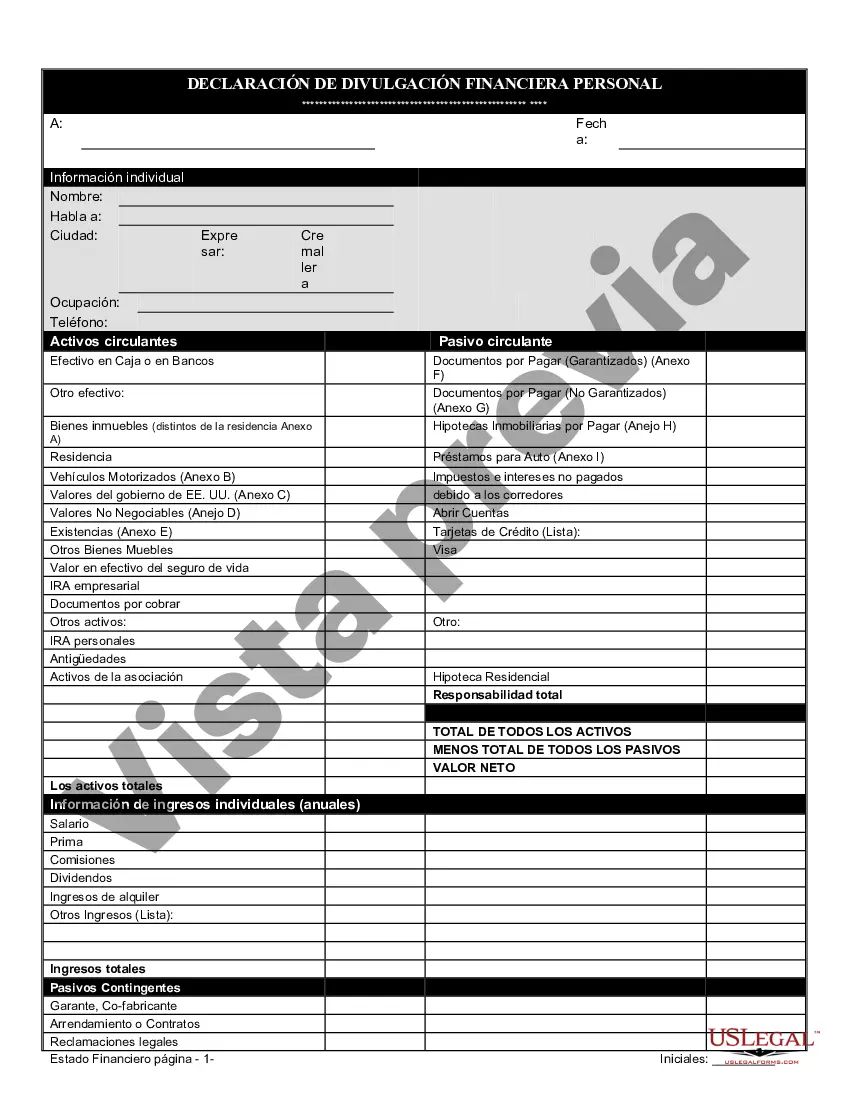

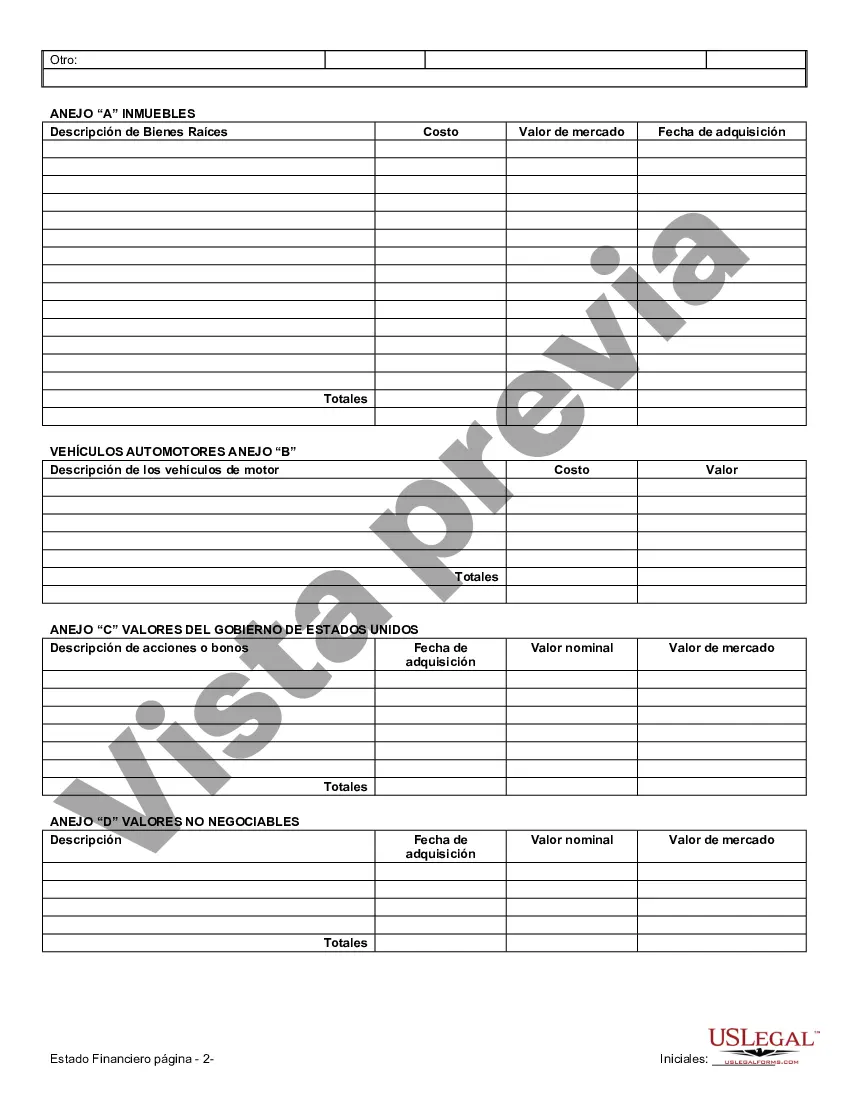

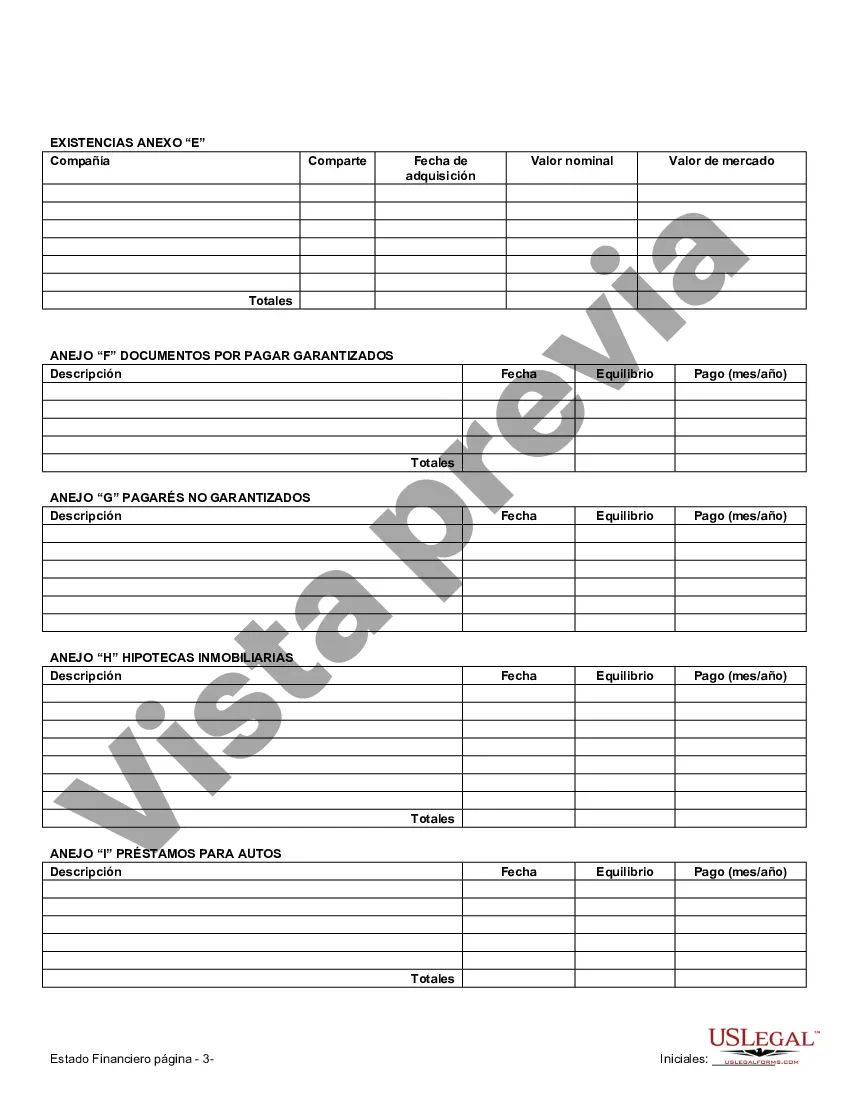

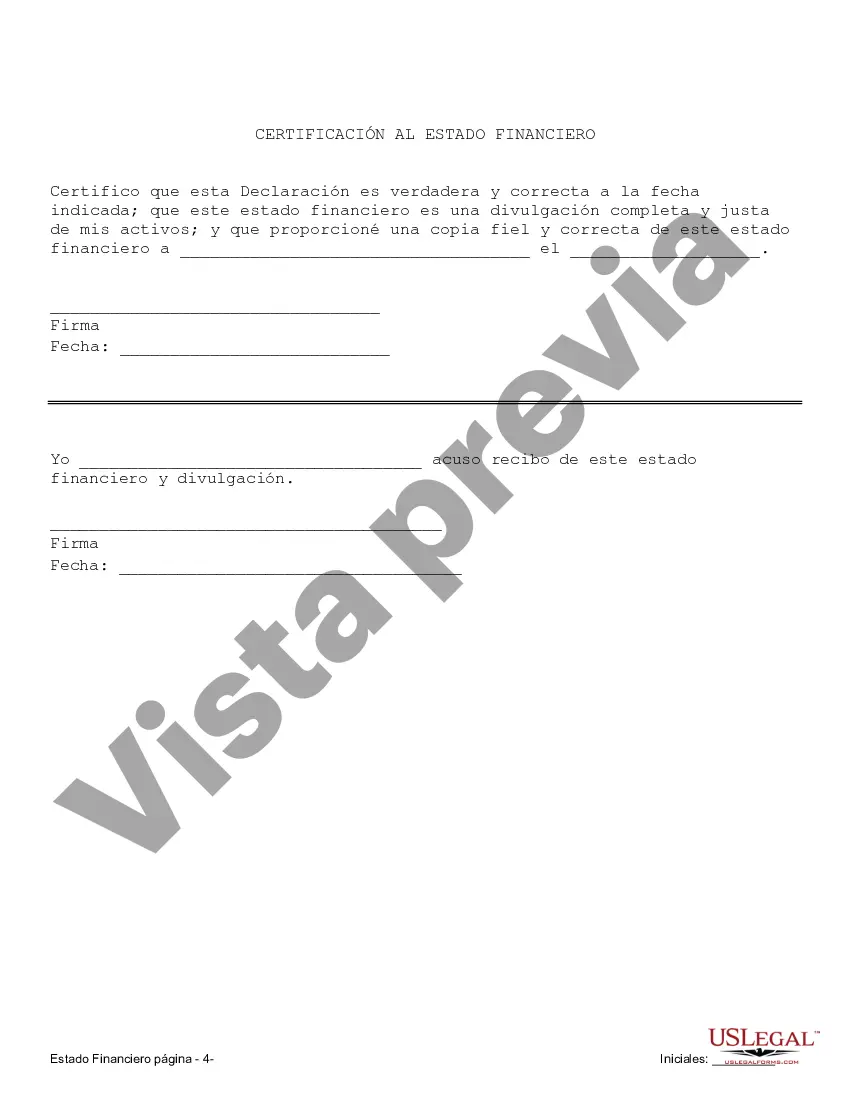

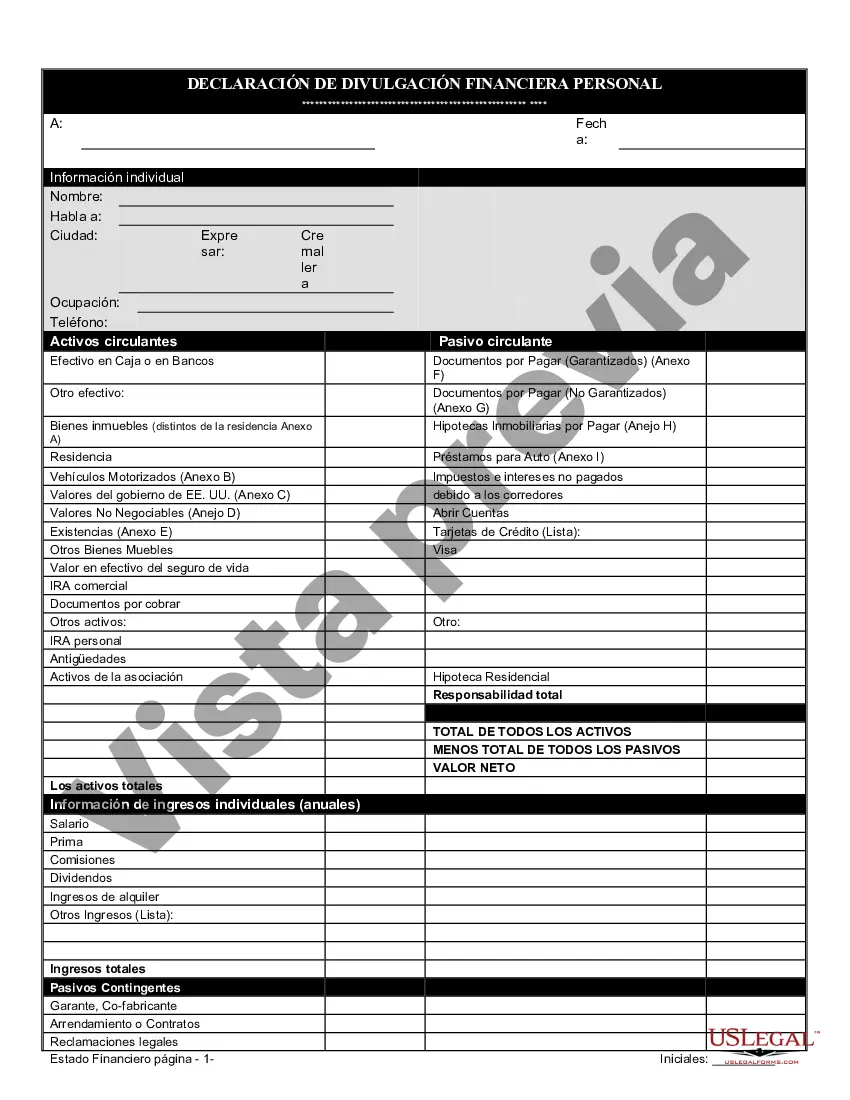

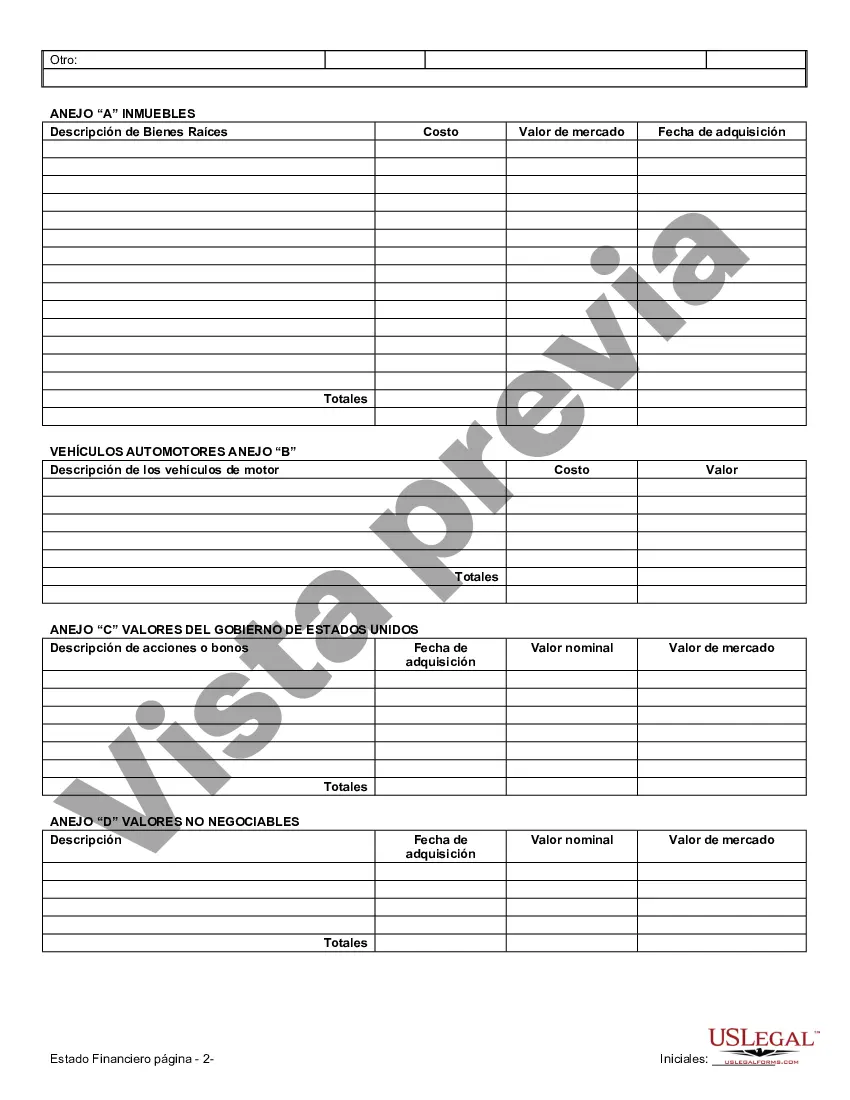

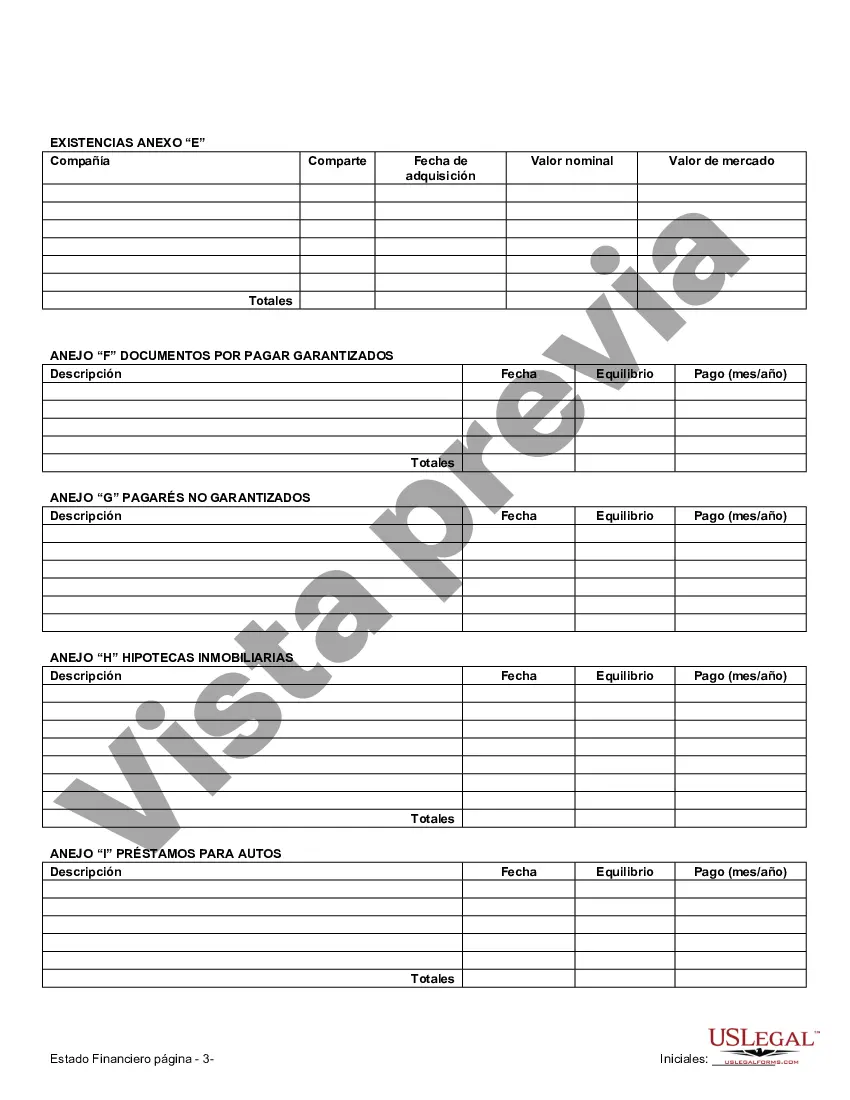

When entering into a prenuptial or premarital agreement in Los Angeles, California, it is essential to include detailed financial statements to ensure transparency and protection for both parties involved. These statements, specifically tailored to the requirements of a prenuptial agreement, provide a comprehensive overview of each individual's financial standing and