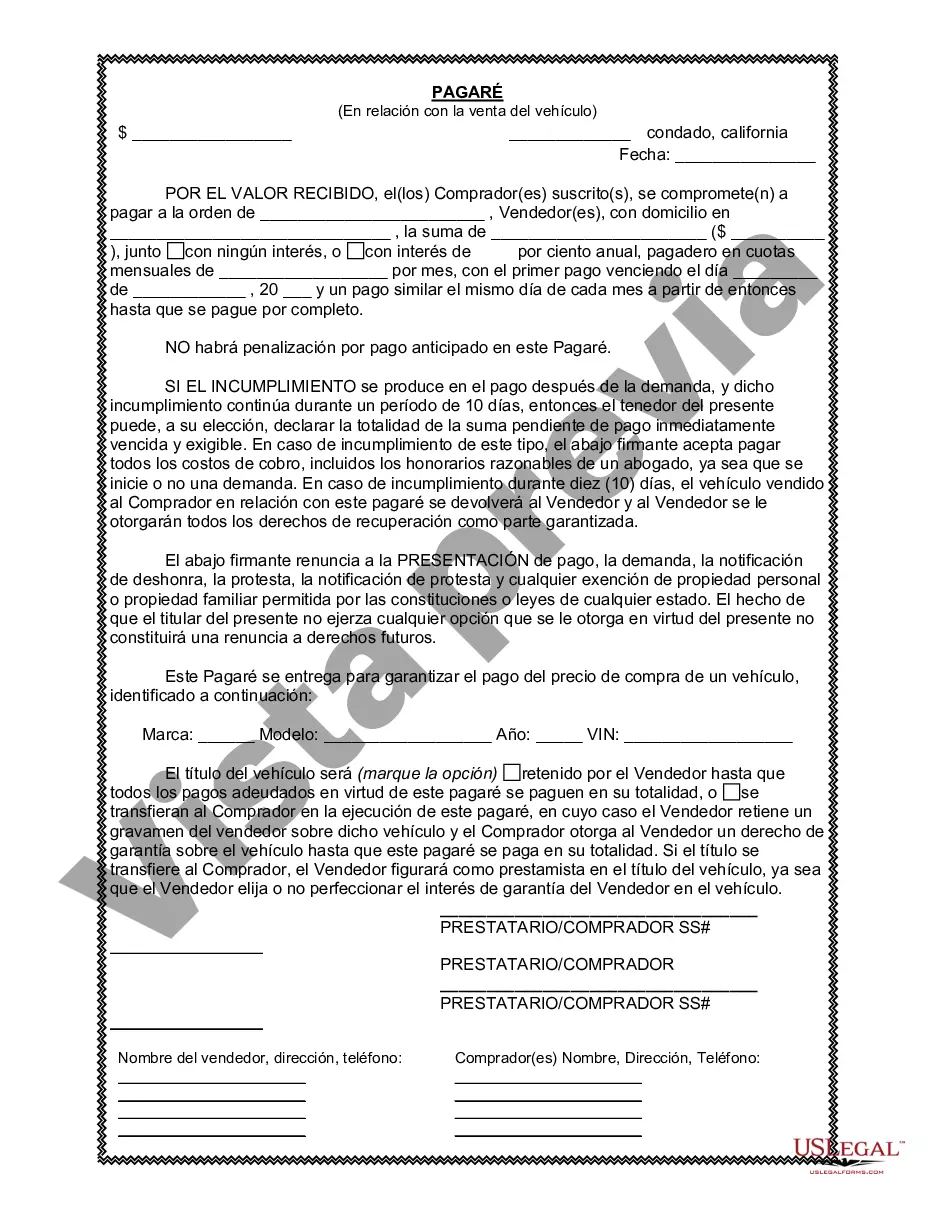

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Vacaville California Promissory Note in connection with the sale of a vehicle or automobile is a legal document that outlines the terms and conditions of a loan agreement between the buyer and the seller. This promissory note serves as a written agreement detailing the repayment plan, interest rate, and consequences of defaulting on the loan. In Vacaville, California, there are various types of promissory notes commonly used in connection with the sale of vehicles or automobiles. Some of these types include: 1. Simple Promissory Note: A straightforward document that states the buyer's promise to repay the borrowed amount to the seller in equal installments over a specific period. It includes essential details such as the loan amount, interest rate, repayment schedule, and consequences of non-payment. 2. Secured Promissory Note: This type of promissory note includes additional provisions to secure the loan, typically by allowing the seller to retain ownership of the vehicle until the loan is fully repaid. If the buyer defaults on the loan, the seller has the right to repossess the vehicle as collateral. 3. Balloon Promissory Note: A type of promissory note that defers most of the repayment until the end of the loan term, requiring the borrower to make smaller periodic payments throughout the loan period. The remaining balance (balloon payment) is then due at the end of the term. Balloon promissory notes are often used when the buyer requires lower monthly payments but can afford a larger payment at the end of the loan. 4. Installment Promissory Note: This type of promissory note splits the total loan amount into equal and regular installments over a predetermined period. Each payment consists of both principal and interest and helps evenly distribute the repayment burden over time. Regardless of the specific type of Vacaville California Promissory Note in connection with the sale of a vehicle or automobile, it is crucial for both parties involved to carefully review and understand the terms before signing. Additionally, it is highly recommended seeking legal counsel to ensure compliance with state laws and protection of rights for both the buyer and the seller.A Vacaville California Promissory Note in connection with the sale of a vehicle or automobile is a legal document that outlines the terms and conditions of a loan agreement between the buyer and the seller. This promissory note serves as a written agreement detailing the repayment plan, interest rate, and consequences of defaulting on the loan. In Vacaville, California, there are various types of promissory notes commonly used in connection with the sale of vehicles or automobiles. Some of these types include: 1. Simple Promissory Note: A straightforward document that states the buyer's promise to repay the borrowed amount to the seller in equal installments over a specific period. It includes essential details such as the loan amount, interest rate, repayment schedule, and consequences of non-payment. 2. Secured Promissory Note: This type of promissory note includes additional provisions to secure the loan, typically by allowing the seller to retain ownership of the vehicle until the loan is fully repaid. If the buyer defaults on the loan, the seller has the right to repossess the vehicle as collateral. 3. Balloon Promissory Note: A type of promissory note that defers most of the repayment until the end of the loan term, requiring the borrower to make smaller periodic payments throughout the loan period. The remaining balance (balloon payment) is then due at the end of the term. Balloon promissory notes are often used when the buyer requires lower monthly payments but can afford a larger payment at the end of the loan. 4. Installment Promissory Note: This type of promissory note splits the total loan amount into equal and regular installments over a predetermined period. Each payment consists of both principal and interest and helps evenly distribute the repayment burden over time. Regardless of the specific type of Vacaville California Promissory Note in connection with the sale of a vehicle or automobile, it is crucial for both parties involved to carefully review and understand the terms before signing. Additionally, it is highly recommended seeking legal counsel to ensure compliance with state laws and protection of rights for both the buyer and the seller.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.