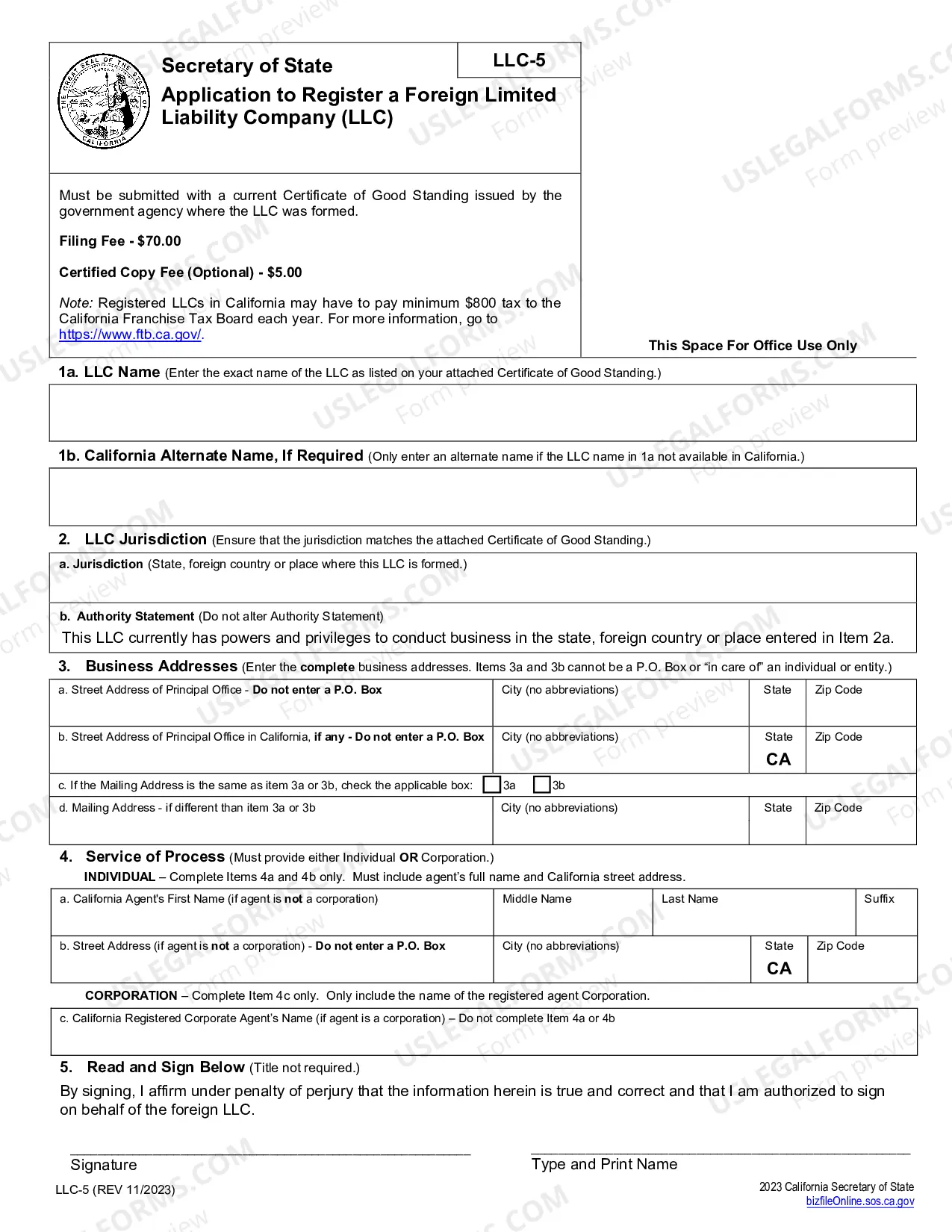

Includes instructions and forms required to register a non-California corporation in California.

