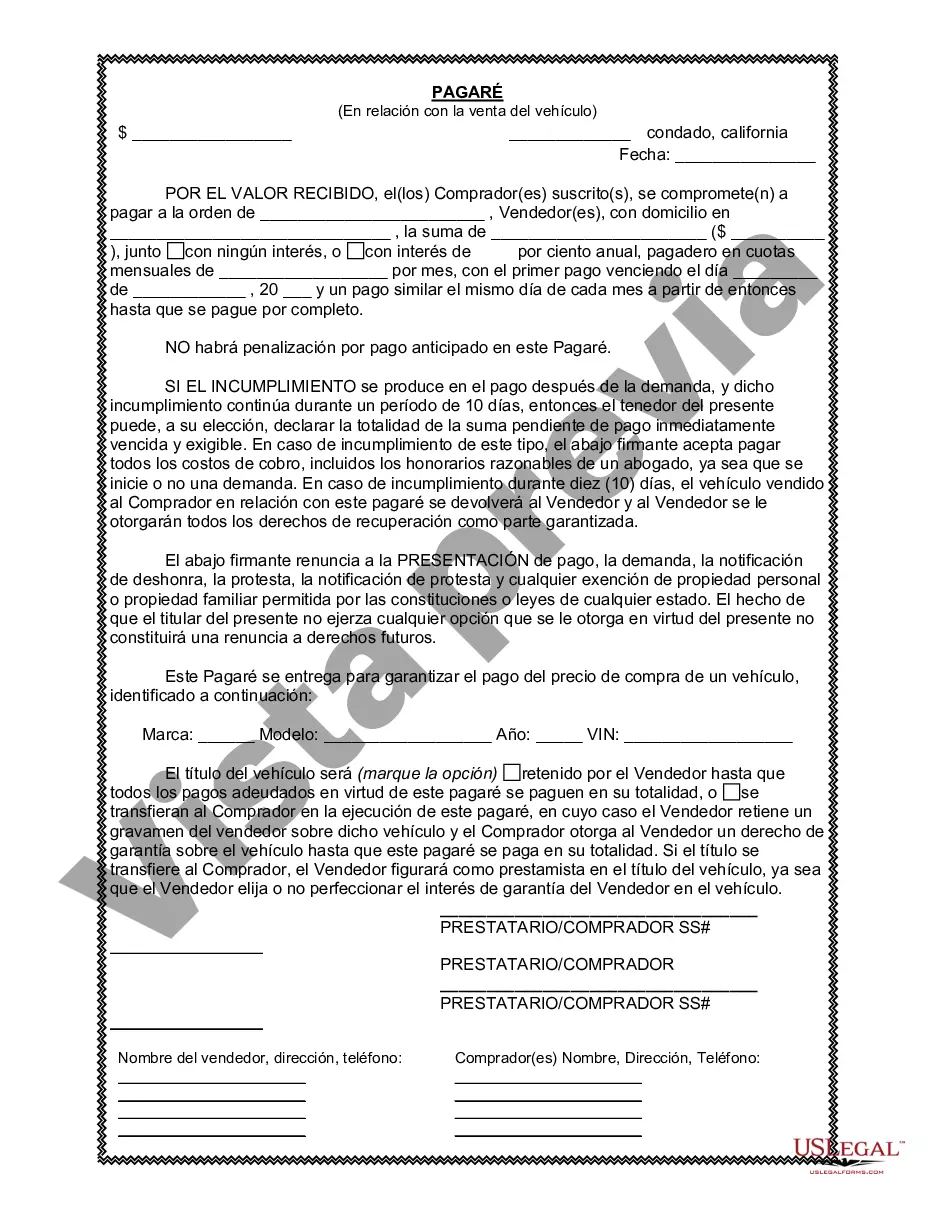

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Thousand Oaks California Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement between the buyer and seller of a vehicle. It serves as a written record of the financial agreement and offers protection to both parties involved in the transaction. The promissory note includes important details such as the names and contact information of the buyer and seller, the description of the vehicle being sold, the agreed purchase price, and the repayment terms. It also outlines the payment schedule, interest rate, and any additional fees or penalties that may be applied in case of default. By signing the promissory note, the buyer acknowledges their obligation to repay the loan amount in a timely manner and agrees to comply with all the terms mentioned. This document can be crucial in resolving any disputes that may arise during or after the sale of the vehicle. There might be variations of Thousand Oaks California Promissory Note in Connection with Sale of Vehicle or Automobile, which may include: 1. Secured Promissory Note: This type of promissory note includes a security agreement, where the vehicle being purchased serves as collateral for the loan. In case of default, the seller has the right to repossess the vehicle as a means of repayment. 2. Unsecured Promissory Note: This version of the promissory note does not involve any collateral. Hence, if the buyer fails to make payments, the seller may need to pursue legal action to recover the outstanding amount. 3. Installment Promissory Note: This type of promissory note outlines the repayment in equal installments over a specific period. It includes details on the amount and frequency of each payment, as well as the interest rate applied. 4. Balloon Promissory Note: In a balloon promissory note, the buyer agrees to make smaller regular payments throughout the loan term, while a large lump sum (balloon payment) is due at the end of the agreed period. This type of note is commonly used when the buyer expects a large sum of money in the future. Overall, the Thousand Oaks California Promissory Note in Connection with Sale of Vehicle or Automobile is a vital legal document that ensures a clear understanding of the financial agreement between the buyer and seller. It protects both parties and outlines the responsibilities and consequences associated with the loan transaction.A Thousand Oaks California Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement between the buyer and seller of a vehicle. It serves as a written record of the financial agreement and offers protection to both parties involved in the transaction. The promissory note includes important details such as the names and contact information of the buyer and seller, the description of the vehicle being sold, the agreed purchase price, and the repayment terms. It also outlines the payment schedule, interest rate, and any additional fees or penalties that may be applied in case of default. By signing the promissory note, the buyer acknowledges their obligation to repay the loan amount in a timely manner and agrees to comply with all the terms mentioned. This document can be crucial in resolving any disputes that may arise during or after the sale of the vehicle. There might be variations of Thousand Oaks California Promissory Note in Connection with Sale of Vehicle or Automobile, which may include: 1. Secured Promissory Note: This type of promissory note includes a security agreement, where the vehicle being purchased serves as collateral for the loan. In case of default, the seller has the right to repossess the vehicle as a means of repayment. 2. Unsecured Promissory Note: This version of the promissory note does not involve any collateral. Hence, if the buyer fails to make payments, the seller may need to pursue legal action to recover the outstanding amount. 3. Installment Promissory Note: This type of promissory note outlines the repayment in equal installments over a specific period. It includes details on the amount and frequency of each payment, as well as the interest rate applied. 4. Balloon Promissory Note: In a balloon promissory note, the buyer agrees to make smaller regular payments throughout the loan term, while a large lump sum (balloon payment) is due at the end of the agreed period. This type of note is commonly used when the buyer expects a large sum of money in the future. Overall, the Thousand Oaks California Promissory Note in Connection with Sale of Vehicle or Automobile is a vital legal document that ensures a clear understanding of the financial agreement between the buyer and seller. It protects both parties and outlines the responsibilities and consequences associated with the loan transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.