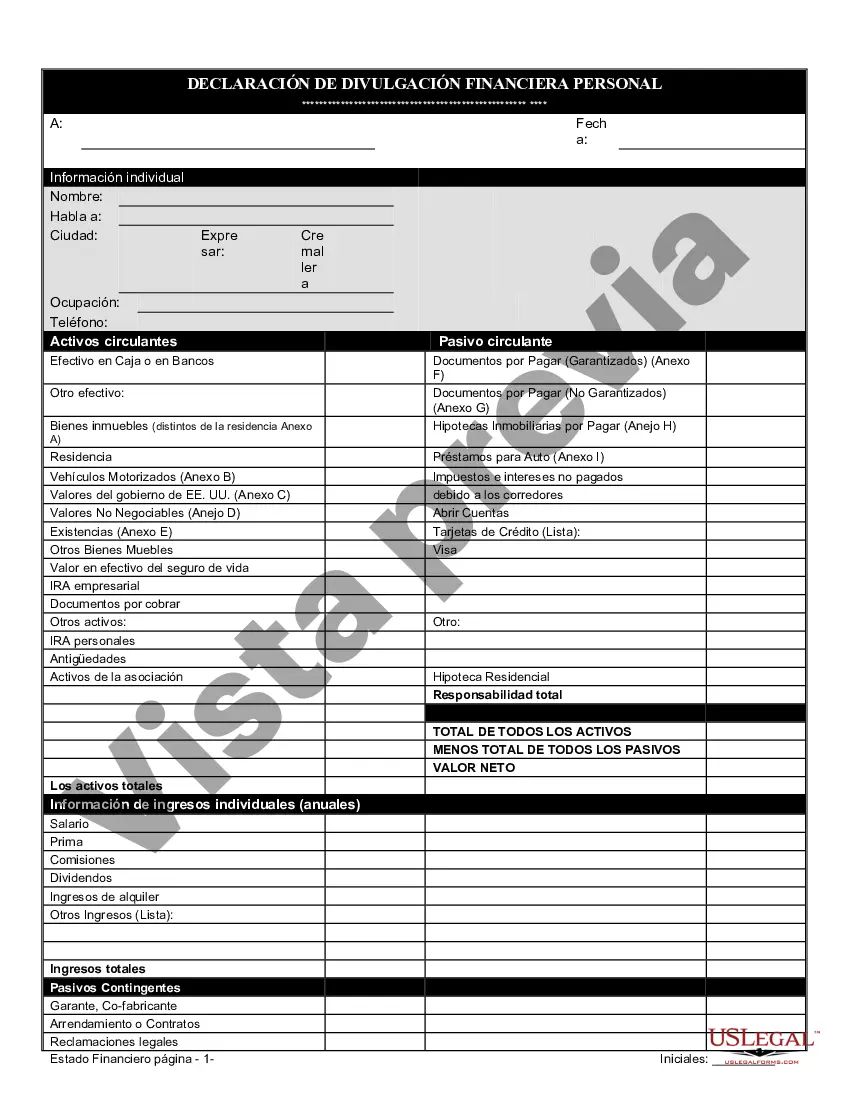

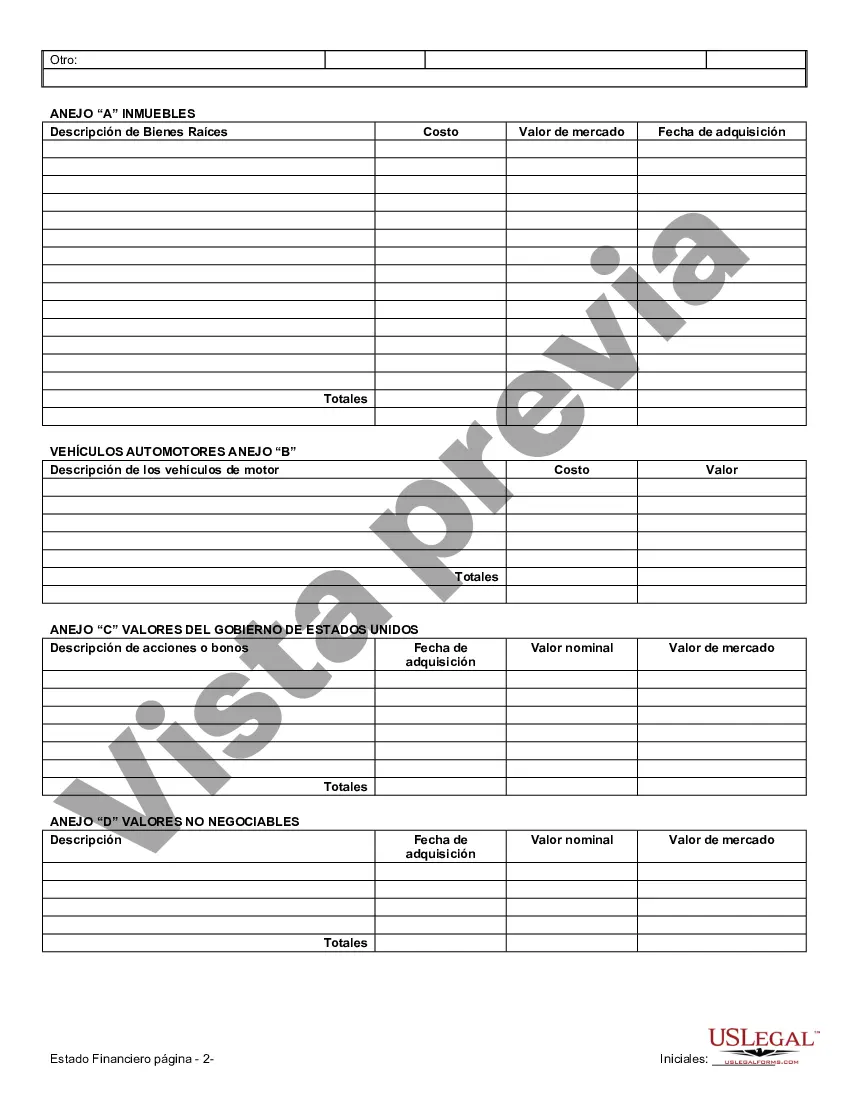

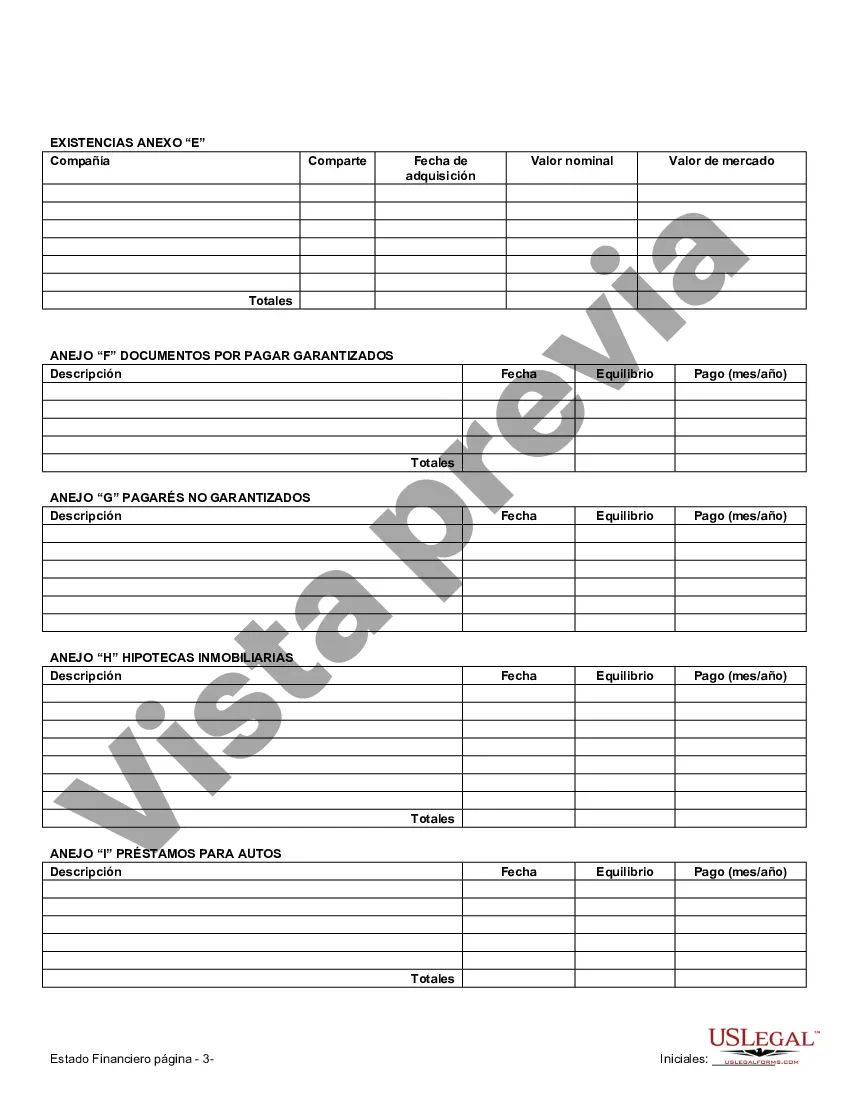

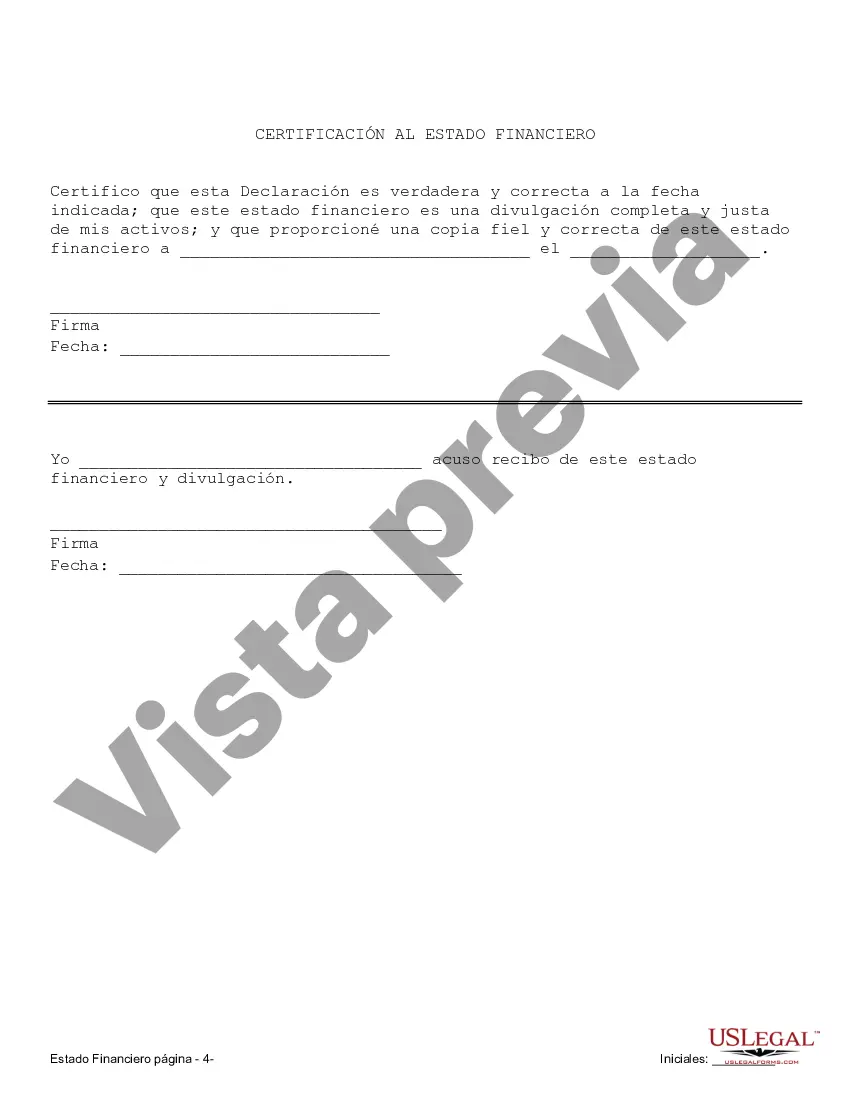

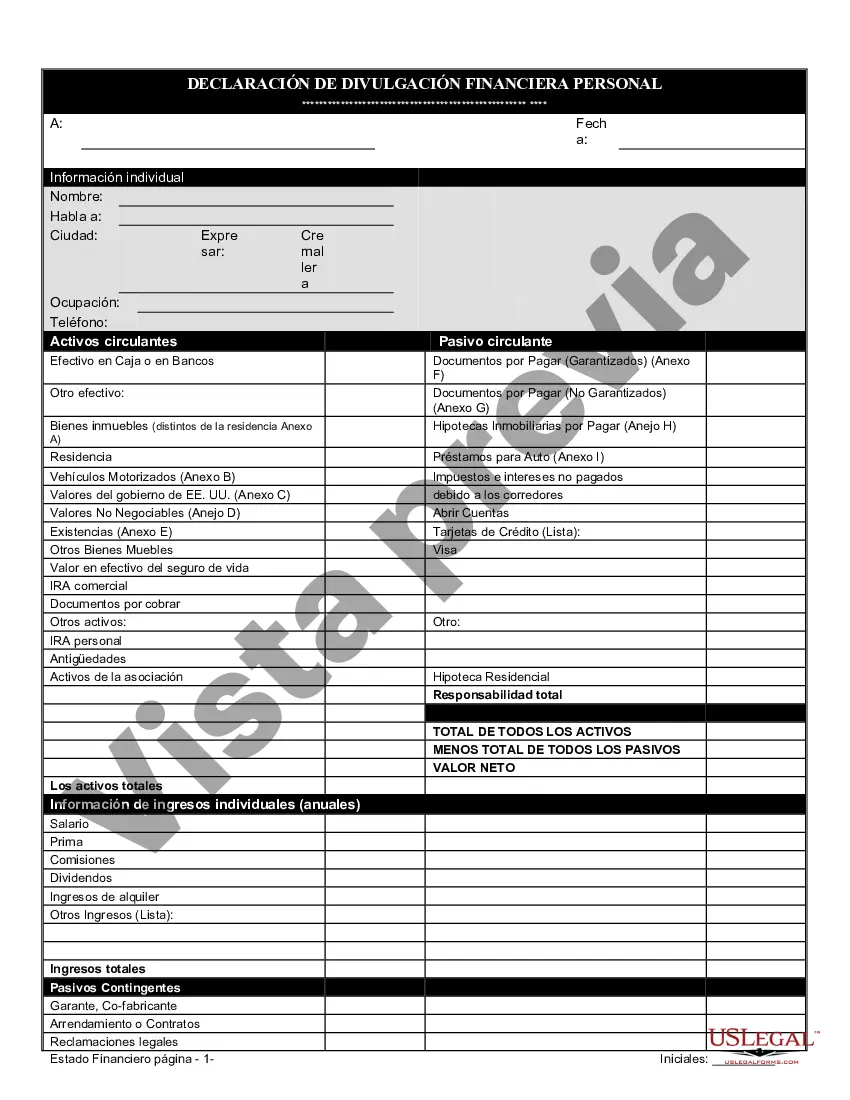

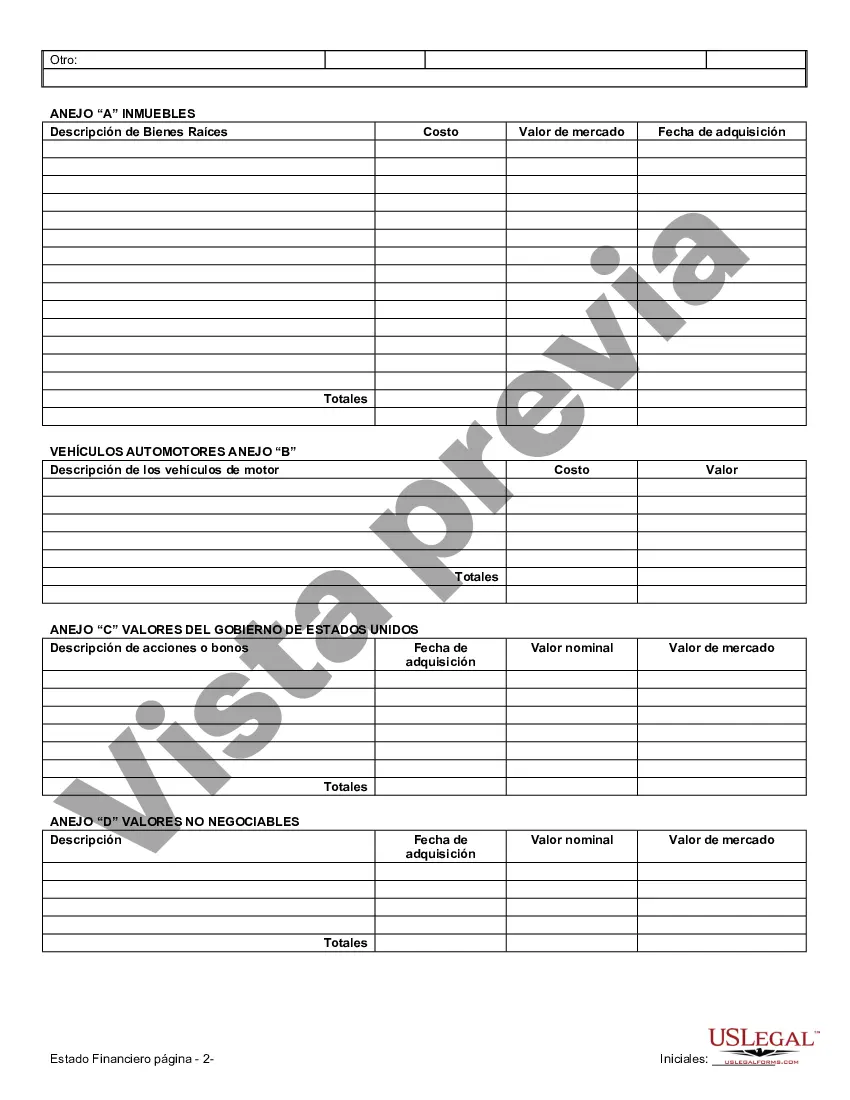

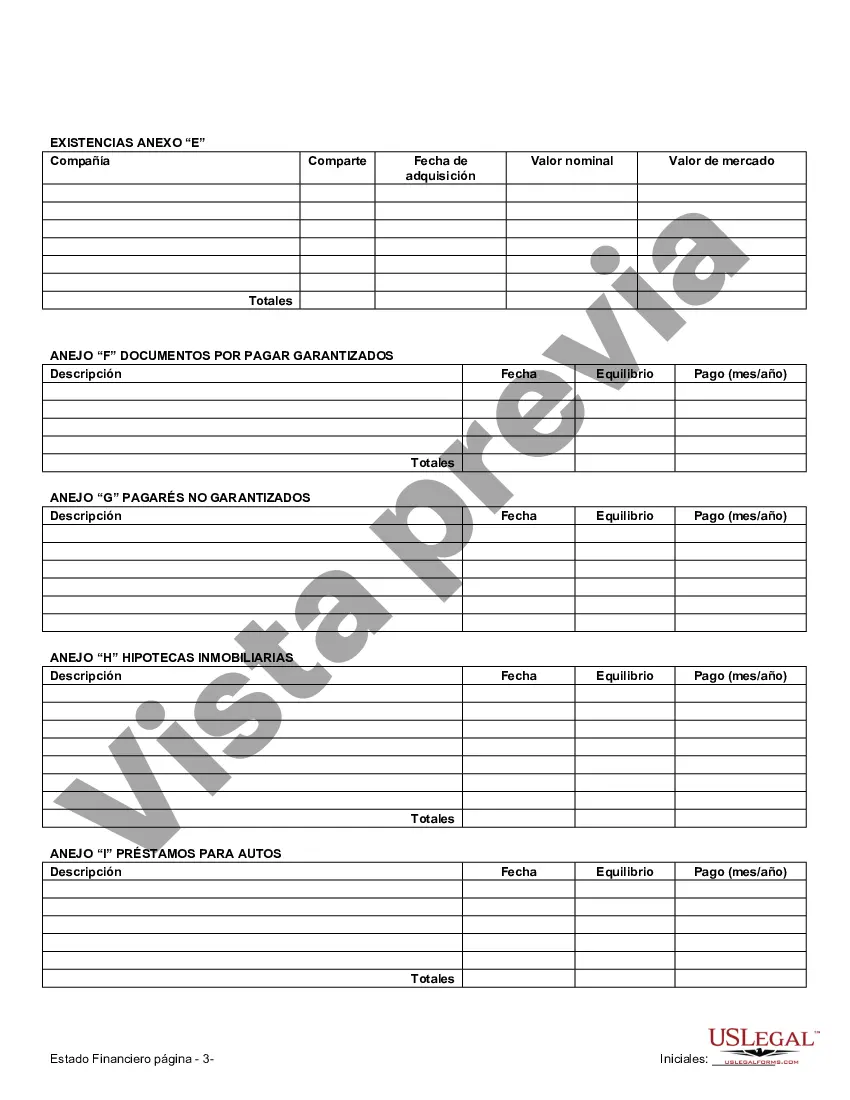

Santa Maria California Financial Statements, in connection with Prenuptial Premarital Agreements, provide a crucial overview of an individual's financial situation before entering into a marriage or domestic partnership. These statements are designed to protect both parties' interests, ensuring transparency and clarity regarding their pre-existing assets, debts, and financial responsibilities. Here are some relevant details about Santa Maria California Financial Statements in connection with Prenuptial Premarital Agreements: 1. Personal Assets: These statements outline the individual's personal assets such as real estate, stocks, bonds, vehicles, retirement