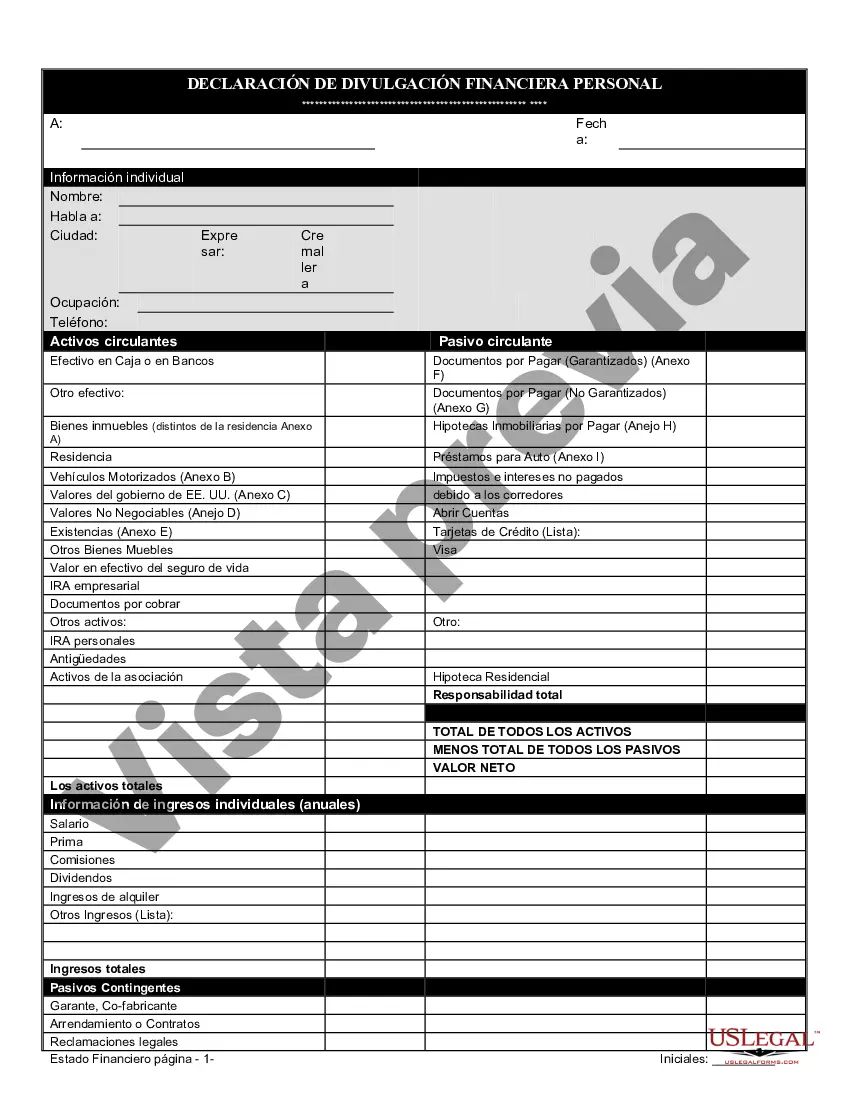

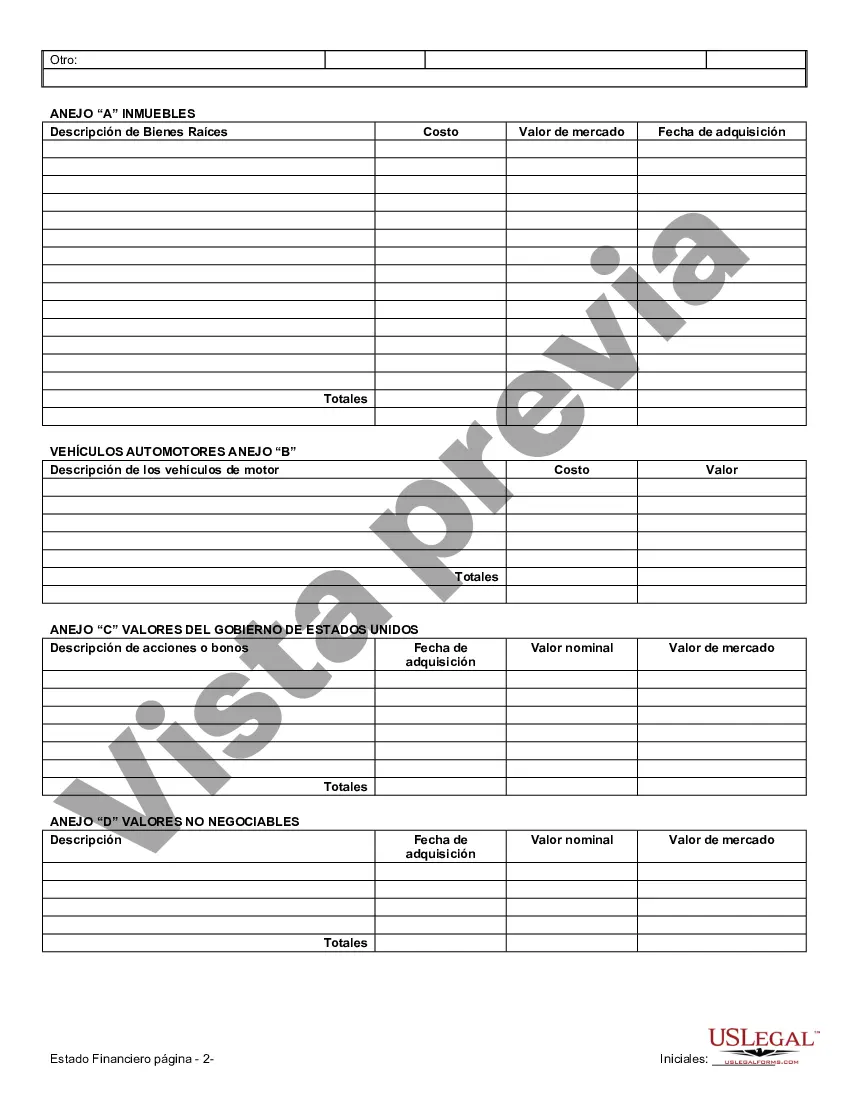

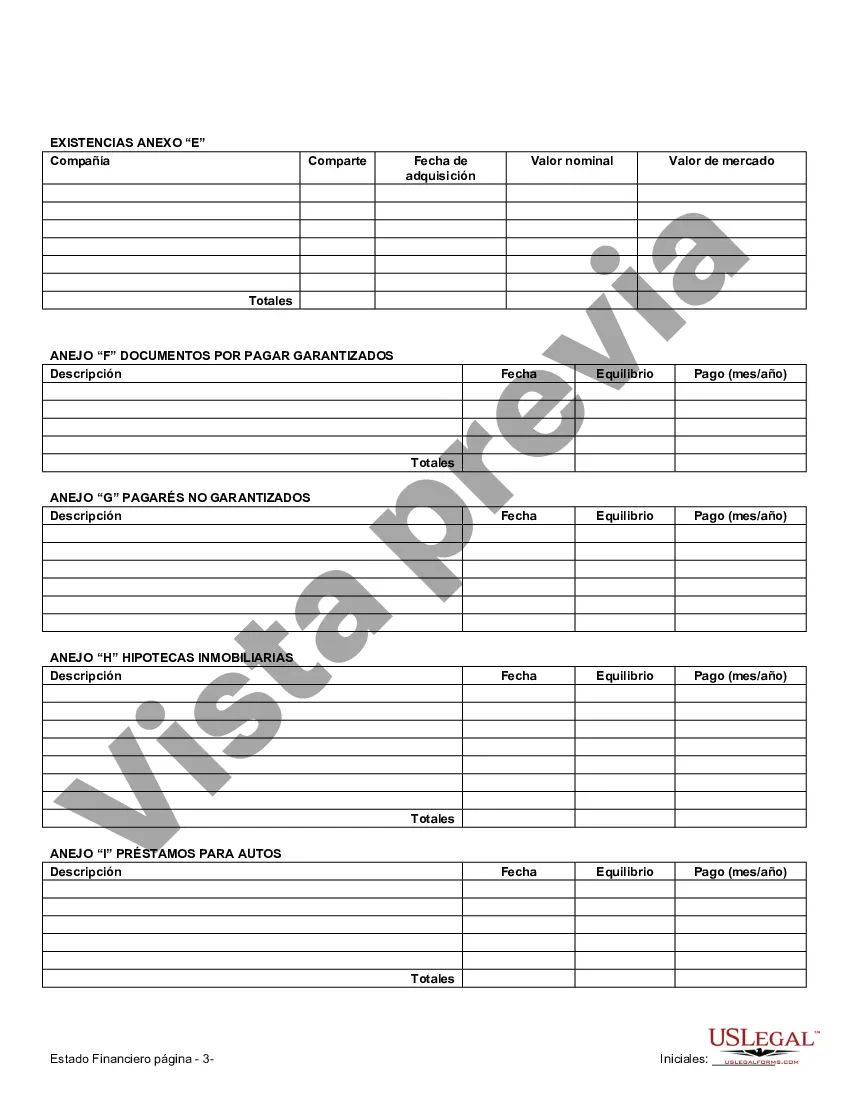

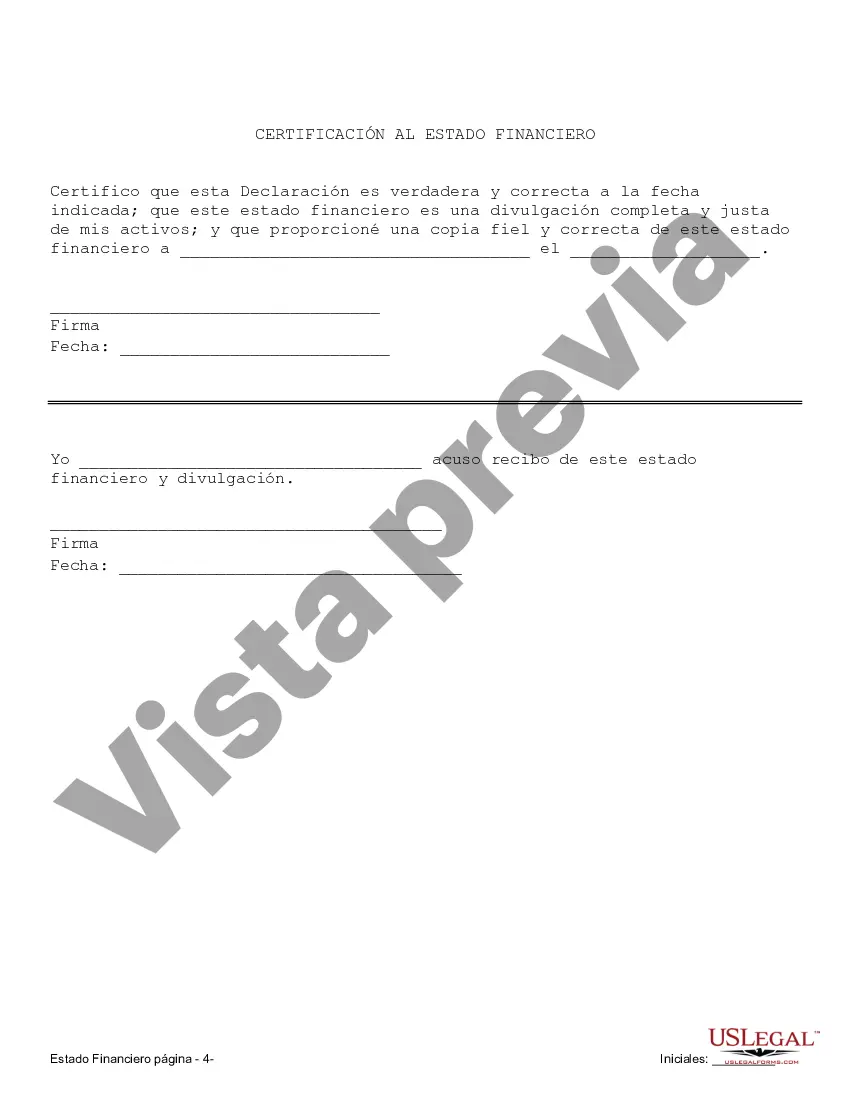

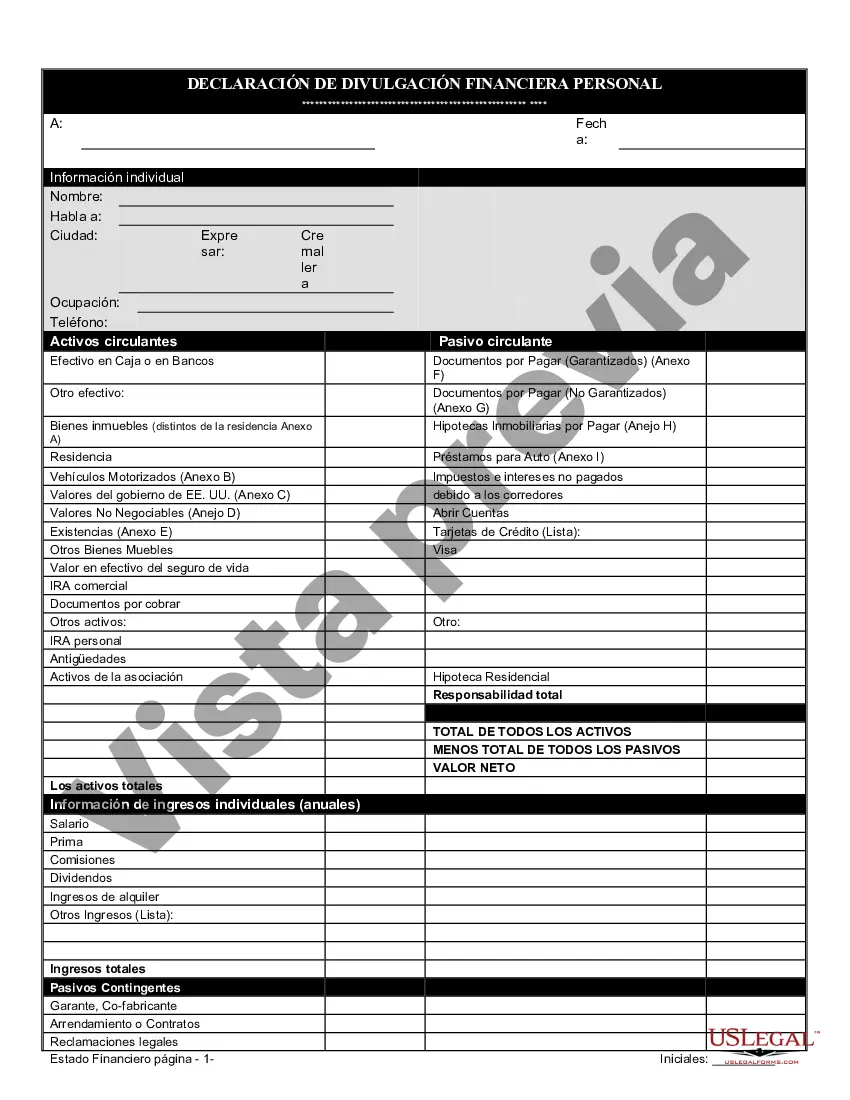

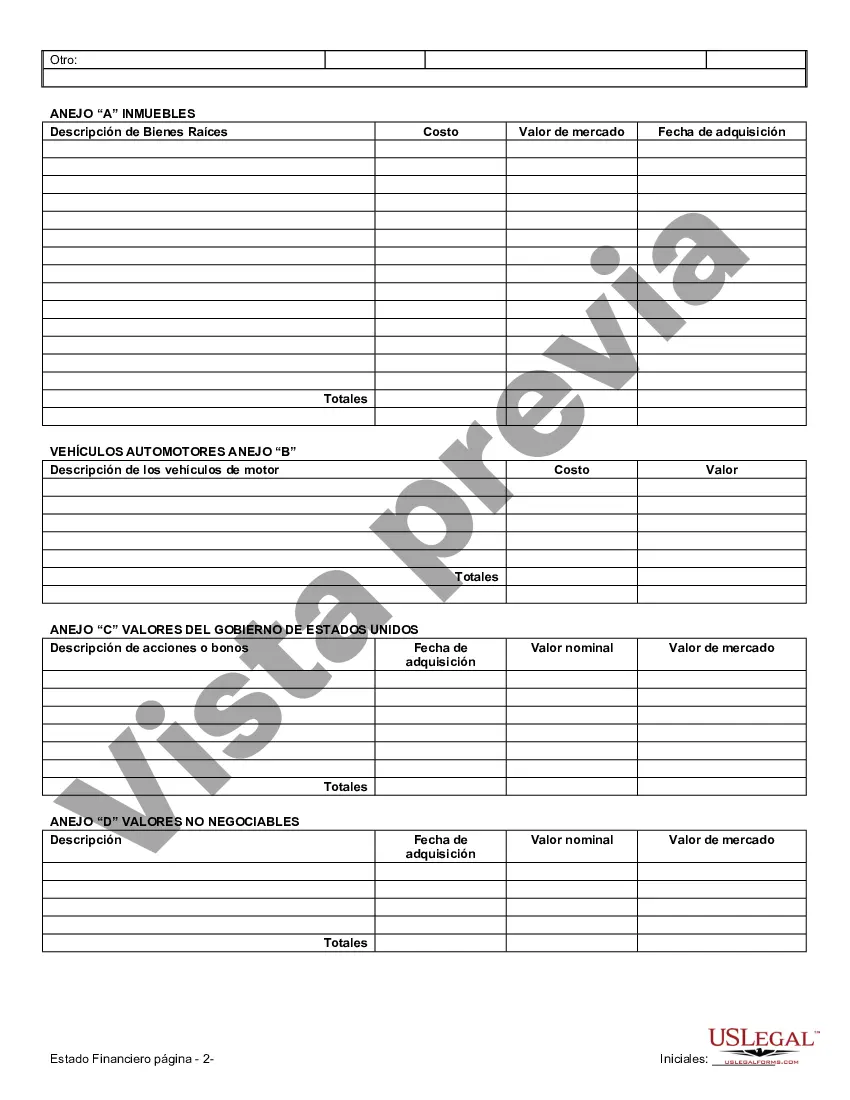

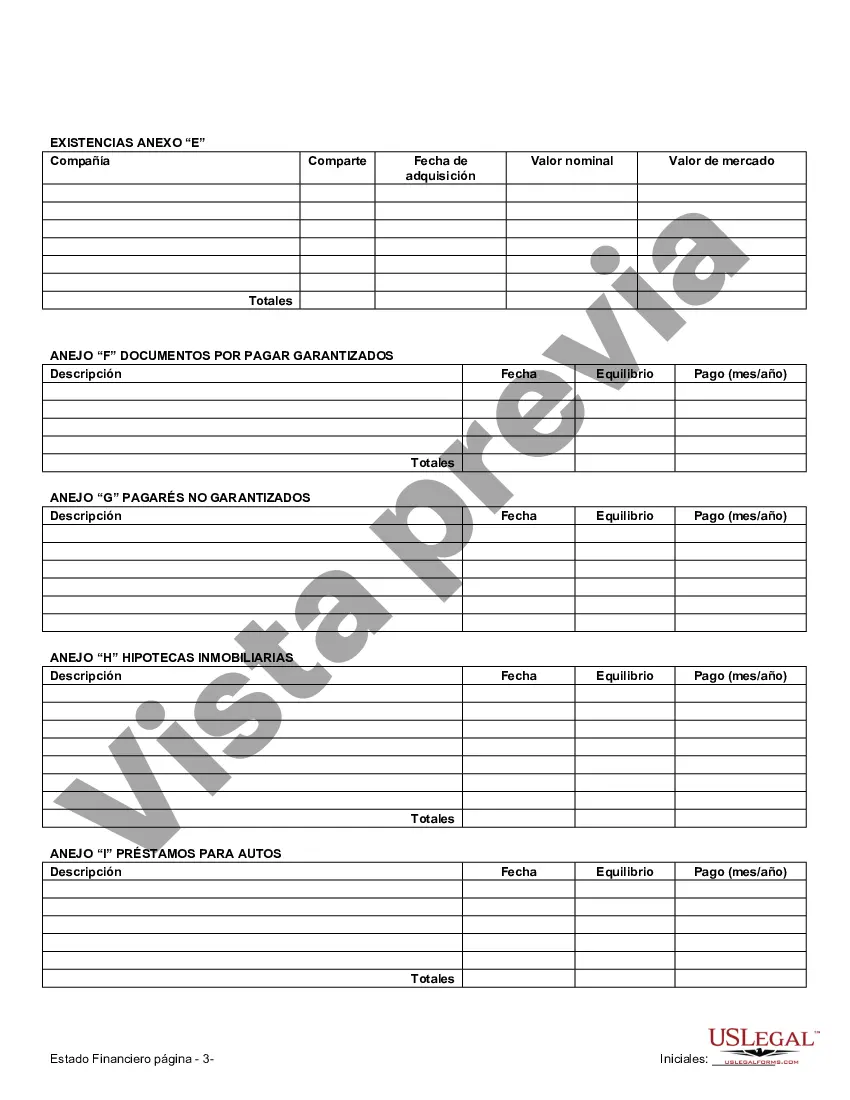

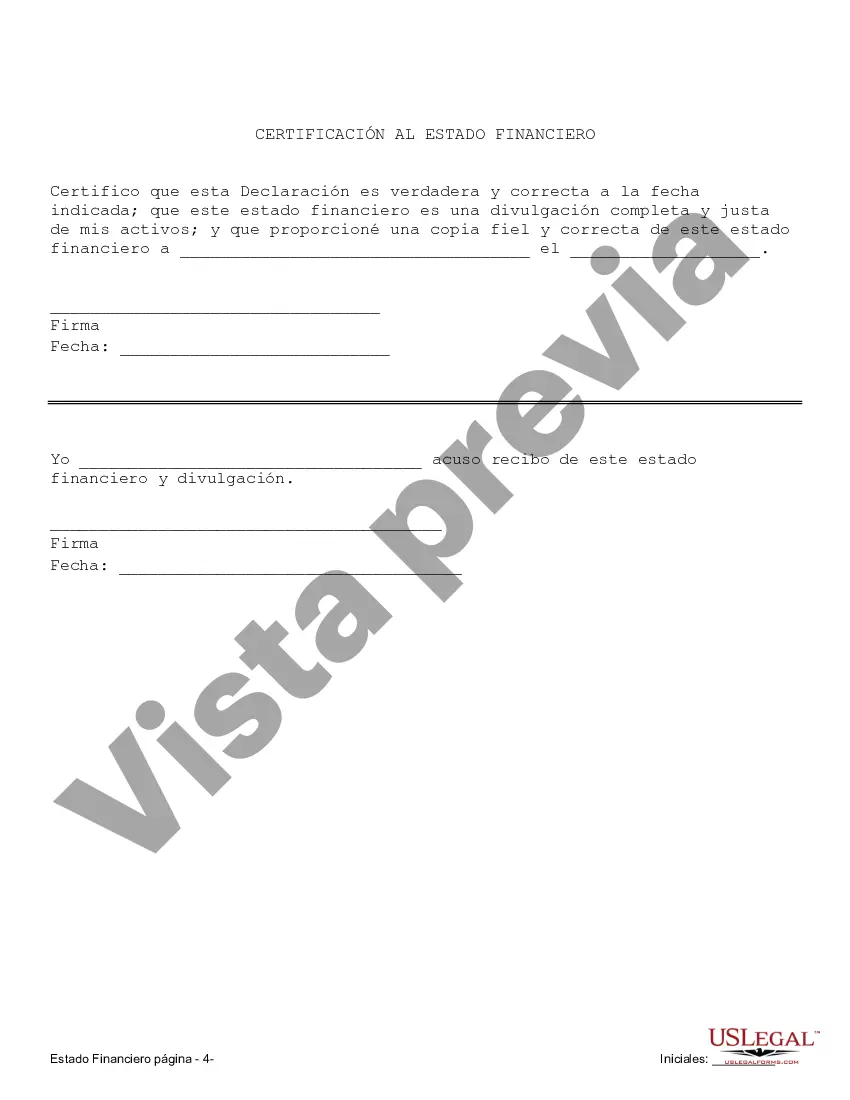

Visalia California Financial Statements in Connection with Prenuptial Premarital Agreement — A Comprehensive Guide When preparing for marriage, many couples prioritize signing a prenuptial or premarital agreement to outline the division of assets in the event of a divorce or separation. In Visalia, California, it is crucial to include accurate and comprehensive financial statements in your prenuptial agreement to ensure legal validity and