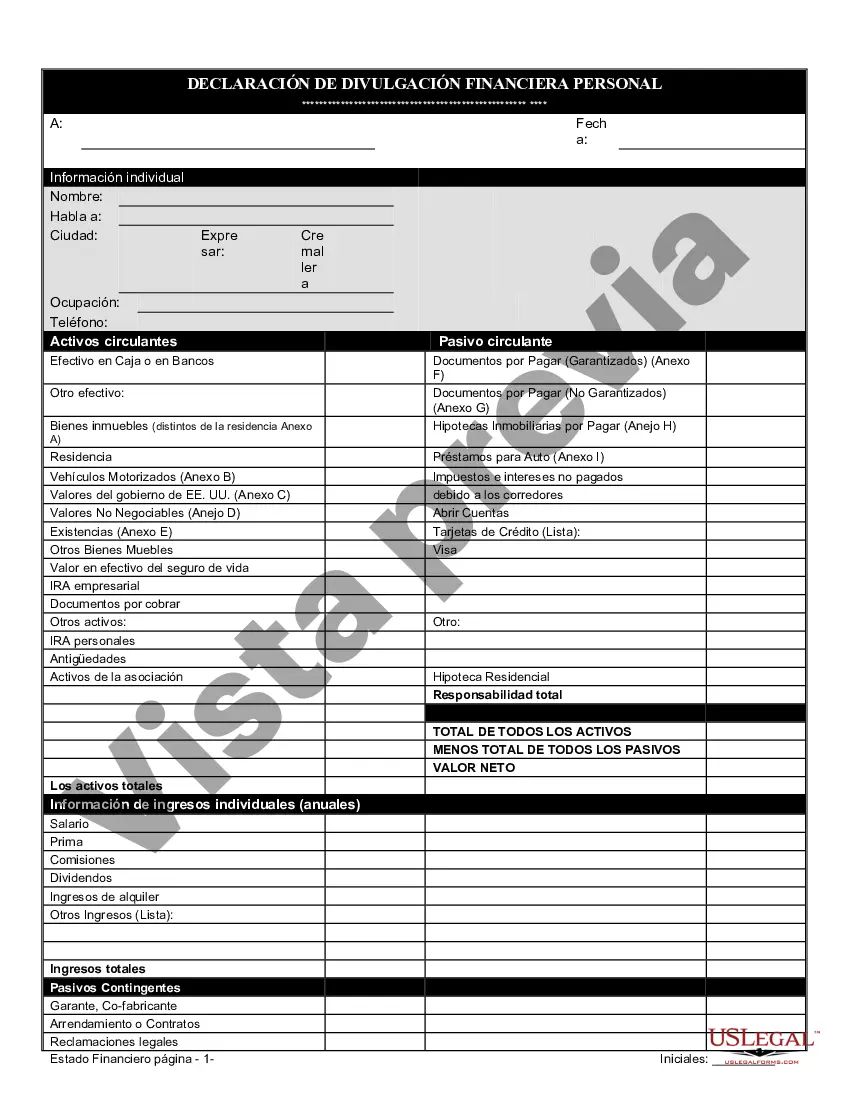

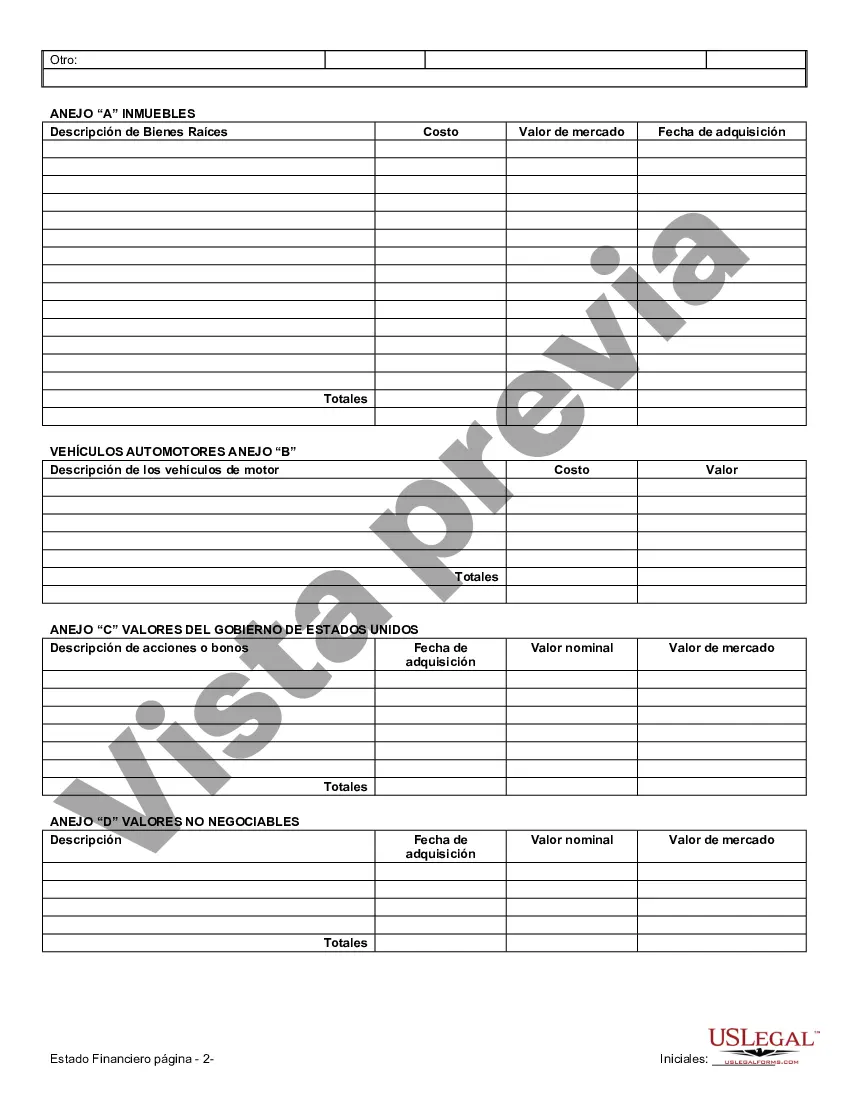

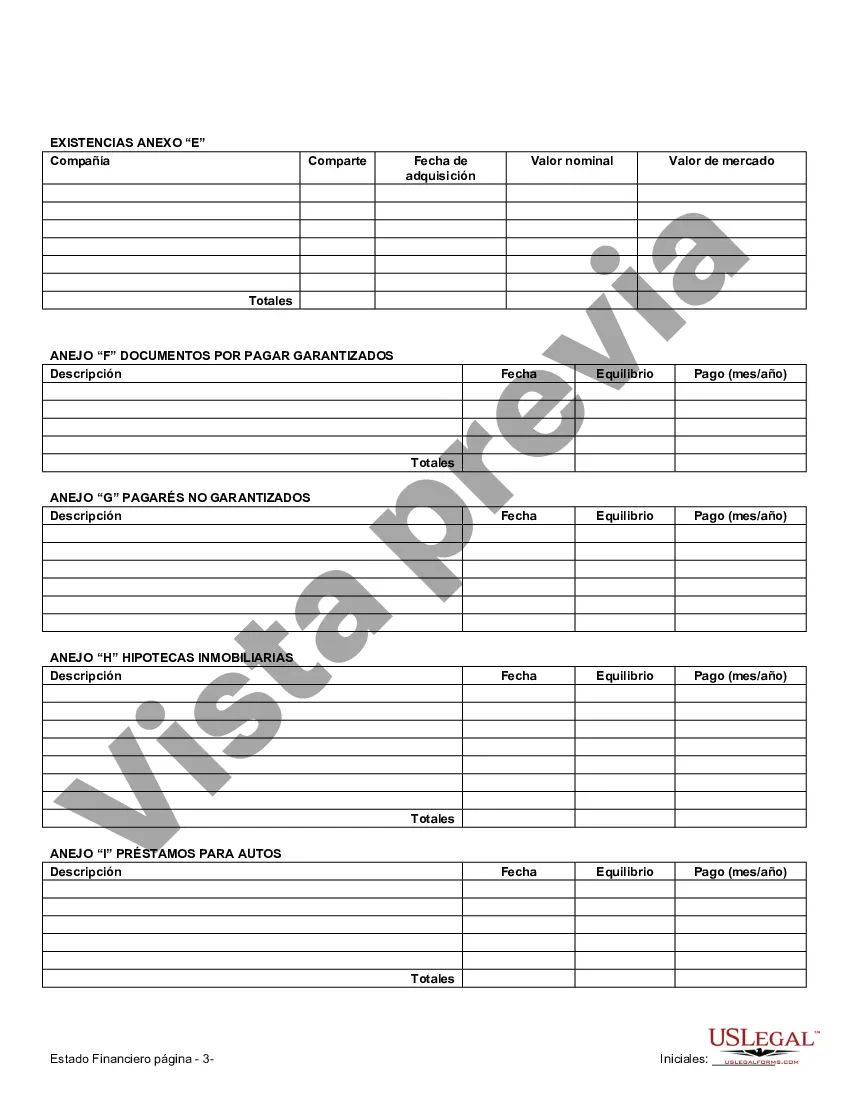

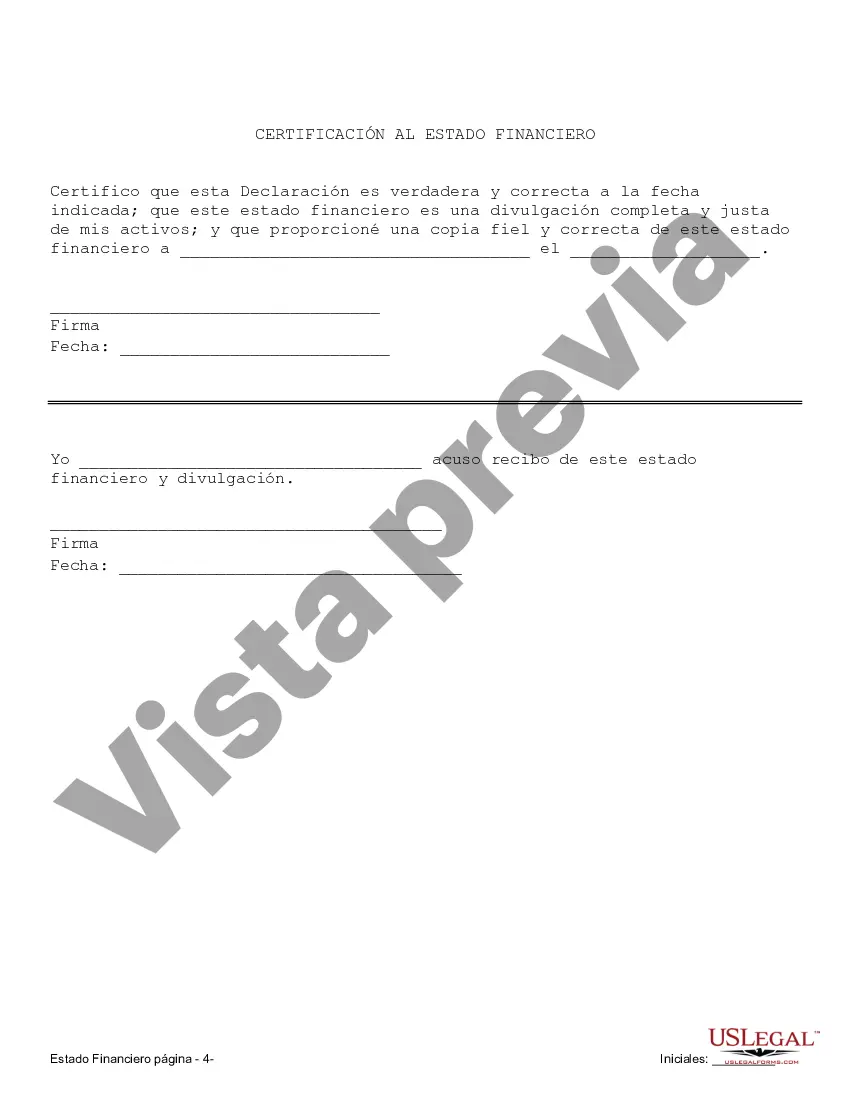

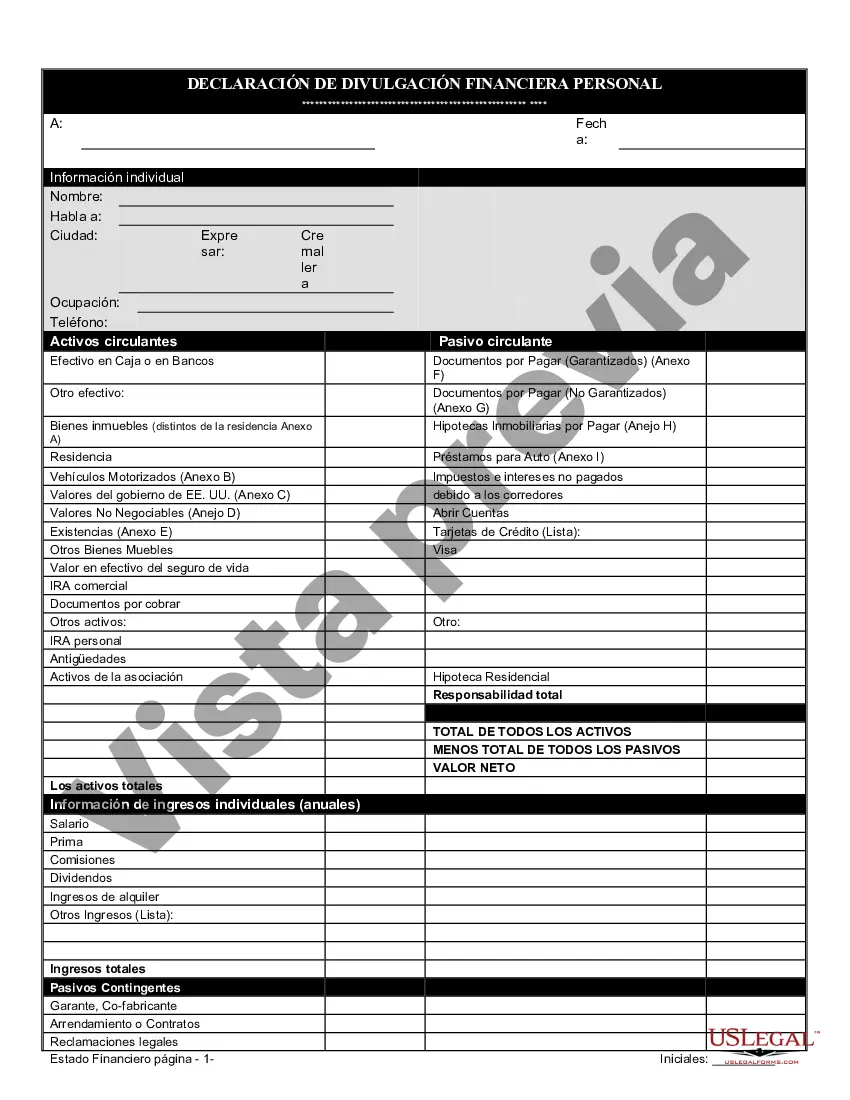

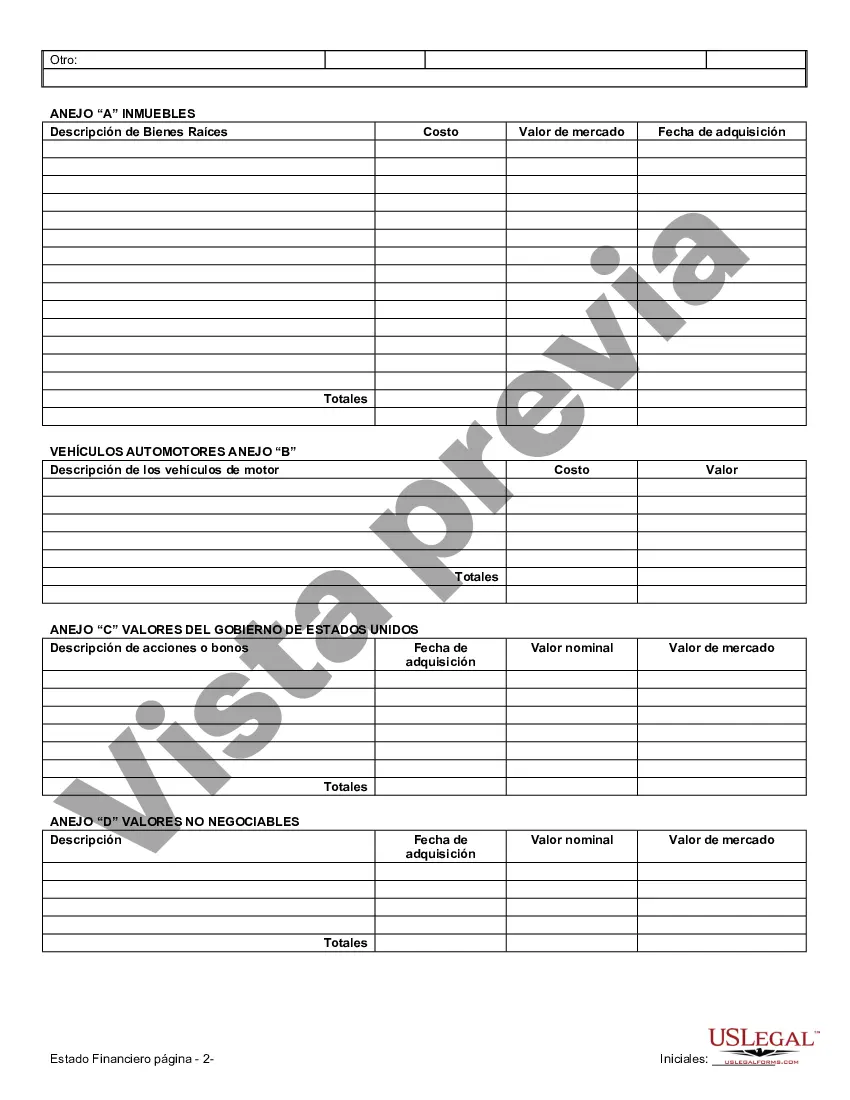

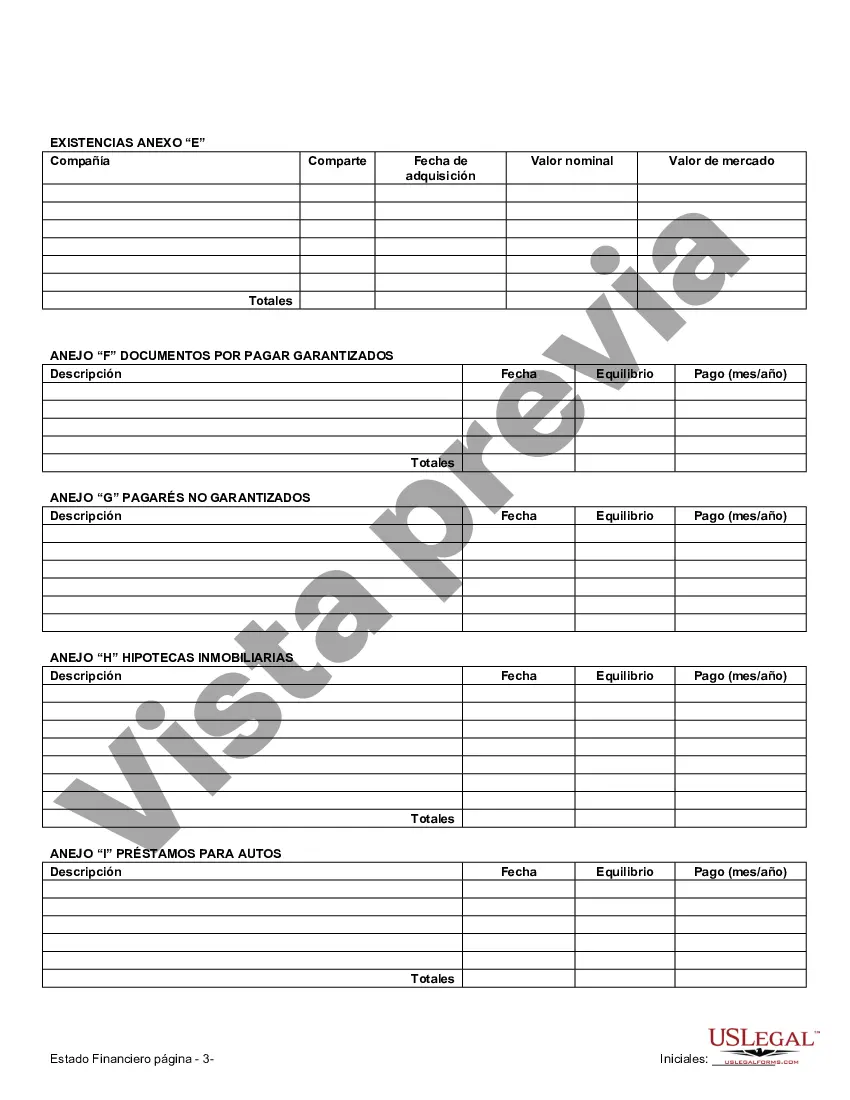

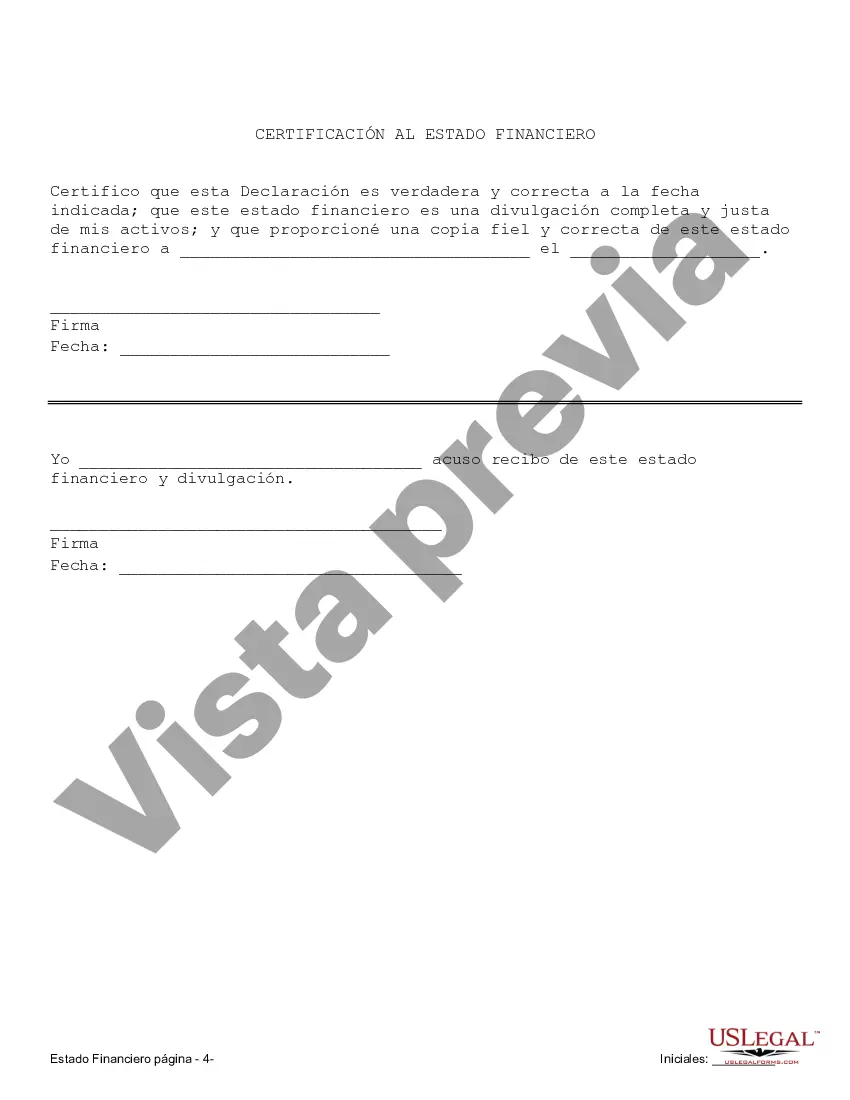

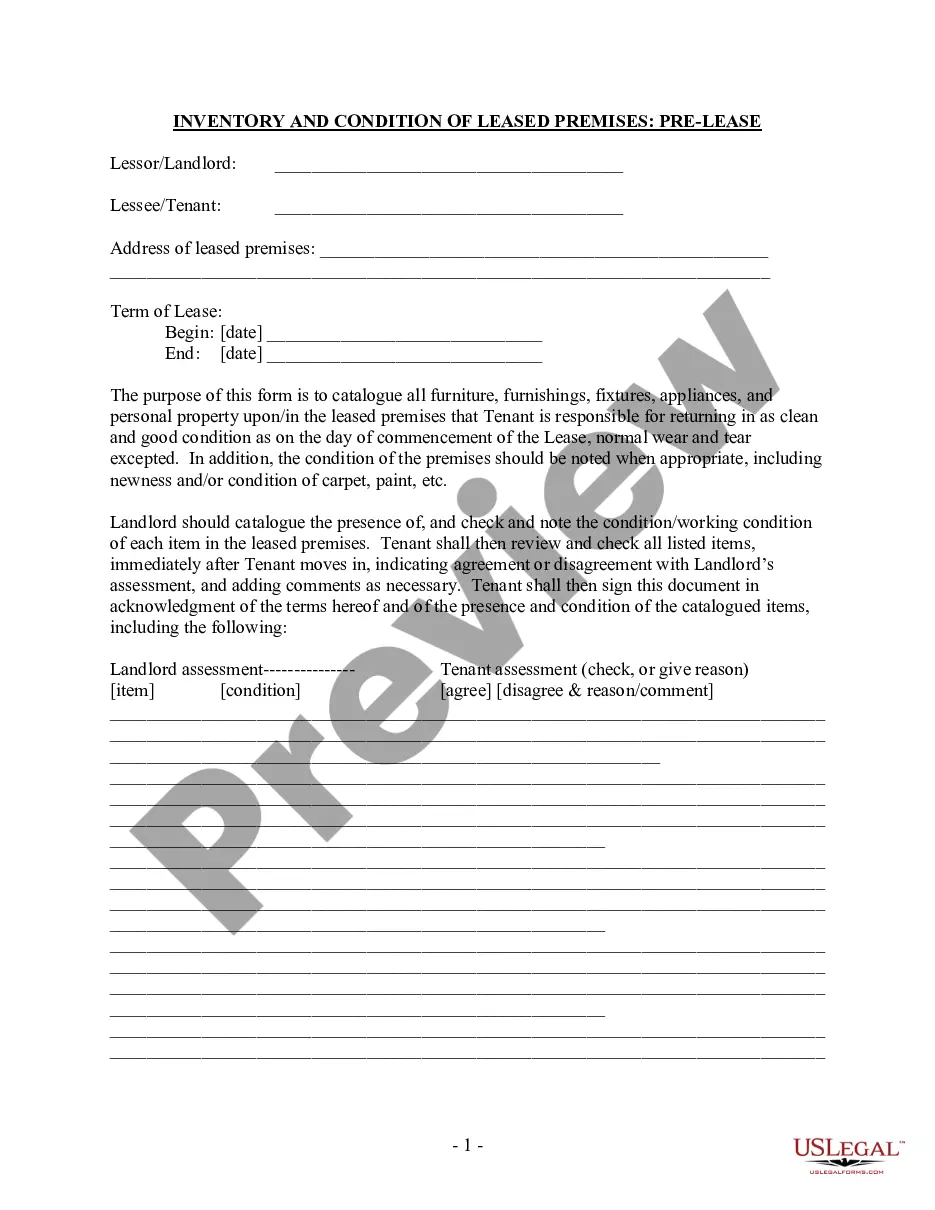

Victorville California Financial Statements in Connection with Prenuptial Premarital Agreement When it comes to prenuptial agreements in Victorville, California, financial statements play a crucial role in ensuring transparency and protecting the interests of both parties involved. A prenuptial agreement is a legal document that establishes the financial and property rights of each spouse in the event of