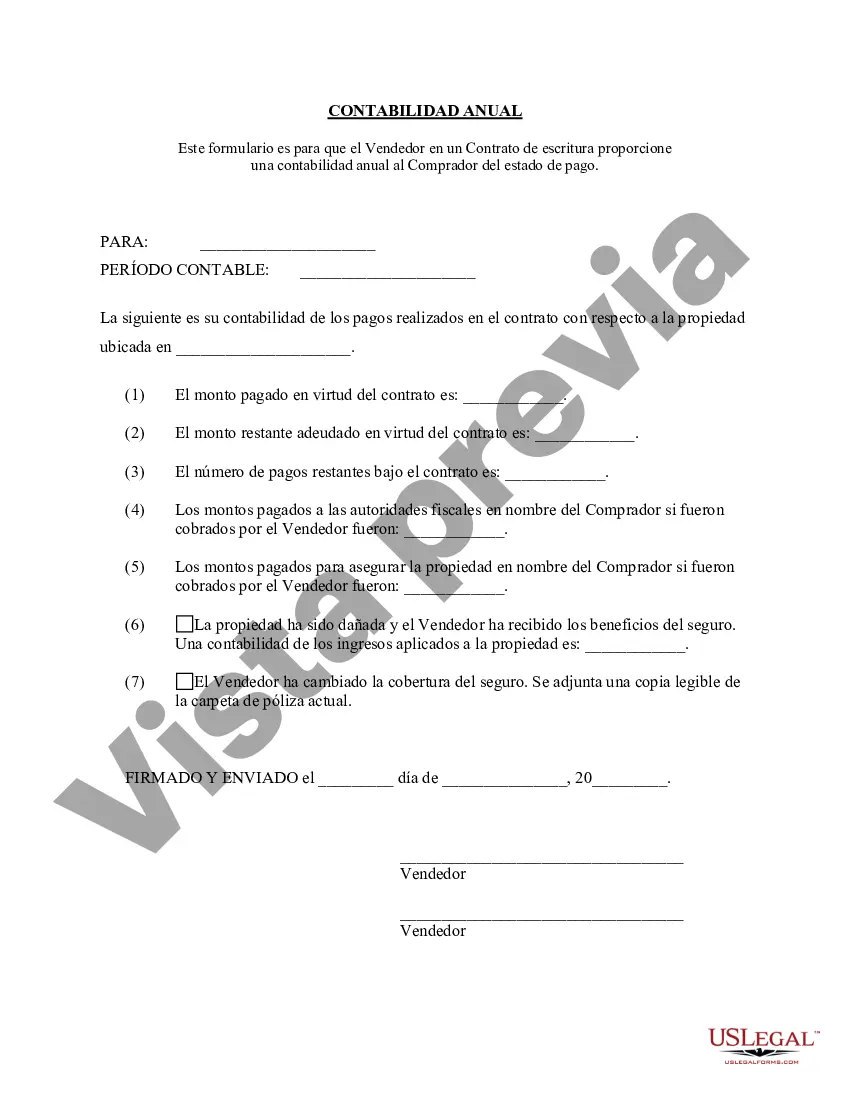

The Alameda California Contract for Deed Seller's Annual Accounting Statement is a crucial document that outlines the financial transactions and obligations between the seller and buyer in a contract for deed agreement. This annual accounting statement serves as an essential record for both parties involved in the real estate transaction, providing a comprehensive overview of the financial aspects of the contract. It is crucial for sellers to complete this statement accurately and in a timely manner to maintain transparency and ensure compliance with contractual obligations. The Alameda California Contract for Deed Seller's Annual Accounting Statement includes various sections that cover the income, expenses, and financial activities related to the property subject to the contract. Key details that should be included in this statement are the property's address, the buyer's name, and the accounting period covered in the statement. Additionally, the annual accounting statement should specify the total amount received from the buyer during the accounting period, including the principal payment, interest, and any other charges or fees agreed upon in the contract. It is essential to accurately break down these amounts to provide a clear report of the financial transactions. Moreover, the statement should highlight any expenses incurred by the seller during the accounting period, such as property taxes, insurance premiums, maintenance costs, or any other relevant expenses related to the property. These expenses should be meticulously recorded to present a comprehensive view of the contract's financial activities. Furthermore, it is important to note that there might be different types of Alameda California Contract for Deed Seller's Annual Accounting Statements depending on the specific terms and conditions of the contract. For instance, there could be separate statements for residential and commercial properties or variations based on the duration of the contract. Each type of statement should be tailored to accurately reflect the financial transactions and obligations specific to that contract. To summarize, the Alameda California Contract for Deed Seller's Annual Accounting Statement is a vital document that ensures clarity and transparency in the financial aspects of a contract for deed agreement. It assists both sellers and buyers in maintaining accurate records of financial transactions and meeting contractual obligations. Keeping meticulous and up-to-date accounting records is key to successful contract management in Alameda, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Contrato de Escrituración Estado Contable Anual del Vendedor - California Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Alameda California Contrato De Escrituración Estado Contable Anual Del Vendedor?

Do you need a reliable and inexpensive legal forms supplier to get the Alameda California Contract for Deed Seller's Annual Accounting Statement? US Legal Forms is your go-to choice.

Whether you need a basic agreement to set rules for cohabitating with your partner or a package of forms to advance your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed based on the requirements of separate state and area.

To download the document, you need to log in account, locate the required form, and click the Download button next to it. Please take into account that you can download your previously purchased form templates at any time from the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Alameda California Contract for Deed Seller's Annual Accounting Statement conforms to the laws of your state and local area.

- Read the form’s description (if available) to find out who and what the document is intended for.

- Start the search over if the form isn’t suitable for your legal situation.

Now you can register your account. Then choose the subscription plan and proceed to payment. As soon as the payment is completed, download the Alameda California Contract for Deed Seller's Annual Accounting Statement in any available format. You can get back to the website at any time and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting your valuable time learning about legal papers online for good.