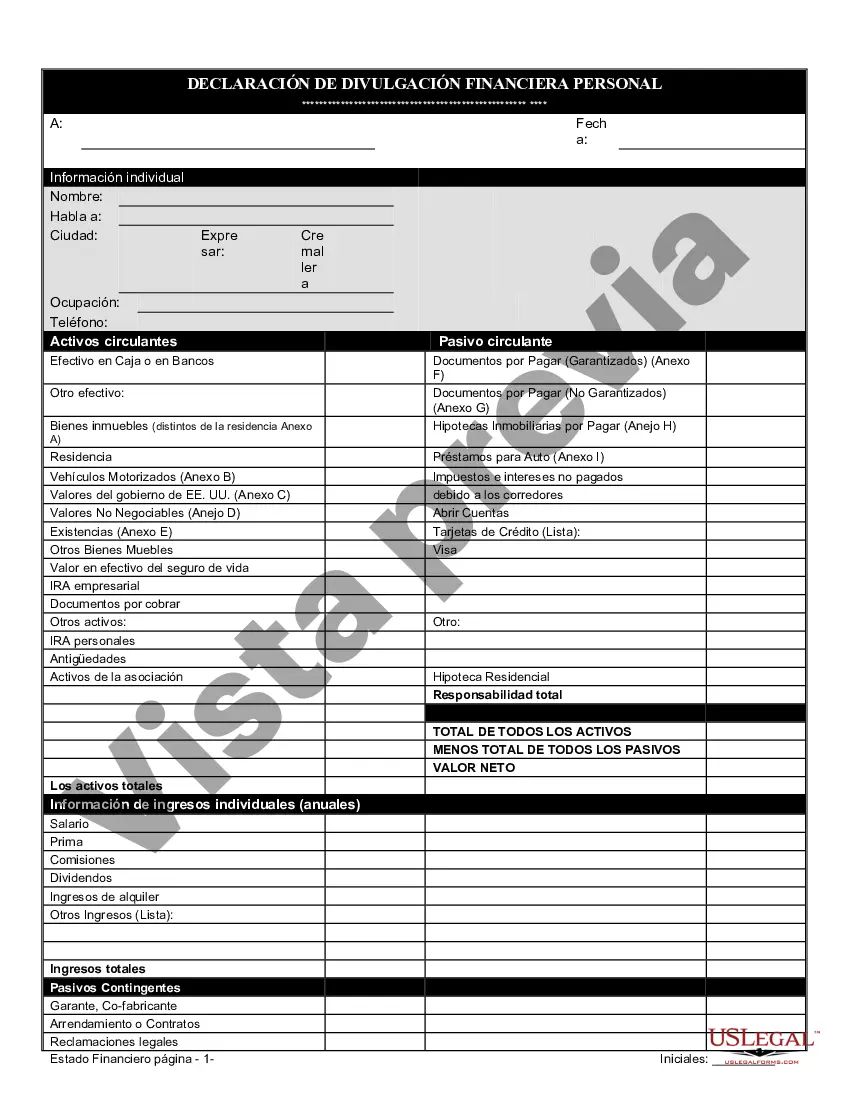

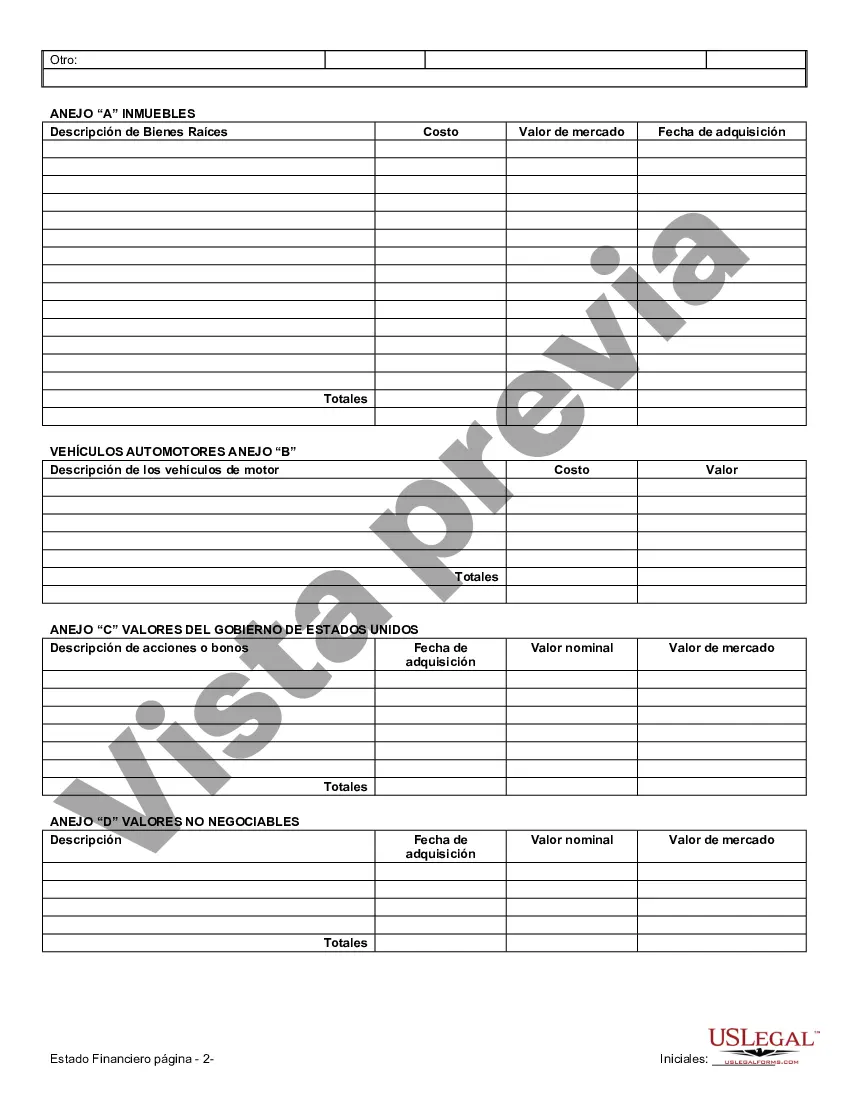

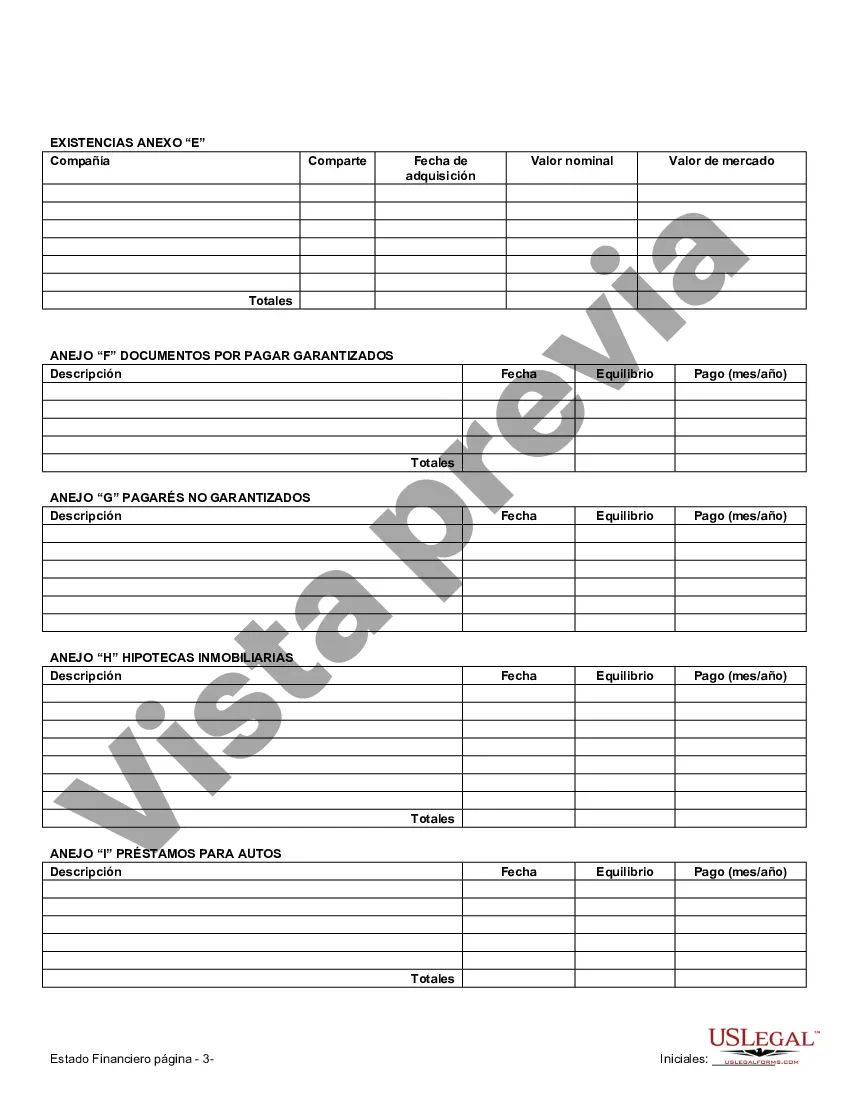

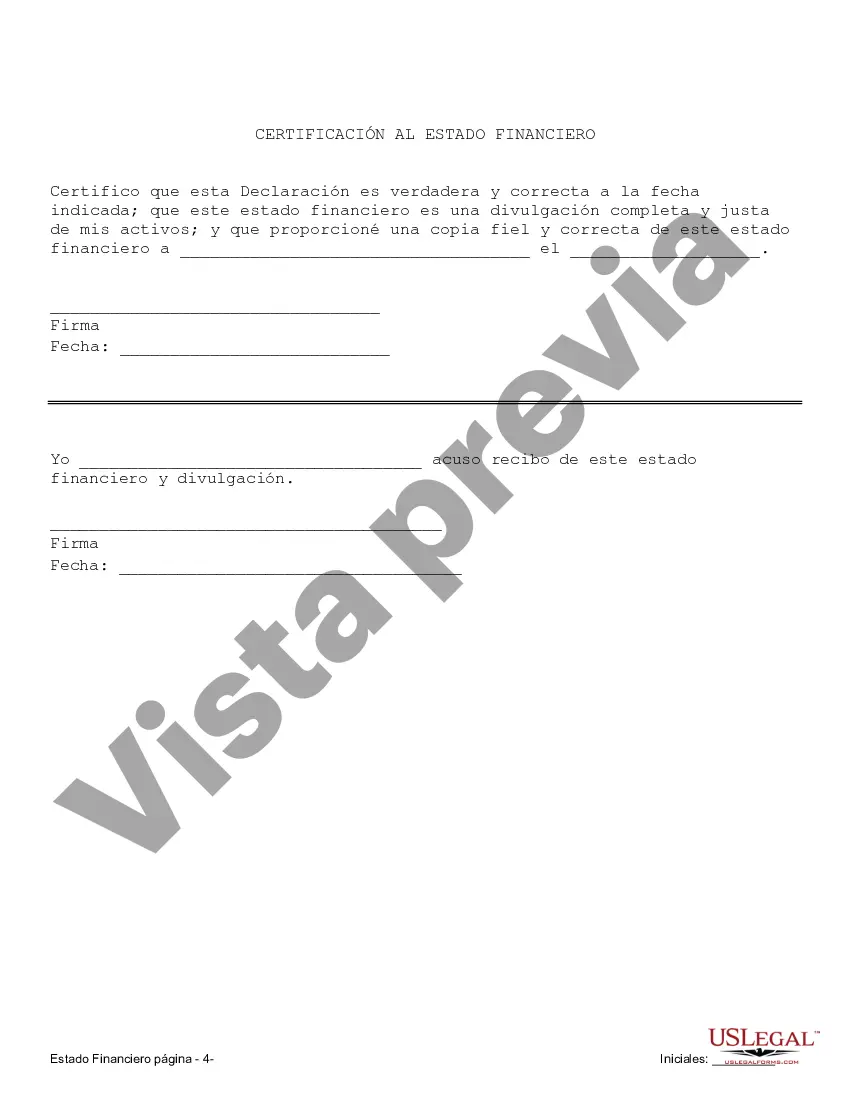

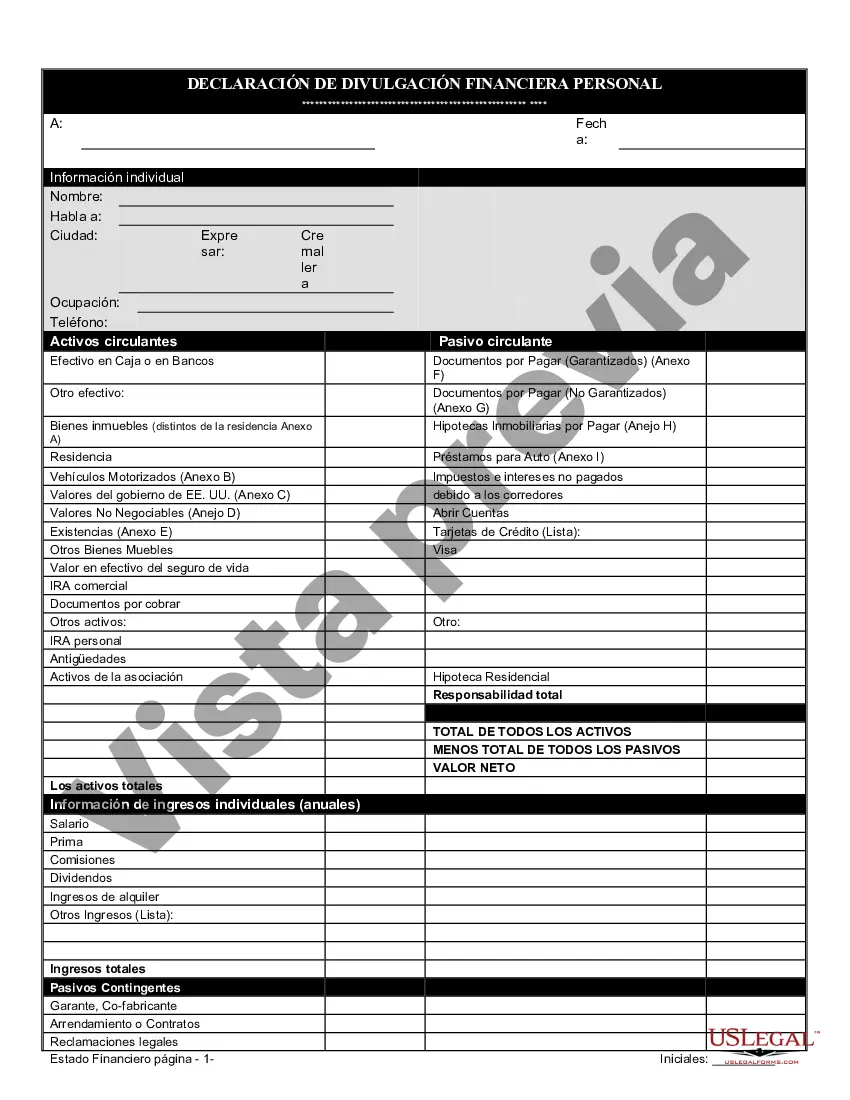

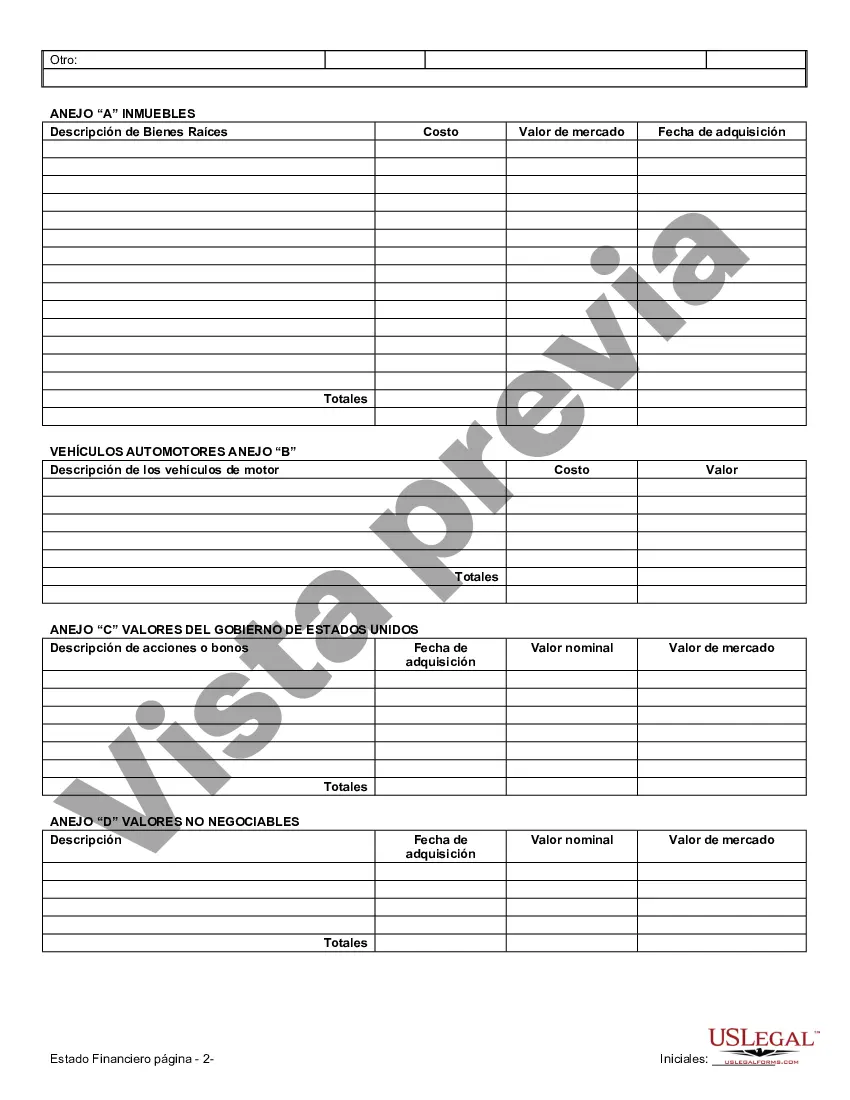

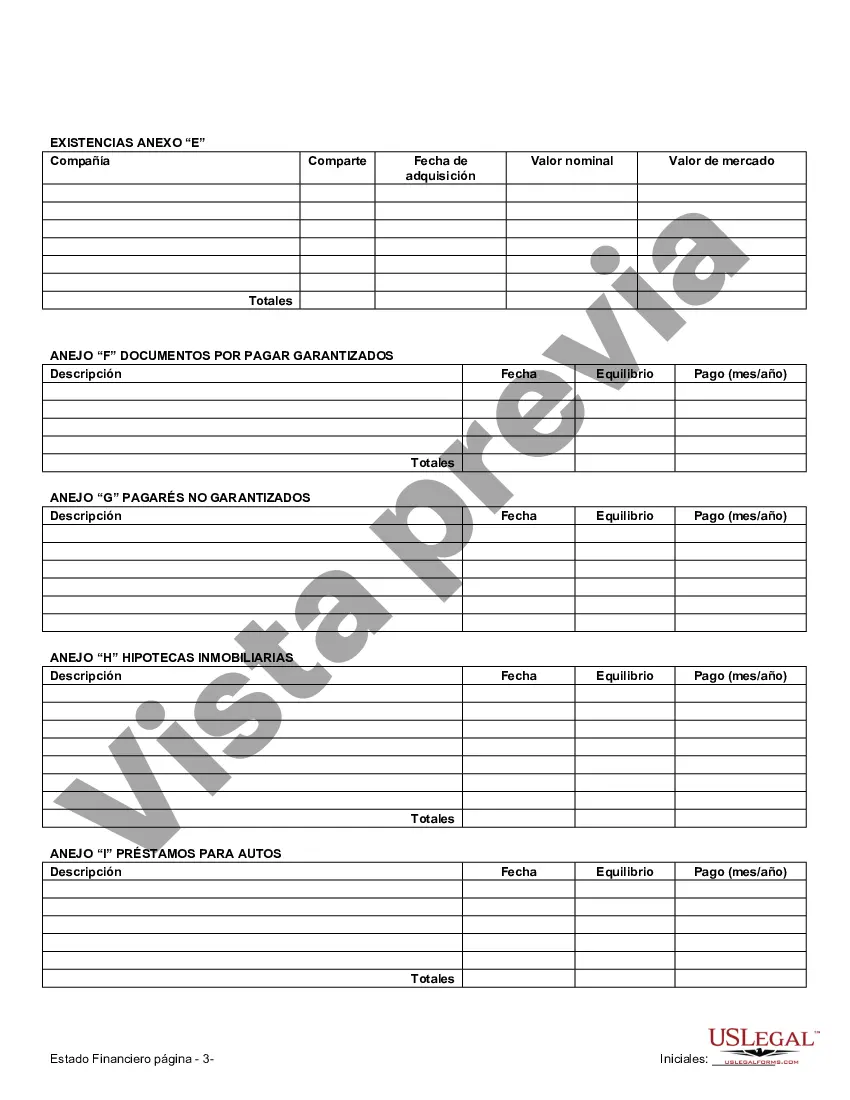

Alameda California Financial Statements in Connection with Prenuptial Premarital Agreement: A Comprehensive Overview When entering into a prenuptial or premarital agreement in Alameda, California, it is essential to include accurate and detailed financial statements as part of the legal documentation. These financial statements serve to provide a clear understanding of the parties' financial positions, assets, and debts before entering into a marriage. By incorporating relevant keywords, we can shed light on the different types of financial statements and their importance in prenuptial agreements. 