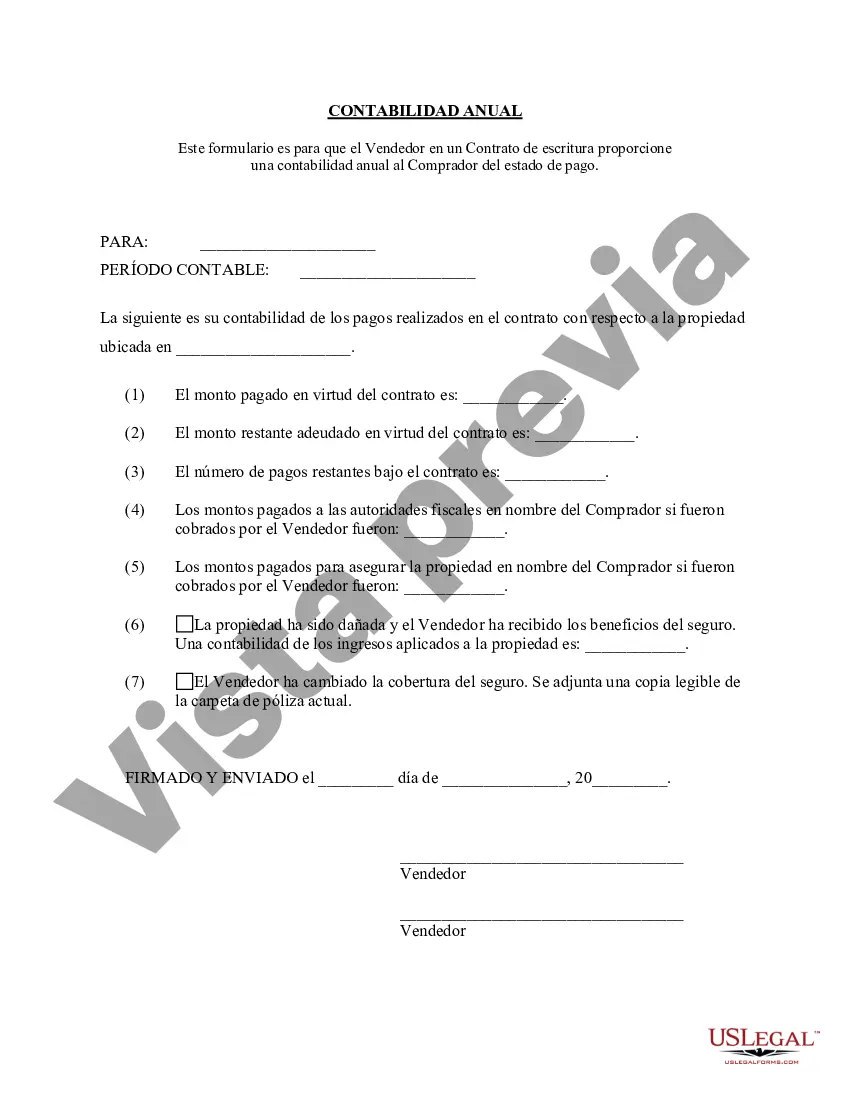

Irvine California Contract for Deed Seller's Annual Accounting Statement is an important document that outlines the financial transactions and obligations between the seller and buyer in a contract for deed agreement in Irvine, California. This statement provides a detailed summary of the financial activities associated with the property sold through a contract for deed. Keywords: Irvine California, Contract for Deed, Seller's Annual Accounting Statement, financial transactions, obligations, contract for deed agreement, property, summary. The Irvine California Contract for Deed Seller's Annual Accounting Statement serves as a comprehensive record of all monetary transactions related to the contract for deed, ensuring transparency and accountability between the seller and the buyer. It plays an essential role in maintaining financial clarity and ensuring compliance with the terms and conditions agreed upon in the contract. This statement includes crucial information such as the payments made by the buyer, including the principal amount, interest, and any additional charges or fees associated with the contract for deed. It also showcases any outstanding balance or delinquent payments and provides a clear breakdown of the total amount paid by the buyer up to that particular accounting year. Moreover, the Seller's Annual Accounting Statement may identify any adjustments made in the financial obligations throughout the year, such as changes in interest rates or payment schedules. This document can serve as a reference point for both the seller and buyer to evaluate the progress of the contract for deed and assess any changes that need to be made moving forward. Different types of Irvine California Contract for Deed Seller's Annual Accounting Statements may vary based on the specific terms and conditions mentioned within the agreement. Some variations may include: 1. Basic Annual Accounting Statement: A simple statement that outlines the principal payments, interest charges, late fees, if any, and the overall financial transactions occurring within the contract for deed in a given year. 2. Detailed Expense Statement: This type of accounting statement provides an elaborated breakdown of expenses associated with the property. It may include property taxes, insurance costs, maintenance fees, and any other financial obligations specifically mentioned in the contract. 3. Interest Adjustment Statement: If interest rates fluctuate throughout the year, an Interest Adjustment Statement may be included to reflect the changes made in the interest charges applied to the contract for deed payments. This ensures that the buyer is aware of any adjustments made to their payment schedule. 4. Delinquency Statement: In cases where the buyer has fallen behind on their payments or has outstanding balances, a Delinquency Statement may be generated, highlighting the overdue amount, penalties, and steps needed to rectify the situation. It is crucial for both the seller and buyer to review the Irvine California Contract for Deed Seller's Annual Accounting Statement each year to maintain a transparent financial relationship and avoid any misunderstandings or disputes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Irvine California Contrato de Escrituración Estado Contable Anual del Vendedor - California Contract for Deed Seller's Annual Accounting Statement

State:

California

City:

Irvine

Control #:

CA-00470-4

Format:

Word

Instant download

Description

Declaración por escrito notificando al Comprador el número y monto de los pagos realizados hacia el contrato por el capital e intereses de la escritura.

