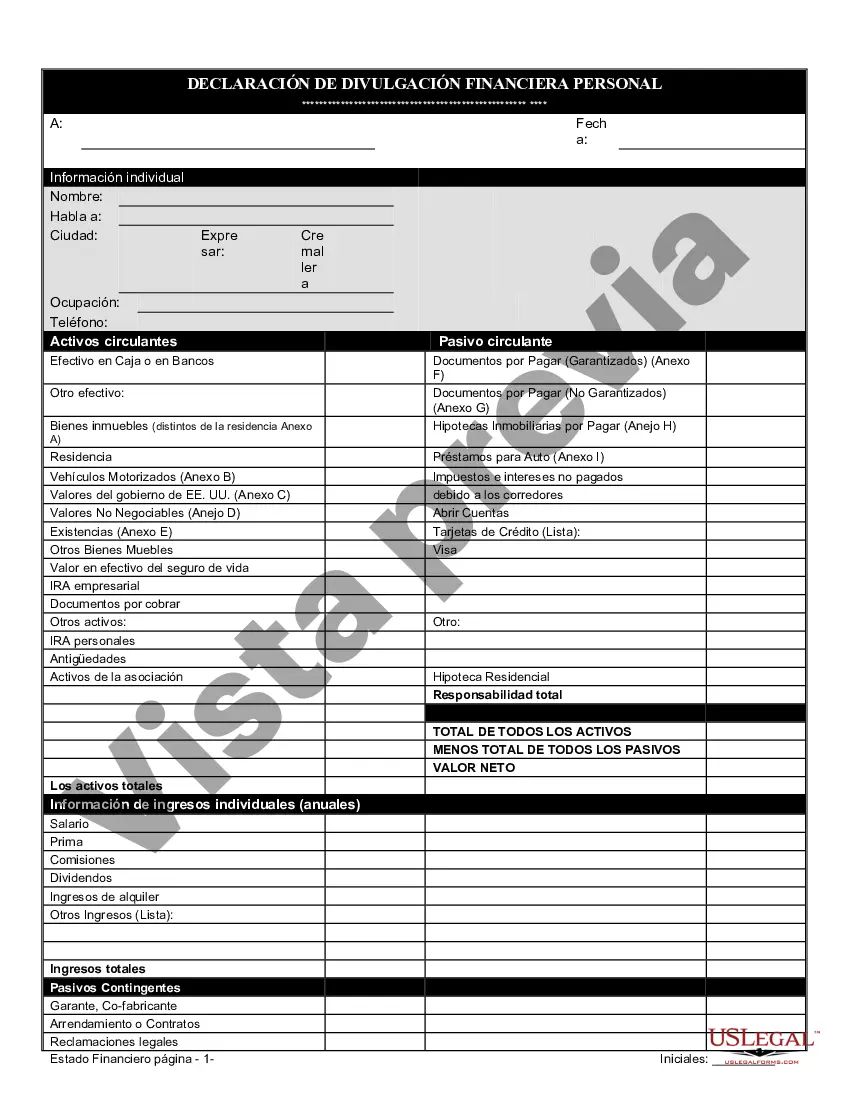

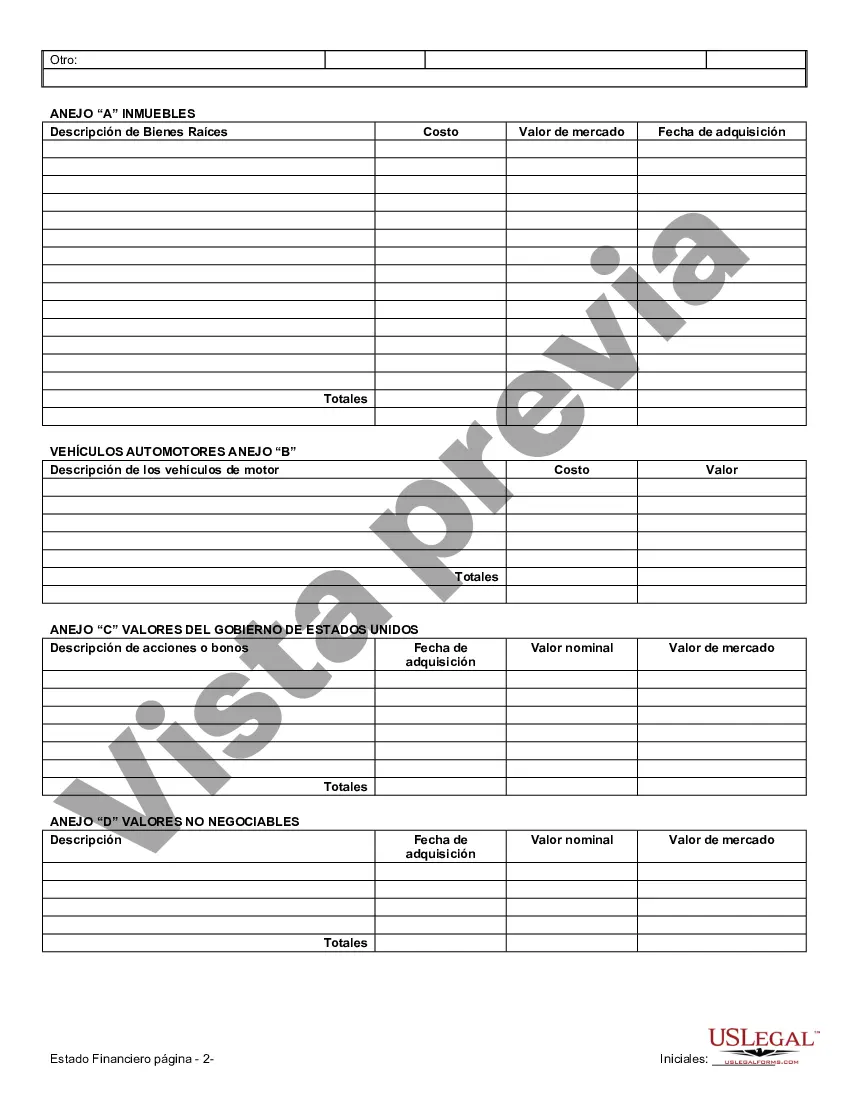

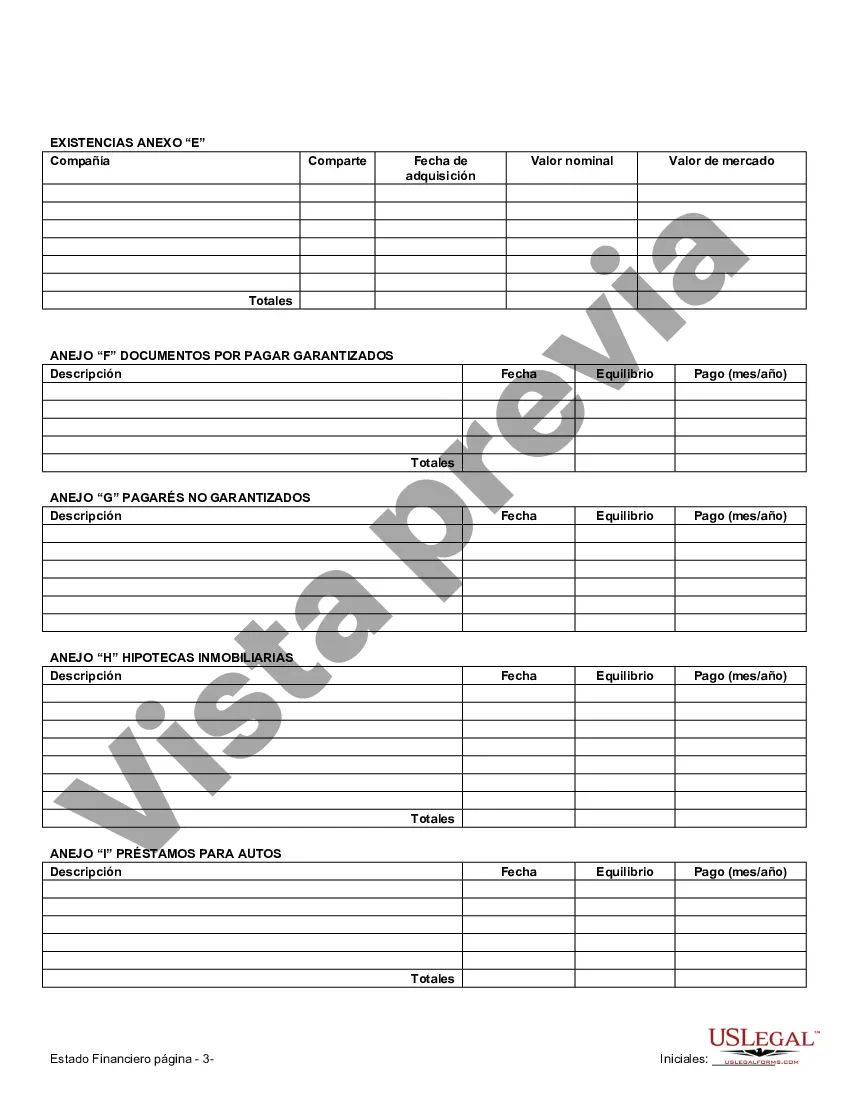

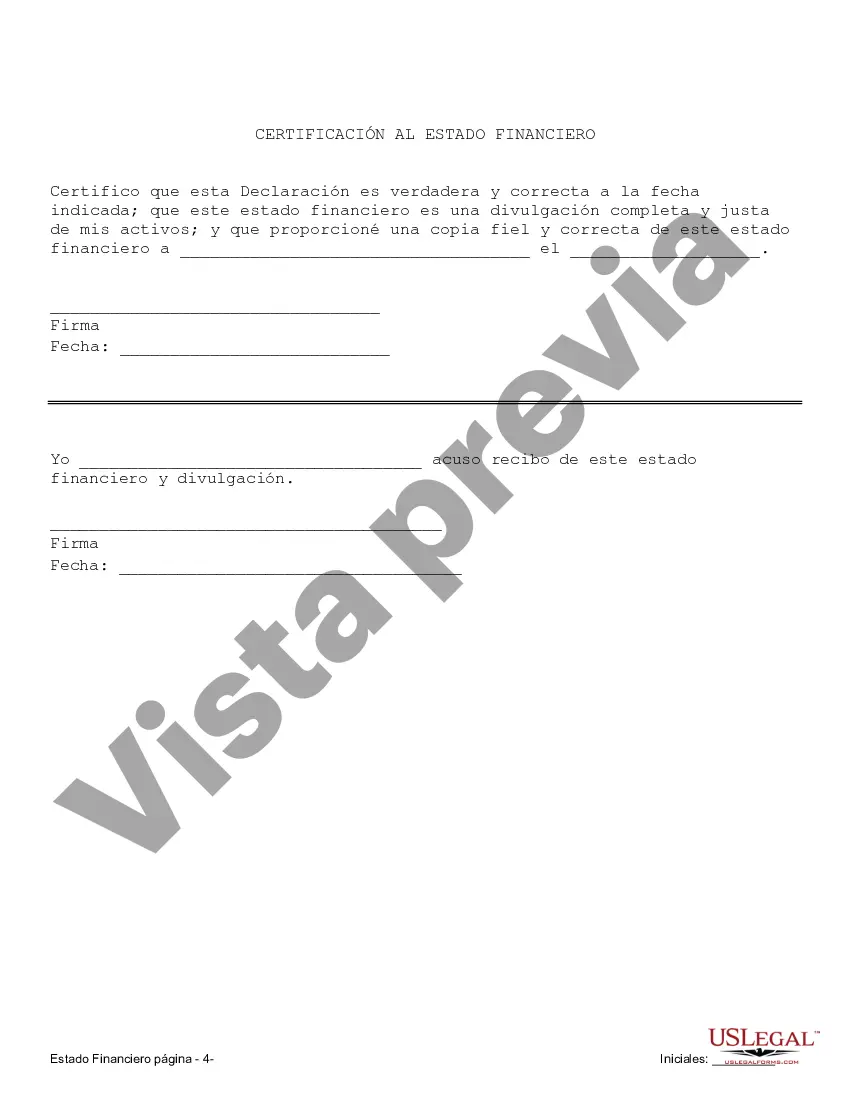

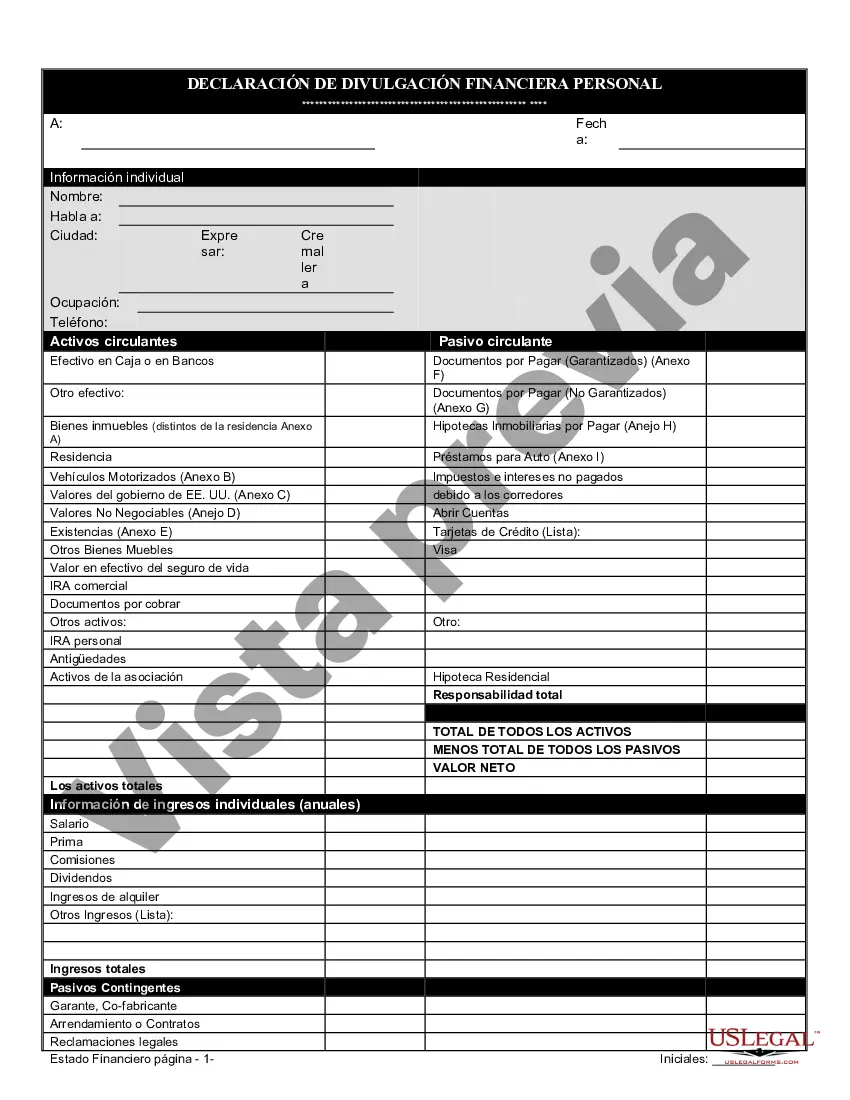

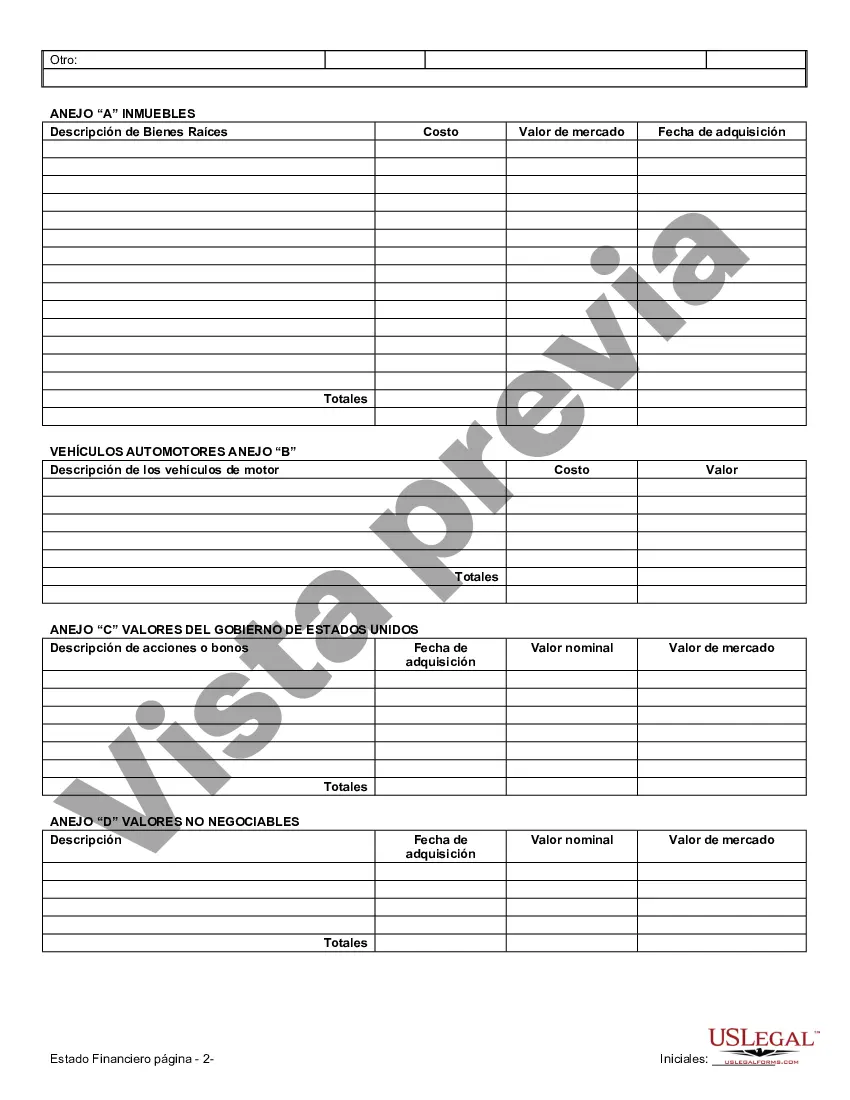

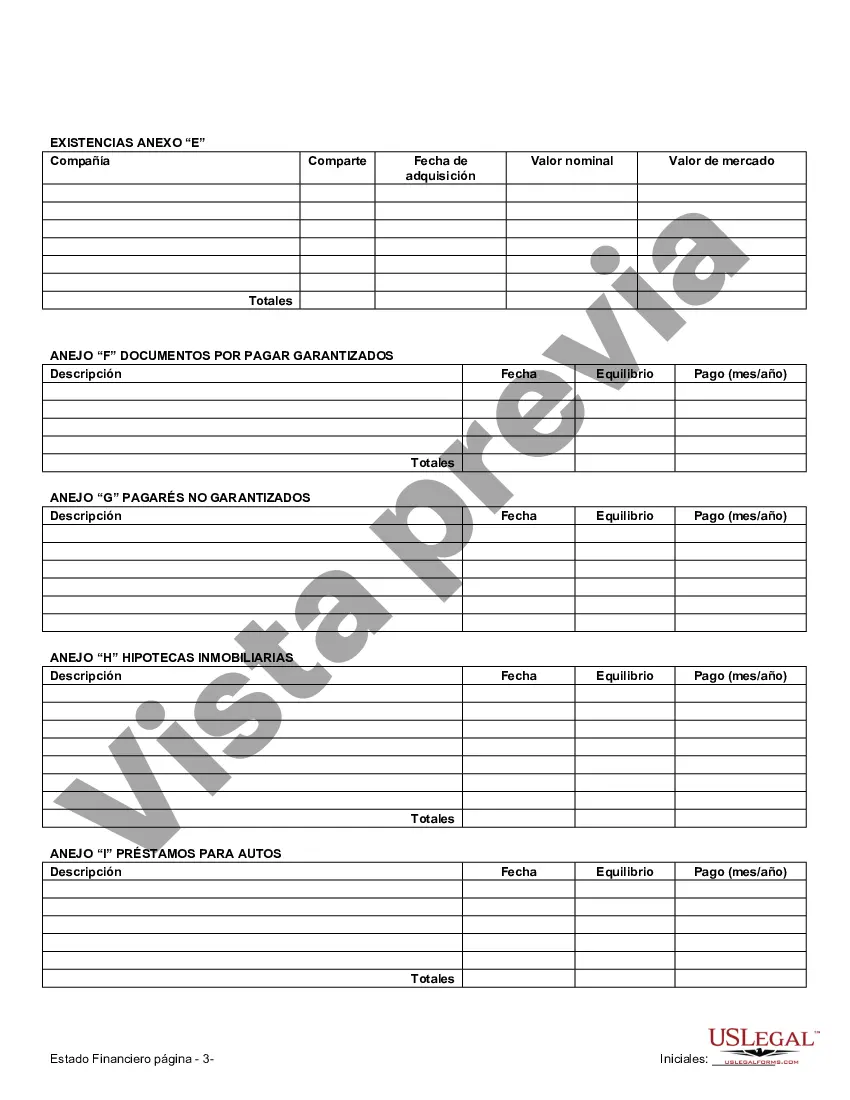

Huntington Beach California Financial Statements in Connection with Prenuptial Premarital Agreement: A Comprehensive Overview Introduction: In Huntington Beach, California, financial statements hold significant importance when it comes to prenuptial and premarital agreements. These statements provide a comprehensive snapshot of each party's financial situation and assets, safeguarding their interests in the event of a divorce or separation. This article aims to provide a detailed description of the various types of Huntington Beach California Financial Statements exclusive to prenuptial and premarital agreements, emphasizing their relevance and key considerations. 