Title: Understanding Roseville California Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: In Roseville, California, a Notice of Default for past due payments in connection with a Contract for Deed serves as a legal document to inform both parties involved about the default in payment and the subsequent consequences. This detailed description will delve into the significance of such a notice, its process, and potential types of notices of default that may arise in such cases. Key terms: Roseville California, Notice of Default, Past Due Payments, Contract for Deed 1. What is a Contract for Deed? A Contract for Deed, also known as a land contract, is a legal agreement wherein the seller provides financing to the buyer for purchasing a property. Instead of traditional bank financing, the seller acts as the lender, and the buyer agrees to make monthly installment payments until the full purchase price is paid. 2. Understanding the Notice of Default: The Notice of Default is a legal notification issued by the seller/lender if the buyer fails to make timely payments as specified in the Contract for Deed agreement. This notice indicates that the buyer is in default and that specific actions or consequences may follow if the past due payments are not rectified within a given period. 3. The Process of Issuing a Notice of Default: — Initial Default: When the buyer fails to make a payment on time, typically within a designated grace period, a default occurs. — Written Notice: The seller/lender will send a Notice of Default to the buyer, outlining the missed payment, the amount due, and the timeframe within which the payment must be made to avoid further consequences. — Cure Period: The buyer is given a specific period, usually defined by state law or the terms of the Contract for Deed, to rectify the default by making the required payment(s). — Notice of Trustee Sale: If the buyer fails to rectify the default within the cure period, the lender may proceed with initiating a Notice of Trustee Sale, marking the start of the foreclosure process. 4. Potential Types of Notices of Default: — Notice of Default for First Missed Payment: The buyer receives this notice after the first missed payment, reminding them of their obligation and the need to rectify the arbitrage promptly. — Notice of Default for Continuous Missed Payments: If the buyer fails to cure previous defaults and continues to miss payments, the lender may issue subsequent notices of default, signaling a more severe breach of the agreement. — Notice of Default with Intent to Accelerate: In some cases, the lender may choose to demand immediate payment of the entire outstanding balance (acceleration) if the buyer consistently fails to meet their payment obligations. Conclusion: The Roseville California Notice of Default for Past Due Payments in Connection with a Contract for Deed serves as an essential legal document indicating a buyer's default on payment obligations. Understanding this notice and its potential consequences is crucial for both parties involved in a Contract for Deed agreement. Compliance with the terms and rectifying defaults promptly can help prevent escalated actions, such as foreclosure.

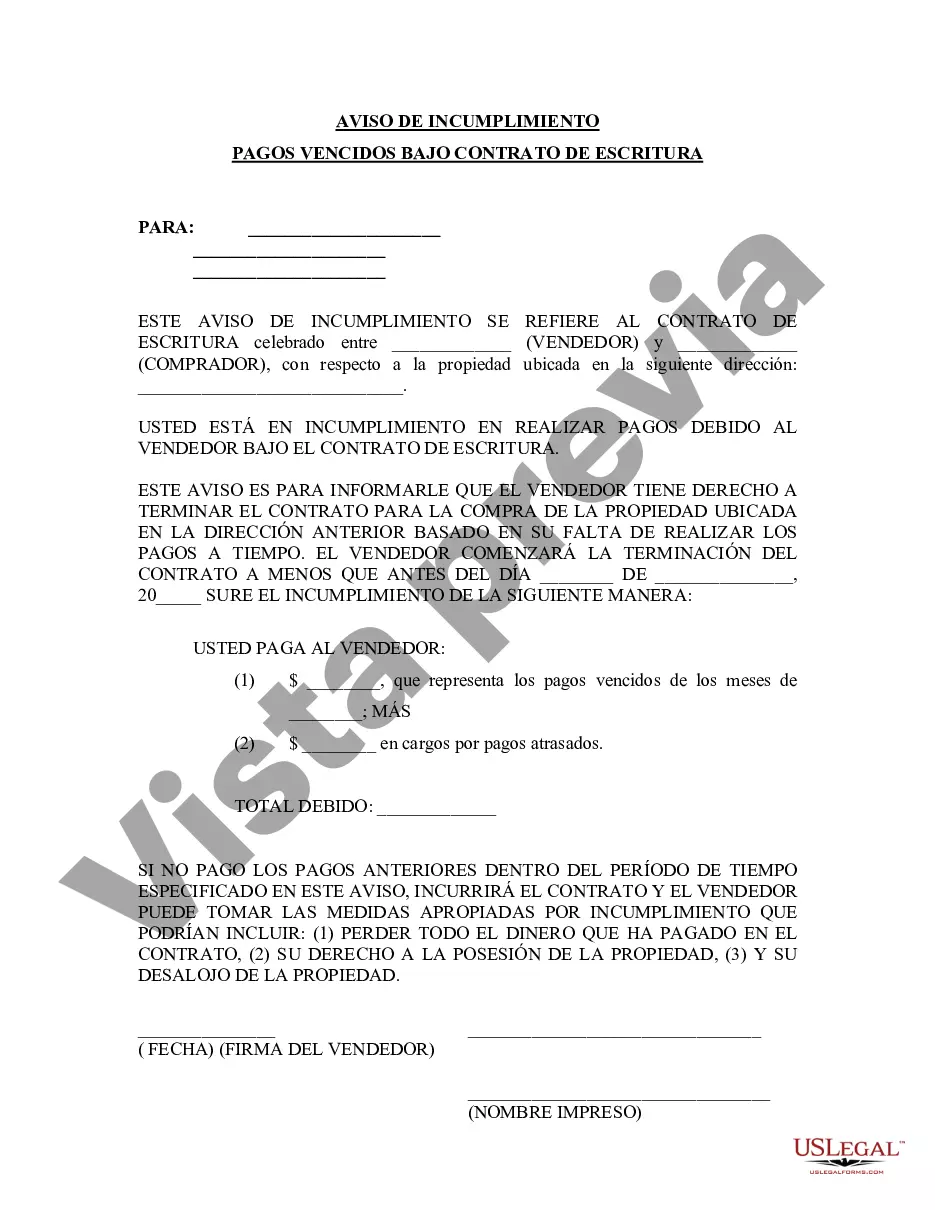

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Roseville California Notificación de Incumplimiento de Pagos Atrasados en relación con el Contrato de Escritura - California Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Roseville California Notificación De Incumplimiento De Pagos Atrasados En Relación Con El Contrato De Escritura?

Finding verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Roseville California Notice of Default for Past Due Payments in connection with Contract for Deed becomes as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the Roseville California Notice of Default for Past Due Payments in connection with Contract for Deed takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a couple of more steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make certain you’ve selected the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Roseville California Notice of Default for Past Due Payments in connection with Contract for Deed. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!