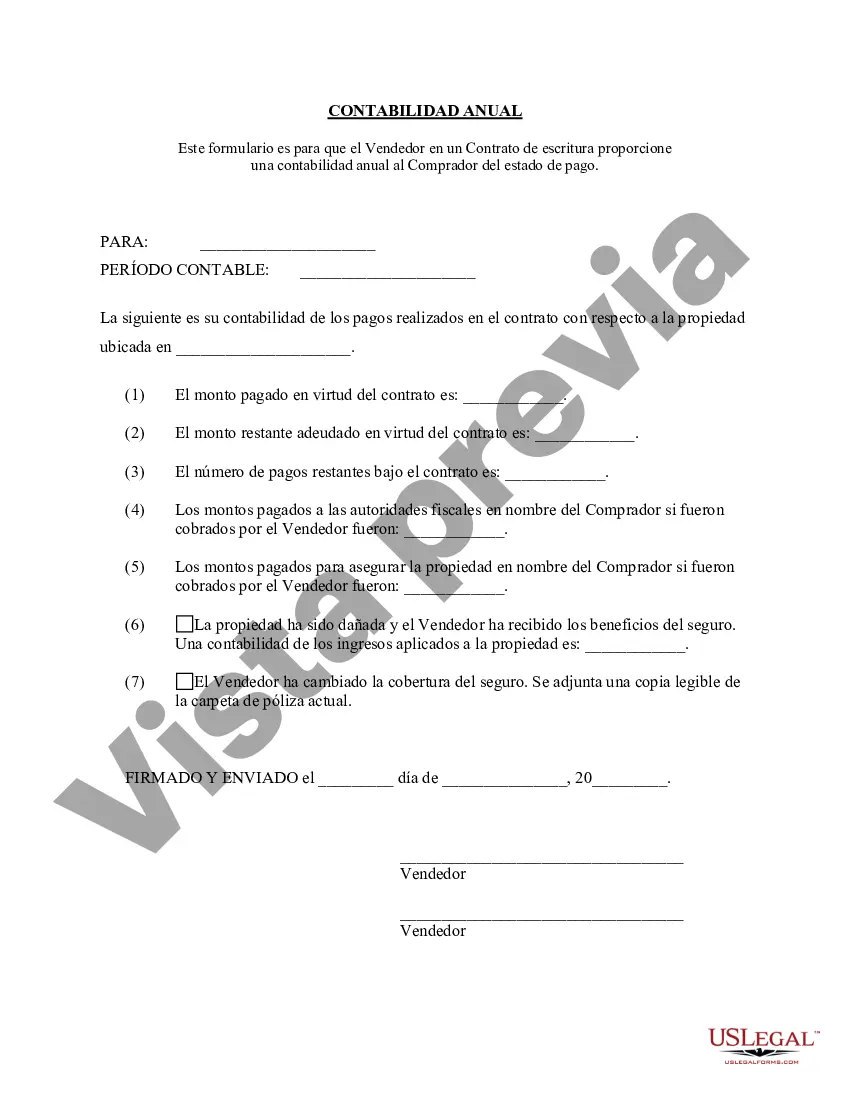

The Chico California Contract for Deed Seller's Annual Accounting Statement is an essential document that outlines the financial details and obligations of a Seller in a contract for deed agreement in Chico, California. This statement provides a comprehensive overview of the Seller's annual financial activities related to the contract for deed, ensuring transparency and accountability between the parties involved. The Seller's Annual Accounting Statement typically covers various aspects of the contract for deed, including but not limited to: 1. Total Payments Received: This section outlines the total amount of money the Seller has received from the Buyer throughout the year as part of the contract for deed arrangement. It includes the principal payments, interest payments, and any other applicable fees. 2. Principal Balance: This component indicates the remaining outstanding balance owed by the Buyer to the Seller. It reflects any payments made towards the principal, thus allowing both parties to track the progress of the debt repayment. 3. Interest Earned: This section highlights the interest income earned by the Seller from the contract for deed. It includes the annual interest rate applied to the outstanding balance and computes the interest amount for the given year. 4. Expenses: The Seller's Annual Accounting Statement also takes into consideration any relevant expenses incurred by the Seller in relation to the contract for deed. This may include property taxes, insurance costs, legal fees, or maintenance expenses, among others. A breakdown of these expenses is provided to give a clear picture of the financial obligations and any deductions. 5. Taxes Paid: This section outlines the taxes paid by the Seller during the reporting period, such as property taxes or any other applicable taxes related to the property. 6. Additional Disclosures: Depending on the specific Chico California Contract for Deed, there may be additional requirements for the Seller's Annual Accounting Statement. It is essential to review the terms and conditions of the contract to ensure compliance and accurate reporting. Some types of Chico California Contract for Deed Seller's Annual Accounting Statements may include variations based on the specific circumstances of the agreement. For instance: 1. Individual Property Seller's Annual Accounting Statement: This document pertains to an individual property seller who enters into a contract for deed without involving any corporate entity or partnership. 2. Corporate Seller's Annual Accounting Statement: In cases where the Seller is a corporation, this statement provides a breakdown of the financial activities related to the contract for deed, specifically outlining the revenue, expenses, and taxes associated with the transaction. 3. Partnership Seller's Annual Accounting Statement: This type of statement applies when the Seller is a partnership entity, providing a comprehensive overview of the financial transactions and distributions within the partnership for the contract for deed. In conclusion, the Chico California Contract for Deed Seller's Annual Accounting Statement is a crucial document that facilitates transparency and accountability between parties in a contract for deed agreement. It provides a comprehensive summary of the Seller's financial activities and obligations throughout the year, ensuring both parties have a clear understanding of the financial aspects of the contract.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chico California Contrato de Escrituración Estado Contable Anual del Vendedor - California Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Chico California Contrato De Escrituración Estado Contable Anual Del Vendedor?

If you are searching for a valid form template, it’s impossible to find a better service than the US Legal Forms site – probably the most comprehensive online libraries. Here you can find a huge number of form samples for company and personal purposes by categories and states, or key phrases. With the advanced search function, discovering the latest Chico California Contract for Deed Seller's Annual Accounting Statement is as easy as 1-2-3. Furthermore, the relevance of every file is proved by a team of skilled attorneys that regularly review the templates on our platform and update them based on the newest state and county requirements.

If you already know about our platform and have an account, all you need to receive the Chico California Contract for Deed Seller's Annual Accounting Statement is to log in to your account and click the Download option.

If you use US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have opened the form you want. Look at its description and use the Preview option to check its content. If it doesn’t meet your requirements, use the Search field at the top of the screen to get the appropriate record.

- Affirm your decision. Select the Buy now option. Following that, pick the preferred subscription plan and provide credentials to sign up for an account.

- Make the purchase. Use your credit card or PayPal account to finish the registration procedure.

- Get the template. Pick the format and save it on your device.

- Make adjustments. Fill out, revise, print, and sign the received Chico California Contract for Deed Seller's Annual Accounting Statement.

Each template you save in your account has no expiration date and is yours forever. You can easily access them via the My Forms menu, so if you want to get an extra copy for enhancing or printing, you can return and save it again at any moment.

Make use of the US Legal Forms professional library to get access to the Chico California Contract for Deed Seller's Annual Accounting Statement you were looking for and a huge number of other professional and state-specific samples on one platform!