protect both parties' interests. In this article, we will discuss the importance of financial statements in Visalia, California, regarding prenuptial or premarital agreements and highlight some different types of financial statements commonly used. Financial statements play a vital role in any prenuptial agreement in Visalia, as they provide a clear snapshot of each spouse's individual financial standing before entering into marriage. These statements should be accurate, complete, and detailed to avoid any ambiguity or disputes in the future. By including financial statements, both parties can disclose their assets, liabilities, income, and expenses, helping to establish a framework for a fair division of property should a divorce occur. Various types of financial statements are typically considered when drafting a prenuptial agreement in Visalia, California. Here are a few commonly used ones: 1. Personal Balance Sheets: A personal balance sheet is a summary of an individual's assets, liabilities, and net worth. It provides a detailed overview of one's financial position, including cash, real estate, investments, stocks, bonds, retirement accounts, and any outstanding debts such as mortgages, loans, or credit card balances. 2. Income Statements: An income statement outlines a person's income and expenses over a specific period. It includes sources of income, such as salaries, interest, dividends, rental income, and business profits, as well as expenses like rent, mortgage payments, utilities, insurance, taxes, and lifestyle expenses. 3. Bank Statements: Bank statements provide a record of all financial transactions made through a particular account. Including bank statements in a prenuptial agreement helps verify income, expenses, and overall financial stability. 4. Tax Returns: Tax returns are crucial documents that provide a comprehensive view of a person's income, deductions, credits, and tax liabilities. Including tax returns in a financial statement adds credibility and transparency to the prenuptial agreement. When creating financial statements for a prenuptial agreement, it is advisable to consult with a knowledgeable attorney who specializes in family law in Visalia, California. They can help ensure your financial statements comply with the state's legal requirements, which consider factors such as