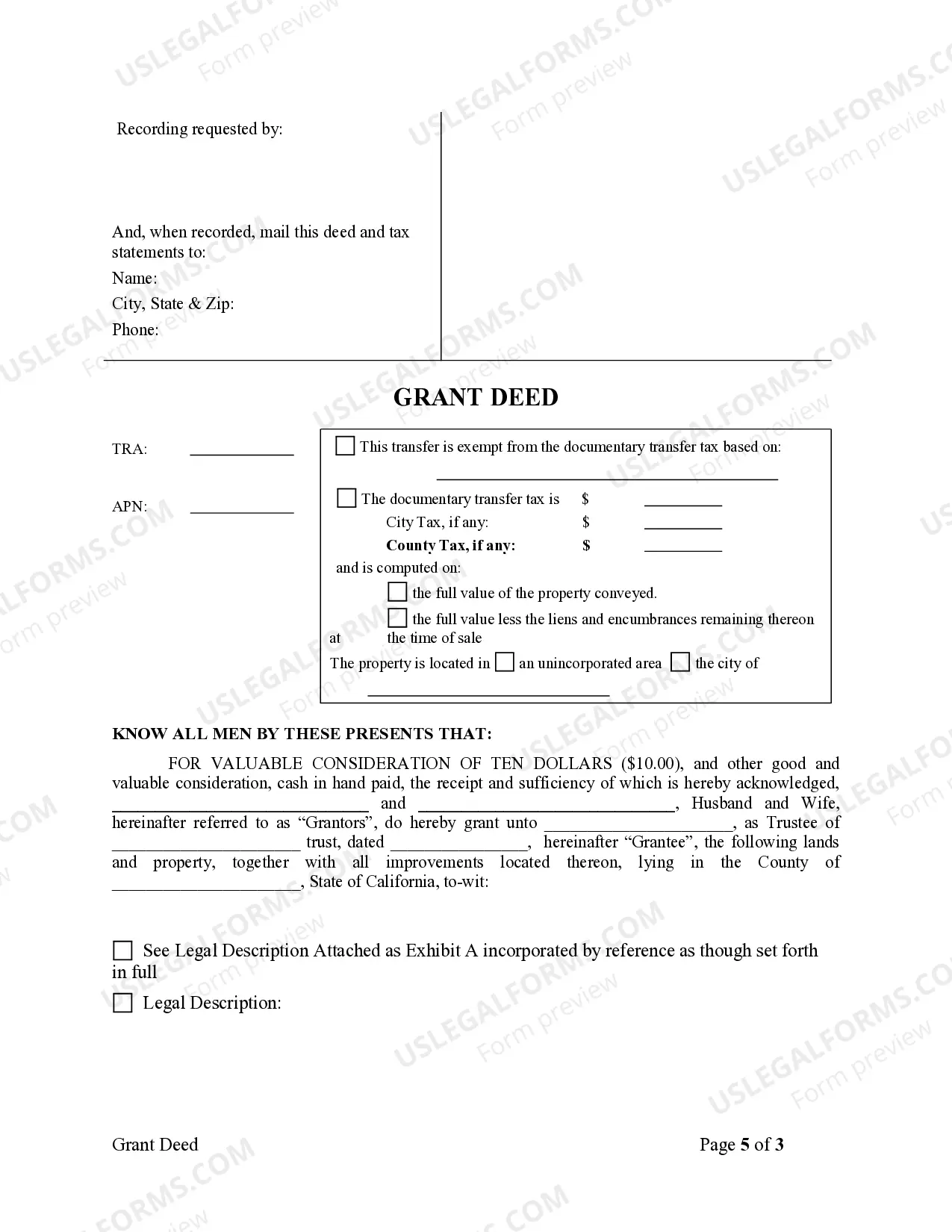

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Title: Alameda, California Grant Deed from Husband and Wife to Trust — A Comprehensive Overview Introduction: The Alameda, California Grant Deed from Husband and Wife to Trust is a legal document commonly used when transferring the ownership of real property from a married couple to a trust within the jurisdiction of Alameda, California. This comprehensive guide aims to provide a detailed description of this process, its significance, and the different types of grant deeds that can be used for this purpose. Keywords: — Alameda, California Grant Dee— - Husband and Wife to Trust — Properttransferfe— - Real estate ownership — Legal documen— - Real property - Marital ownership — Trusformationio— - Trustee Types of Alameda, California Grant Deed from Husband and Wife to Trust: 1. Revocable Living Trust Grant Deed: This type of grant deed is used when a married couple, as granters, want to transfer their ownership rights in real estate to a revocable living trust, of which they are also the trustees during their lifetime. 2. Irrevocable Living Trust Grant Deed: Unlike the revocable living trust grant deed, the irrevocable living trust grant deed transfers ownership of real estate to an irrevocable living trust. Once executed, the granters' rights are relinquished and cannot be altered or revoked. 3. Testamentary Trust Grant Deed: A testamentary trust grant deed is used for transferring property to a trust established by a will, which becomes effective upon the death of the granters. This type of grant deed is typically utilized for estate planning purposes to ensure a smooth transfer of assets and minimize probate. 4. Qualified Personnel Residence Trust Grant Deed: Specifically designed for a primary residence, a qualified personnel residence trust grant deed enables the granters to transfer ownership of their home to a trust, while retaining the right to live in the property for a fixed period. This type of trust holds estate tax benefits. 5. Special Needs Trust Grant Deed: A special needs trust grant deed allows for the transfer of real estate to a trust specifically created for the benefit of an individual with special needs. This type of trust ensures that the individual can maintain government assistance while accessing additional resources. Significance and Process: The Alameda, California Grant Deed from Husband and Wife to Trust holds several advantages, including asset protection, privacy, and controlled distribution. By transferring real property to a trust, the granters can shield their assets from potential creditors, streamline the distribution of their estate, and maintain certain tax benefits. To execute this grant deed, the granters, as husband and wife, must prepare the necessary legal documents, including the deed itself, a legal description of the property, and any applicable tax forms. The deed must be executed following the proper legal protocol, such as notarization and recording with the Alameda County Recorder's Office. Conclusion: The Alameda, California Grant Deed from Husband and Wife to Trust is an essential legal process that allows married property owners to transfer their real estate holdings to a trust, providing numerous benefits such as asset protection, centralized management, and smoother estate planning. Understanding the different types of grant deeds applicable in Alameda, California enables individuals to choose the most appropriate trust type