Irvine California Contract for Deed Seller's Annual Accounting Statement is an important document that outlines the financial transactions and obligations between the seller and buyer in a contract for deed agreement in Irvine, California. This statement provides a detailed summary of the financial activities associated with the property sold through a contract for deed. Keywords: Irvine California, Contract for Deed, Seller's Annual Accounting Statement, financial transactions, obligations, contract for deed agreement, property, summary. The Irvine California Contract for Deed Seller's Annual Accounting Statement serves as a comprehensive record of all monetary transactions related to the contract for deed, ensuring transparency and accountability between the seller and the buyer. It plays an essential role in maintaining financial clarity and ensuring compliance with the terms and conditions agreed upon in the contract. This statement includes crucial information such as the payments made by the buyer, including the principal amount, interest, and any additional charges or fees associated with the contract for deed. It also showcases any outstanding balance or delinquent payments and provides a clear breakdown of the total amount paid by the buyer up to that particular accounting year. Moreover, the Seller's Annual Accounting Statement may identify any adjustments made in the financial obligations throughout the year, such as changes in interest rates or payment schedules. This document can serve as a reference point for both the seller and buyer to evaluate the progress of the contract for deed and assess any changes that need to be made moving forward. Different types of Irvine California Contract for Deed Seller's Annual Accounting Statements may vary based on the specific terms and conditions mentioned within the agreement. Some variations may include: 1. Basic Annual Accounting Statement: A simple statement that outlines the principal payments, interest charges, late fees, if any, and the overall financial transactions occurring within the contract for deed in a given year. 2. Detailed Expense Statement: This type of accounting statement provides an elaborated breakdown of expenses associated with the property. It may include property taxes, insurance costs, maintenance fees, and any other financial obligations specifically mentioned in the contract. 3. Interest Adjustment Statement: If interest rates fluctuate throughout the year, an Interest Adjustment Statement may be included to reflect the changes made in the interest charges applied to the contract for deed payments. This ensures that the buyer is aware of any adjustments made to their payment schedule. 4. Delinquency Statement: In cases where the buyer has fallen behind on their payments or has outstanding balances, a Delinquency Statement may be generated, highlighting the overdue amount, penalties, and steps needed to rectify the situation. It is crucial for both the seller and buyer to review the Irvine California Contract for Deed Seller's Annual Accounting Statement each year to maintain a transparent financial relationship and avoid any misunderstandings or disputes.

How to fill out Irvine California Contrato De Escrituración Estado Contable Anual Del Vendedor?

If you’ve already utilized our service before, log in to your account and download the Irvine California Contract for Deed Seller's Annual Accounting Statement on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make sure you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Irvine California Contract for Deed Seller's Annual Accounting Statement. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!