community property laws. Additionally, keep in mind that financial circumstances can change over time. It is wise to periodically update your financial statements and consider revising your prenuptial agreement to reflect any significant changes in assets, liabilities, or income. In conclusion, when entering into a prenuptial or premarital agreement in Visalia, California, it is essential to include accurate, comprehensive, and detailed financial statements. These statements provide transparency, protection, and a clear understanding of each spouse's financial position. By considering different types of financial statements, such as personal balance sheets, income statements, bank statements, and tax returns, couples can lay the foundation for a fair division of assets while mitigating potential disputes in the future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Visalia California Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - California Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Visalia California Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

We consistently aim to reduce or evade legal complications when managing intricate legal or financial matters.

To achieve this, we enroll in legal services that are typically quite costly. Nonetheless, not all legal issues are equally intricate. Many can be managed independently.

US Legal Forms is a digital repository of current DIY legal documents encompassing various topics from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Our platform empowers you to handle your matters independently without resorting to an attorney. We provide access to legal document templates that are not always accessible to the public.

The process is equally straightforward even if you are not accustomed to the platform! You can set up your account in just a few minutes.

- Our templates are tailored to specific states and regions, making the search process considerably easier.

- Utilize US Legal Forms whenever you need to obtain and download the Visalia California Financial Statements only concerning Prenuptial Premarital Agreement or any other document conveniently and securely.

- Simply Log In to your account and click the Get button adjacent to it.

- If you happen to misplace the document, you can always retrieve it again from the My documents section.