Title: Understand Concord California Final Notice of Default for Past Due Payments in Connection with Contract for Deed Keywords: Concord California, final notice of default, past due payments, contract for deed Introduction: Concord, California, is a city where individuals may enter into a Contract for Deed to purchase property. However, failure to make timely payments according to the agreement may result in a Final Notice of Default. This article will explain the specifics of such notices and their implications. Types of Concord California Final Notice of Default for Past Due Payments in connection with Contract for Deed: 1. Standard Concord California Final Notice of Default for Past Due Payments: This type of notice is issued when a buyer under a contract for deed has missed payments and has breached the agreed-upon payment schedule. It serves as an official notification to the buyer that their account is past due, indicating their default status. 2. Cure or Quit Concord California Final Notice of Default for Past Due Payments: In certain cases, the seller or lender may offer the buyer a chance to remedy the missed payments within a specific timeframe. This particular notice gives the buyer an opportunity to "Cure" their default by making past due payments or face the possibility of "Quitting" the contract for deed. 3. Acceleration Concord California Final Notice of Default for Past Due Payments: If a buyer fails to cure their default within the specified timeframe provided in the Cure or Quit notice, the seller or lender may choose to accelerate the remaining balance due on the contract. This type of notice demands the immediate payment of the total outstanding debt, which could result in foreclosure or legal action if not resolved promptly. Importance of Responding to a Concord California Final Notice of Default for Past Due Payments: It is crucial for buyers in Concord, California, to respond promptly to any type of Final Notice of Default for Past Due Payments. Failing to address the situation appropriately can have severe consequences, including potential legal action, foreclosure, or the termination of the contract for deed. Actions Buyers Can Take Upon Receiving a Notice: 1. Contact the Seller or Lender: Immediately reaching out to the seller or lender allows for potential negotiation, establishing a repayment plan, or requesting alternative solutions to avoid further legal action. 2. Review the Contract for Deed: Thoroughly review the original contract for deed, paying close attention to any clauses or provisions related to defaults, late payments, or the remedies available to both parties. 3. Seek Legal Advice: Consulting with an attorney who specializes in real estate law can provide valuable insights and guidance on how to handle the situation professionally, ensuring the buyer's rights are protected. Conclusion: Receiving a Concord California Final Notice of Default for Past Due Payments can be a stressful situation for buyers under a contract for deed. Being aware of the various types of notices and taking appropriate action can lead to resolving the default and potentially avoiding more severe consequences.

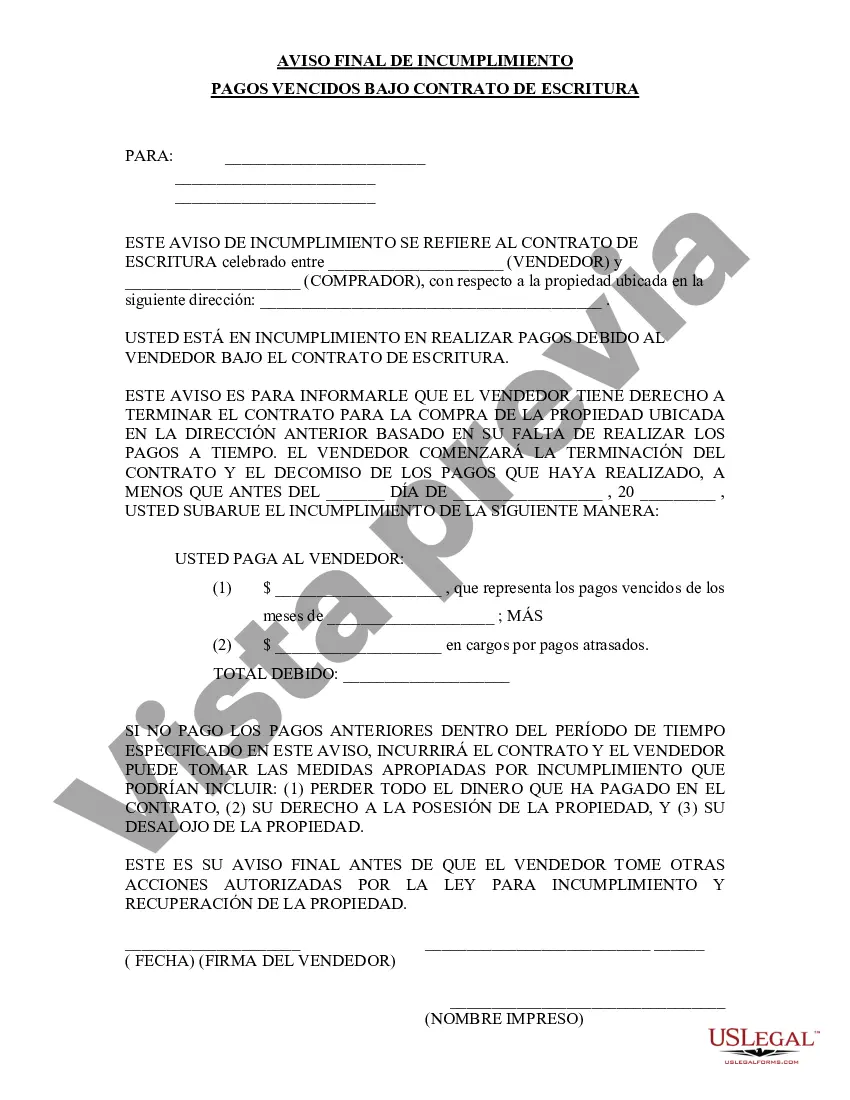

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Concord California Aviso final de incumplimiento de pagos vencidos en relación con el contrato de escritura - California Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Concord California Aviso Final De Incumplimiento De Pagos Vencidos En Relación Con El Contrato De Escritura?

Are you looking for a reliable and affordable legal forms provider to buy the Concord California Final Notice of Default for Past Due Payments in connection with Contract for Deed? US Legal Forms is your go-to solution.

No matter if you need a simple arrangement to set rules for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and frameworked in accordance with the requirements of particular state and area.

To download the form, you need to log in account, locate the required template, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates at any time in the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Concord California Final Notice of Default for Past Due Payments in connection with Contract for Deed conforms to the regulations of your state and local area.

- Go through the form’s details (if available) to learn who and what the form is intended for.

- Restart the search if the template isn’t good for your specific scenario.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Concord California Final Notice of Default for Past Due Payments in connection with Contract for Deed in any available format. You can return to the website at any time and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending your valuable time learning about legal papers online once and for all.