divorce or separation. Including financial statements in this agreement provides a comprehensive overview of the couple's assets, income, debts, and expenses, making it an essential part of the process. The purpose of having Victorville California Financial Statements in Connection with a Prenuptial Premarital Agreement is to provide a clear understanding of the financial circumstances of both parties. It allows the couple to have an open discussion, addressing any disparities or potential concerns, and ultimately reach a fair agreement. Financial statements serve as a tool for disclosure, ensuring that both individuals have equal knowledge of each other's financial situations before entering into marriage. In Victorville, there are different types of financial statements that may be included in a prenuptial agreement: 1. Income Statements: This type of financial statement provides a detailed breakdown of each spouse's income, including wages, bonuses, dividends, rental income, or any other sources of funds. It highlights the amount earned and the sources which affect the potential distribution of financial assets. 2. Asset Statements: Asset statements outline the assets owned individually or jointly by the couple. This includes real estate properties, vehicles, investments, bank accounts, retirement accounts, and any other notable assets. Asset statements are crucial in determining the division of property in the event of separation or divorce. 3. Debt Statements: Debt statements cover any existing debts or liabilities held by either party. This includes mortgages, credit card debt, student loans, car loans, or any other outstanding financial obligations. Understanding the debt burden of each spouse allows for fair distribution in case the marriage ends. 4. Expense Statements: Expense statements track the monthly expenses of both parties, such as rent or mortgage payments, utility bills, insurance premiums, loan payments, and other regular expenses. This provides insight into the lifestyle and financial commitments of each person, shaping expectations and potential spousal support arrangements. Including the appropriate Victorville California Financial Statements in Connection with a Prenuptial Premarital Agreement helps establish transparency, protect individual assets, and lay a solid foundation for financial decision-making