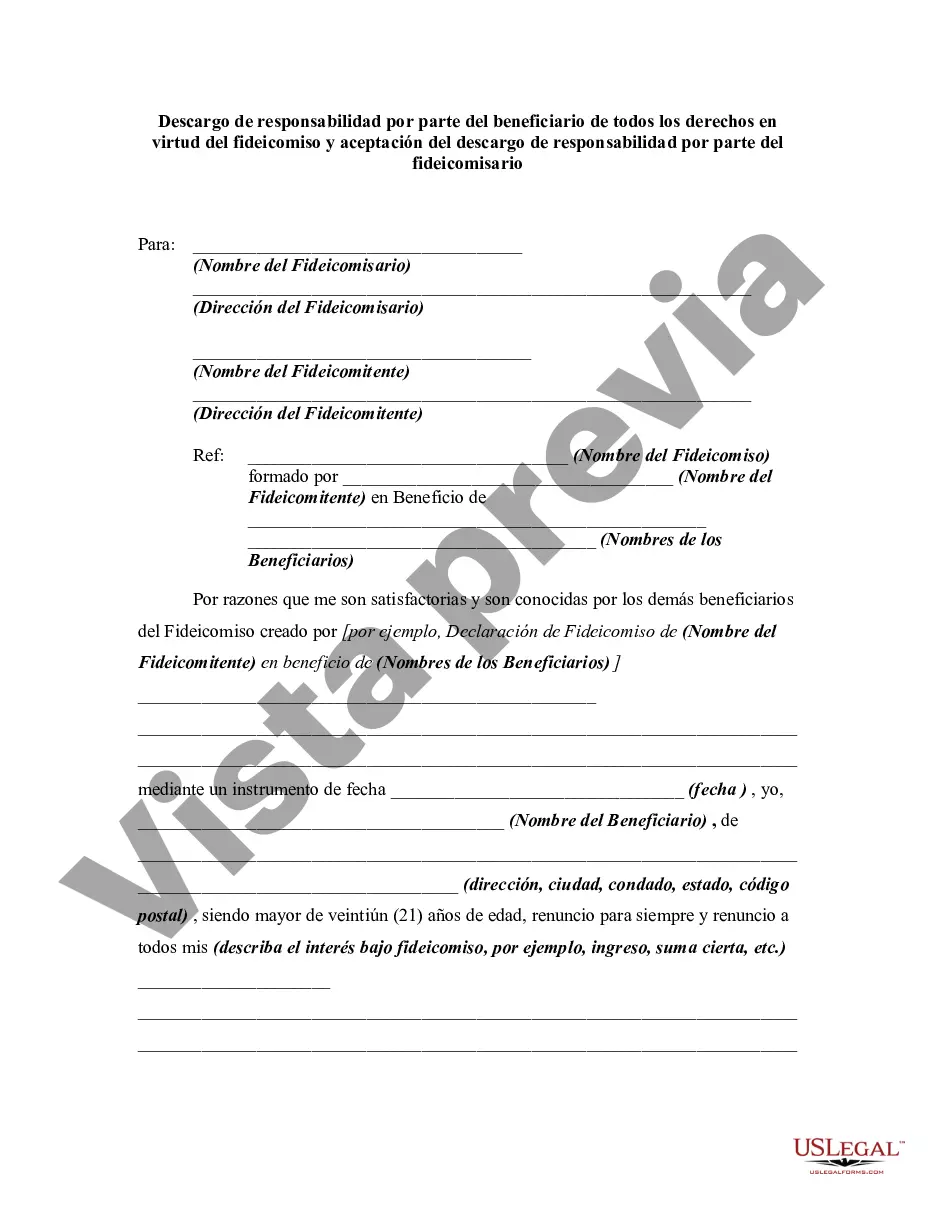

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which he/she refuses to accept an estate which has been conveyed to him/her. In this instrument, the beneficiary of a trust is disclaiming any rights he/she has in the trust.

