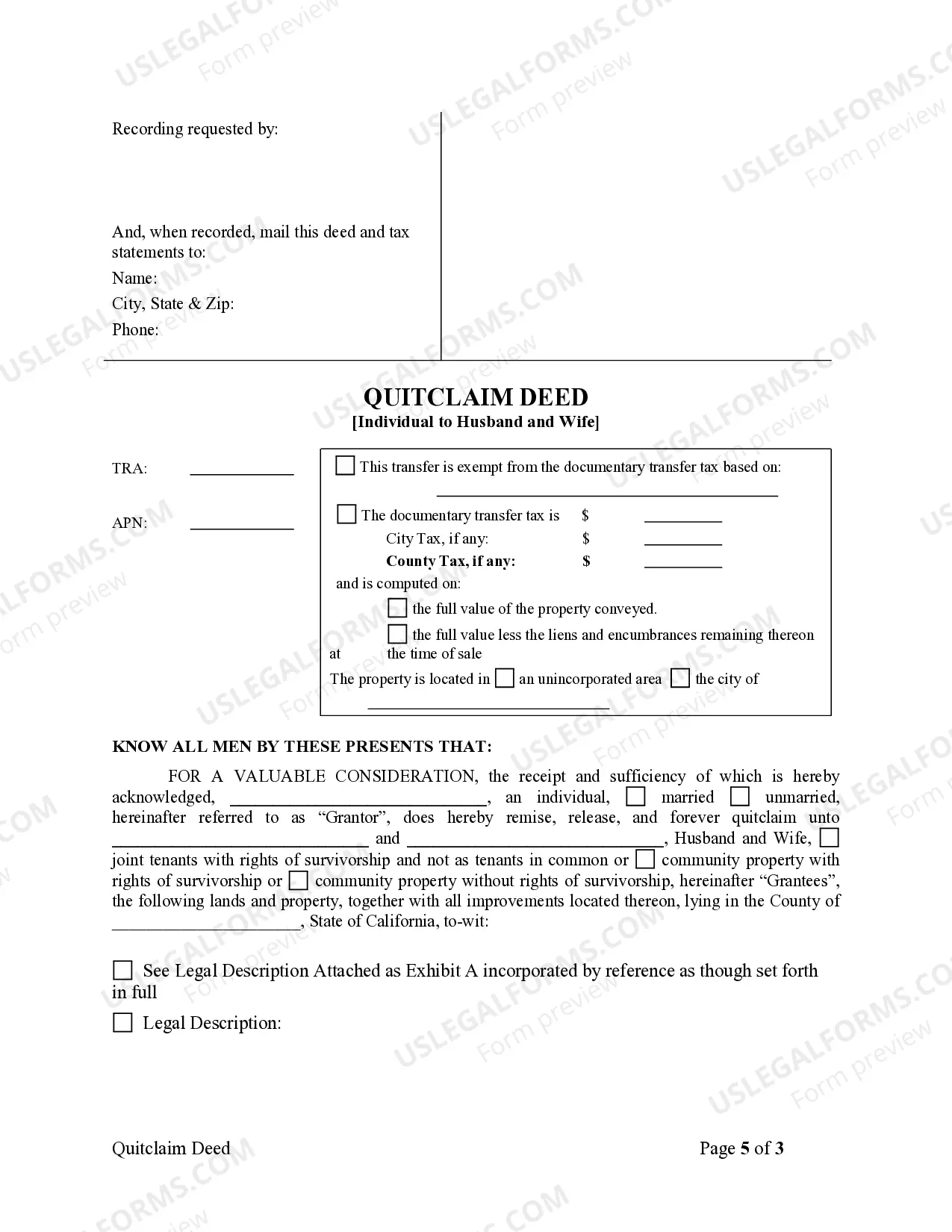

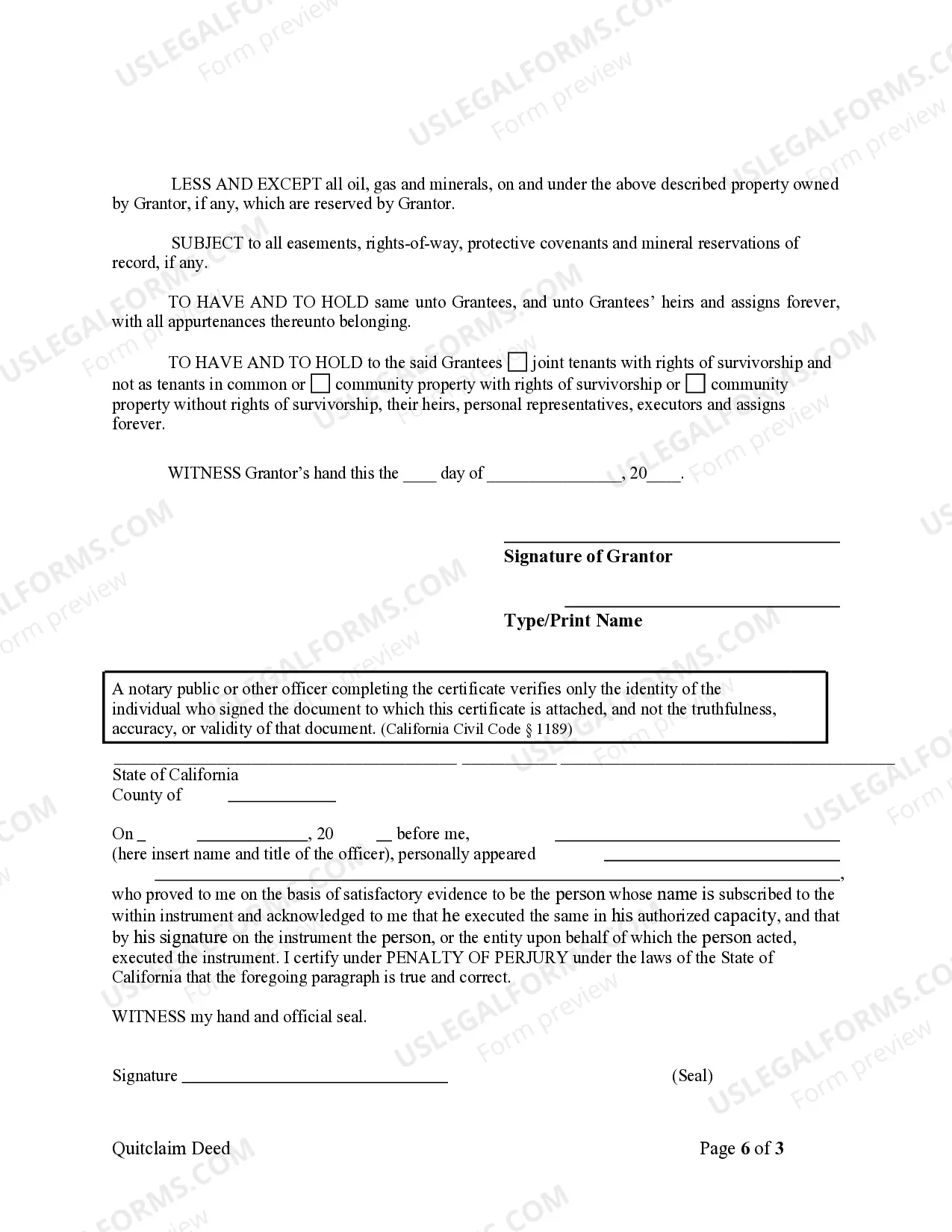

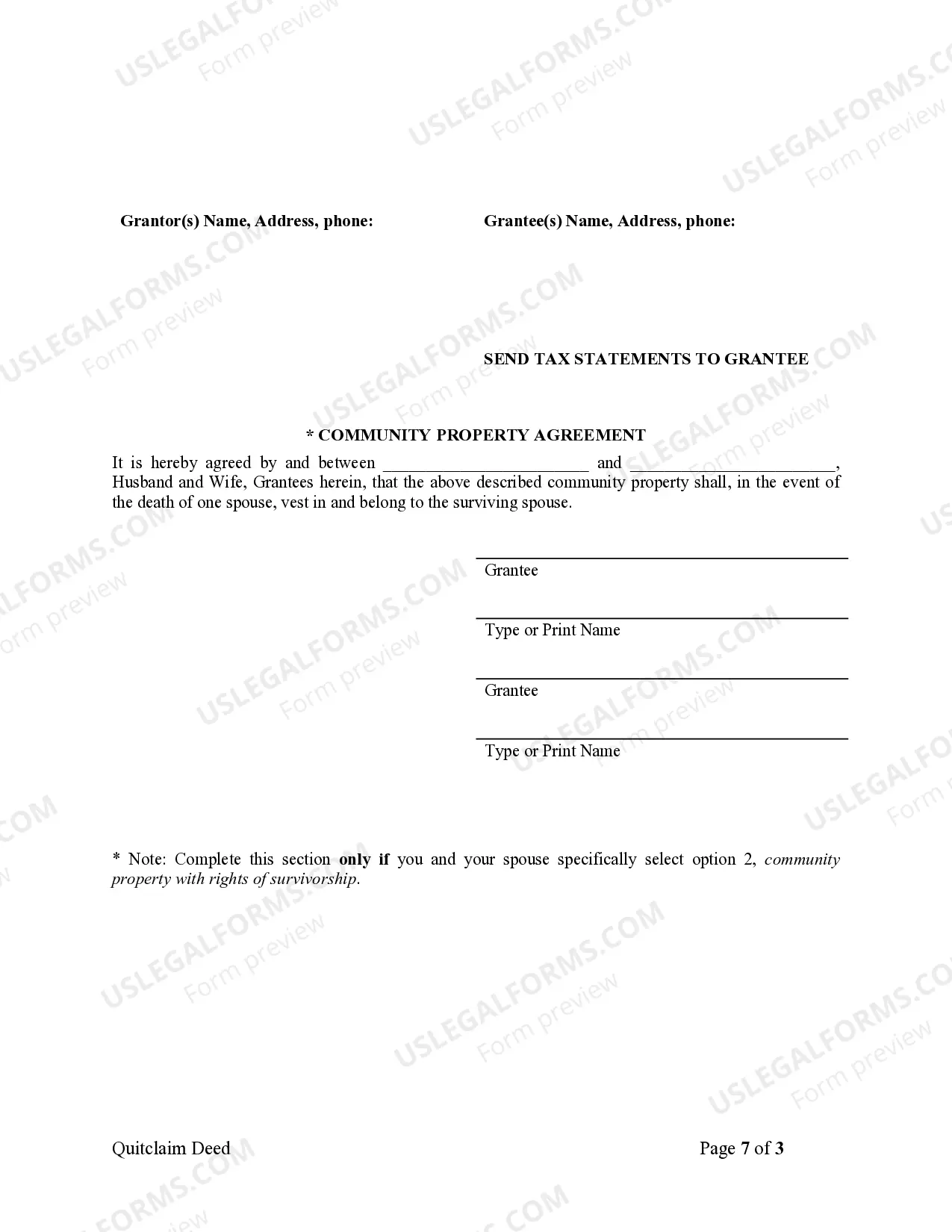

This Quitclaim Deed from Individual to Husband and Wife form is a Quitclaim Deed where the Grantor is an individual and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees, less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

A Rialto California Quitclaim Deed from an Individual to Husband and Wife is a legal document used to transfer ownership of real estate property from an individual (granter) to a married couple (grantees) in the city of Rialto, California. This type of deed ensures that the granter is relinquishing all rights and claims to the property, while the grantees become the sole owners. A Quitclaim Deed is commonly used when the granter wants to transfer their interest in the property without making any warranties or guarantees about the property's title. It is important to note that a Quitclaim Deed does not offer any form of title insurance or provide any guarantee against future claims. Examples of different types of Rialto California Quitclaim Deed from Individual to Husband and Wife: 1. Rialto California Quitclaim Deed with Right of Survivorship: This type of deed includes the provision of "right of survivorship," which means that if one spouse passes away, the surviving spouse automatically becomes the sole owner of the property. 