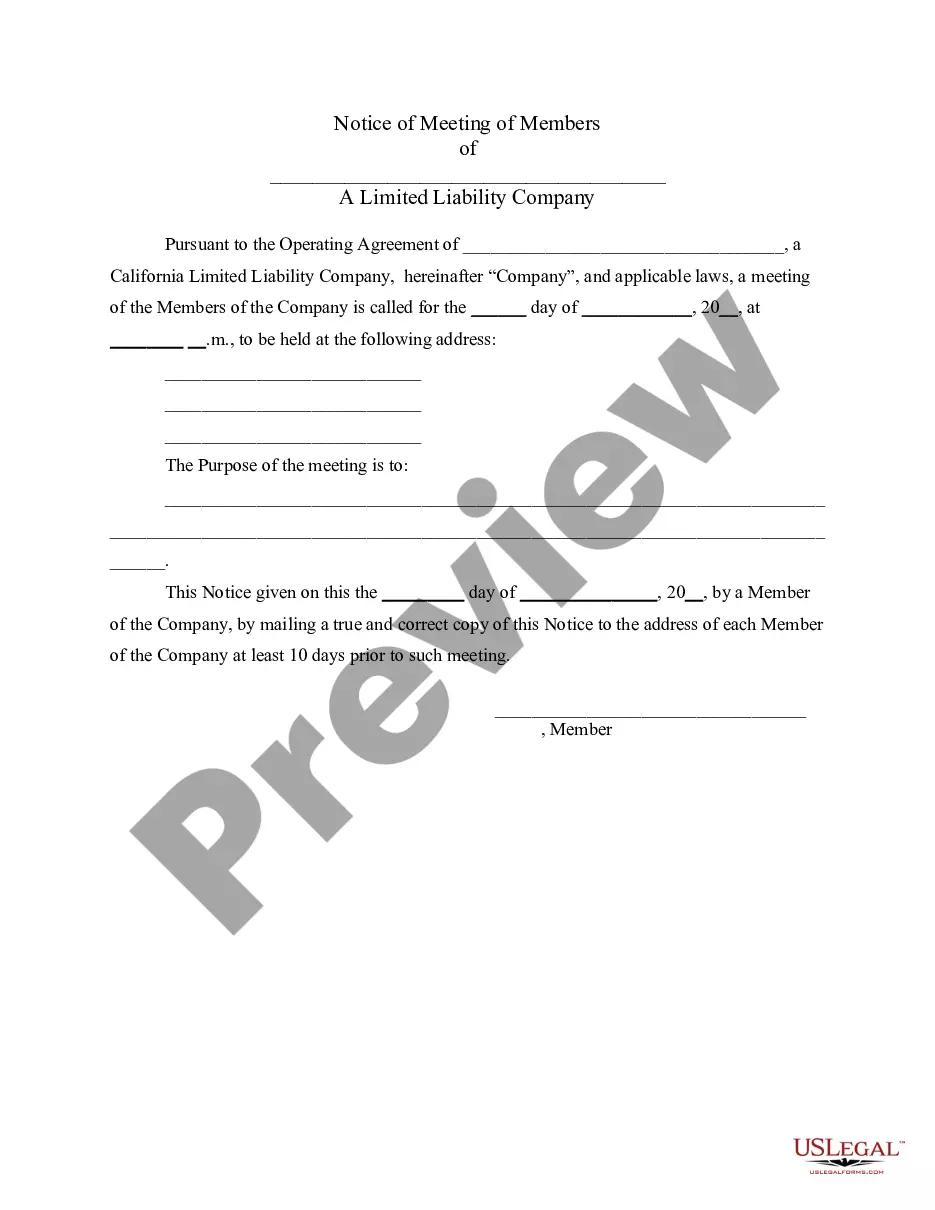

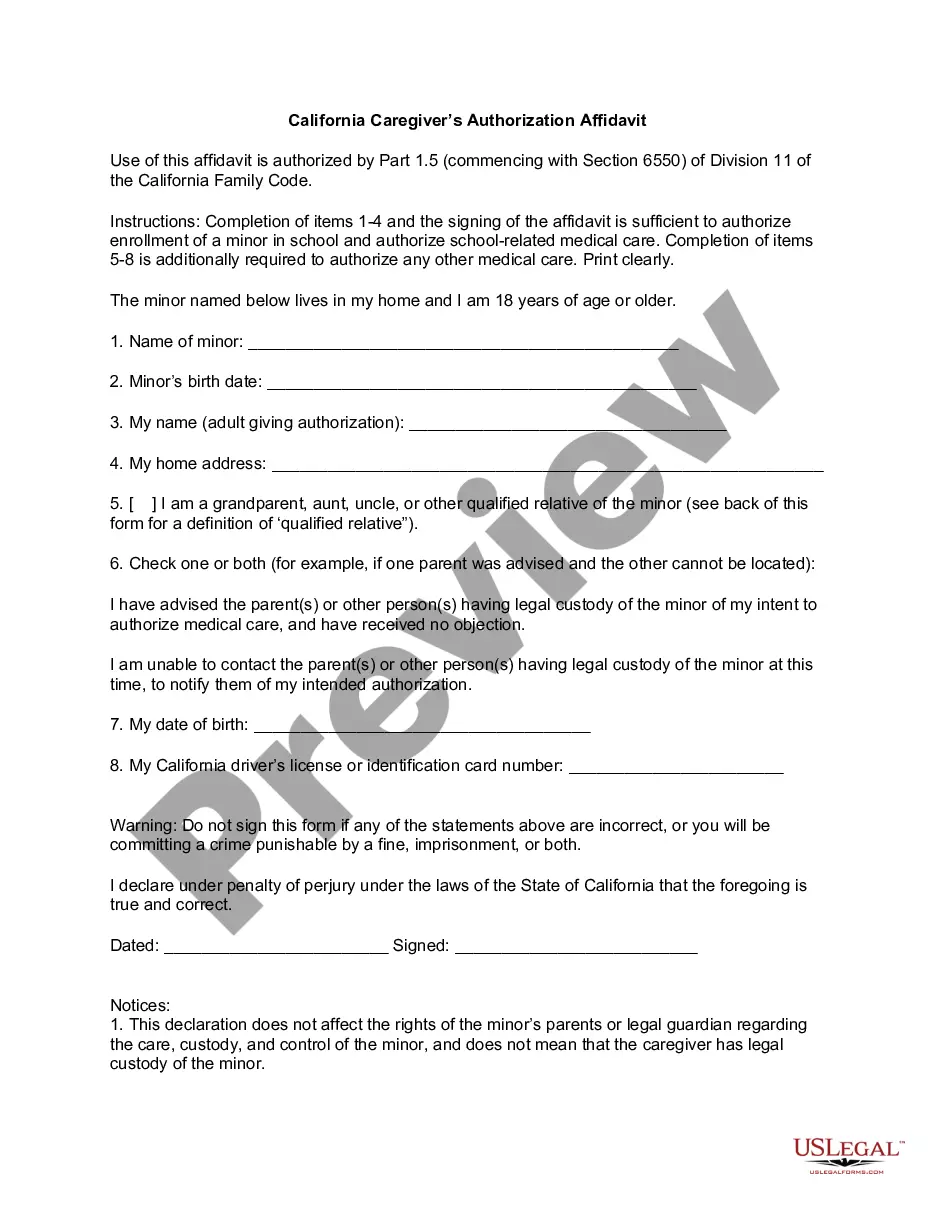

Hayward California Limited Liability Company (LLC) Operating Agreement is a crucial legal document that outlines the internal operations, management structure, and responsibilities of an LLC based in Hayward, California. This agreement is vital for organizing and formalizing the relationships among the LLC's members, and it is typically required by state law. Depending on the specific needs and nature of the LLC, there might be different types or variations of the operating agreement available. However, the most common ones include: 1. Single-Member LLC Operating Agreement: This type of agreement is applicable when the LLC is owned and operated by a single individual or entity. It outlines the member's rights, roles, and responsibilities, as well as the guidelines for managing the LLC's affairs. 2. Multi-Member LLC Operating Agreement: When an LLC is owned and operated by multiple members, this type of agreement is essential. It defines the rights, obligations, and contributions of each member, along with details regarding profit sharing, decision-making processes, and the transfer of membership interests. 3. Series LLC Operating Agreement: A Series LLC is a unique entity that allows for the creation of separate "series" or divisions within the LLC, each with its own assets, liabilities, and members. The operating agreement for a Series LLC must specify the establishment and management of each series, including its separate financial records, ownership structure, and limited liability protection. 4. Professional LLC Operating Agreement: If the Hayward LLC provides professional services, such as legal, medical, or accounting services, a professional LLC operating agreement might be necessary. This agreement includes specific provisions that comply with the state's regulations governing licensed professionals' ownership and management of an LLC. Within the Hayward