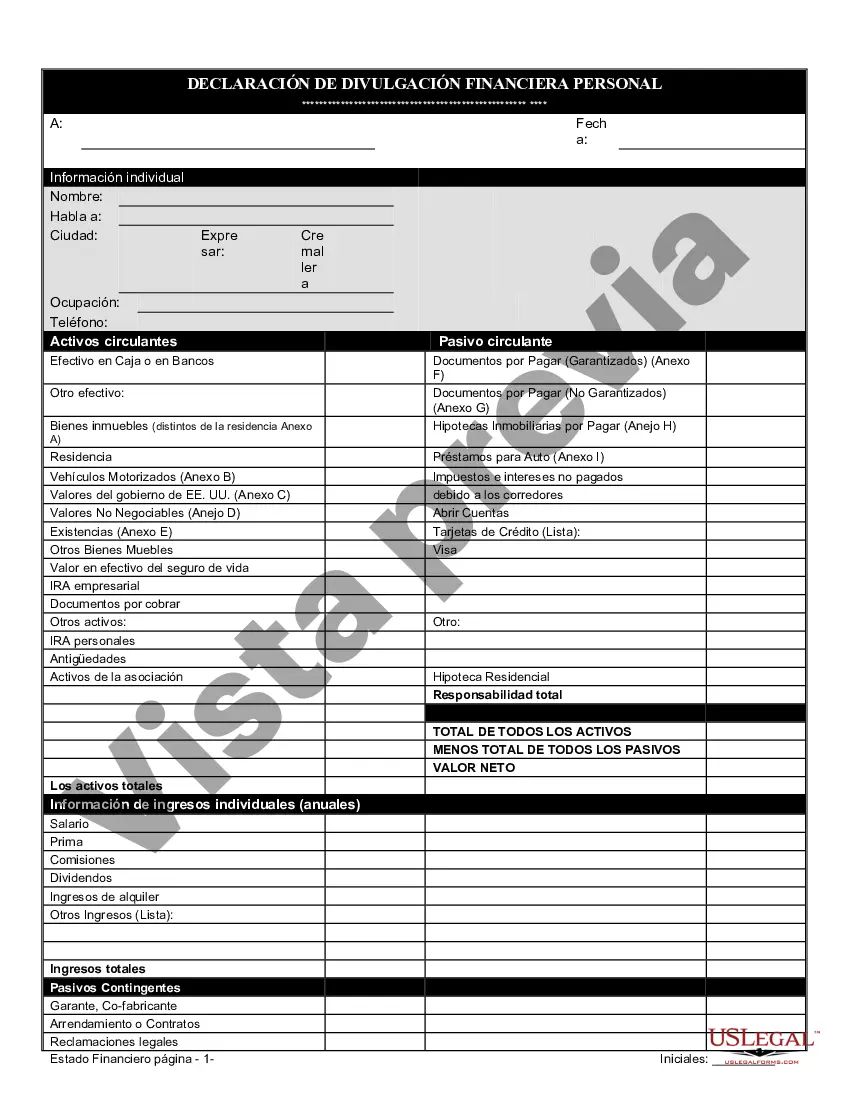

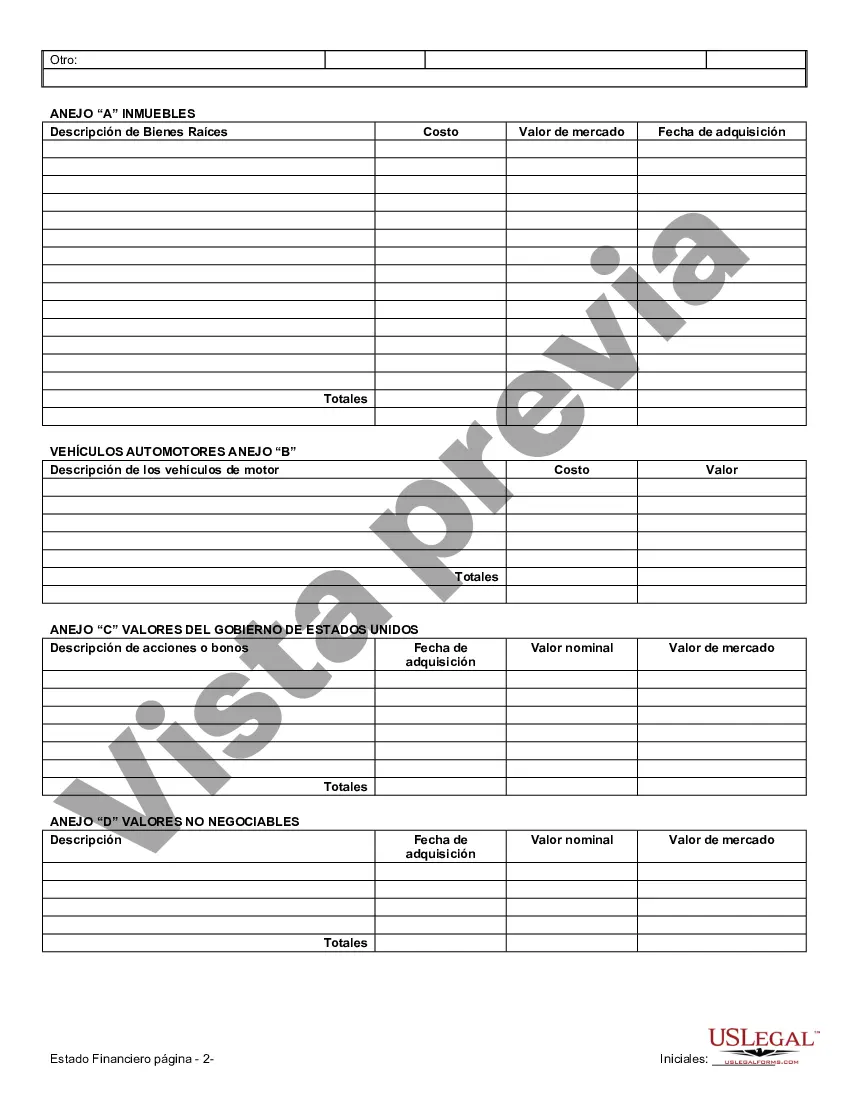

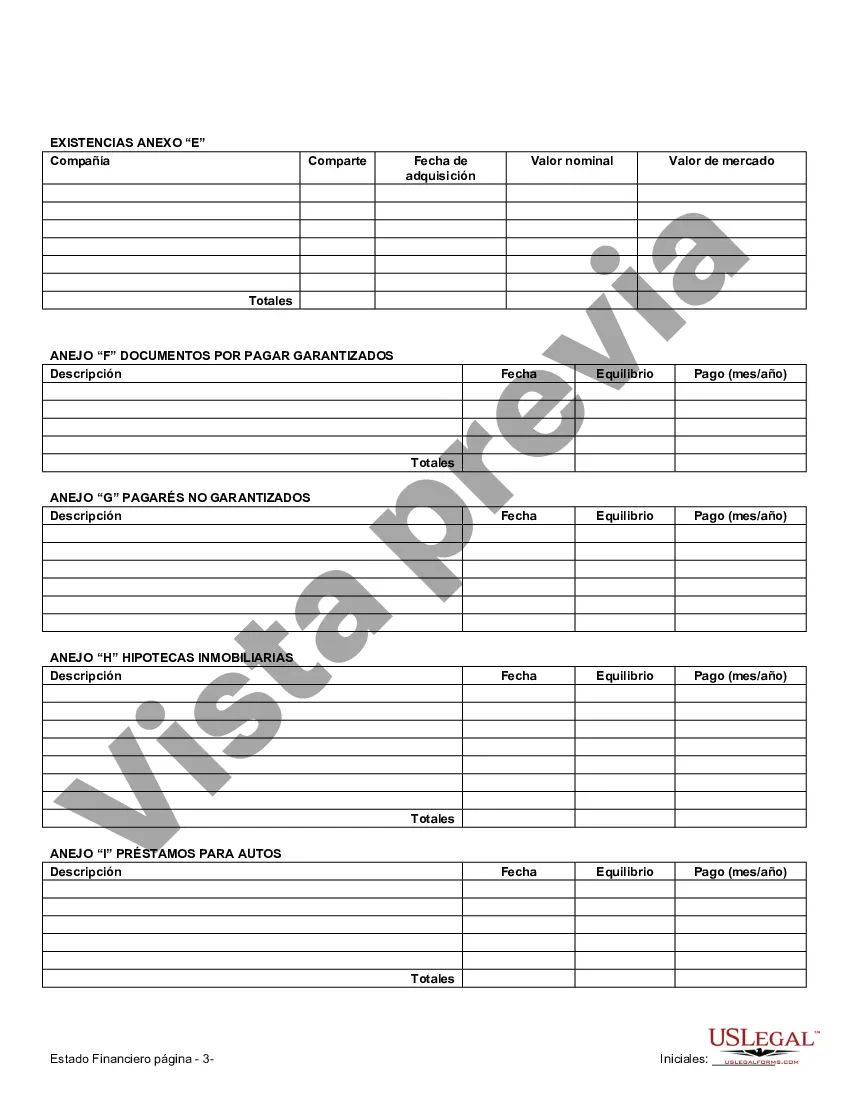

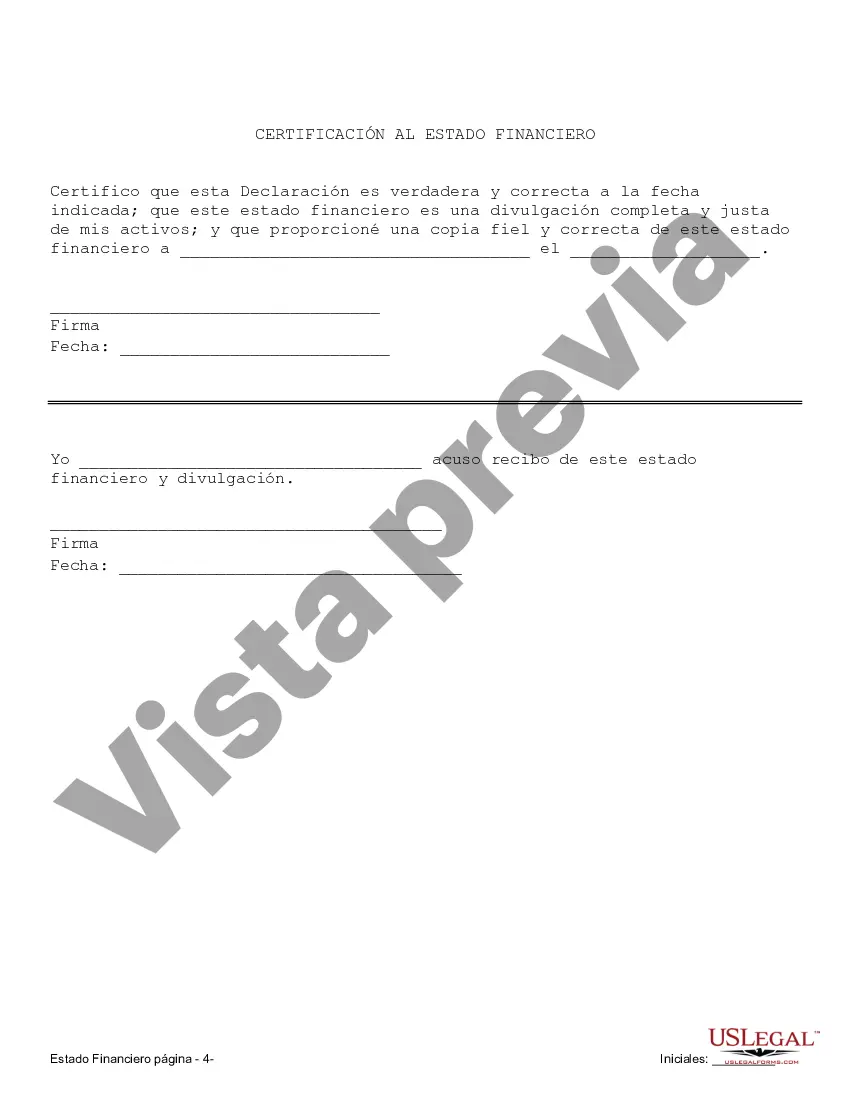

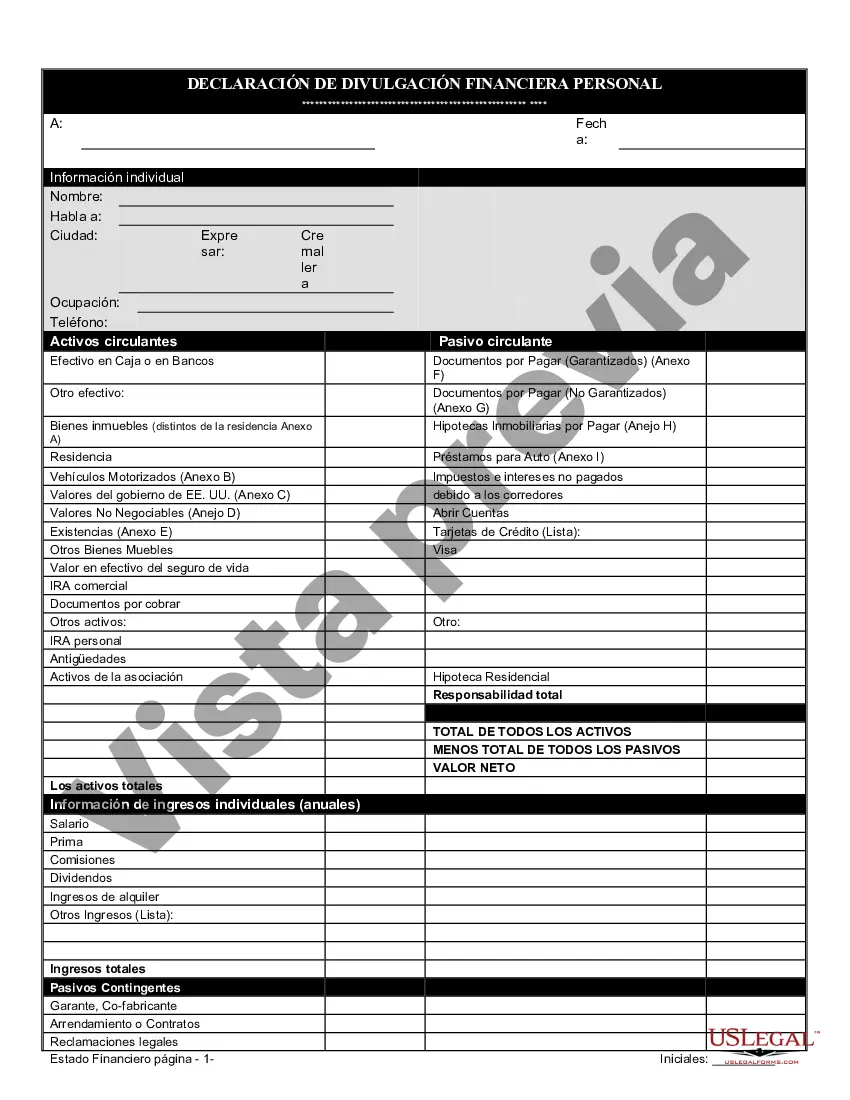

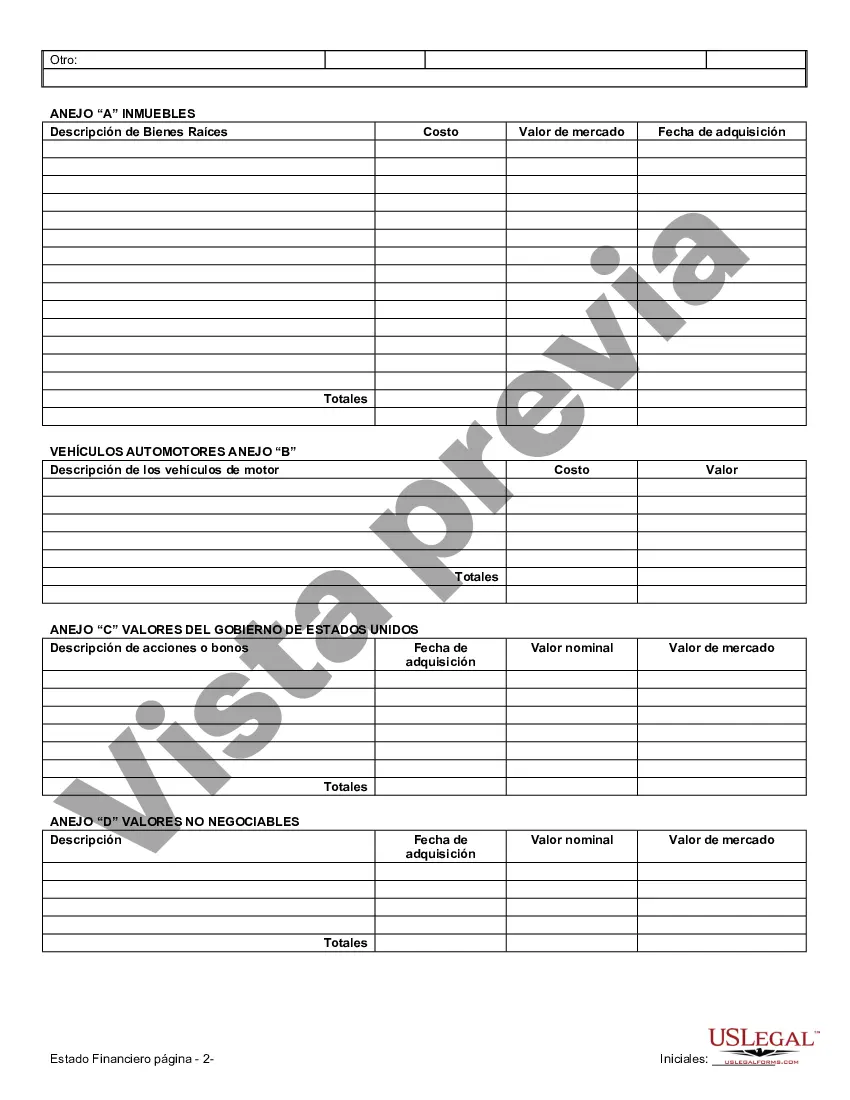

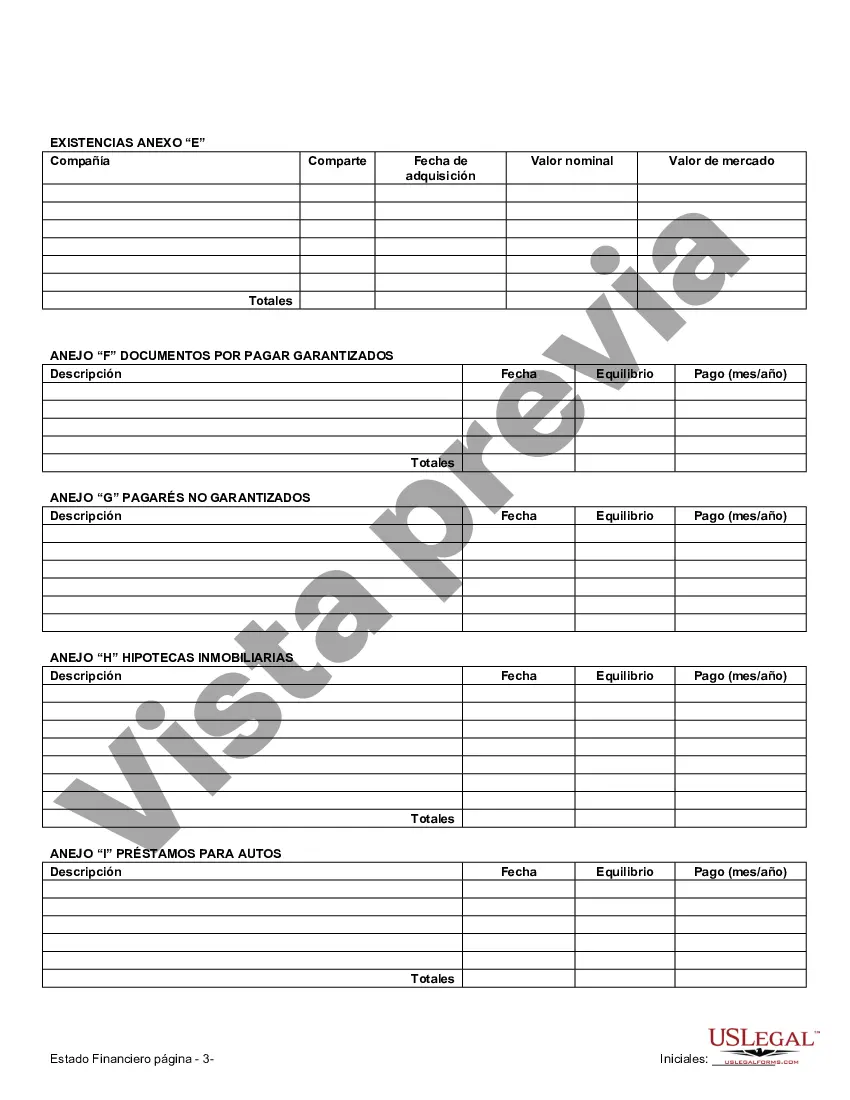

Riverside California Financial Statements play a crucial role when it comes to prenuptial or premarital agreements. These statements provide in-depth information about an individual's financial standing, assets, liabilities, and income. When a couple decides to enter into a prenuptial agreement, having accurate financial statements