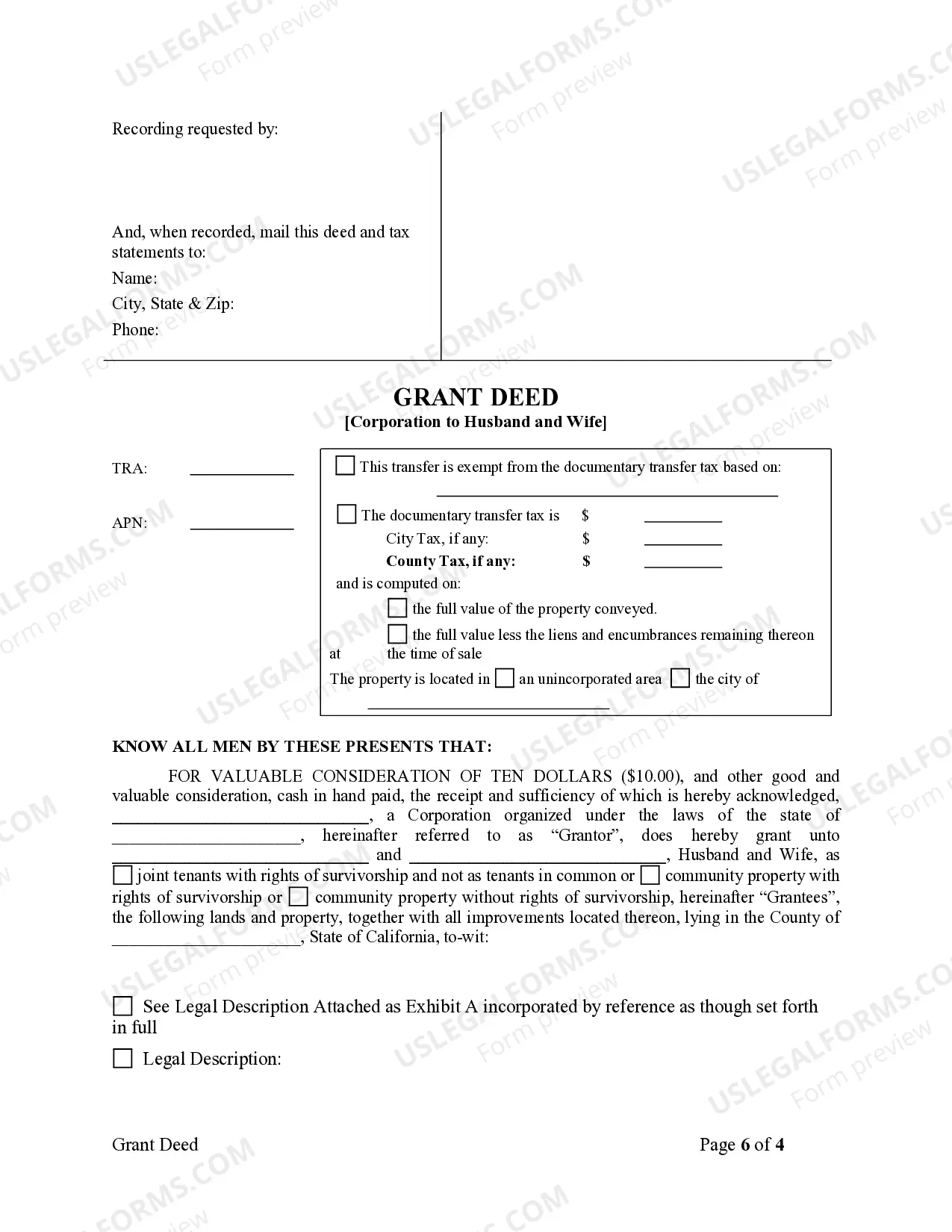

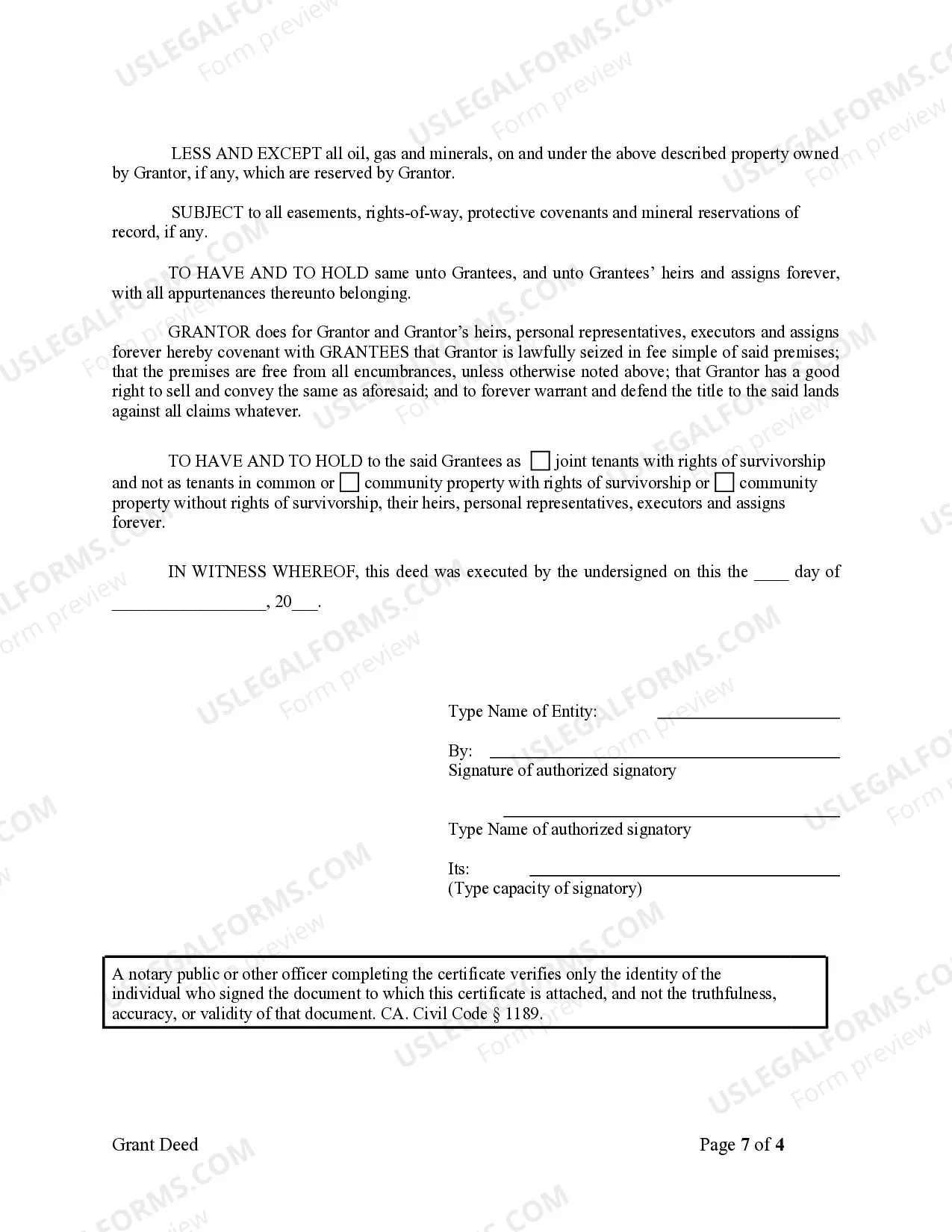

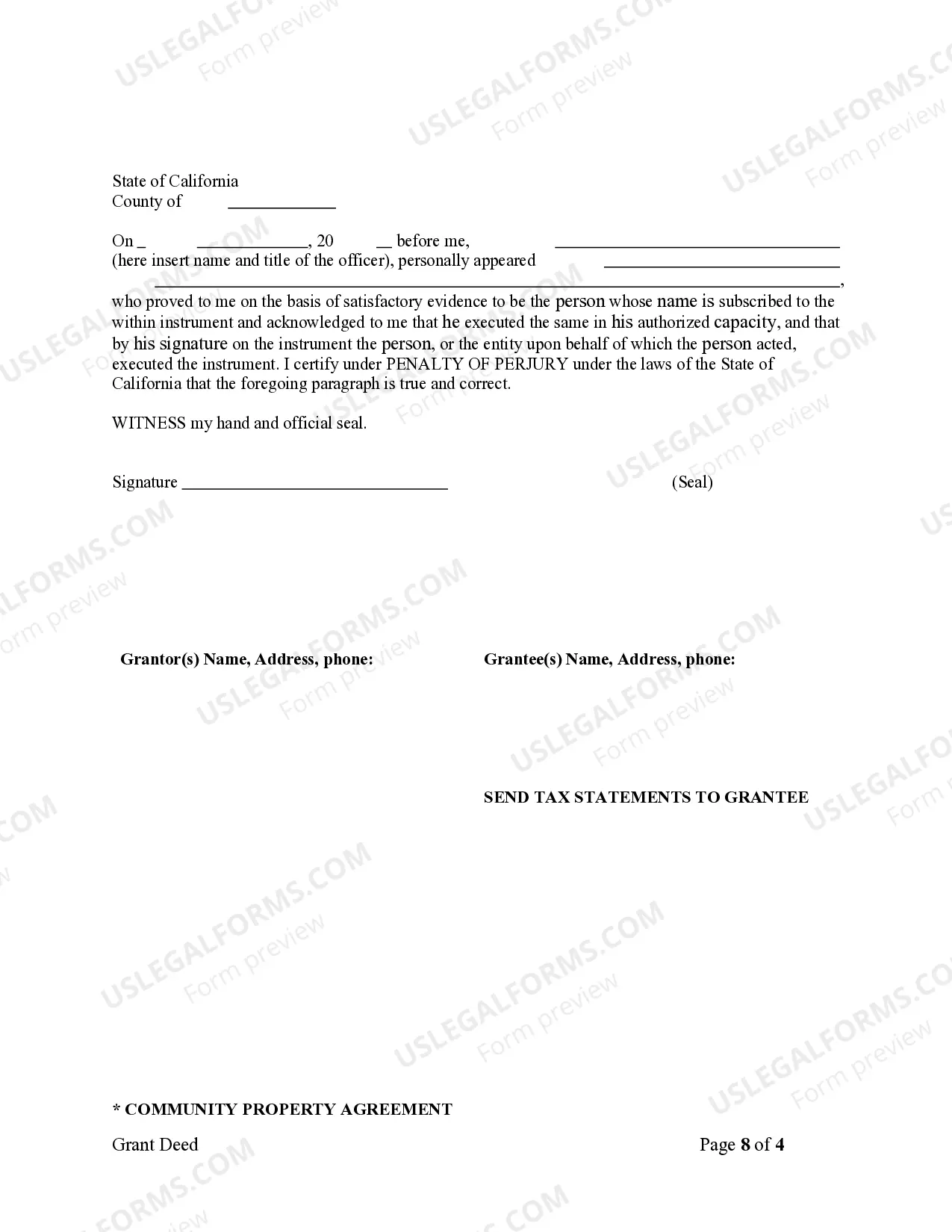

This Warranty Deed from Corporation to Husband and Wife form is a Warranty Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and warrants the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

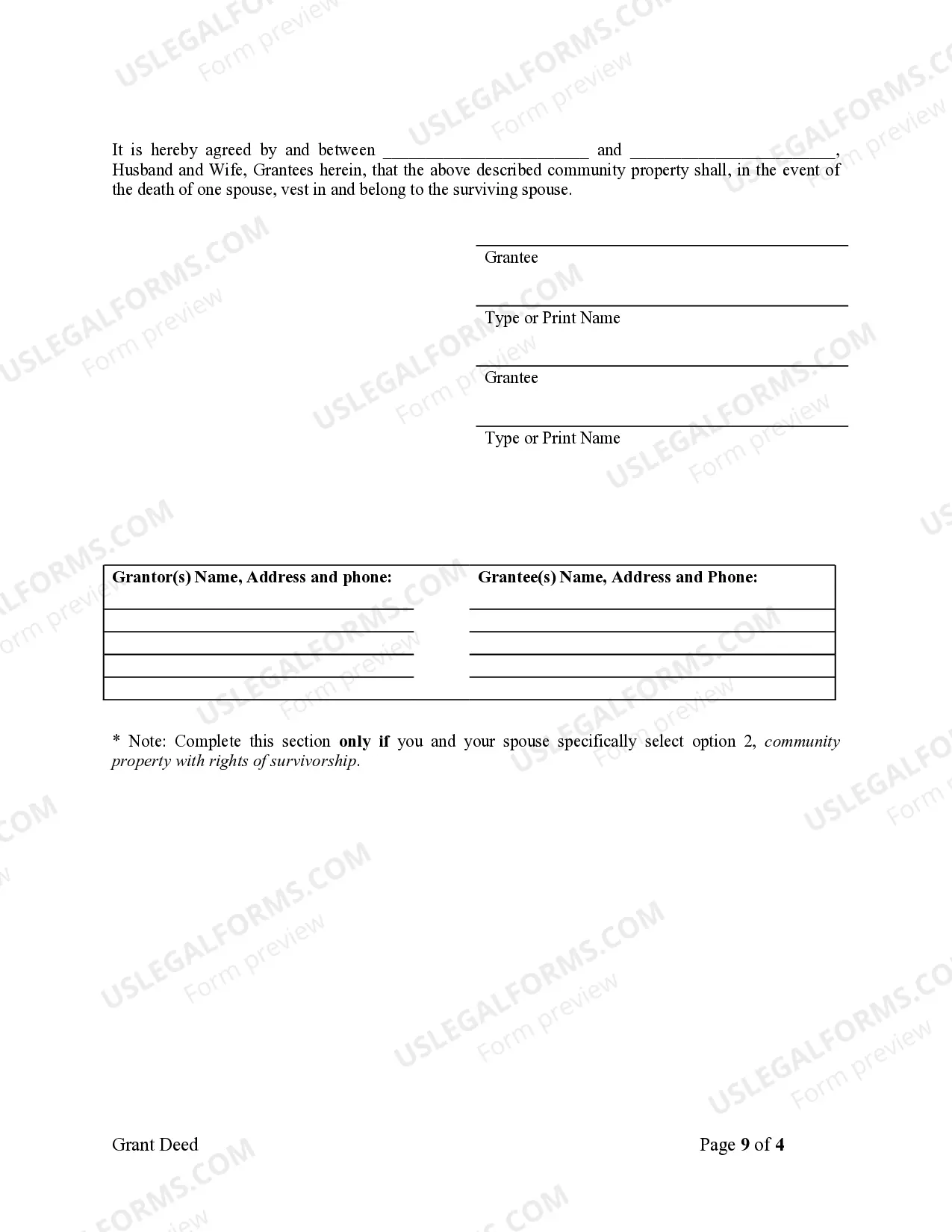

A Thousand Oaks California Grant Deed is a legal document used to transfer ownership of real estate from a corporation to a husband and wife. This type of deed is commonly used when the property is jointly owned by a married couple and the transfer of ownership needs to be executed by a corporation. The grant deed ensures that the property is transferred with a clear title and establishes the husband and wife as the new owners. There are several variations of Thousand Oaks California Grant Deed from Corporation to Husband and Wife, including: 1. General Grant Deed: This type of grant deed transfers ownership of the property without any warranties or guarantees. It simply conveys the property from the corporation to the husband and wife. 2. Special Warranty Grant Deed: In this