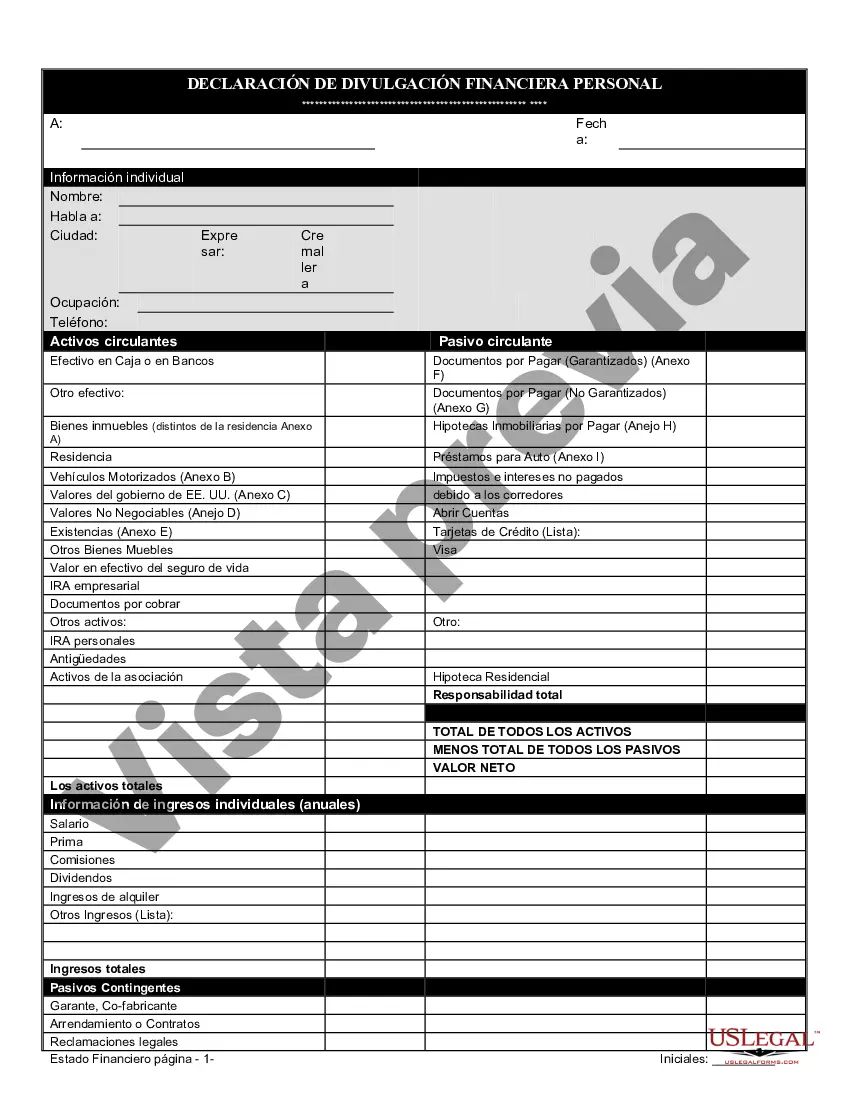

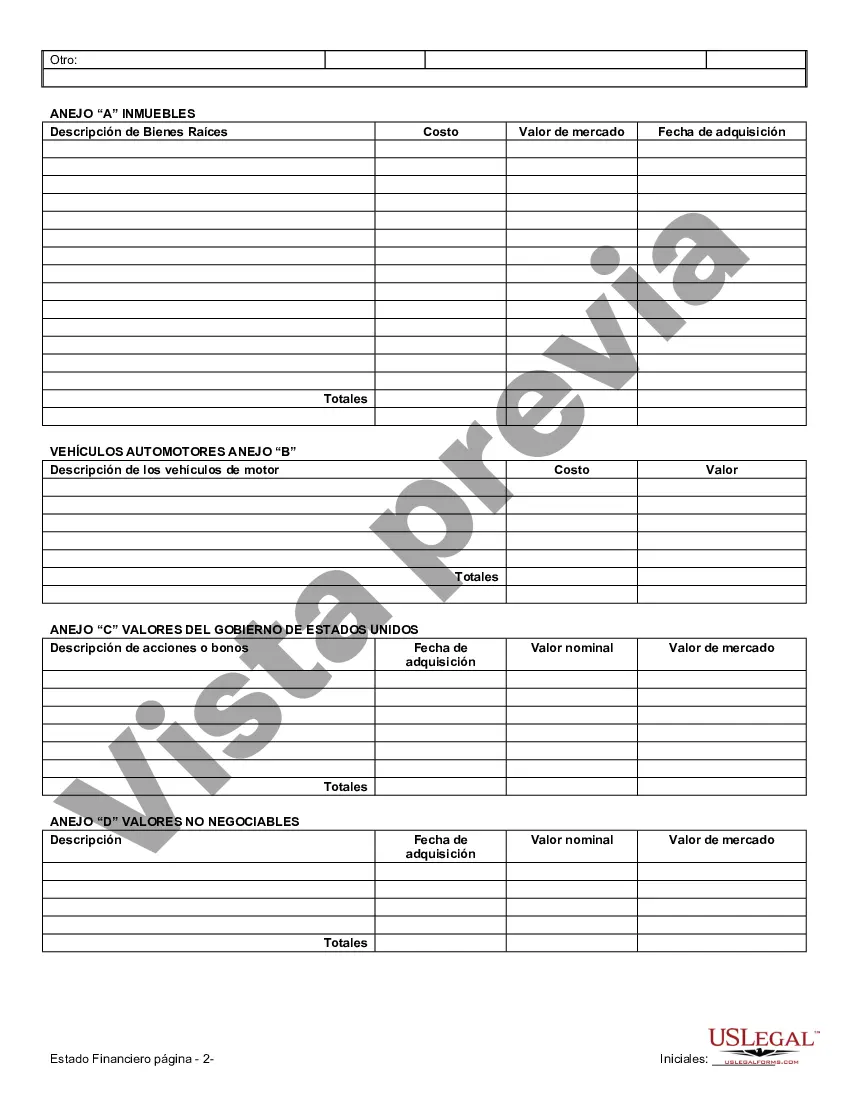

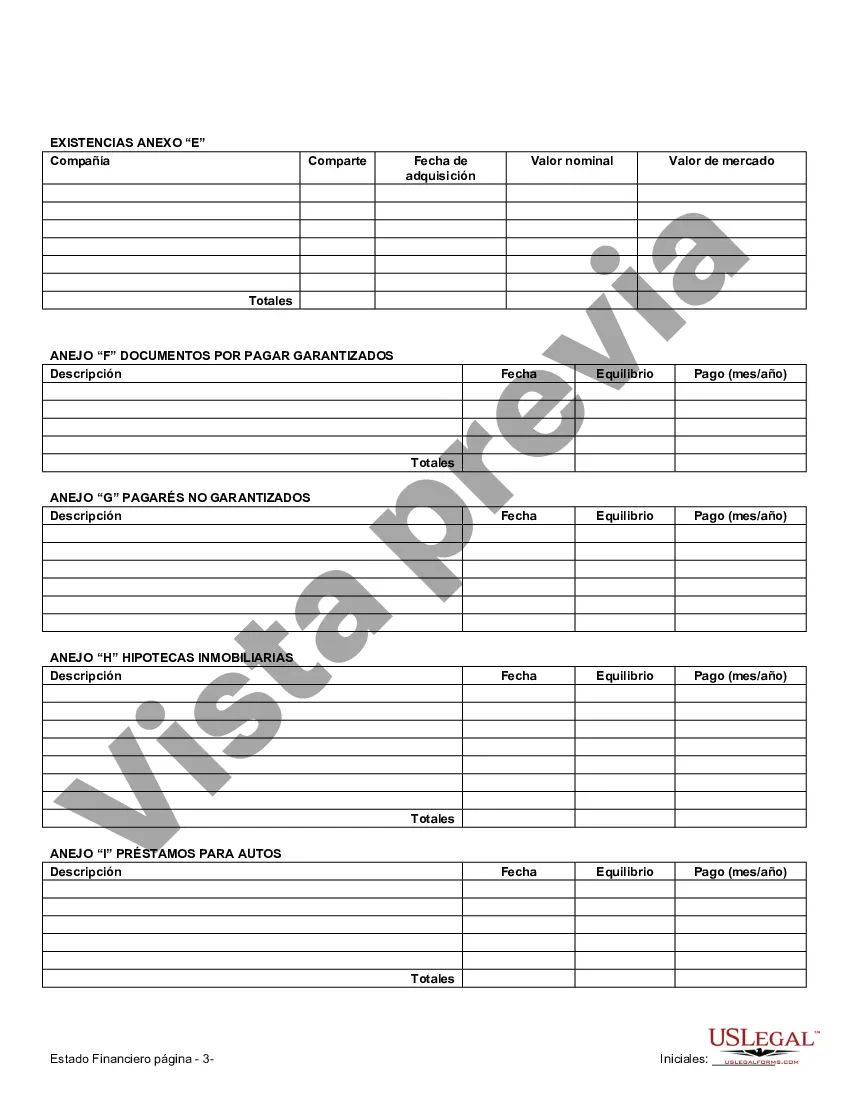

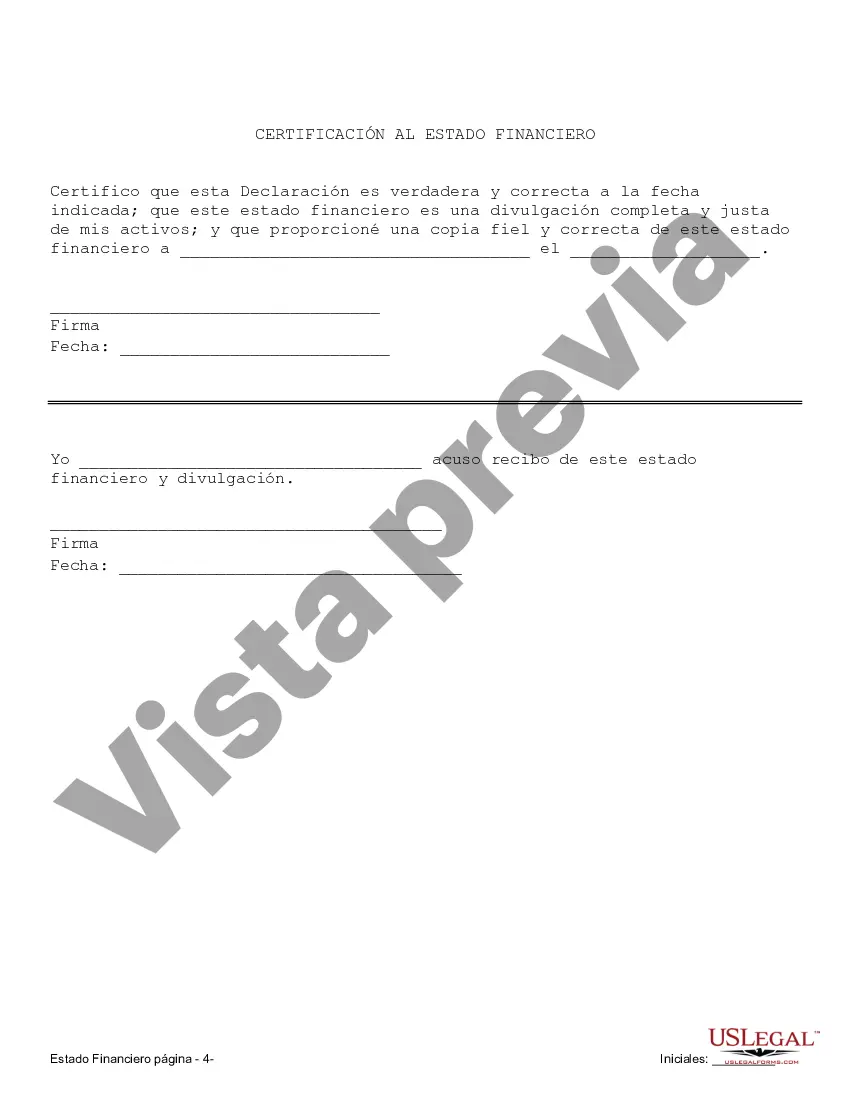

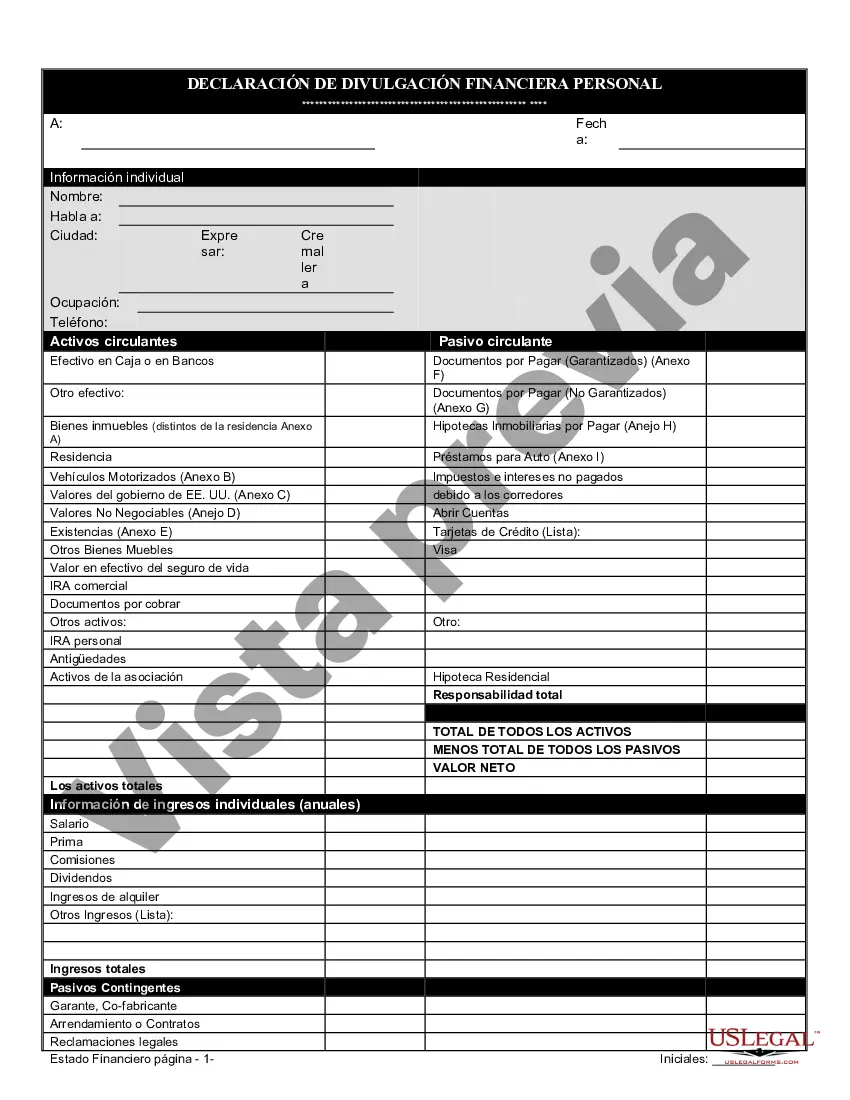

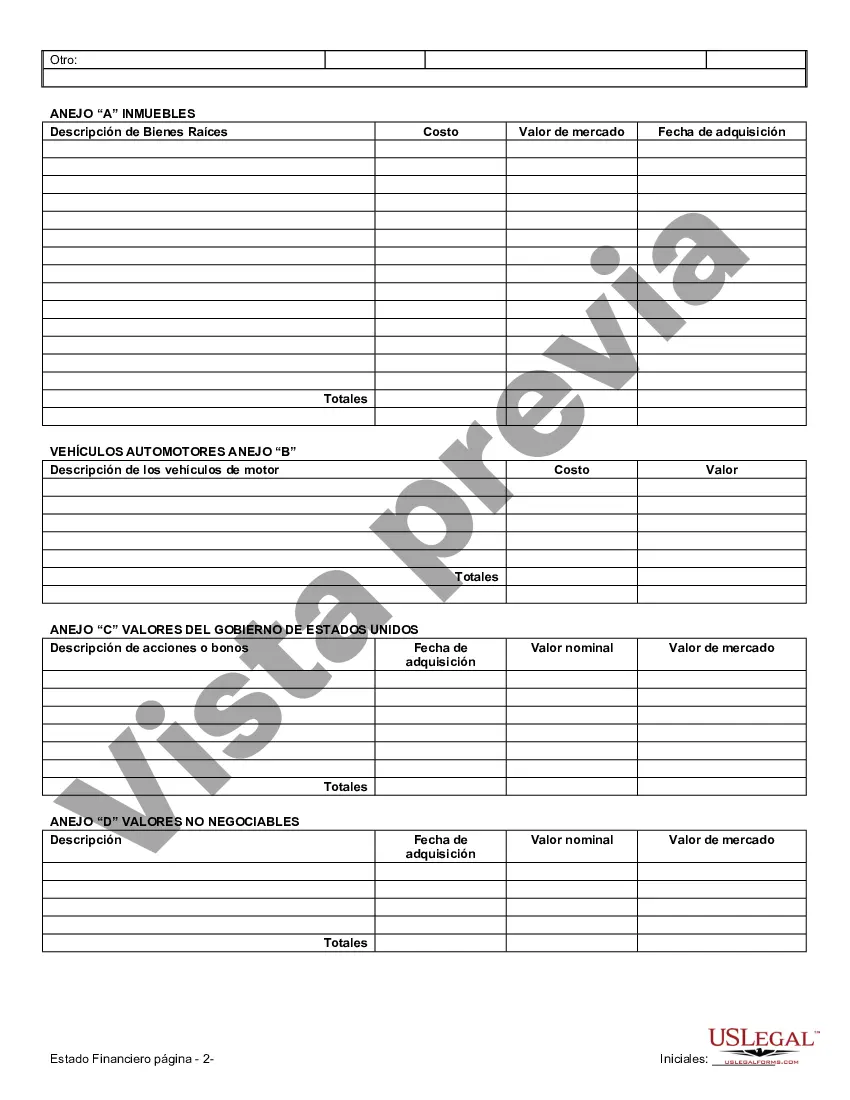

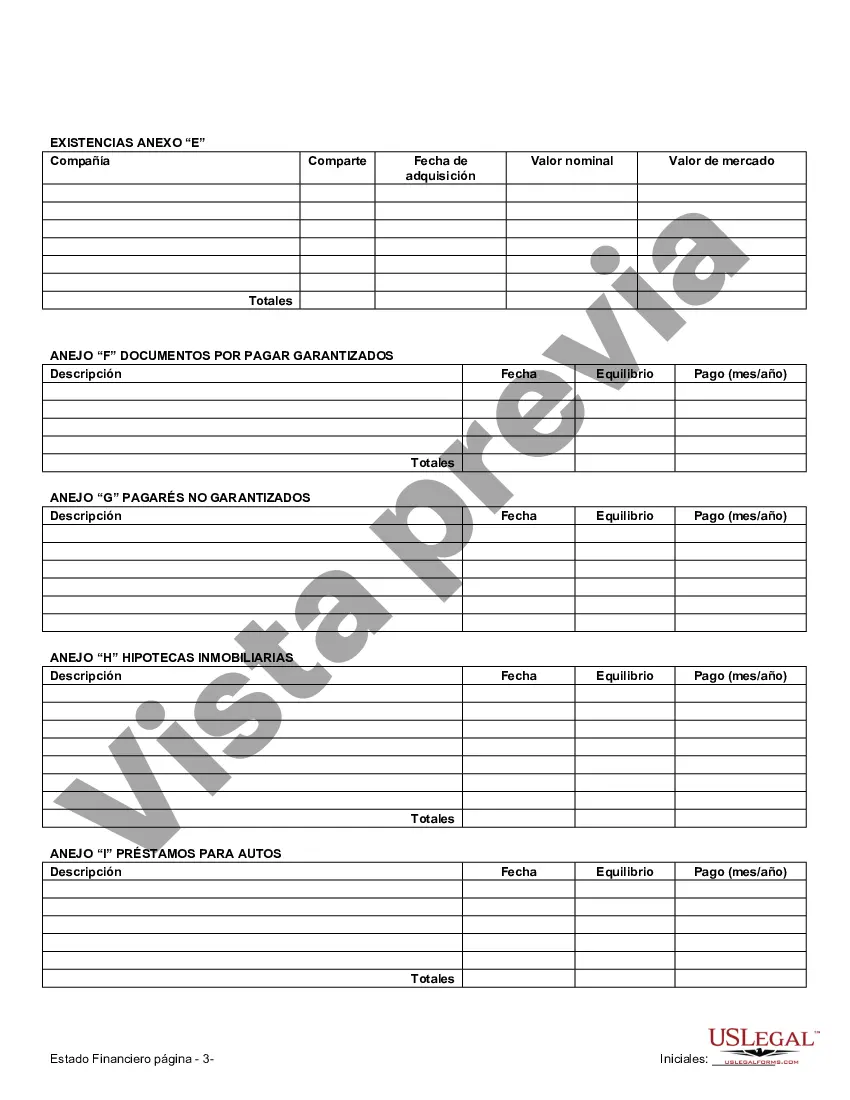

Elk Grove California Financial Statements in Connection with Prenuptial Premarital Agreement: A Comprehensive Overview When entering into a prenuptial or premarital agreement in Elk Grove, California, it is essential to include accurate and detailed financial statements. These statements provide transparency and understanding between couples, safeguarding their financial interests and ensuring a fair division of assets and liabilities should the marriage unfortunately dissolve in the future. There are different types of financial statements utilized in the context of prenuptial or premarital agreements in Elk Grove, California. Let's explore them below: 1. Personal Financial Statements: These statements outline an