is essential to ensure transparency and protect the rights and interests of both parties involved. Here are some key aspects to consider regarding Riverside California Financial Statements in connection with prenuptial agreements: 1. Personal Financial Statement: A personal financial statement is an integral part of a prenuptial agreement in Riverside, California. It presents an overview of each partner's assets, liabilities, expenses, and income. This statement helps establish a clear understanding of each individual's financial position before entering into a marriage. 2. Real Estate Holdings: The financial statement related to real estate holdings focuses primarily on properties owned by either party, including residential homes, commercial properties, or any other real estate assets. This statement details the current value, outstanding mortgages, rental income, and other pertinent information related to the properties. 3. Investment Accounts and Securities: This type of financial statement encompasses all investment accounts and securities owned by either party. It includes stocks, bonds, certificates of deposits, mutual funds, retirement accounts (such as IRAs or 401(k)s), and other investment instruments. The statement outlines the value of each investment, any incurred debts, and any potential income or dividends generated. 4. Business Interests and Ownership: In cases where either party owns a business, a financial statement specifically focusing on business interests and ownership is required. This statement details the nature of the business, its financial health, assets, liabilities, revenues, and profits or losses. It provides crucial insight into the value and financial stability of the business in question. 5. Debts and Obligations: A comprehensive financial statement also includes information about outstanding debts, loans, credit card obligations, and other financial liabilities. This component allows each party to have a clear understanding of the financial obligations they may be responsible for within the marriage. 6. Income and Cash Flow: Income and cash flow statements provide an overview of the regular income sources for each party, such as salaries, bonuses, rental income, investment returns, or any other sources of income. These statements help evaluate the financial stability of each partner and ensure financial transparency. It is important to note that Riverside California Financial Statements must be complete, accurate, and up-to-date at the time of drafting a prenuptial agreement. Both parties should disclose their financial information truthfully and transparently to avoid any future disputes or legal complications. Consulting with a qualified family law attorney is advisable to ensure that all necessary financial statements are included and that they comply with the applicable laws and regulations of Riverside, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - California Financial Statements only in Connection with Prenuptial Premarital Agreement

State:

California

County:

Riverside

Control #:

CA-00590-D

Format:

Word

Instant download

Description

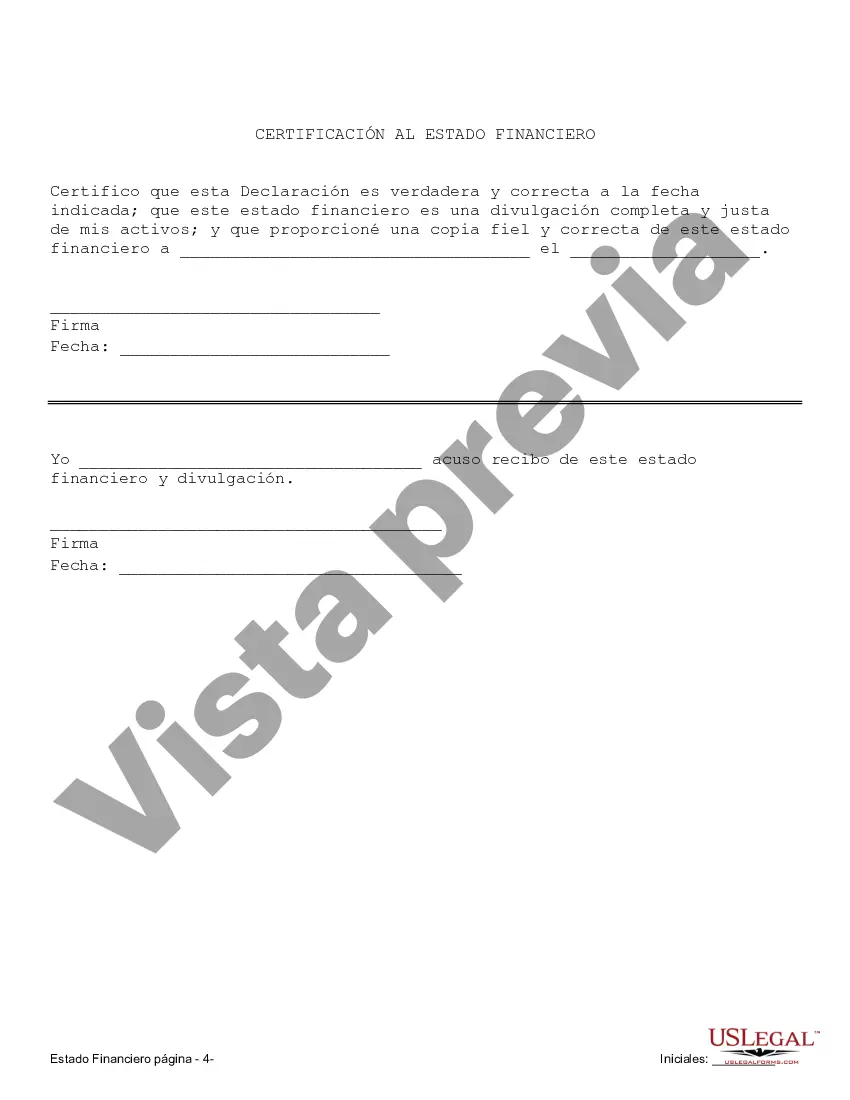

Incluye dos estados financieros.

Riverside California Financial Statements play a crucial role when it comes to prenuptial or premarital agreements. These statements provide in-depth information about an individual's financial standing, assets, liabilities, and income. When a couple decides to enter into a prenuptial agreement, having accurate financial statements is essential to ensure transparency and protect the rights and interests of both parties involved. Here are some key aspects to consider regarding Riverside California Financial Statements in connection with prenuptial agreements: 1. Personal Financial Statement: A personal financial statement is an integral part of a prenuptial agreement in Riverside, California. It presents an overview of each partner's assets, liabilities, expenses, and income. This statement helps establish a clear understanding of each individual's financial position before entering into a marriage. 2. Real Estate Holdings: The financial statement related to real estate holdings focuses primarily on properties owned by either party, including residential homes, commercial properties, or any other real estate assets. This statement details the current value, outstanding mortgages, rental income, and other pertinent information related to the properties. 3. Investment Accounts and Securities: This type of financial statement encompasses all investment accounts and securities owned by either party. It includes stocks, bonds, certificates of deposits, mutual funds, retirement accounts (such as IRAs or 401(k)s), and other investment instruments. The statement outlines the value of each investment, any incurred debts, and any potential income or dividends generated. 4. Business Interests and Ownership: In cases where either party owns a business, a financial statement specifically focusing on business interests and ownership is required. This statement details the nature of the business, its financial health, assets, liabilities, revenues, and profits or losses. It provides crucial insight into the value and financial stability of the business in question. 5. Debts and Obligations: A comprehensive financial statement also includes information about outstanding debts, loans, credit card obligations, and other financial liabilities. This component allows each party to have a clear understanding of the financial obligations they may be responsible for within the marriage. 6. Income and Cash Flow: Income and cash flow statements provide an overview of the regular income sources for each party, such as salaries, bonuses, rental income, investment returns, or any other sources of income. These statements help evaluate the financial stability of each partner and ensure financial transparency. It is important to note that Riverside California Financial Statements must be complete, accurate, and up-to-date at the time of drafting a prenuptial agreement. Both parties should disclose their financial information truthfully and transparently to avoid any future disputes or legal complications. Consulting with a qualified family law attorney is advisable to ensure that all necessary financial statements are included and that they comply with the applicable laws and regulations of Riverside, California.

Free preview

How to fill out Riverside California Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

If you’ve already utilized our service before, log in to your account and save the Riverside California Financial Statements only in Connection with Prenuptial Premarital Agreement on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Make sure you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Riverside California Financial Statements only in Connection with Prenuptial Premarital Agreement. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!