type of grant deed, the corporation assures the husband and wife that it holds clear title to the property, but only warrants against any claims that may have arisen during its ownership. This means that the corporation will not be held responsible for any claims or issues that occurred prior to its ownership. 3. Quitclaim Grant Deed: This grant deed is often used when the corporation does not want to make any warranties or guarantees regarding the ownership of the property. It simply transfers whatever interest the corporation has in the property to the husband and wife, without providing any assurance of clear title. When executing a Thousand Oaks California Grant Deed from Corporation to Husband and Wife, it is crucial to ensure that the document is prepared correctly, following all legal requirements and regulations. It is recommended to consult with a qualified real estate attorney or a title company to help with the drafting and recording process. This will ensure that the transfer of ownership is legally valid and protects the interests of the husband and wife as the new property owners. Note: While this description focuses on Thousand Oaks, California, grant deeds from a corporation to a husband and wife can be applicable in other cities and states as well, with slight variations in local laws and regulations.A Thousand Oaks California Grant Deed is a legal document used to transfer ownership of real estate from a corporation to a husband and wife. This type of deed is commonly used when the property is jointly owned by a married couple and the transfer of ownership needs to be executed by a corporation. The grant deed ensures that the property is transferred with a clear title and establishes the husband and wife as the new owners. There are several variations of Thousand Oaks California Grant Deed from Corporation to Husband and Wife, including: 1. General Grant Deed: This type of grant deed transfers ownership of the property without any warranties or guarantees. It simply conveys the property from the corporation to the husband and wife. 2. Special Warranty Grant Deed: In this type of grant deed, the corporation assures the husband and wife that it holds clear title to the property, but only warrants against any claims that may have arisen during its ownership. This means that the corporation will not be held responsible for any claims or issues that occurred prior to its ownership. 3. Quitclaim Grant Deed: This grant deed is often used when the corporation does not want to make any warranties or guarantees regarding the ownership of the property. It simply transfers whatever interest the corporation has in the property to the husband and wife, without providing any assurance of clear title. When executing a Thousand Oaks California Grant Deed from Corporation to Husband and Wife, it is crucial to ensure that the document is prepared correctly, following all legal requirements and regulations. It is recommended to consult with a qualified real estate attorney or a title company to help with the drafting and recording process. This will ensure that the transfer of ownership is legally valid and protects the interests of the husband and wife as the new property owners. Note: While this description focuses on Thousand Oaks, California, grant deeds from a corporation to a husband and wife can be applicable in other cities and states as well, with slight variations in local laws and regulations.