assets. Here, we will explore the types of Los Angeles California Financial Statements that are typically used in connection with a prenuptial or premarital agreement. 1. Personal Balance Sheet: A personal balance sheet in the context of a prenuptial agreement outlines an individual's assets, liabilities, and net worth at the time of entering into the agreement. It includes detailed information such as bank account balances, investment portfolios, real estate owned, vehicles, and other valuable assets owned by each party. 2. Income Statement: The income statement provides a comprehensive summary of an individual's income, expenses, and overall financial performance. This statement is crucial for determining each party's financial commitments within the prenuptial or premarital agreement, such as spousal support or alimony, based on their respective earnings. 3. List of Investments: This statement focuses specifically on an individual's investment portfolio, including stocks, bonds, mutual funds, retirement accounts, and any other investments. It may detail the value of each investment and indicate whether they were acquired prior to the marriage or will be subject to division in case of divorce. 4. Real Estate Statement: This statement concentrates on real estate owned by either party individually or jointly. It includes details such as property addresses, purchase prices, current market values, outstanding mortgages or liens, and any other relevant information pertaining to real estate assets. 5. Business Statement: If either party owns a business or shares in a business, this statement highlights the overall financial health of the business, including annual revenue, expenses, and profit or loss. It is crucial for determining the division of business assets and obligations within the prenuptial agreement. 6. Debts and Liabilities Statement: This statement outlines any outstanding debts or liabilities held by the individuals, such as credit card debt, student loans, mortgages, or any other financial obligations. It ensures that both parties are aware of and agree upon existing financial responsibilities prior to marriage. Including these various types of financial statements within a prenuptial or premarital agreement in Los Angeles, California, demonstrates a commitment to transparency and fairness in handling financial matters. It is important to consult with a qualified family law attorney who can guide you through the process and ensure that these statements are accurate, comprehensive, and in compliance with the relevant laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - California Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Los Angeles California Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Los Angeles California Financial Statements only in Connection with Prenuptial Premarital Agreement gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Los Angeles California Financial Statements only in Connection with Prenuptial Premarital Agreement takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a few more steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve chosen the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Los Angeles California Financial Statements only in Connection with Prenuptial Premarital Agreement. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!