A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which he/she refuses to accept an estate which has been conveyed to him/her. In this instrument, the beneficiary of a trust is disclaiming any rights he/she has in the trust.

Fullerton California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legally binding document that outlines the relinquishment of a beneficiary's rights and interests in a trust, along with the acceptance of this disclaimer by the trustee. This type of disclaimer is crucial in estate planning to ensure a smooth transition of assets and avoid potential complications. Keywords: Fullerton California, Disclaimer, Beneficiary, Rights under Trust, Acceptance, Trustee. Types of Fullerton California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee: 1. Interests and Rights Relinquishment: This type of disclaimer involves the beneficiary surrendering any rights or claims to the assets held within the trust. By signing the disclaimer, the beneficiary disclaims their present or future interests, including any income, gains, or distributions that may arise from the trust. 2. Acceptance of Disclaimer by Trustee: The trustee plays a significant role in the Fullerton California Disclaimer by Beneficiary. This type involves the trustee acknowledging and accepting the beneficiary's disclaimer, absolving them from any liabilities or responsibilities associated with the beneficiary's interests under the trust. 3. Fullerton California Trust Administration: The Fullerton California Disclaimer by Beneficiary is an essential component of the trust administration process. It allows for the smooth transfer of assets and ensures compliance with state laws and regulations. 4. Estate Planning and Probate: This disclaimer is commonly used within the context of estate planning and probate proceedings. Beneficiaries may choose to disclaim their interests in a trust to redirect assets to other beneficiaries or to minimize tax implications. 5. Tax Planning: Fullerton California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is an effective tax planning strategy. By disclaiming certain assets or interests in a trust, the beneficiary can bypass or redirect potential tax liabilities. In conclusion, the Fullerton California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a vital legal document within estate planning and trust administration. It allows beneficiaries to relinquish their rights and interests in a trust, ensuring a smooth transfer of assets while addressing potential tax implications. Trustee acceptance is essential to validate the disclaimer and acknowledged the beneficiary's decision effectively.Fullerton California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legally binding document that outlines the relinquishment of a beneficiary's rights and interests in a trust, along with the acceptance of this disclaimer by the trustee. This type of disclaimer is crucial in estate planning to ensure a smooth transition of assets and avoid potential complications. Keywords: Fullerton California, Disclaimer, Beneficiary, Rights under Trust, Acceptance, Trustee. Types of Fullerton California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee: 1. Interests and Rights Relinquishment: This type of disclaimer involves the beneficiary surrendering any rights or claims to the assets held within the trust. By signing the disclaimer, the beneficiary disclaims their present or future interests, including any income, gains, or distributions that may arise from the trust. 2. Acceptance of Disclaimer by Trustee: The trustee plays a significant role in the Fullerton California Disclaimer by Beneficiary. This type involves the trustee acknowledging and accepting the beneficiary's disclaimer, absolving them from any liabilities or responsibilities associated with the beneficiary's interests under the trust. 3. Fullerton California Trust Administration: The Fullerton California Disclaimer by Beneficiary is an essential component of the trust administration process. It allows for the smooth transfer of assets and ensures compliance with state laws and regulations. 4. Estate Planning and Probate: This disclaimer is commonly used within the context of estate planning and probate proceedings. Beneficiaries may choose to disclaim their interests in a trust to redirect assets to other beneficiaries or to minimize tax implications. 5. Tax Planning: Fullerton California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is an effective tax planning strategy. By disclaiming certain assets or interests in a trust, the beneficiary can bypass or redirect potential tax liabilities. In conclusion, the Fullerton California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a vital legal document within estate planning and trust administration. It allows beneficiaries to relinquish their rights and interests in a trust, ensuring a smooth transfer of assets while addressing potential tax implications. Trustee acceptance is essential to validate the disclaimer and acknowledged the beneficiary's decision effectively.

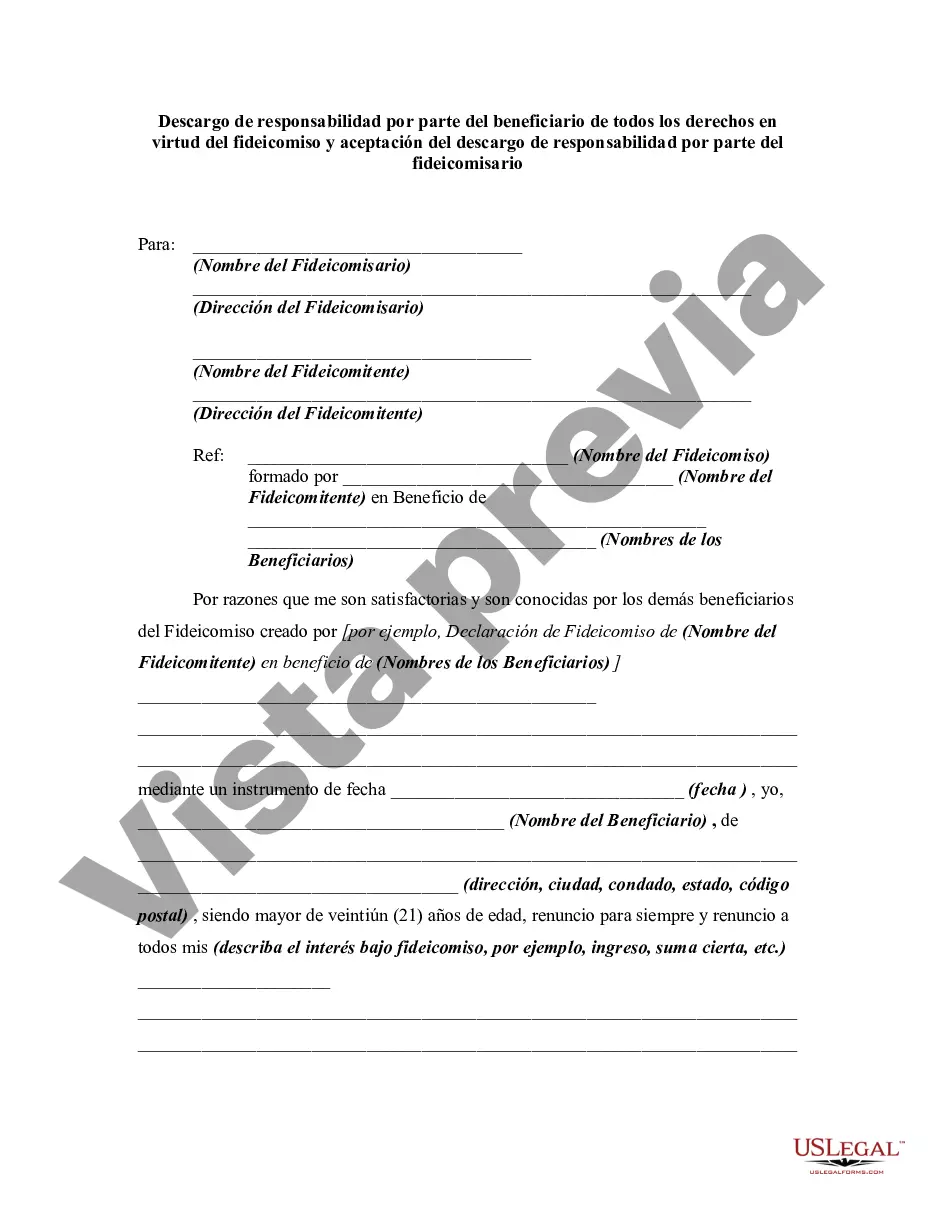

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.