Title: Huntington Beach California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee: Explained Introduction: In Huntington Beach, California, beneficiaries of trusts may choose to disclaim their rights under a trust, while trustees must accept such disclaimers. This article provides a detailed description of the Huntington Beach California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, including types of disclaimers one can make. 1. Understanding the Huntington Beach California Disclaimer by Beneficiary: The Huntington Beach California Disclaimer by Beneficiary of all Rights under Trust refers to the act of renouncing or disclaiming one's rights as a beneficiary in a trust. By doing so, the beneficiary relinquishes their entitlement to the trust's assets, distributions, or any other benefits associated with the trust. This disclaimer can have various implications and benefits for both beneficiaries and trustees. 2. The Role of the Trustee: The Trustee plays a crucial role in the Huntington Beach California Disclaimer process. They act as the recipient of the beneficiary disclaimer and are responsible for accepting it. Once accepted, the trustee acknowledges and carries out the wishes of the beneficiary to disclaim their rights under the trust. This can involve redistributing the disclaimed assets to other beneficiaries or fulfilling alternative arrangements outlined in the trust. 3. Types of Huntington Beach California Disclaimer by Beneficiary: a) Partial Disclaimer: A Partial Disclaimer allows a beneficiary to disclaim only a specific portion or interest in the trust rather than the entire trust. For example, a beneficiary may choose to disclaim a specific asset or a percentage of their inheritance under the trust while retaining the rest. b) Specific Asset Disclaimer: This type of disclaimer allows a beneficiary to renounce their rights to a specific asset or property within the trust, usually due to personal reasons such as tax implications or incapacity to manage that particular asset. c) Conditional Disclaimer: In some cases, beneficiaries may choose to disclaim their rights under the trust but with certain conditions. For instance, a beneficiary might disclaim their rights unless a specific event occurs, or the asset's value reaches a specific threshold. 4. How to Execute the Disclaimer: To execute the Huntington Beach California Disclaimer by Beneficiary, the beneficiary must file a written disclaimer with the trustee, expressing their intent to disclaim all or a portion of their rights under the trust. The disclaimer must meet legal requirements and deadlines to be valid and enforceable. 5. Benefits and Considerations: i) Tax Planning: Disclaiming assets under a trust can have positive tax implications for beneficiaries, allowing them to minimize their tax burden or preserve eligibility for certain government benefits. ii) Protection against Creditors: Disclaiming assets may safeguard beneficiaries from creditors seeking to collect debts, as the renounced assets are no longer part of their estate. iii) Preserve Family Harmony: Disclaiming inherited assets can prevent potential conflicts among beneficiaries, ensuring the equitable distribution of trust assets. Conclusion: Understanding the Huntington Beach California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is vital for both beneficiaries and trustees. This comprehensive overview explains the concept of the disclaimer, the role of trustees, different types of disclaimers available, execution procedures, and the potential benefits associated with disclaiming trust assets.Title: Huntington Beach California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee: Explained Introduction: In Huntington Beach, California, beneficiaries of trusts may choose to disclaim their rights under a trust, while trustees must accept such disclaimers. This article provides a detailed description of the Huntington Beach California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, including types of disclaimers one can make. 1. Understanding the Huntington Beach California Disclaimer by Beneficiary: The Huntington Beach California Disclaimer by Beneficiary of all Rights under Trust refers to the act of renouncing or disclaiming one's rights as a beneficiary in a trust. By doing so, the beneficiary relinquishes their entitlement to the trust's assets, distributions, or any other benefits associated with the trust. This disclaimer can have various implications and benefits for both beneficiaries and trustees. 2. The Role of the Trustee: The Trustee plays a crucial role in the Huntington Beach California Disclaimer process. They act as the recipient of the beneficiary disclaimer and are responsible for accepting it. Once accepted, the trustee acknowledges and carries out the wishes of the beneficiary to disclaim their rights under the trust. This can involve redistributing the disclaimed assets to other beneficiaries or fulfilling alternative arrangements outlined in the trust. 3. Types of Huntington Beach California Disclaimer by Beneficiary: a) Partial Disclaimer: A Partial Disclaimer allows a beneficiary to disclaim only a specific portion or interest in the trust rather than the entire trust. For example, a beneficiary may choose to disclaim a specific asset or a percentage of their inheritance under the trust while retaining the rest. b) Specific Asset Disclaimer: This type of disclaimer allows a beneficiary to renounce their rights to a specific asset or property within the trust, usually due to personal reasons such as tax implications or incapacity to manage that particular asset. c) Conditional Disclaimer: In some cases, beneficiaries may choose to disclaim their rights under the trust but with certain conditions. For instance, a beneficiary might disclaim their rights unless a specific event occurs, or the asset's value reaches a specific threshold. 4. How to Execute the Disclaimer: To execute the Huntington Beach California Disclaimer by Beneficiary, the beneficiary must file a written disclaimer with the trustee, expressing their intent to disclaim all or a portion of their rights under the trust. The disclaimer must meet legal requirements and deadlines to be valid and enforceable. 5. Benefits and Considerations: i) Tax Planning: Disclaiming assets under a trust can have positive tax implications for beneficiaries, allowing them to minimize their tax burden or preserve eligibility for certain government benefits. ii) Protection against Creditors: Disclaiming assets may safeguard beneficiaries from creditors seeking to collect debts, as the renounced assets are no longer part of their estate. iii) Preserve Family Harmony: Disclaiming inherited assets can prevent potential conflicts among beneficiaries, ensuring the equitable distribution of trust assets. Conclusion: Understanding the Huntington Beach California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is vital for both beneficiaries and trustees. This comprehensive overview explains the concept of the disclaimer, the role of trustees, different types of disclaimers available, execution procedures, and the potential benefits associated with disclaiming trust assets.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.