legal professional before entering into a promissory note agreement is recommended to ensure compliance with state and local laws and to protect both parties' rights and interests.A promissory note is a legal document that outlines the terms and conditions of a loan agreement between two parties. When purchasing a vehicle or automobile in Temecula, California, a promissory note in connection with the sale is often used to establish the payment arrangements between the buyer and the seller. This document details the loan amount, the interest rate, the repayment schedule, and any other relevant clauses that both parties agree upon. In Temecula, California, there are different types of promissory notes in connection with the sale of a vehicle or automobile. These variations may include: 1. Simple Promissory Note: This is the most common type of promissory note used in vehicle sales. It outlines the loan amount, the interest rate, the repayment terms, and the consequences for defaulting on the loan. 2. Installment Promissory Note: This type of promissory note is used when the buyer agrees to make regular installment payments over a specific period. The terms of this note include details such as the number of installments, the due dates, and any late payment penalties. 3. Balloon Payment Promissory Note: In some cases, a buyer may choose to make smaller monthly payments with a large final payment known as a "balloon payment." This type of promissory note specifies the regular payments, the date of the balloon payment, and any applicable interest. 4. Secured Promissory Note: A secured promissory note is used when the buyer offers collateral to secure the loan, such as the vehicle being purchased. This type of note includes details about the collateral, how it will be held, and the consequences if the buyer defaults. 5. Unsecured Promissory Note: Unlike a secured promissory note, an unsecured note does not require collateral. Instead, it relies solely on the buyer's promise to repay the loan. This type of note typically carries a higher interest rate to compensate for the increased risk to the seller. Regardless of the type of promissory note used, it is essential for both parties involved in the sale of a vehicle or automobile in Temecula, California, to carefully review and understand all the terms and conditions outlined in the document. Consulting with a legal professional before entering into a promissory note agreement is recommended to ensure compliance with state and local laws and to protect both parties' rights and interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.