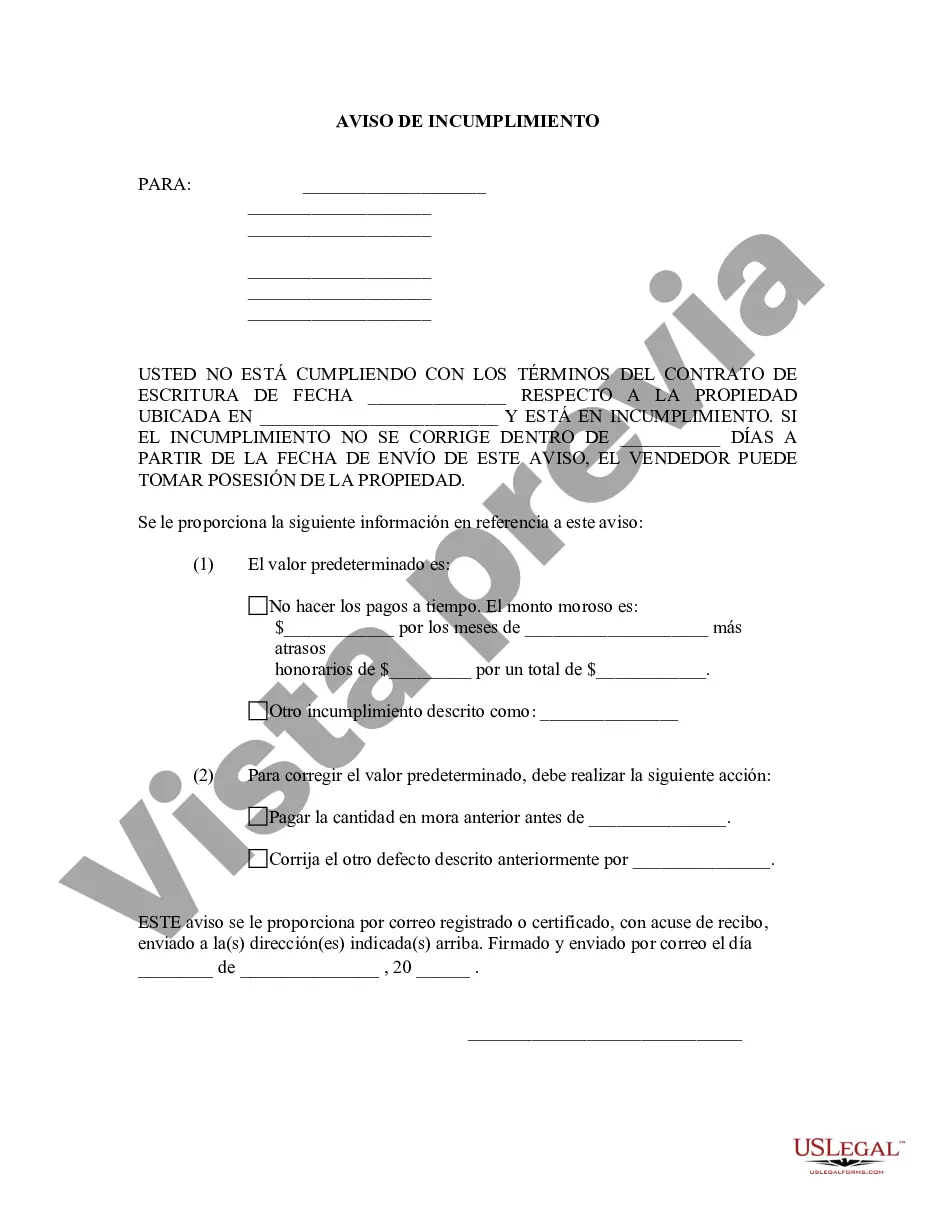

A General Notice of Default for Contract for Deed in Sunnyvale, California is a legal document issued by the lender or holder of a contract for deed to notify the buyer that they have breached the terms of the agreement. This notice serves as a warning that if the default is not cured within a specified period of time, the lender may initiate foreclosure proceedings and take possession of the property. In Sunnyvale, California, there are two main types of General Notice of Default for Contract for Deed: 1. Non-Payment Default: This type of default occurs when the buyer fails to make the agreed-upon payments under the terms of the contract for deed. The lender will issue a notice stating the specific amount past due, including the principal, interest, and any late fees. The notice will also provide a deadline by which the buyer must bring the payments current to avoid further action. 2. Breach of Contract Default: This type of default arises when the buyer violates any other terms and conditions specified in the contract for deed. This can include failure to maintain the property, unauthorized alterations, unpaid property taxes, or failure to obtain proper insurance coverage. The General Notice of Default will outline the specific breach and provide a deadline for the buyer to rectify the situation. It's important to note that the process for handling General Notices of Default for Contract for Deed may vary depending on the specific terms and conditions of the agreement. Buyers should always consult with an attorney to understand their rights and options when facing a default. In Sunnyvale, California, homeowners who receive a General Notice of Default for Contract for Deed should consider the following steps: 1. Review the Notice: Carefully read the notice to understand the specific reasons for the default and the required actions to cure it. 2. Consult an Attorney: Seek legal advice from a qualified attorney who specializes in real estate law and contract for deed agreements. 3. Assess Options: Explore possible solutions, such as renegotiating the terms, seeking refinancing, or restructuring the agreement with the lender. 4. Communicate with the Lender: Contact the lender to discuss possible resolutions and demonstrate the willingness to rectify the default. 5. Cure the Default: Take necessary actions to cure the default within the specified timeframe, which may involve making outstanding payments, rectifying property defects, or resolving other breaches. 6. Document Everything: Keep detailed records of all communications, payments, and actions taken to resolve the default. 7. Seek Mediation: In case of disputes or difficulties in resolving the default, consider engaging in mediation to reach a mutually agreeable solution. 8. Monitor the Situation: Stay updated on the status of the default and proactively respond to any further correspondence from the lender or holder of the contract for deed. Facing a General Notice of Default for Contract for Deed can be a complex and financially stressful situation. It's crucial for buyers to understand their rights and seek professional guidance throughout the process to protect their interests and potentially avoid foreclosure.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sunnyvale California Aviso general de incumplimiento de contrato de escritura - California General Notice of Default for Contract for Deed

Description

How to fill out Sunnyvale California Aviso General De Incumplimiento De Contrato De Escritura?

Regardless of social or professional status, completing law-related documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for someone without any legal education to draft this sort of papers from scratch, mostly due to the convoluted jargon and legal nuances they involve. This is where US Legal Forms can save the day. Our service provides a massive catalog with over 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

No matter if you need the Sunnyvale California General Notice of Default for Contract for Deed or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Sunnyvale California General Notice of Default for Contract for Deed in minutes using our trustworthy service. If you are presently an existing customer, you can proceed to log in to your account to get the appropriate form.

Nevertheless, if you are unfamiliar with our platform, make sure to follow these steps before obtaining the Sunnyvale California General Notice of Default for Contract for Deed:

- Be sure the template you have found is good for your location since the rules of one state or area do not work for another state or area.

- Review the document and go through a brief outline (if available) of cases the paper can be used for.

- In case the form you selected doesn’t meet your requirements, you can start again and look for the necessary form.

- Click Buy now and pick the subscription option that suits you the best.

- Log in to your account credentials or register for one from scratch.

- Pick the payment gateway and proceed to download the Sunnyvale California General Notice of Default for Contract for Deed once the payment is completed.

You’re good to go! Now you can proceed to print the document or fill it out online. Should you have any issues locating your purchased documents, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.