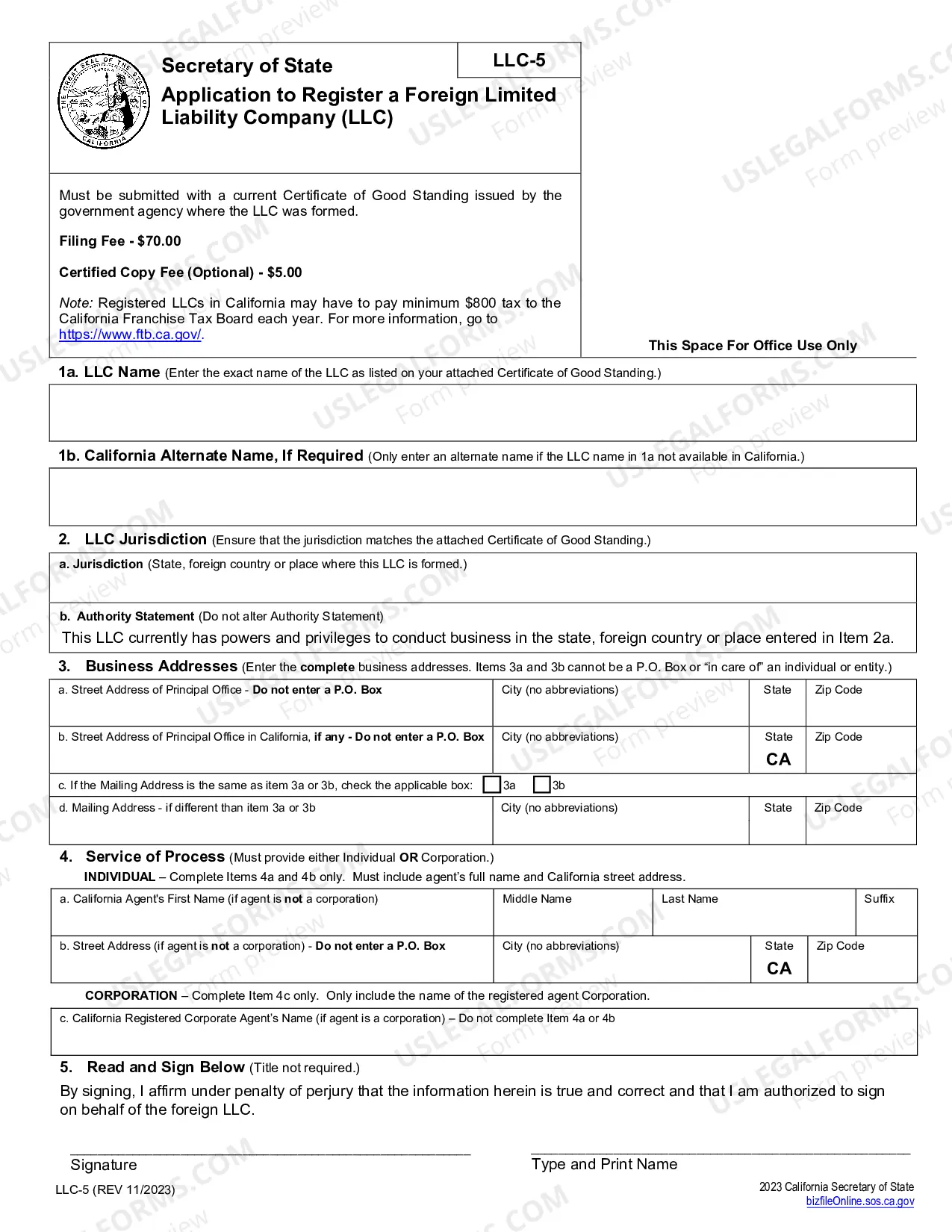

Includes instructions and forms required to register a non-California corporation in California.

Sacramento California Registration of Foreign Corporation is a legal process that allows corporations incorporated outside of California to do business within the state. It is mandatory for foreign corporations to register with the California Secretary of State's office in order to legally operate and conduct business activities in Sacramento. To complete the Sacramento California Registration of Foreign Corporation, a corporation must submit the necessary registration documents, fees, and meet certain requirements set forth by the state. The process ensures that foreign corporations adhere to local laws, pay their taxes, and fulfill any other obligations as required by the state of California. Some relevant keywords related to Sacramento California Registration of Foreign Corporation include: 1. Foreign Corporation: A corporation that is incorporated in a state other than California. 2. Registration: The formal process of submitting documentation and fees to the California Secretary of State's office to establish legal authority to operate in the state. 3. Business Activities: Any activities conducted by a corporation within the state of California, including sales, contracts, marketing, and more. 4. Legal Compliance: Ensuring that the corporation adheres to all applicable laws, regulations, and statutes of the state of California. 5. California Secretary of State: The governmental office responsible for processing and maintaining corporate filings and registrations within the state of California. 6. Tax Obligations: The responsibilities of foreign corporations to pay state taxes on income generated within California. 7. Operating Authority: The official permission granted to a foreign corporation allowing it to conduct business activities within the state. 8. Document Submission: The process of providing the required legal documents, such as Articles of Incorporation, to the California Secretary of State's office for registration. 9. Fees: The monetary costs associated with the registration process, including filing fees and any other applicable charges. 10. Corporation Name Availability: Ensuring that the proposed corporation name is not already in use or reserved by another entity in California. Different types of Sacramento California Registration of Foreign Corporation may include variations based on the specific nature of the corporation's business. For example, there may be separate processes for nonprofit foreign corporations, professional service foreign corporations, or corporations operating in specific industries. It is essential for each corporation to carefully evaluate the specific requirements and regulations that may apply to their particular business before initiating the registration process in Sacramento, California.Sacramento California Registration of Foreign Corporation is a legal process that allows corporations incorporated outside of California to do business within the state. It is mandatory for foreign corporations to register with the California Secretary of State's office in order to legally operate and conduct business activities in Sacramento. To complete the Sacramento California Registration of Foreign Corporation, a corporation must submit the necessary registration documents, fees, and meet certain requirements set forth by the state. The process ensures that foreign corporations adhere to local laws, pay their taxes, and fulfill any other obligations as required by the state of California. Some relevant keywords related to Sacramento California Registration of Foreign Corporation include: 1. Foreign Corporation: A corporation that is incorporated in a state other than California. 2. Registration: The formal process of submitting documentation and fees to the California Secretary of State's office to establish legal authority to operate in the state. 3. Business Activities: Any activities conducted by a corporation within the state of California, including sales, contracts, marketing, and more. 4. Legal Compliance: Ensuring that the corporation adheres to all applicable laws, regulations, and statutes of the state of California. 5. California Secretary of State: The governmental office responsible for processing and maintaining corporate filings and registrations within the state of California. 6. Tax Obligations: The responsibilities of foreign corporations to pay state taxes on income generated within California. 7. Operating Authority: The official permission granted to a foreign corporation allowing it to conduct business activities within the state. 8. Document Submission: The process of providing the required legal documents, such as Articles of Incorporation, to the California Secretary of State's office for registration. 9. Fees: The monetary costs associated with the registration process, including filing fees and any other applicable charges. 10. Corporation Name Availability: Ensuring that the proposed corporation name is not already in use or reserved by another entity in California. Different types of Sacramento California Registration of Foreign Corporation may include variations based on the specific nature of the corporation's business. For example, there may be separate processes for nonprofit foreign corporations, professional service foreign corporations, or corporations operating in specific industries. It is essential for each corporation to carefully evaluate the specific requirements and regulations that may apply to their particular business before initiating the registration process in Sacramento, California.