Includes instructions and forms required to register a non-California corporation in California.

Clovis California Registration of Foreign Corporation

Description

How to fill out California Registration Of Foreign Corporation?

Regardless of your social or professional position, completing legal documents is an unfortunate requirement in today’s society.

Often, it’s nearly unfeasible for an individual without any legal education to create such papers from scratch, primarily due to the intricate language and legal nuances they entail.

This is where US Legal Forms steps in to assist.

Ensure the form you selected is valid for your region since the laws of one state or county may not apply to another.

Review the document and examine a brief overview (if available) of situations for which the form can be utilized. If the selected one doesn't fulfill your needs, you can reset and search for the required form.

- Our service offers a vast collection of over 85,000 ready-to-use, state-specific forms that cater to nearly every legal situation.

- US Legal Forms also acts as a valuable resource for associates or legal advisors looking to enhance efficiency by using our DIY forms.

- Whether you need the Clovis California Registration of Foreign Corporation or any other document applicable in your state or county, US Legal Forms has everything accessible at your convenience.

- Here's how to quickly obtain the Clovis California Registration of Foreign Corporation using our reliable service.

- If you are already a registered user, simply Log In to your account to retrieve the necessary form.

- If you are a newcomer to our platform, make sure to follow these steps before acquiring the Clovis California Registration of Foreign Corporation.