based on their specific needs and circumstances.Title: Alameda, California Grant Deed from Husband and Wife to Trust — A Comprehensive Overview Introduction: The Alameda, California Grant Deed from Husband and Wife to Trust is a legal document commonly used when transferring the ownership of real property from a married couple to a trust within the jurisdiction of Alameda, California. This comprehensive guide aims to provide a detailed description of this process, its significance, and the different types of grant deeds that can be used for this purpose. Keywords: — Alameda, California Grant Dee— - Husband and Wife to Trust — Properttransferfe— - Real estate ownership — Legal documen— - Real property - Marital ownership — Trusformationio— - Trustee Types of Alameda, California Grant Deed from Husband and Wife to Trust: 1. Revocable Living Trust Grant Deed: This type of grant deed is used when a married couple, as granters, want to transfer their ownership rights in real estate to a revocable living trust, of which they are also the trustees during their lifetime. 2. Irrevocable Living Trust Grant Deed: Unlike the revocable living trust grant deed, the irrevocable living trust grant deed transfers ownership of real estate to an irrevocable living trust. Once executed, the granters' rights are relinquished and cannot be altered or revoked. 3. Testamentary Trust Grant Deed: A testamentary trust grant deed is used for transferring property to a trust established by a will, which becomes effective upon the death of the granters. This type of grant deed is typically utilized for estate planning purposes to ensure a smooth transfer of assets and minimize probate. 4. Qualified Personnel Residence Trust Grant Deed: Specifically designed for a primary residence, a qualified personnel residence trust grant deed enables the granters to transfer ownership of their home to a trust, while retaining the right to live in the property for a fixed period. This type of trust holds estate tax benefits. 5. Special Needs Trust Grant Deed: A special needs trust grant deed allows for the transfer of real estate to a trust specifically created for the benefit of an individual with special needs. This type of trust ensures that the individual can maintain government assistance while accessing additional resources. Significance and Process: The Alameda, California Grant Deed from Husband and Wife to Trust holds several advantages, including asset protection, privacy, and controlled distribution. By transferring real property to a trust, the granters can shield their assets from potential creditors, streamline the distribution of their estate, and maintain certain tax benefits. To execute this grant deed, the granters, as husband and wife, must prepare the necessary legal documents, including the deed itself, a legal description of the property, and any applicable tax forms. The deed must be executed following the proper legal protocol, such as notarization and recording with the Alameda County Recorder's Office. Conclusion: The Alameda, California Grant Deed from Husband and Wife to Trust is an essential legal process that allows married property owners to transfer their real estate holdings to a trust, providing numerous benefits such as asset protection, centralized management, and smoother estate planning. Understanding the different types of grant deeds applicable in Alameda, California enables individuals to choose the most appropriate trust type based on their specific needs and circumstances.