during and after the marriage. It is essential for both parties to work together, possibly with the guidance of a mediator or legal professionals, to ensure that the financial statements accurately reflect their financial situations. Remember, it's crucial to seek legal advice to understand the specific requirements and legal implications of these financial statements in your prenuptial agreement in Victorville, California. Each couple's circumstances may vary, so it is always recommended consulting with an experienced attorney to ensure compliance with local laws and to protect your interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Victorville California Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - California Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Victorville California Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

If you are searching for a relevant form template, it’s extremely hard to choose a better place than the US Legal Forms site – probably the most extensive libraries on the internet. With this library, you can find a large number of document samples for business and personal purposes by types and states, or key phrases. With our advanced search option, getting the most up-to-date Victorville California Financial Statements only in Connection with Prenuptial Premarital Agreement is as elementary as 1-2-3. In addition, the relevance of each and every record is confirmed by a group of professional attorneys that on a regular basis review the templates on our website and revise them according to the most recent state and county regulations.

If you already know about our system and have an account, all you need to get the Victorville California Financial Statements only in Connection with Prenuptial Premarital Agreement is to log in to your profile and click the Download option.

If you utilize US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have discovered the sample you need. Look at its description and make use of the Preview option to check its content. If it doesn’t meet your needs, utilize the Search option near the top of the screen to find the proper document.

- Affirm your choice. Choose the Buy now option. After that, pick the preferred pricing plan and provide credentials to register an account.

- Make the financial transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Get the form. Select the format and download it on your device.

- Make changes. Fill out, modify, print, and sign the obtained Victorville California Financial Statements only in Connection with Prenuptial Premarital Agreement.

Every single form you add to your profile has no expiration date and is yours forever. You can easily access them using the My Forms menu, so if you want to have an additional version for enhancing or printing, you may come back and save it again whenever you want.

Make use of the US Legal Forms extensive collection to get access to the Victorville California Financial Statements only in Connection with Prenuptial Premarital Agreement you were seeking and a large number of other professional and state-specific samples in one place!