individual's personal financial position, including income, assets, liabilities, debts, investments, and any other relevant financial information. This statement offers clarity on an individual's financial standing and establishes a baseline for future comparisons. 2. Business Financial Statements: For individuals with business interests or ownership in Elk Grove, including sole proprietorship, partnerships, or corporations, it is crucial to provide business financial statements. These statements encompass the business's income, expenses, assets, liabilities, and other financial details. Including business financial statements in the prenuptial agreement ensures that the business interests receive appropriate consideration in case of a divorce. 3. Real Estate Property Financial Statements: Real estate holdings represent a significant portion of many individuals' assets. It is vital to disclose detailed financial information related to any owned properties, such as residential homes, commercial buildings, or rental properties. These financial statements should include property valuations, mortgage details, rental income, property taxes, insurance, and any associated expenses. 4. Investment Portfolio Financial Statements: Investment accounts, whether stocks, bonds, mutual funds, retirement plans, or other investments, hold considerable importance when determining the division of assets. Including investment portfolio financial statements provides a complete picture of an individual's financial portfolio, including the values, types of investments, income generated, and potential tax implications. 5. Debts and Liabilities Financial Statements: Debts and liabilities can significantly impact the financial obligations of both parties involved in a prenuptial agreement. Disclosing outstanding loans, credit card balances, mortgages, student loans, and any other financial obligations ensures transparency and fairness in determining asset division and responsibilities for settling debts. Elk Grove, California financial