Form popularity

FAQ

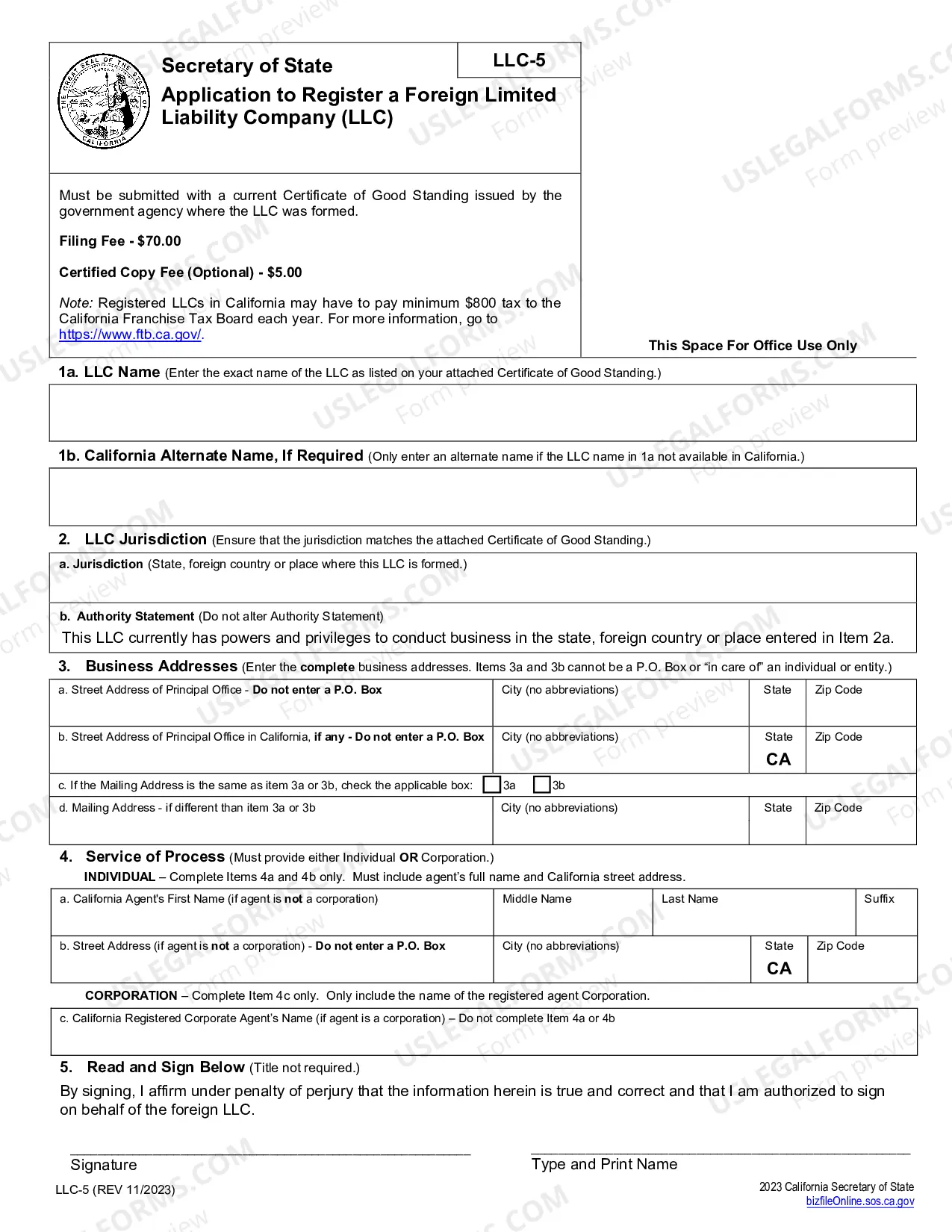

To register a foreign corporation in California, begin by obtaining a Certificate of Qualification from the California Secretary of State. You will need to provide information about your business, including its name, address, and structure. Additionally, you must submit the required forms along with the appropriate fees. For a streamlined process, consider using USLegalForms, which offers resources specifically for the Clovis California Registration of Foreign Corporation.

To register a Foreign Corporation in California, you must first gather necessary documents such as a Certificate of Good Standing from your home state. Next, complete the application process, which includes filing form SI 100 and paying the required fees. Utilizing platforms like US Legal Forms can simplify this procedure by providing templates and guidance for the Clovis California Registration of Foreign Corporation. Ensuring proper registration allows your business to operate smoothly in California, enhancing your growth opportunities.

Filing form SI 100 is a crucial step for the Clovis California Registration of Foreign Corporation. To start, download the form from the California Secretary of State's website. You will need to fill it out with accurate business information, and then submit it along with the appropriate fees either online or by mail. This straightforward process helps ensure your business is officially recognized in California.

Yes, foreign corporations must register in California to legally conduct business in the state. This requirement ensures that you comply with local laws and can perform transactions without legal complications. The Clovis California Registration of Foreign Corporation process includes submitting the necessary documents to the Secretary of State and paying specified fees. Completing this registration fortifies your business's standing and reputation in California.

To avoid the $800 LLC fees in California, consider registering as a foreign corporation instead of forming a new LLC. The Clovis California Registration of Foreign Corporation allows you to leverage your existing business structure while complying with state requirements. You can also explore different business types that may have lower fees. For comprehensive support and solutions, consider using the uslegalforms platform to navigate the registration process efficiently.

Registering Your Business LLCs, Corporations, LPs, LLPs, or GPs operating in California need to register and form their legal entity with the California Secretary of State's Office, file appropriate taxes, register as an employer, and obtain business licenses and other permits from appropriate cities or counties.

Foreign corporations A foreign corporation qualifies to do business in California by filing: A Statement and Designation by Foreign Corporation. An original certificate of good standing from the state or country in which it was incorporated, with the SOS.

Do I have to qualify or register a foreign (out?of?state or out?of?country) business entity? Before transacting intrastate business in California, the business must first qualify/register with the California Secretary of State online at bizfileOnline.sos.ca.gov.

California's LLC Act requires foreign LLCs to register with the state of California if they are transacting business within the state.

You can register a foreign (out-of-state) corporation in California by filing a Statement and Designation by Foreign Corporation (Form S&DC-S/N), along with a Certificate of Good Standing, to the Secretary of State's office. Through June 2023, there is no filing fee, so now is the time to register.