Title: Understanding Clovis California Notice of Default for Past Due Payments in Connection with Contract for Deed Meta Description: Gain a comprehensive understanding of the different types and implications of Clovis California Notice of Default for Past Due Payments in connection with a Contract for Deed. Explore the significance of this legal notice and its impact on the parties involved. Keywords: Clovis California, Notice of Default, Past Due Payments, Contract for Deed, types, implications, legal notice, parties involved Introduction: A Clovis California Notice of Default for Past Due Payments is a crucial legal document that serves as a warning to parties involved in a Contract for Deed transaction. This notice highlights non-payment or delinquency of contractual obligations related to the agreement. Understanding the different types and implications of this notice is essential to protect the interests of both the buyer and seller. Read on to delve deeper into the details surrounding Clovis California Notice of Default for Past Due Payments in connection with a Contract for Deed. 1. Type 1: Notice of Default for Past Due Payments: This type of Notice of Default is issued when the buyer fails to make timely payments as stipulated in the Contract for Deed. Non-payment or delinquency of scheduled payments could trigger the filing of this notice by the seller. The notice initiates a legal process to address the defaulted payments while potentially leading to foreclosure and the forfeiture of the property. 2. Type 2: Notice of Default Resolution Options: Under this type, the Notice of Default provides the buyer with options to resolve the past due payments. These options may include a request for payment arrangements, renegotiation of terms, or a repayment plan to bring the payments up to date. The seller may extend a specific timeframe for the buyer to rectify the default and prevent further legal action. 3. Implications of the Notice of Default for Past Due Payments: a. Risk of Property Loss: When a Notice of Default is issued, it signifies that the buyer is in danger of losing the property due to non-payment. The seller may initiate foreclosure proceedings if a resolution is not reached within the specified period, potentially leading to the buyer's eviction and loss of investment. b. Credit Consequences: A Notice of Default can negatively impact the buyer's credit score and overall creditworthiness. This adverse credit reporting can affect future borrowing ability and financial stability. c. Legal Process: Once a Notice of Default is filed, it starts a legal process wherein the seller may pursue foreclosure actions against the buyer. The buyer should seek legal advice promptly to understand their rights and explore potential alternatives to foreclosure. d. Opportunities for Resolution: The Notice of Default also provides an opportunity for the buyer and seller to work collaboratively to find a resolution. However, cooperation, timely communication, and negotiation are vital to arriving at a mutually agreeable outcome. Conclusion: A Clovis California Notice of Default for Past Due Payments related to a Contract for Deed is a critical legal document emphasizing non-payment or delinquency issues. Understanding the different types and implications of this notice enables both buyer and seller to navigate the situation effectively. It is crucial for the parties involved to seek legal advice and explore possible resolution options, ensuring the protection of their respective interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clovis California Notificación de Incumplimiento de Pagos Atrasados en relación con el Contrato de Escritura - California Notice of Default for Past Due Payments in connection with Contract for Deed

State:

California

City:

Clovis

Control #:

CA-00470-8

Format:

Word

Instant download

Description

Aviso al Comprador de que los pagos están vencidos. Aviso inicial.

Title: Understanding Clovis California Notice of Default for Past Due Payments in Connection with Contract for Deed Meta Description: Gain a comprehensive understanding of the different types and implications of Clovis California Notice of Default for Past Due Payments in connection with a Contract for Deed. Explore the significance of this legal notice and its impact on the parties involved. Keywords: Clovis California, Notice of Default, Past Due Payments, Contract for Deed, types, implications, legal notice, parties involved Introduction: A Clovis California Notice of Default for Past Due Payments is a crucial legal document that serves as a warning to parties involved in a Contract for Deed transaction. This notice highlights non-payment or delinquency of contractual obligations related to the agreement. Understanding the different types and implications of this notice is essential to protect the interests of both the buyer and seller. Read on to delve deeper into the details surrounding Clovis California Notice of Default for Past Due Payments in connection with a Contract for Deed. 1. Type 1: Notice of Default for Past Due Payments: This type of Notice of Default is issued when the buyer fails to make timely payments as stipulated in the Contract for Deed. Non-payment or delinquency of scheduled payments could trigger the filing of this notice by the seller. The notice initiates a legal process to address the defaulted payments while potentially leading to foreclosure and the forfeiture of the property. 2. Type 2: Notice of Default Resolution Options: Under this type, the Notice of Default provides the buyer with options to resolve the past due payments. These options may include a request for payment arrangements, renegotiation of terms, or a repayment plan to bring the payments up to date. The seller may extend a specific timeframe for the buyer to rectify the default and prevent further legal action. 3. Implications of the Notice of Default for Past Due Payments: a. Risk of Property Loss: When a Notice of Default is issued, it signifies that the buyer is in danger of losing the property due to non-payment. The seller may initiate foreclosure proceedings if a resolution is not reached within the specified period, potentially leading to the buyer's eviction and loss of investment. b. Credit Consequences: A Notice of Default can negatively impact the buyer's credit score and overall creditworthiness. This adverse credit reporting can affect future borrowing ability and financial stability. c. Legal Process: Once a Notice of Default is filed, it starts a legal process wherein the seller may pursue foreclosure actions against the buyer. The buyer should seek legal advice promptly to understand their rights and explore potential alternatives to foreclosure. d. Opportunities for Resolution: The Notice of Default also provides an opportunity for the buyer and seller to work collaboratively to find a resolution. However, cooperation, timely communication, and negotiation are vital to arriving at a mutually agreeable outcome. Conclusion: A Clovis California Notice of Default for Past Due Payments related to a Contract for Deed is a critical legal document emphasizing non-payment or delinquency issues. Understanding the different types and implications of this notice enables both buyer and seller to navigate the situation effectively. It is crucial for the parties involved to seek legal advice and explore possible resolution options, ensuring the protection of their respective interests.

