A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which he/she refuses to accept an estate which has been conveyed to him/her. In this instrument, the beneficiary of a trust is disclaiming any rights he/she has in the trust.

Escondido, California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee Explained: In Escondido, California, a disclaimer by a beneficiary of all rights under a trust is a legal document that allows a beneficiary to decline any interest or rights bestowed upon them within a trust agreement. This disclaimer effectively relinquishes their claim to any assets, property, income, or benefits specifically designated for them under the trust. The Acceptance of Disclaimer by Trustee is another important aspect of this process, where the trustee acknowledges and accepts the beneficiary's decision to disclaim their rights. This acceptance formalizes the beneficiary's disclaimer, ensuring that it is properly recognized and implemented under the terms of the trust. There are different types of Escondido California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, including: 1. General Disclaimer: This type of disclaimer applies when a beneficiary wants to decline all benefits, rights, and interests associated with the trust. By utilizing a general disclaimer, the beneficiary effectively removes themselves from any involvement with the trust's assets and provisions. 2. Partial Disclaimer: In some cases, a beneficiary may want to disclaim only a portion of their rights or interest under the trust. This can be done through a partial disclaimer, which allows the beneficiary to specify which specific assets or benefits they wish to waive, while still retaining others. 3. Qualified Disclaimer: A qualified disclaimer refers to an action taken by a beneficiary to disclaim their rights in a specific manner recognized by the Internal Revenue Service (IRS). By complying with specific criteria outlined by the IRS, the beneficiary may be able to achieve certain tax benefits or avoid potential tax liabilities associated with the trust assets. 4. Time-Limited Disclaimer: This type of disclaimer allows the beneficiary to disclaim their rights under the trust for a specified period. This can be useful in situations where the beneficiary may want to revisit their decision at a later time or based on certain conditions. It is important to consult with legal professionals and financial advisors to fully understand the implications and requirements of an Escondido California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. Individual circumstances may differ, and it is always recommended seeking specialized advice to ensure compliance with relevant laws and regulations.Escondido, California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee Explained: In Escondido, California, a disclaimer by a beneficiary of all rights under a trust is a legal document that allows a beneficiary to decline any interest or rights bestowed upon them within a trust agreement. This disclaimer effectively relinquishes their claim to any assets, property, income, or benefits specifically designated for them under the trust. The Acceptance of Disclaimer by Trustee is another important aspect of this process, where the trustee acknowledges and accepts the beneficiary's decision to disclaim their rights. This acceptance formalizes the beneficiary's disclaimer, ensuring that it is properly recognized and implemented under the terms of the trust. There are different types of Escondido California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, including: 1. General Disclaimer: This type of disclaimer applies when a beneficiary wants to decline all benefits, rights, and interests associated with the trust. By utilizing a general disclaimer, the beneficiary effectively removes themselves from any involvement with the trust's assets and provisions. 2. Partial Disclaimer: In some cases, a beneficiary may want to disclaim only a portion of their rights or interest under the trust. This can be done through a partial disclaimer, which allows the beneficiary to specify which specific assets or benefits they wish to waive, while still retaining others. 3. Qualified Disclaimer: A qualified disclaimer refers to an action taken by a beneficiary to disclaim their rights in a specific manner recognized by the Internal Revenue Service (IRS). By complying with specific criteria outlined by the IRS, the beneficiary may be able to achieve certain tax benefits or avoid potential tax liabilities associated with the trust assets. 4. Time-Limited Disclaimer: This type of disclaimer allows the beneficiary to disclaim their rights under the trust for a specified period. This can be useful in situations where the beneficiary may want to revisit their decision at a later time or based on certain conditions. It is important to consult with legal professionals and financial advisors to fully understand the implications and requirements of an Escondido California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. Individual circumstances may differ, and it is always recommended seeking specialized advice to ensure compliance with relevant laws and regulations.

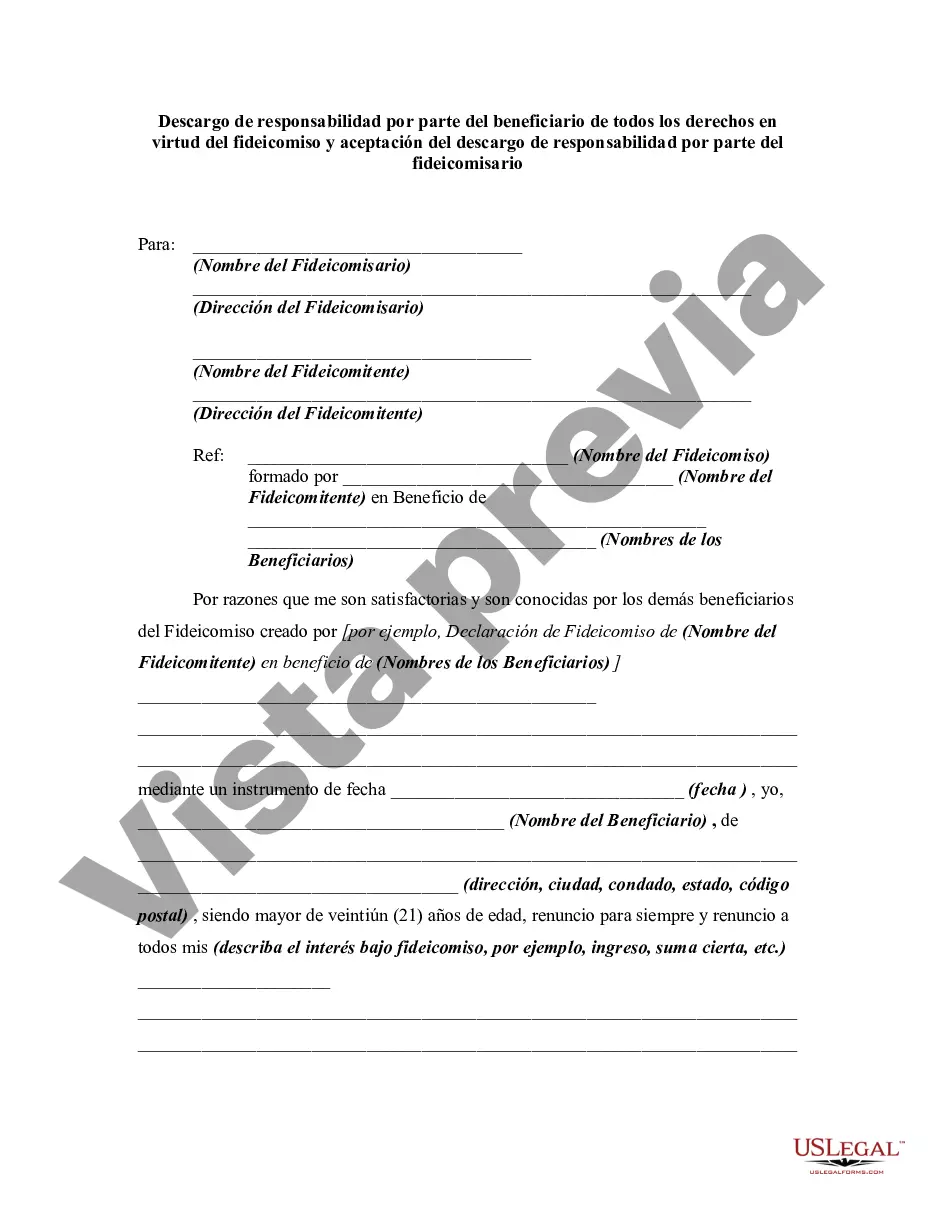

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.