1. Personal Financial Statements: Personal financial statements play a crucial role in prenuptial agreements, serving as a foundation for understanding each party's financial position. These statements detail individual assets, liabilities, income sources, and expenses. By carefully analyzing these statements, couples can determine how their finances will be managed, distributed, and protected throughout their marriage. 2. Bank Statements: Bank statements are essential subsets of personal financial statements. These documents provide a comprehensive record of individual bank accounts, including checking, savings, and investment accounts. They demonstrate income streams, expenditure patterns, and the overall financial stability of each party involved in the prenuptial or premarital agreement. 3. Asset Valuation Statements: Asset valuation statements assess the value of individual assets owned by each party, such as real estate properties, vehicles, businesses, investments, and intellectual property. These statements assign a monetary worth to each asset, making it easier to determine how property and wealth will be divided or protected in the event of a divorce or separation. 4. Debt Statements: Debt statements are crucial in prenuptial agreements to outline the existing debts and obligations of each individual before entering the marriage. These statements detail liabilities, such as mortgages, loans, credit card debt, and alimony from previous relationships. By identifying and documenting each party's liabilities, couples can create a fair division of debts and establish financial responsibilities. 5. Income Tax Returns and Statements: Income tax returns and statements provide an in-depth understanding of each party's financial situation. These documents reveal income sources, deductions, and tax liabilities. Analyzing these statements allows both parties to understand their respective tax obligations and devise strategies for managing joint finances effectively. 6. Retirement Account Statements: Retirement account statements serve as vital components of prenuptial agreements, as they indicate the status of individual accounts, including 401(k)s, IRAs, pensions, and other retirement plans. By examining these statements, couples can assess each other's financial readiness for retirement and determine the strategies for handling these accounts upon divorce or separation. Key Considerations: When incorporating financial statements in prenuptial or premarital agreements, several considerations are essential to ensure their legality and effectiveness: 1. Full Disclosure: Complete transparency and accurate disclosure of financial information are critical for these statements to be legally binding. Both parties must provide comprehensive, up-to-date, and truthful financial details. 2. Professional Assistance: Seeking the guidance of a qualified family law attorney or financial advisor is highly recommended while preparing and reviewing these statements. Professionals can help navigate complex financial matters and ensure the agreement is fair and enforceable. 3. Updating and Reviewing: Regularly updating and reviewing financial statements throughout the marriage is crucial. Changes in financial circumstances, such as new assets, debts, or investments, should be documented and reflected accurately in the statements. Conclusion: Huntington Beach, California financial statements in connection with prenuptial and premarital agreements serve as vital tools for safeguarding the financial interests of individuals entering into a marriage. By conscientiously preparing and maintaining these statements, couples can establish mutually agreeable terms that protect their assets, debts, and overall financial well-being. Consulting professionals and adhering to legal guidelines will ensure the validity and efficacy of these financial statements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Huntington Beach California Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - California Financial Statements only in Connection with Prenuptial Premarital Agreement

State:

California

City:

Huntington Beach

Control #:

CA-00590-D

Format:

Word

Instant download

Description

Incluye dos estados financieros.

