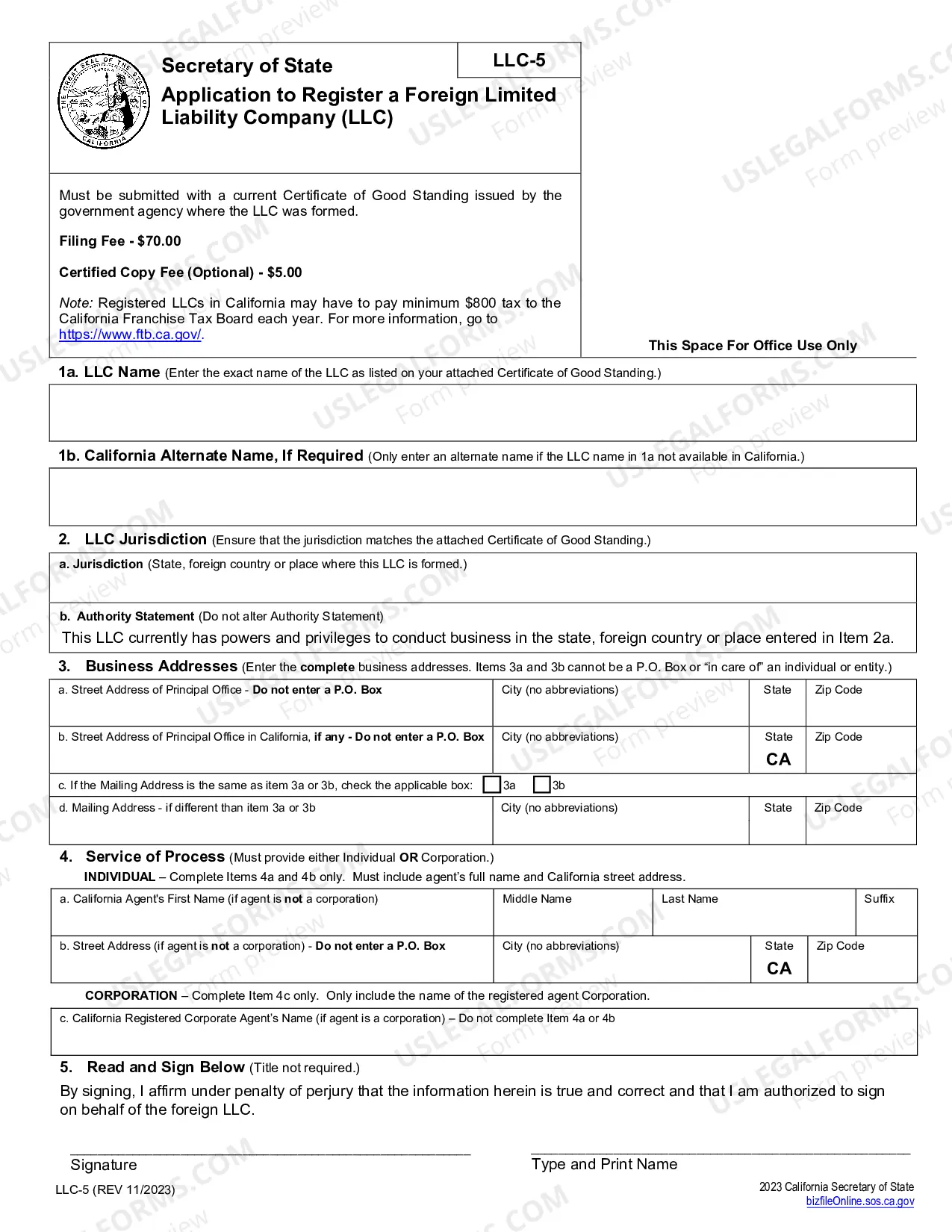

Includes instructions and forms required to register a non-California corporation in California.

Salinas California Registration of Foreign Corporation is a legal process that allows businesses incorporated outside of California to operate and conduct business within the city of Salinas. This registration is mandatory and serves as proof of the corporation's commitment to comply with local laws, regulations, and taxation requirements. The Salinas California Registration of Foreign Corporation involves several steps and requirements to ensure proper documentation and transparency. The process begins by obtaining an application form from the California Secretary of State's office or their official website. The necessary information for Salinas California Registration of Foreign Corporation includes the corporation's legal name, the jurisdiction where it was initially incorporated, the physical and mailing address of its principal executive office, the purpose of the corporation, and a list of its officers and directors. Additionally, corporations need to appoint a registered agent, located in California, who will act as the corporation's official representative and receive legal documents, tax notices, and other important correspondence on behalf of the corporation. There are different types of Salinas California Registration of Foreign Corporation: 1. Qualification as a Foreign Corporation: This is the most common type of registration and is required when a corporation incorporated outside of California intends to conduct regular business operations in Salinas. By completing this process, the corporation gains the legal right to operate and conduct business within the state. 2. Statement and Designation by Foreign Corporation: In some cases, corporations may need to provide additional details regarding specific activities they plan to undertake within Salinas. This type of registration allows corporations to specify the nature of their business activities, ensuring compliance with local laws. 3. Annual Filing for Foreign Corporations: Once registered as a foreign corporation, companies are required to file an annual report with the California Secretary of State's office to maintain their active status. This filing provides updated information about the corporation's officers, directors, and addresses. It is important for foreign corporations to remember that registration requirements and processes may vary from state to state. Therefore, it is recommended to consult with legal professionals well-versed in corporate law to ensure full compliance with the Salinas California Registration of Foreign Corporation process. By adhering to the registration requirements, foreign corporations can operate smoothly within Salinas while enjoying all the benefits and opportunities offered by the city.Salinas California Registration of Foreign Corporation is a legal process that allows businesses incorporated outside of California to operate and conduct business within the city of Salinas. This registration is mandatory and serves as proof of the corporation's commitment to comply with local laws, regulations, and taxation requirements. The Salinas California Registration of Foreign Corporation involves several steps and requirements to ensure proper documentation and transparency. The process begins by obtaining an application form from the California Secretary of State's office or their official website. The necessary information for Salinas California Registration of Foreign Corporation includes the corporation's legal name, the jurisdiction where it was initially incorporated, the physical and mailing address of its principal executive office, the purpose of the corporation, and a list of its officers and directors. Additionally, corporations need to appoint a registered agent, located in California, who will act as the corporation's official representative and receive legal documents, tax notices, and other important correspondence on behalf of the corporation. There are different types of Salinas California Registration of Foreign Corporation: 1. Qualification as a Foreign Corporation: This is the most common type of registration and is required when a corporation incorporated outside of California intends to conduct regular business operations in Salinas. By completing this process, the corporation gains the legal right to operate and conduct business within the state. 2. Statement and Designation by Foreign Corporation: In some cases, corporations may need to provide additional details regarding specific activities they plan to undertake within Salinas. This type of registration allows corporations to specify the nature of their business activities, ensuring compliance with local laws. 3. Annual Filing for Foreign Corporations: Once registered as a foreign corporation, companies are required to file an annual report with the California Secretary of State's office to maintain their active status. This filing provides updated information about the corporation's officers, directors, and addresses. It is important for foreign corporations to remember that registration requirements and processes may vary from state to state. Therefore, it is recommended to consult with legal professionals well-versed in corporate law to ensure full compliance with the Salinas California Registration of Foreign Corporation process. By adhering to the registration requirements, foreign corporations can operate smoothly within Salinas while enjoying all the benefits and opportunities offered by the city.