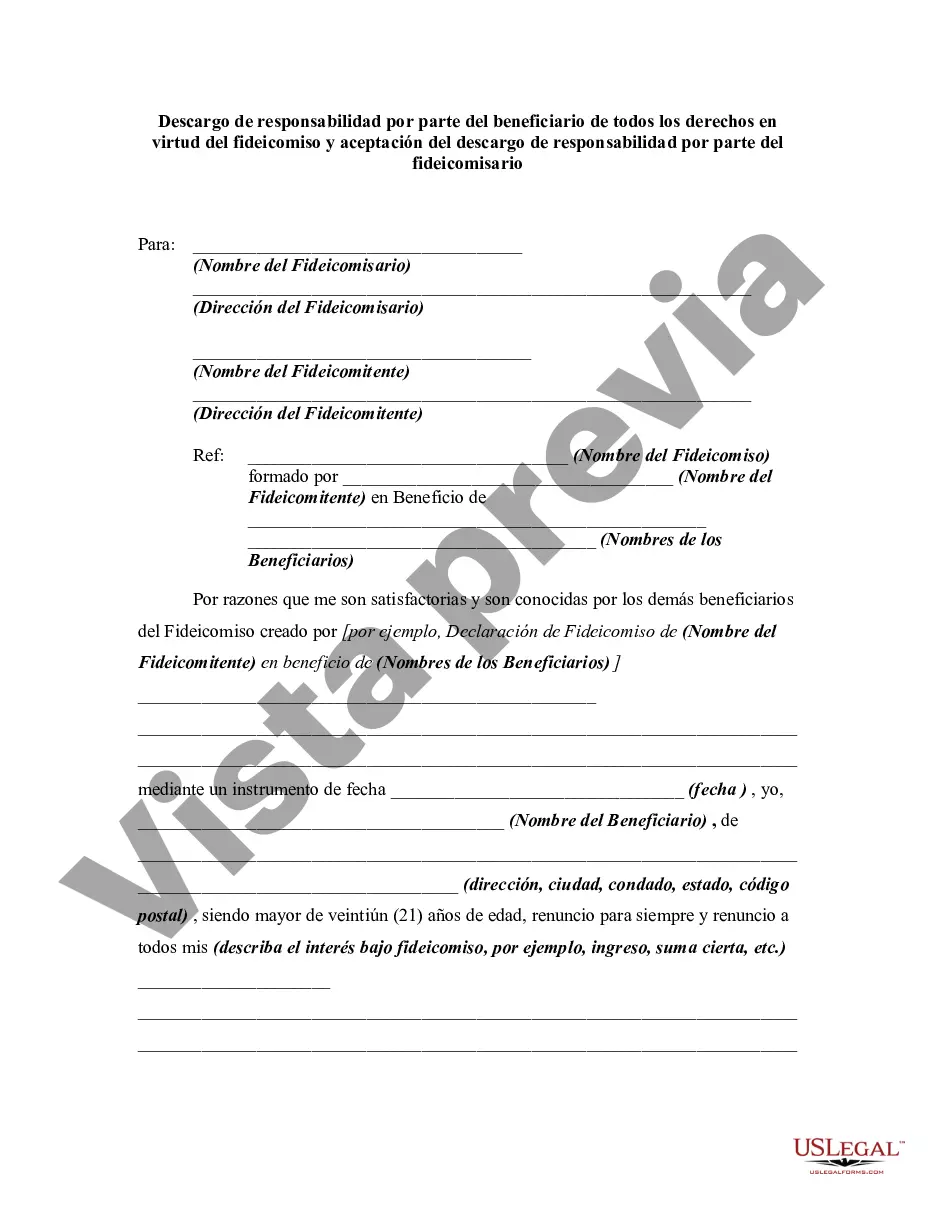

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which he/she refuses to accept an estate which has been conveyed to him/her. In this instrument, the beneficiary of a trust is disclaiming any rights he/she has in the trust.

A Burbank California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal document that outlines the relinquishment of rights and acceptance of responsibilities within a trust arrangement in Burbank, California. This disclaimer is an important part of trust administration and acknowledges a beneficiary's decision to decline any rights, interests, or benefits they may be entitled to as a beneficiary of a trust. Simultaneously, it outlines the trustee's acceptance of this disclaimer and their responsibilities thereafter. In Burbank, California, there are several types of Burbank California Disclaimers by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, each applicable in different scenarios: 1. General Disclaimer: This type of disclaimer is used when a beneficiary completely renounces all rights and interests in a trust. By disclaiming, the beneficiary forfeits any potential inheritance, rights to property, or other benefits attached to the trust. 2. Partial Disclaimer: In certain situations, a beneficiary may not want to fully disclaim their rights under the trust but wish to renounce specific assets or benefits. This partial disclaimer allows the beneficiary to relinquish select portions of the trust while still retaining others. 3. Qualified Disclaimer: If a beneficiary wishes to disclaim their rights under a trust for tax planning purposes, they may use a qualified disclaimer. This type of disclaimer ensures that the renouncement is valid under IRS regulations, allowing for potential tax benefits. Regardless of the type of Burbank California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, it is crucial to carefully consider the implications of such a decision. Seeking legal advice from an experienced trust attorney in Burbank, California, is highly recommended ensuring that this process is carried out correctly and in compliance with state laws. Note: The content generated here is for informational purposes only and should not be considered legal advice. It is always advisable to consult with a qualified attorney for precise guidance regarding Burbank California Disclaimers by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.A Burbank California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal document that outlines the relinquishment of rights and acceptance of responsibilities within a trust arrangement in Burbank, California. This disclaimer is an important part of trust administration and acknowledges a beneficiary's decision to decline any rights, interests, or benefits they may be entitled to as a beneficiary of a trust. Simultaneously, it outlines the trustee's acceptance of this disclaimer and their responsibilities thereafter. In Burbank, California, there are several types of Burbank California Disclaimers by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, each applicable in different scenarios: 1. General Disclaimer: This type of disclaimer is used when a beneficiary completely renounces all rights and interests in a trust. By disclaiming, the beneficiary forfeits any potential inheritance, rights to property, or other benefits attached to the trust. 2. Partial Disclaimer: In certain situations, a beneficiary may not want to fully disclaim their rights under the trust but wish to renounce specific assets or benefits. This partial disclaimer allows the beneficiary to relinquish select portions of the trust while still retaining others. 3. Qualified Disclaimer: If a beneficiary wishes to disclaim their rights under a trust for tax planning purposes, they may use a qualified disclaimer. This type of disclaimer ensures that the renouncement is valid under IRS regulations, allowing for potential tax benefits. Regardless of the type of Burbank California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, it is crucial to carefully consider the implications of such a decision. Seeking legal advice from an experienced trust attorney in Burbank, California, is highly recommended ensuring that this process is carried out correctly and in compliance with state laws. Note: The content generated here is for informational purposes only and should not be considered legal advice. It is always advisable to consult with a qualified attorney for precise guidance regarding Burbank California Disclaimers by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.