2. Rialto California Quitclaim Deed with Tenancy in Common: In this case, the property ownership is divided equally between the husband and wife, and if one spouse passes away, their share will pass to their heirs or beneficiaries mentioned in their will. 3. Rialto California Quitclaim Deed with Community Property Rights: This type of deed recognizes the property as community property, which means that both spouses have an equal interest in the property. In the event of one spouse's death, their share will automatically pass to the surviving spouse. When executing a Rialto California Quitclaim Deed from an Individual to Husband and Wife, it is crucial to consult with a qualified real estate attorney or professional to ensure all legal requirements are met. Additionally, it is recommended to conduct a thorough title search and obtain title insurance to protect against any potential issues or claims related to the property's title.A Rialto California Quitclaim Deed from an Individual to Husband and Wife is a legal document used to transfer ownership of real estate property from an individual (granter) to a married couple (grantees) in the city of Rialto, California. This type of deed ensures that the granter is relinquishing all rights and claims to the property, while the grantees become the sole owners. A Quitclaim Deed is commonly used when the granter wants to transfer their interest in the property without making any warranties or guarantees about the property's title. It is important to note that a Quitclaim Deed does not offer any form of title insurance or provide any guarantee against future claims. Examples of different types of Rialto California Quitclaim Deed from Individual to Husband and Wife: 1. Rialto California Quitclaim Deed with Right of Survivorship: This type of deed includes the provision of "right of survivorship," which means that if one spouse passes away, the surviving spouse automatically becomes the sole owner of the property. 2. Rialto California Quitclaim Deed with Tenancy in Common: In this case, the property ownership is divided equally between the husband and wife, and if one spouse passes away, their share will pass to their heirs or beneficiaries mentioned in their will. 3. Rialto California Quitclaim Deed with Community Property Rights: This type of deed recognizes the property as community property, which means that both spouses have an equal interest in the property. In the event of one spouse's death, their share will automatically pass to the surviving spouse. When executing a Rialto California Quitclaim Deed from an Individual to Husband and Wife, it is crucial to consult with a qualified real estate attorney or professional to ensure all legal requirements are met. Additionally, it is recommended to conduct a thorough title search and obtain title insurance to protect against any potential issues or claims related to the property's title.