California Limited Liability Company LLC Operating Agreement, several essential elements should be addressed. These include but are not limited to: a. LLC Purpose: Clearly defining the LLC's primary business purpose and activities. b. Capital Contributions: Outlining each member's initial contributions to the LLC and the process for additional capital contributions if required. c. Profit and Loss Allocation: Detailing how the LLC's profits and losses will be distributed among members and the methods for calculating and distributing them. d. Management Structure: Specifying whether the LLC will be member-managed (members themselves) or manager-managed (appointing individuals to handle day-to-day operations). e. Voting Rights: Defining voting rights and decision-making processes, including the number of votes required for various matters. f. Transfer of Membership Interests: Establishing the procedures and restrictions for the transfer of ownership interests between members or to third parties. g. Dissolution: Addressing circumstances that would trigger the dissolution of the LLC and the subsequent distribution of assets among members. It is crucial for any Hayward California Limited Liability Company to consult with a legal professional or attorney experienced in business law to draft or review the LLC Operating Agreement. This ensures compliance with California state laws and helps protect the members' and the company's interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hayward California Acuerdo Operativo de Sociedad de Responsabilidad Limitada LLC - California Limited Liability Company LLC Operating Agreement

Description

How to fill out Hayward California Acuerdo Operativo De Sociedad De Responsabilidad Limitada LLC?

We always want to minimize or prevent legal damage when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for attorney services that, as a rule, are extremely expensive. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