Huntington Beach California Financial Statements in Connection with Prenuptial Premarital Agreement: A Comprehensive Overview Introduction: In Huntington Beach, California, financial statements hold significant importance when it comes to prenuptial and premarital agreements. These statements provide a comprehensive snapshot of each party's financial situation and assets, safeguarding their interests in the event of a divorce or separation. This article aims to provide a detailed description of the various types of Huntington Beach California Financial Statements exclusive to prenuptial and premarital agreements, emphasizing their relevance and key considerations. 1. Personal Financial Statements: Personal financial statements play a crucial role in prenuptial agreements, serving as a foundation for understanding each party's financial position. These statements detail individual assets, liabilities, income sources, and expenses. By carefully analyzing these statements, couples can determine how their finances will be managed, distributed, and protected throughout their marriage. 2. Bank Statements: Bank statements are essential subsets of personal financial statements. These documents provide a comprehensive record of individual bank accounts, including checking, savings, and investment accounts. They demonstrate income streams, expenditure patterns, and the overall financial stability of each party involved in the prenuptial or premarital agreement. 3. Asset Valuation Statements: Asset valuation statements assess the value of individual assets owned by each party, such as real estate properties, vehicles, businesses, investments, and intellectual property. These statements assign a monetary worth to each asset, making it easier to determine how property and wealth will be divided or protected in the event of a divorce or separation. 4. Debt Statements: Debt statements are crucial in prenuptial agreements to outline the existing debts and obligations of each individual before entering the marriage. These statements detail liabilities, such as mortgages, loans, credit card debt, and alimony from previous relationships. By identifying and documenting each party's liabilities, couples can create a fair division of debts and establish financial responsibilities. 5. Income Tax Returns and Statements: Income tax returns and statements provide an in-depth understanding of each party's financial situation. These documents reveal income sources, deductions, and tax liabilities. Analyzing these statements allows both parties to understand their respective tax obligations and devise strategies for managing joint finances effectively. 6. Retirement Account Statements: Retirement account statements serve as vital components of prenuptial agreements, as they indicate the status of individual accounts, including 401(k)s, IRAs, pensions, and other retirement plans. By examining these statements, couples can assess each other's financial readiness for retirement and determine the strategies for handling these accounts upon divorce or separation. Key Considerations: When incorporating financial statements in prenuptial or premarital agreements, several considerations are essential to ensure their legality and effectiveness: 1. Full Disclosure: Complete transparency and accurate disclosure of financial information are critical for these statements to be legally binding. Both parties must provide comprehensive, up-to-date, and truthful financial details. 2. Professional Assistance: Seeking the guidance of a qualified family law attorney or financial advisor is highly recommended while preparing and reviewing these statements. Professionals can help navigate complex financial matters and ensure the agreement is fair and enforceable. 3. Updating and Reviewing: Regularly updating and reviewing financial statements throughout the marriage is crucial. Changes in financial circumstances, such as new assets, debts, or investments, should be documented and reflected accurately in the statements. Conclusion: Huntington Beach, California financial statements in connection with prenuptial and premarital agreements serve as vital tools for safeguarding the financial interests of individuals entering into a marriage. By conscientiously preparing and maintaining these statements, couples can establish mutually agreeable terms that protect their assets, debts, and overall financial well-being. Consulting professionals and adhering to legal guidelines will ensure the validity and efficacy of these financial statements.

Free preview

How to fill out Huntington Beach California Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

If you’ve already used our service before, log in to your account and download the Huntington Beach California Financial Statements only in Connection with Prenuptial Premarital Agreement on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Make sure you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Huntington Beach California Financial Statements only in Connection with Prenuptial Premarital Agreement. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!