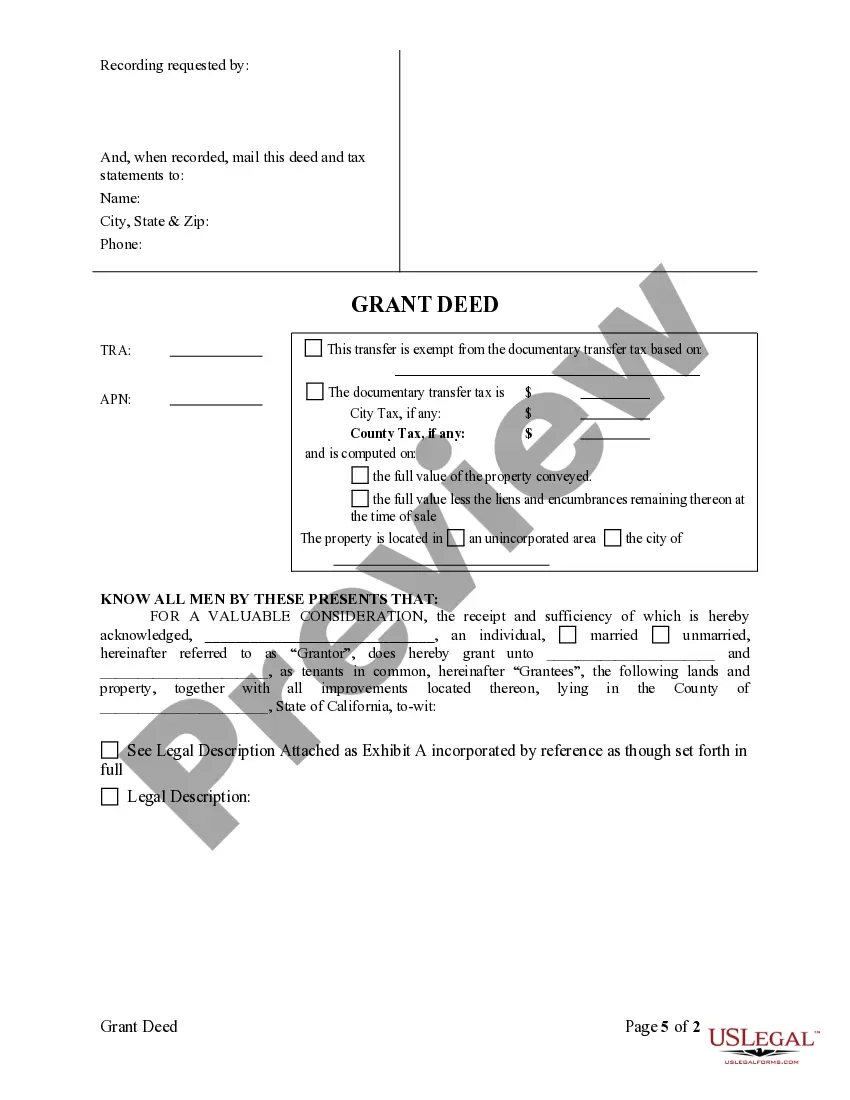

This form is a Warranty Deed where the grantors is an individual and the grantees are two individuals. Grantor conveys and warrants the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