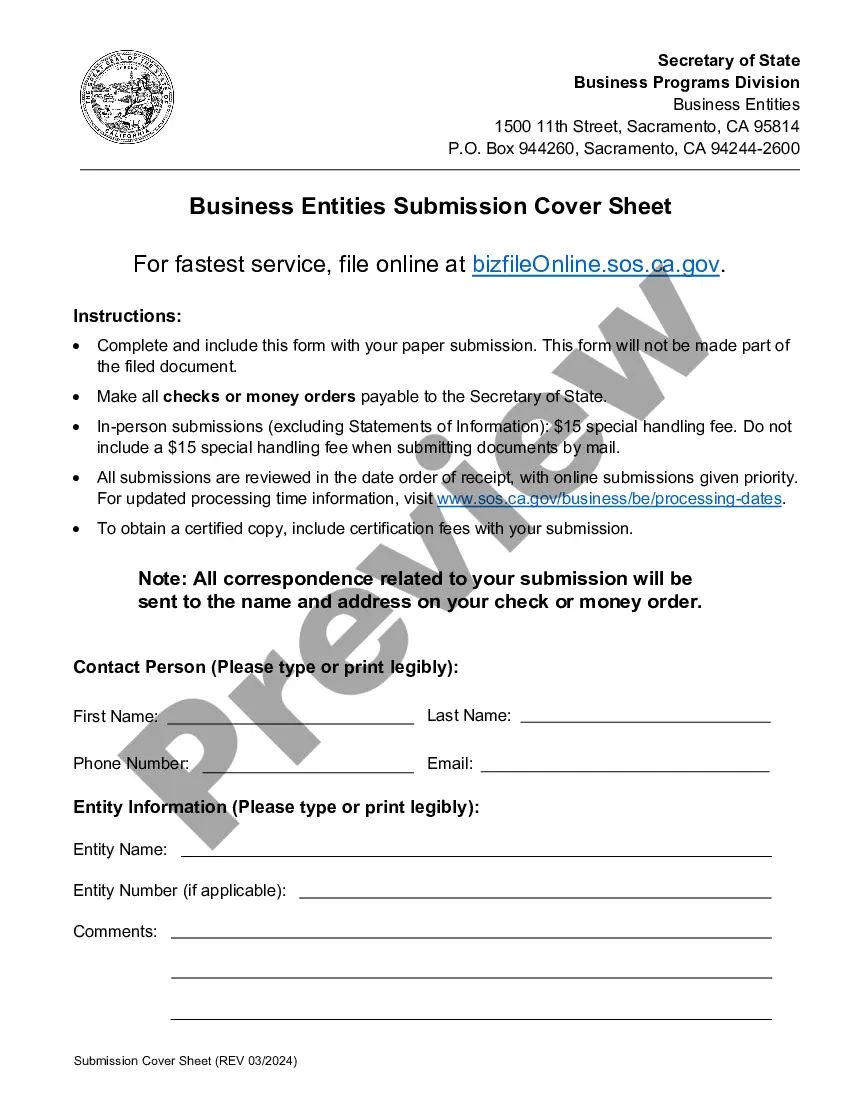

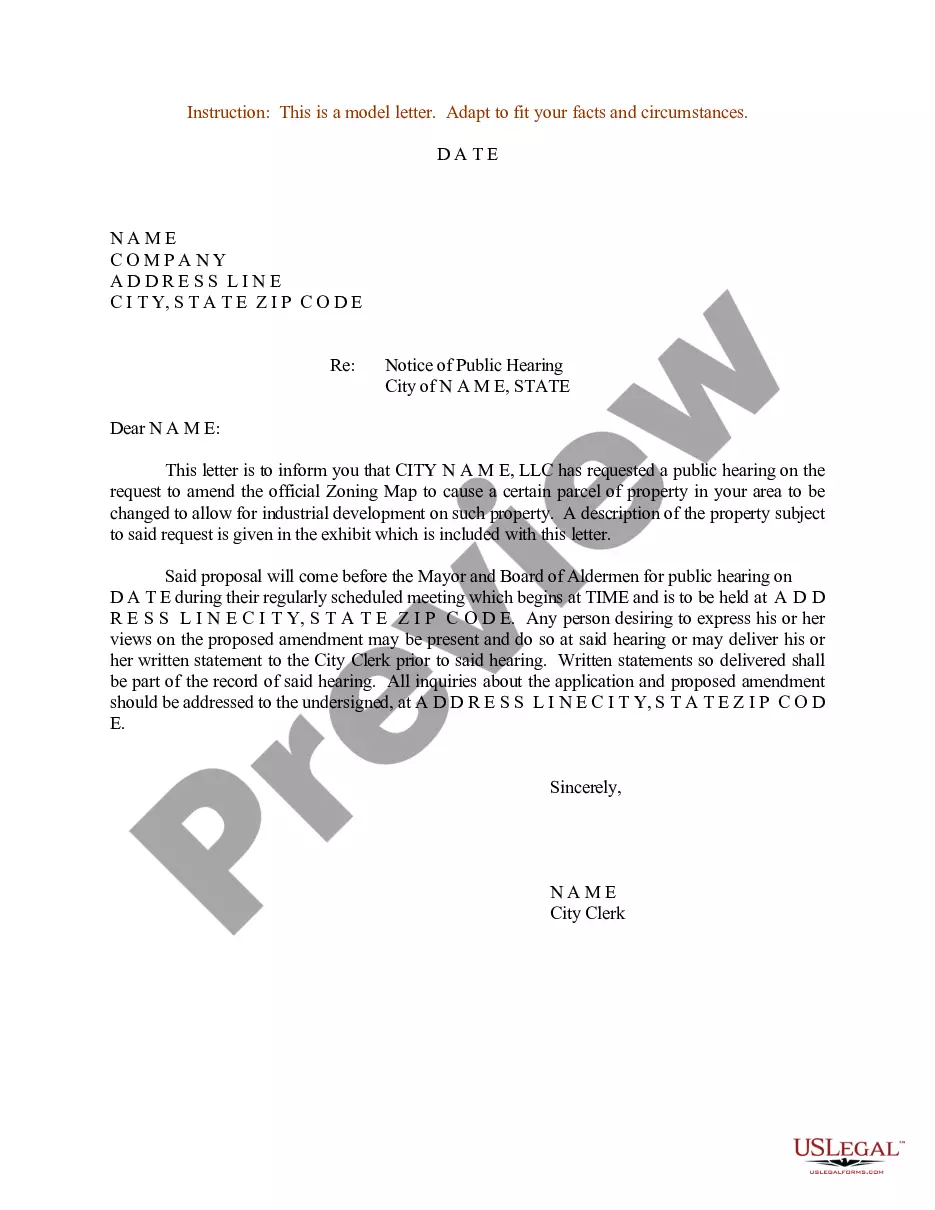

US Legal Forms is a web-based library of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to a lawyer. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Hayward California Limited Liability Company LLC Operating Agreement or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Hayward California Limited Liability Company LLC Operating Agreement adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Hayward California Limited Liability Company LLC Operating Agreement is proper for you, you can pick the subscription plan and make a payment.

- Then you can download the document in any suitable format.

For more than 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!