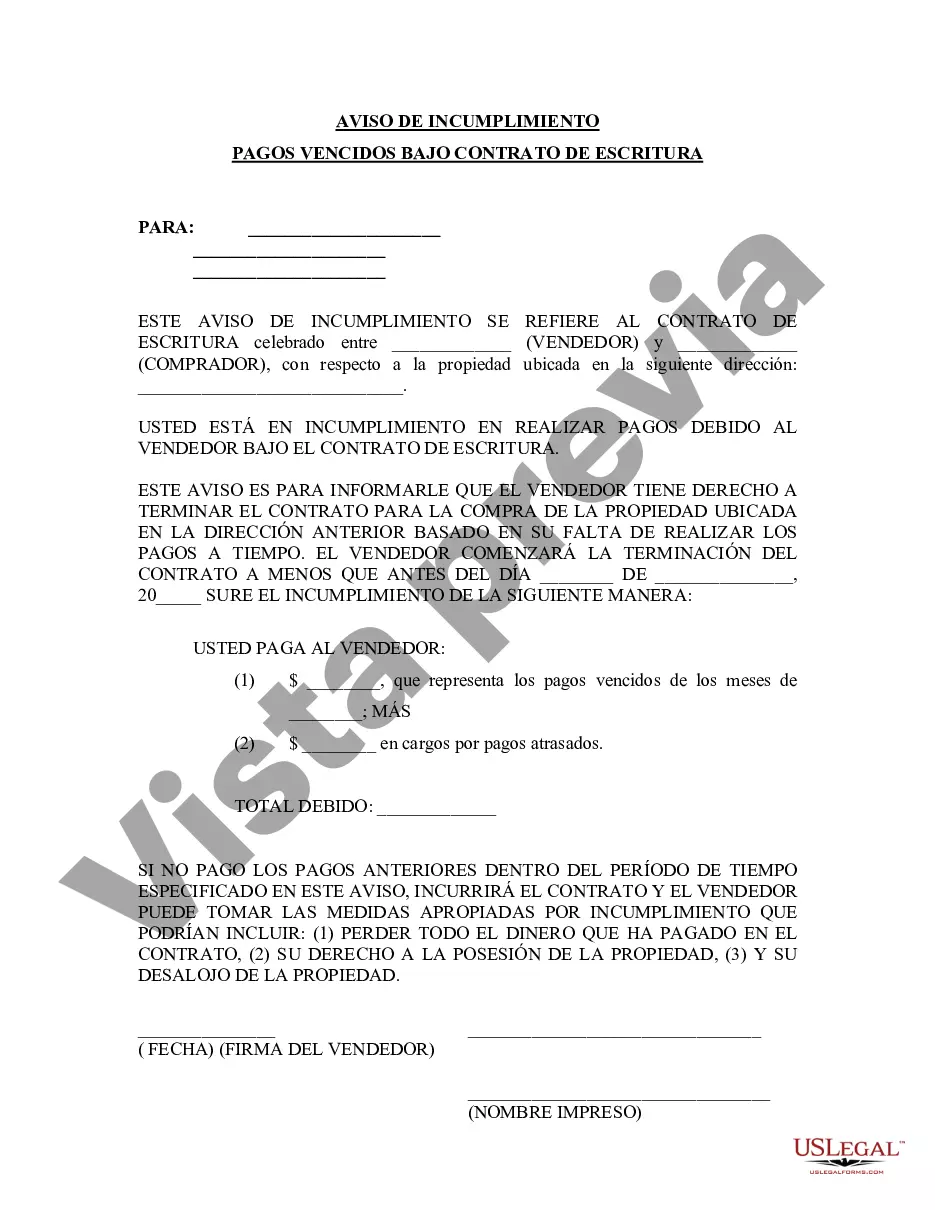

Free preview

How to fill out Clovis California Notificación De Incumplimiento De Pagos Atrasados En Relación Con El Contrato De Escritura?

If you’ve already utilized our service before, log in to your account and save the Clovis California Notice of Default for Past Due Payments in connection with Contract for Deed on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Make certain you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Clovis California Notice of Default for Past Due Payments in connection with Contract for Deed. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!