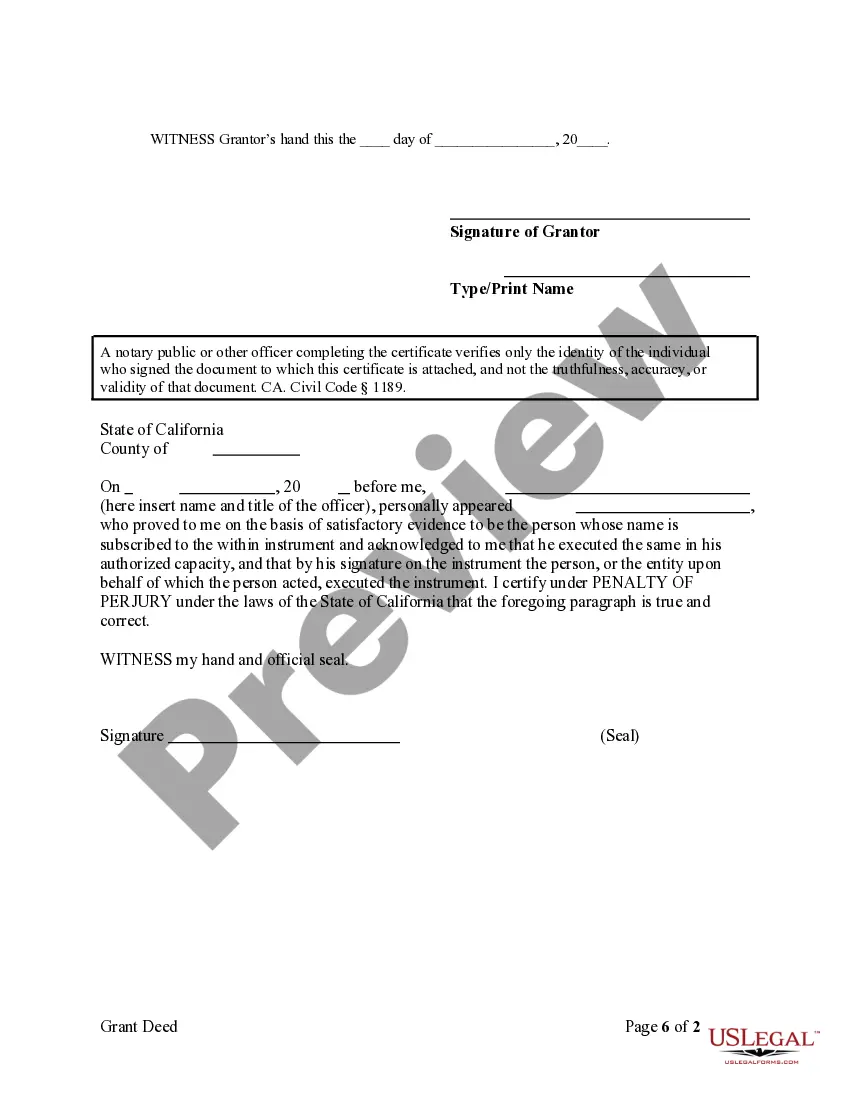

A Murrieta California Grant Deed from an Individual to Two Individuals as Tenants in Common is a legal document that facilitates the transfer of real estate ownership from one individual to two other individuals, who will then hold the property as tenants in common. This type of deed is commonly used when two or more individuals want to jointly own a property, allowing each of them to have a specific share of the ownership. In this grant deed, the individual who currently owns the property, known as the granter, is transferring their interest in the property to the two individuals, known as the grantees. The grantees will then hold the property together, as tenants in common, with each individual having a specified percentage of ownership. Tenants in common ownership means that each individual has a distinct, undivided ownership interest in the property. The percentage share of ownership can vary and is typically determined by the individuals involved. This type of ownership also allows each tenant in common to freely transfer or sell their share of the property without the consent of the other co-owners. It is important to understand that there may be different variations of Murrieta California Grant Deeds from an Individual to Two Individuals as Tenants in Common, depending on the specific circumstances of the transaction. Some potential variations may include: 1. Murrieta California Grant Deed from Married Individual to Two Individuals as Tenants in Common: This type of deed would be used when the granter is a married individual who wishes to transfer the property to two other individuals as tenants in common. In this case, additional considerations, such as spousal consent and community property laws, may come into play. 2. Murrieta California Grant Deed with Specified Ownership Percentage: This variation of the grant deed would include a specific allocation of ownership percentages among the tenants in common. For example, one individual may have a 60% ownership interest while the other has a 40% interest. This ensures clarity and transparency in terms of the share of ownership each individual holds. 3. Murrieta California Grant Deed with Stipulations and Restrictions: In certain cases, the granter may include stipulations or restrictions on the use or transfer of the property. These might include limitations on building structures, restrictions on property sales, or guidelines for shared expenses. Such conditions should be clearly stated in the deed to avoid disputes or misunderstandings in the future. It is advisable for all parties involved in a Murrieta California Grant Deed from an Individual to Two Individuals as Tenants in Common to consult with a qualified attorney or real estate professional to ensure the preparation and execution of the deed comply with all applicable laws and regulations. Legal advice can help protect the interests of all parties involved and facilitate a smooth transfer of ownership.A Murrieta California Grant Deed from an Individual to Two Individuals as Tenants in Common is a legal document that facilitates the transfer of real estate ownership from one individual to two other individuals, who will then hold the property as tenants in common. This type of deed is commonly used when two or more individuals want to jointly own a property, allowing each of them to have a specific share of the ownership. In this grant deed, the individual who currently owns the property, known as the granter, is transferring their interest in the property to the two individuals, known as the grantees. The grantees will then hold the property together, as tenants in common, with each individual having a specified percentage of ownership. Tenants in common ownership means that each individual has a distinct, undivided ownership interest in the property. The percentage share of ownership can vary and is typically determined by the individuals involved. This type of ownership also allows each tenant in common to freely transfer or sell their share of the property without the consent of the other co-owners. It is important to understand that there may be different variations of Murrieta California Grant Deeds from an Individual to Two Individuals as Tenants in Common, depending on the specific circumstances of the transaction. Some potential variations may include: 1. Murrieta California Grant Deed from Married Individual to Two Individuals as Tenants in Common: This type of deed would be used when the granter is a married individual who wishes to transfer the property to two other individuals as tenants in common. In this case, additional considerations, such as spousal consent and community property laws, may come into play. 2. Murrieta California Grant Deed with Specified Ownership Percentage: This variation of the grant deed would include a specific allocation of ownership percentages among the tenants in common. For example, one individual may have a 60% ownership interest while the other has a 40% interest. This ensures clarity and transparency in terms of the share of ownership each individual holds. 3. Murrieta California Grant Deed with Stipulations and Restrictions: In certain cases, the granter may include stipulations or restrictions on the use or transfer of the property. These might include limitations on building structures, restrictions on property sales, or guidelines for shared expenses. Such conditions should be clearly stated in the deed to avoid disputes or misunderstandings in the future. It is advisable for all parties involved in a Murrieta California Grant Deed from an Individual to Two Individuals as Tenants in Common to consult with a qualified attorney or real estate professional to ensure the preparation and execution of the deed comply with all applicable laws and regulations. Legal advice can help protect the interests of all parties involved and facilitate a smooth transfer of ownership.