accounts, and any other investments they possess. It includes a detailed description of each asset along with their corresponding estimated values. 2. Income and Earnings: The financial statement provides a comprehensive analysis of the individual's income sources, including salary, bonuses, commissions, rental income, dividends, and any other form of income. Additionally, it includes copies of recent tax returns and pay stubs to verify the income stated. 3. Liabilities and Debt: This section of the financial statement lays out all existing debts and liabilities, which may include mortgages, loans, credit card debts, and any other financial obligations. Providing accurate information regarding these liabilities ensures an equitable distribution of debts in case of divorce or separation. 4. Business Interests: If one or both parties have ownership in any businesses, the financial statement requires disclosure of the nature of the business, percentage of ownership, and estimated value. It may also include information about business assets like equipment, inventory, and accounts receivable. 5. Estate Planning and Inheritance: Santa Maria California Financial Statements in connection with Prenuptial Premarital Agreements also delve into estate planning and potential inheritance. It may include details about trusts, wills, life insurance policies, and beneficiaries, ensuring transparency around future financial matters. 6. Expenses and Budgeting: While not mandatory, some individuals may choose to include a breakdown of their monthly expenses and budgeting plan within the financial statement. This information provides a comprehensive view of their spending habits and helps both parties understand future financial obligations. 7. Declarations and Signatures: To authenticate the financial statement, both parties must sign and date the document. It's crucial to ensure that the information provided