statements in connection with prenuptial or premarital agreements are aimed at securing the financial well-being of both parties involved. By providing accurate and comprehensive financial information, couples can establish trust, protect their individual interests, and ensure a smooth resolution in the event of a divorce or separation. It is crucial to consult with a qualified attorney specializing in family law to ensure compliance with California laws and to obtain tailored advice on structuring the financial statements in connection with prenuptial or premarital agreements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Elk Grove California Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - California Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Elk Grove California Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

If you are searching for a relevant form template, it’s extremely hard to choose a better place than the US Legal Forms site – probably the most considerable online libraries. Here you can get a large number of form samples for business and personal purposes by categories and states, or keywords. With the advanced search option, finding the newest Elk Grove California Financial Statements only in Connection with Prenuptial Premarital Agreement is as easy as 1-2-3. In addition, the relevance of each file is proved by a group of skilled lawyers that regularly review the templates on our website and revise them based on the newest state and county demands.

If you already know about our system and have a registered account, all you need to receive the Elk Grove California Financial Statements only in Connection with Prenuptial Premarital Agreement is to log in to your profile and click the Download button.

If you utilize US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have chosen the sample you require. Check its explanation and make use of the Preview feature (if available) to see its content. If it doesn’t suit your needs, use the Search field at the top of the screen to find the needed file.

- Affirm your decision. Click the Buy now button. After that, choose the preferred pricing plan and provide credentials to sign up for an account.

- Process the transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Receive the template. Pick the format and download it on your device.

- Make changes. Fill out, revise, print, and sign the received Elk Grove California Financial Statements only in Connection with Prenuptial Premarital Agreement.

Each template you save in your profile has no expiration date and is yours permanently. You can easily gain access to them via the My Forms menu, so if you need to get an extra copy for enhancing or creating a hard copy, you may come back and save it again at any moment.

Make use of the US Legal Forms professional catalogue to get access to the Elk Grove California Financial Statements only in Connection with Prenuptial Premarital Agreement you were looking for and a large number of other professional and state-specific samples in one place!