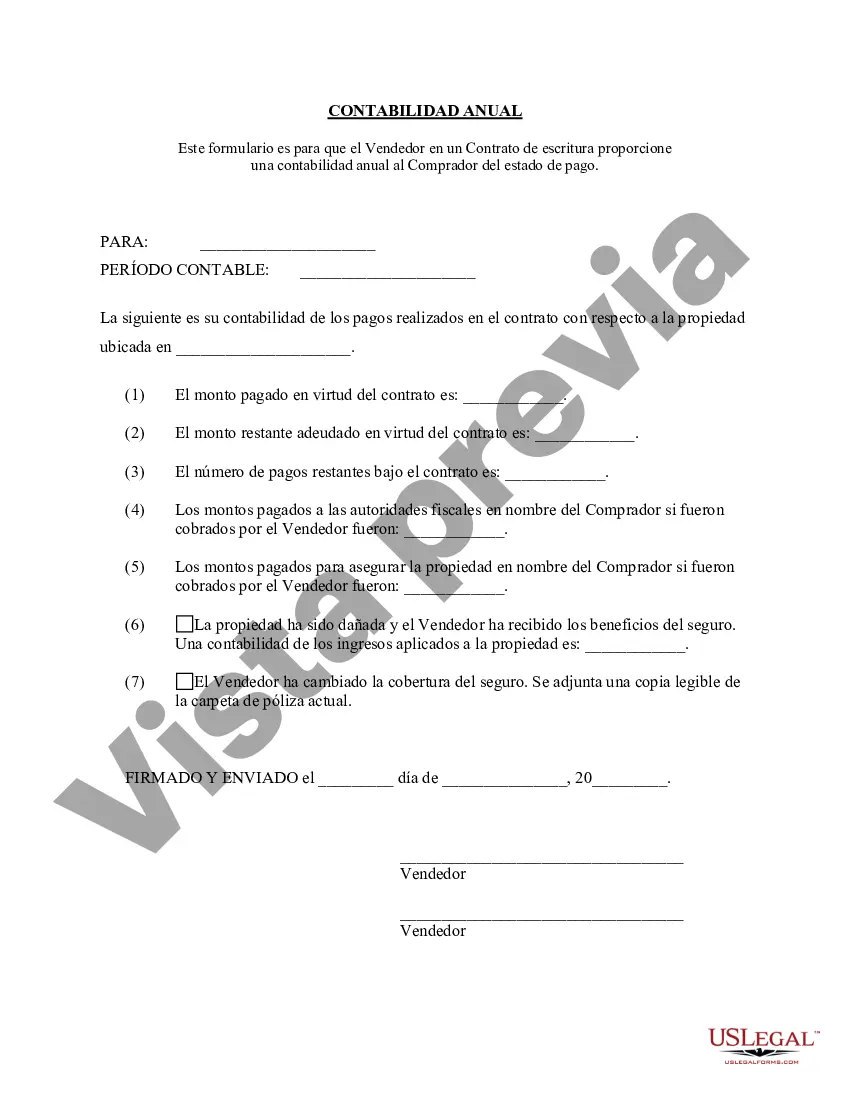

Simi Valley California Contract for Deed Seller's Annual Accounting Statement is a crucial financial document that outlines the financial transactions and obligations for sellers involved in a Contract for Deed agreement in Simi Valley, California. This statement provides detailed information on the seller's income, expenses, and overall financial performance for a specific period. By examining these statements, both parties involved can assess the contract's progress and ensure transparency in financial matters. Keywords: Simi Valley California, Contract for Deed, seller's annual accounting statement, financial transactions, obligations, income, expenses, financial performance, transparency. Different types of Simi Valley California Contract for Deed Seller's Annual Accounting Statement may include: 1. Basic Annual Accounting Statement: This type of statement provides an overview of the seller's annual financial activities, including the total income received from the buyer, any expenses related to the property, and the resulting profit or loss. 2. Property Maintenance Annual Accounting Statement: This statement specifically focuses on the expenses incurred for property maintenance and repairs throughout the year. It includes details about repairs, upgrades, landscaping, and other related expenses. 3. Tax Deduction Annual Accounting Statement: In this type of statement, sellers can document and report eligible tax deductions relating to the Contract for Deed agreement. It includes deductions such as property taxes, mortgage interest, and other applicable expenses. 4. Insurance Annual Accounting Statement: This statement provides information on the seller's annual insurance premiums and any claims made during the year. It aims to ensure that the property being sold under the Contract for Deed agreement remains adequately insured. 5. Escrow Account Annual Accounting Statement: For sellers who establish an escrow account to handle payments and expenses related to the Contract for Deed, this statement outlines the inflows and outflows from the account. It ensures proper tracking and allocation of funds for various purposes. 6. Legal Annual Accounting Statement: This type of accounting statement specifically covers any legal expenses incurred by the seller throughout the year. It includes costs related to drafting or revising the Contract for Deed agreement, consulting with attorneys, and resolving any disputes. By categorizing the different types of Simi Valley California Contract for Deed Seller's Annual Accounting Statement, it becomes easier for the involved parties to understand and track the specific financial aspects related to the Contract for Deed agreement. This enhanced clarity ensures smoother financial management and strengthens the overall contractual relationship. Keywords: Simi Valley California, Contract for Deed, annual accounting statement, financial activities, gross income, expenses, profit, loss, property maintenance, tax deductions, insurance, escrow account, legal expenses, contractual relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Simi Valley California Contrato de Escrituración Estado Contable Anual del Vendedor - California Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Simi Valley California Contrato De Escrituración Estado Contable Anual Del Vendedor?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Simi Valley California Contract for Deed Seller's Annual Accounting Statement becomes as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Simi Valley California Contract for Deed Seller's Annual Accounting Statement takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a few more steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve chosen the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Simi Valley California Contract for Deed Seller's Annual Accounting Statement. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!