is accurate, as any misrepresentation can lead to legal consequences or nullify the overall effectiveness of the Prenuptial Premarital Agreement. When drafting Santa Maria California Financial Statements, it is essential to seek legal counsel to ensure compliance with local laws and regulations. Remember, these statements aim to protect both parties' interests and promote transparency, trust, and fairness in the premarital agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Maria California Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - California Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Santa Maria California Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

Make use of the US Legal Forms and get immediate access to any form template you require. Our beneficial platform with a huge number of document templates simplifies the way to find and get virtually any document sample you need. You are able to export, fill, and sign the Santa Maria California Financial Statements only in Connection with Prenuptial Premarital Agreement in just a couple of minutes instead of surfing the Net for many hours searching for an appropriate template.

Using our catalog is a wonderful strategy to raise the safety of your form filing. Our experienced attorneys on a regular basis check all the records to ensure that the templates are relevant for a particular region and compliant with new acts and polices.

How can you obtain the Santa Maria California Financial Statements only in Connection with Prenuptial Premarital Agreement? If you have a profile, just log in to the account. The Download button will appear on all the samples you look at. Moreover, you can get all the earlier saved records in the My Forms menu.

If you haven’t registered a profile yet, stick to the instructions below:

- Open the page with the template you require. Make sure that it is the template you were looking for: examine its name and description, and take take advantage of the Preview function if it is available. Otherwise, use the Search field to look for the appropriate one.

- Start the downloading procedure. Click Buy Now and select the pricing plan you like. Then, create an account and pay for your order with a credit card or PayPal.

- Download the document. Pick the format to obtain the Santa Maria California Financial Statements only in Connection with Prenuptial Premarital Agreement and change and fill, or sign it according to your requirements.

US Legal Forms is probably the most significant and trustworthy template libraries on the internet. We are always ready to assist you in virtually any legal case, even if it is just downloading the Santa Maria California Financial Statements only in Connection with Prenuptial Premarital Agreement.

Feel free to benefit from our platform and make your document experience as efficient as possible!