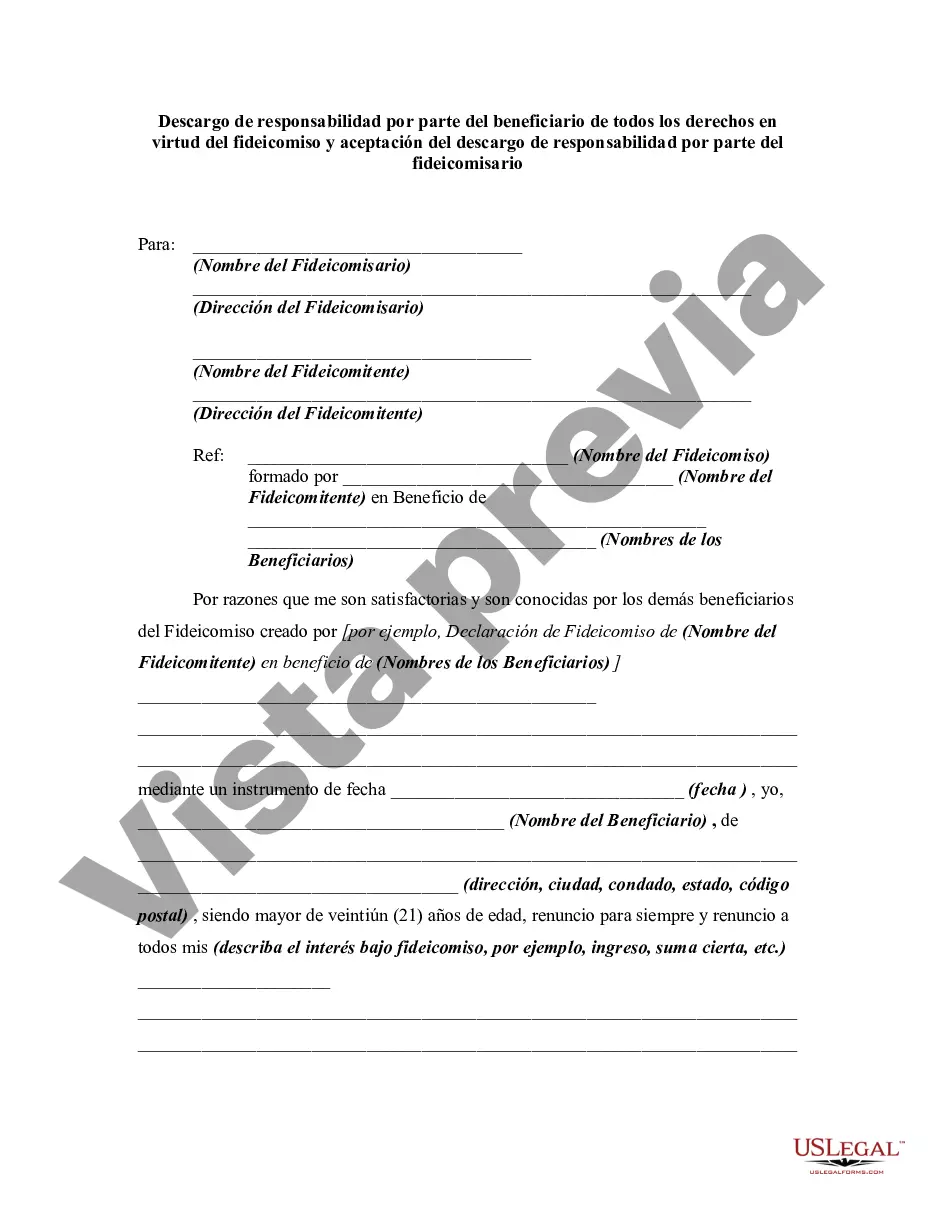

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which he/she refuses to accept an estate which has been conveyed to him/her. In this instrument, the beneficiary of a trust is disclaiming any rights he/she has in the trust.

Orange California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal document that outlines the voluntary relinquishment of a beneficiary's rights under a trust in Orange, California. This disclaimer allows the beneficiary to refuse their entitlement to assets and benefits that would have been passed on to them through the trust. The Trustee also needs to accept and approve this disclaimer for it to take effect. This type of disclaimer is commonly used when a beneficiary chooses not to accept their rights or inheritance for various reasons. It could be due to tax considerations, desire to avoid certain obligations tied to the assets, or simply personal preference. In Orange, California, there are different types of disclaimers that beneficiaries may choose to utilize. Some of these include: 1. Total Disclaimer: This is the most common type of disclaimer, where the beneficiary fully renounces all their rights, including all assets, income, and any other benefits associated with the trust. By doing so, they effectively pass on their portion of the trust to the contingent beneficiaries or follow the order of succession set forth in the trust agreement. 2. Partial Disclaimer: It is also possible for a beneficiary to partially disclaim their entitlements. In this case, they would specify which assets or benefits they wish to disclaim while retaining others. This can be a useful option if the beneficiary wants to avoid receiving assets that may come with substantial tax burdens or responsibilities. 3. Qualified Disclaimer: A qualified disclaimer is a special type of disclaimer that allows a beneficiary to disclaim their rights under a trust with the intention of redirecting the assets to someone else. By utilizing a qualified disclaimer, the beneficiary can ensure that the assets pass directly to another individual or entity, without being subject to gift or estate taxes. It is essential for both the beneficiary and the trustee to understand the legal implications and consequences of making and accepting a disclaimer. Consulting with a knowledgeable attorney in Orange, California, who specializes in estate planning and trusts, is highly recommended navigating the complexities and ensure compliance with state laws. Please note that this content is a general description and may not cover all specific details or variations of the Orange California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.Orange California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal document that outlines the voluntary relinquishment of a beneficiary's rights under a trust in Orange, California. This disclaimer allows the beneficiary to refuse their entitlement to assets and benefits that would have been passed on to them through the trust. The Trustee also needs to accept and approve this disclaimer for it to take effect. This type of disclaimer is commonly used when a beneficiary chooses not to accept their rights or inheritance for various reasons. It could be due to tax considerations, desire to avoid certain obligations tied to the assets, or simply personal preference. In Orange, California, there are different types of disclaimers that beneficiaries may choose to utilize. Some of these include: 1. Total Disclaimer: This is the most common type of disclaimer, where the beneficiary fully renounces all their rights, including all assets, income, and any other benefits associated with the trust. By doing so, they effectively pass on their portion of the trust to the contingent beneficiaries or follow the order of succession set forth in the trust agreement. 2. Partial Disclaimer: It is also possible for a beneficiary to partially disclaim their entitlements. In this case, they would specify which assets or benefits they wish to disclaim while retaining others. This can be a useful option if the beneficiary wants to avoid receiving assets that may come with substantial tax burdens or responsibilities. 3. Qualified Disclaimer: A qualified disclaimer is a special type of disclaimer that allows a beneficiary to disclaim their rights under a trust with the intention of redirecting the assets to someone else. By utilizing a qualified disclaimer, the beneficiary can ensure that the assets pass directly to another individual or entity, without being subject to gift or estate taxes. It is essential for both the beneficiary and the trustee to understand the legal implications and consequences of making and accepting a disclaimer. Consulting with a knowledgeable attorney in Orange, California, who specializes in estate planning and trusts, is highly recommended navigating the complexities and ensure compliance with state laws. Please note that this content is a general description and may not cover all specific details or variations of the Orange California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.