1. Alameda California Financial Statements: These are the foundational documents used to assess a couple's financial situation. They outline each party's assets, liabilities, income, and expenses. Alameda California Financial Statements provide a snapshot of an individual's financial status, including real estate properties, investments, business ownership, bank accounts, debts, and other monetary holdings. 2. Personal Financial Statements: These financial documents detail an individual's financial standing independently of their future partner. Personal financial statements showcase an individual's personal assets, such as savings accounts, stocks, bonds, retirement funds, vehicles, valuable personal property, and outstanding debts like student loans or credit card balances. It is crucial to present an accurate and comprehensive personal financial statement to ensure transparency and fairness in a prenuptial agreement. 3. Business Financial Statements: In cases where one or both parties own a business, including detailed business financial statements becomes essential. These statements provide a comprehensive overview of the business's financial health, including its assets, liabilities, income, expenses, and potential risks. They include balance sheets, income statements, and cash flow statements that offer a holistic view of the business's financial position and sustainability. Business financial statements also indicate the ownership interest of each spouse in the business. 4. Real Estate Financial Statements: If either party owns real estate, whether residential, commercial, or rental properties, it is imperative to include real estate financial statements. These documents outline the value of the properties, any outstanding mortgages or liens, rental income, property management expenses, and maintenance costs. Additionally, such statements may include property appraisals, home insurance documentation, and evidence of property ownership. 5. Investment Financial Statements: When couples hold investment portfolios, stocks, bonds, mutual funds, or other securities, investment financial statements become crucial components of the prenuptial agreement. These statements