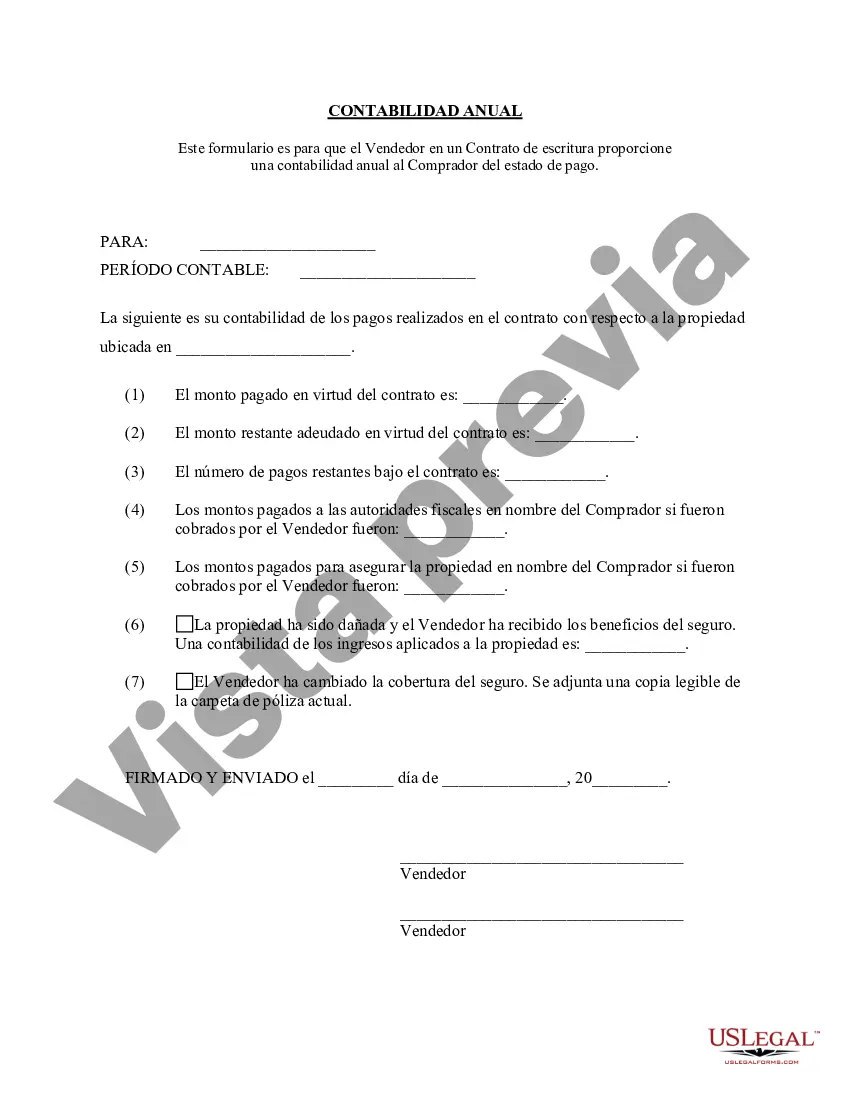

The Sacramento California Contract for Deed Seller's Annual Accounting Statement is a comprehensive financial document that provides a detailed overview of the seller's financial transactions and obligations related to the contract for deed agreement. This statement serves to maintain transparency and accountability between the parties involved in the contract for deed, ensuring that both the buyer and seller are aware of the financial status and any adjustments that may be necessary. Keywords: Sacramento California, Contract for Deed, Seller's Annual Accounting Statement, financial transactions, obligations, transparency, accountability, buyer, seller, adjustments. Different types of Sacramento California Contract for Deed Seller's Annual Accounting Statements may include: 1. General Contract for Deed Seller's Annual Accounting Statement: This type of statement is the standard variation and covers all essential financial aspects related to the contract for deed agreement in Sacramento, California. It includes details about the principal amount, interest payments, taxes, insurance premiums, and any other relevant financial obligations of the seller. 2. Adjusted Seller's Annual Accounting Statement: In some cases, adjustments might be required during the course of the contract for deed agreement due to changes in interest rates, property taxes, or insurance premiums. This variation of the accounting statement provides a comprehensive overview of the adjustments made to the initial statement, calculating the updated financial obligations of the seller. 3. Late Payment Penalty Seller's Annual Accounting Statement: If the buyer fails to make timely payments, a late payment penalty may be imposed. This type of accounting statement focuses on outlining the penalties incurred by the buyer due to late payments, providing transparency regarding the added financial burden. 4. Early Payment Seller's Annual Accounting Statement: In the event that the buyer chooses to pay off the contract for deed before its scheduled maturity date, an early payment statement becomes relevant. This accounting statement details the financial obligations of the seller and any adjustments, such as prepayment penalties or interest rate reductions, as a result of the early payment. 5. Escrow Seller's Annual Accounting Statement: In cases where an escrow account is established, a specific accounting statement is required. This statement focuses on tracking the funds held in escrow, detailing the deposits, withdrawals, interest earned, and any other transactions related to the escrow account. Remember, the variations mentioned above are just examples, and the actual types of accounting statements may differ based on the specific terms and conditions outlined in the Sacramento California Contract for Deed.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sacramento California Contrato de Escrituración Estado Contable Anual del Vendedor - California Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Sacramento California Contrato De Escrituración Estado Contable Anual Del Vendedor?

Are you looking for a reliable and inexpensive legal forms supplier to buy the Sacramento California Contract for Deed Seller's Annual Accounting Statement? US Legal Forms is your go-to choice.

Whether you need a simple agreement to set rules for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed based on the requirements of separate state and area.

To download the document, you need to log in account, locate the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime in the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Sacramento California Contract for Deed Seller's Annual Accounting Statement conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to learn who and what the document is good for.

- Start the search over in case the template isn’t good for your legal scenario.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Sacramento California Contract for Deed Seller's Annual Accounting Statement in any provided format. You can return to the website when you need and redownload the document free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting hours learning about legal papers online for good.