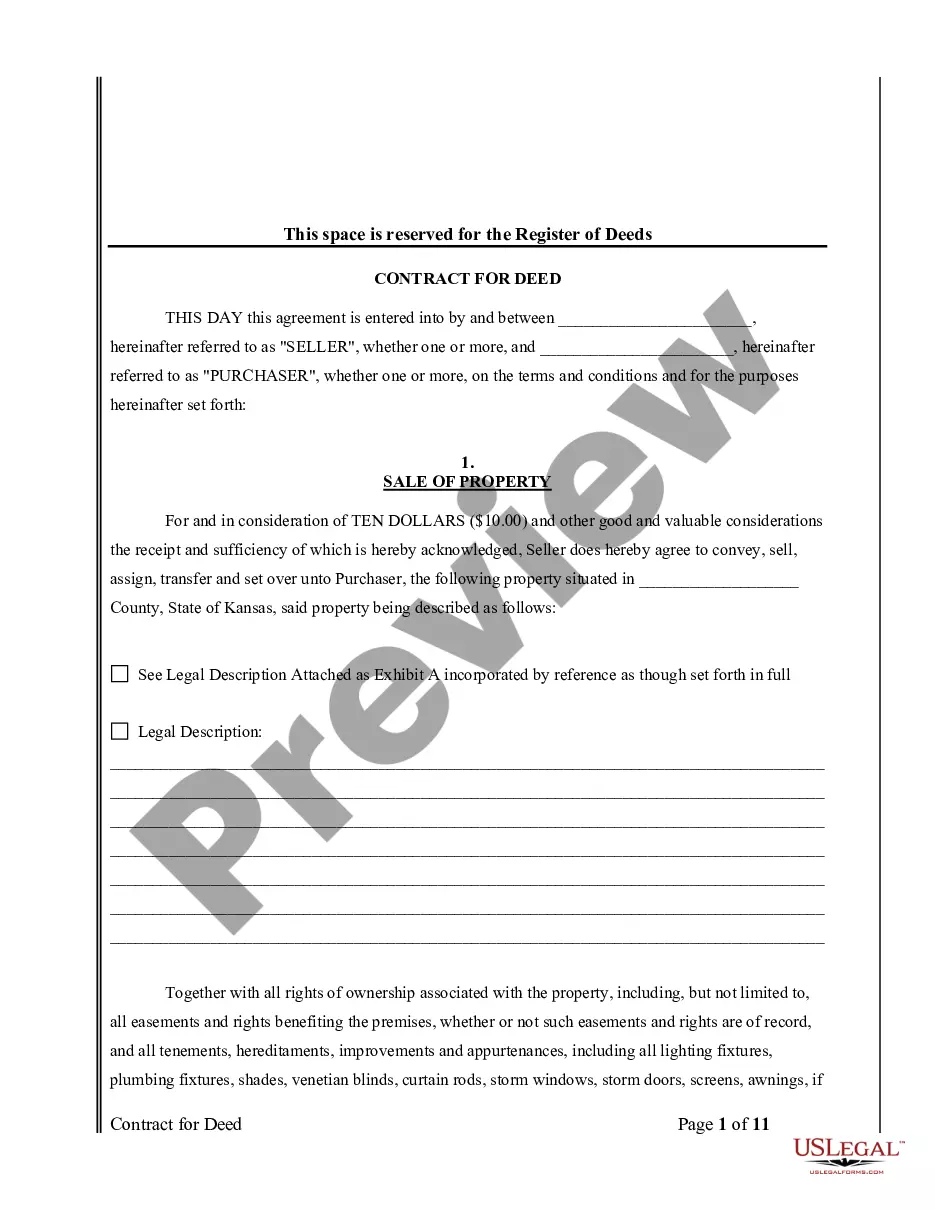

The Riverside California Registration of Foreign Corporation is an important process that foreign corporations must undergo in order to conduct business within the state. This registration ensures compliance with local laws and regulations while providing a legal framework for the corporation to operate in Riverside, California. Foreign corporations refer to entities that have been incorporated outside the state of California but wish to expand their business operations or establish a presence in Riverside. This registration process establishes their legal existence in the state and allows them to engage in various business activities, such as selling products or providing services. There are different types of Riverside California Registration of Foreign Corporation, depending on the specific nature of the corporation's business activities. These types include: 1. General Foreign Corporation: This type of registration applies to foreign corporations engaging in a wide range of business activities in Riverside. It includes corporations involved in manufacturing, retail, professional services, consulting, and others. 2. Professional Corporation: Certain professions, such as medical, legal, engineering, or accounting, require foreign corporations to register as professional corporations when conducting business in Riverside. This ensures that these corporations comply with the specific regulations and licensing requirements applicable to their profession. 3. Non-Profit Corporation: Foreign non-profit organizations that wish to operate in Riverside must register as a non-profit corporation. This type of registration allows them to carry out charitable, educational, religious, or scientific activities within the state. The Riverside California Registration of Foreign Corporation involves a series of steps and requirements. The corporation must typically file an application with the California Secretary of State, providing the necessary information such as the corporation's name, jurisdiction of incorporation, principal address, and a designated agent for service of process in Riverside. The registration may also require submitting documents like a certificate of good standing from the home jurisdiction or articles of incorporation. The registration fee depends on the type of foreign corporation and the services provided by the Secretary of State. It's important to note that once registered, the foreign corporation must comply with ongoing filing and reporting requirements, such as submitting annual statements or updates on any changes in the corporation's information. By undergoing the Riverside California Registration of Foreign Corporation, foreign entities can establish their presence in Riverside and legally conduct business activities. This process ensures compliance with local laws, promotes transparency, and allows for the growth and expansion of these corporations within the state.The Riverside California Registration of Foreign Corporation is an important process that foreign corporations must undergo in order to conduct business within the state. This registration ensures compliance with local laws and regulations while providing a legal framework for the corporation to operate in Riverside, California. Foreign corporations refer to entities that have been incorporated outside the state of California but wish to expand their business operations or establish a presence in Riverside. This registration process establishes their legal existence in the state and allows them to engage in various business activities, such as selling products or providing services. There are different types of Riverside California Registration of Foreign Corporation, depending on the specific nature of the corporation's business activities. These types include: 1. General Foreign Corporation: This type of registration applies to foreign corporations engaging in a wide range of business activities in Riverside. It includes corporations involved in manufacturing, retail, professional services, consulting, and others. 2. Professional Corporation: Certain professions, such as medical, legal, engineering, or accounting, require foreign corporations to register as professional corporations when conducting business in Riverside. This ensures that these corporations comply with the specific regulations and licensing requirements applicable to their profession. 3. Non-Profit Corporation: Foreign non-profit organizations that wish to operate in Riverside must register as a non-profit corporation. This type of registration allows them to carry out charitable, educational, religious, or scientific activities within the state. The Riverside California Registration of Foreign Corporation involves a series of steps and requirements. The corporation must typically file an application with the California Secretary of State, providing the necessary information such as the corporation's name, jurisdiction of incorporation, principal address, and a designated agent for service of process in Riverside. The registration may also require submitting documents like a certificate of good standing from the home jurisdiction or articles of incorporation. The registration fee depends on the type of foreign corporation and the services provided by the Secretary of State. It's important to note that once registered, the foreign corporation must comply with ongoing filing and reporting requirements, such as submitting annual statements or updates on any changes in the corporation's information. By undergoing the Riverside California Registration of Foreign Corporation, foreign entities can establish their presence in Riverside and legally conduct business activities. This process ensures compliance with local laws, promotes transparency, and allows for the growth and expansion of these corporations within the state.