provide an overview of the investments, including their market value, dividends or interest received, future growth potential, and any associated risks. Each party should disclose all investment accounts and provide thorough documentation to ensure complete transparency. These various types of Alameda California Financial Statements only in Connection with Prenuptial Premarital Agreements are crucial for crafting fair and enforceable agreements. By presenting accurate and comprehensive financial information, both parties can make informed decisions and establish terms that protect their individual rights and assets. It is advisable to seek legal counsel when drafting a prenuptial agreement to ensure compliance with California state laws and comprehensive financial disclosure.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - California Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Alameda California Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

Benefit from the US Legal Forms and obtain instant access to any form you need. Our useful platform with a huge number of document templates allows you to find and obtain virtually any document sample you want. You are able to download, fill, and certify the Alameda California Financial Statements only in Connection with Prenuptial Premarital Agreement in just a few minutes instead of browsing the web for hours seeking an appropriate template.

Utilizing our catalog is a superb strategy to increase the safety of your form submissions. Our professional attorneys regularly review all the documents to ensure that the forms are appropriate for a particular state and compliant with new laws and regulations.

How can you get the Alameda California Financial Statements only in Connection with Prenuptial Premarital Agreement? If you already have a subscription, just log in to the account. The Download option will be enabled on all the documents you view. Additionally, you can find all the previously saved documents in the My Forms menu.

If you don’t have an account yet, stick to the instructions below:

- Open the page with the template you require. Ensure that it is the form you were hoping to find: verify its headline and description, and make use of the Preview function when it is available. Otherwise, utilize the Search field to look for the needed one.

- Start the downloading procedure. Click Buy Now and select the pricing plan that suits you best. Then, create an account and process your order utilizing a credit card or PayPal.

- Download the file. Select the format to obtain the Alameda California Financial Statements only in Connection with Prenuptial Premarital Agreement and change and fill, or sign it for your needs.

US Legal Forms is one of the most extensive and reliable document libraries on the internet. We are always happy to help you in any legal case, even if it is just downloading the Alameda California Financial Statements only in Connection with Prenuptial Premarital Agreement.

Feel free to take advantage of our service and make your document experience as efficient as possible!