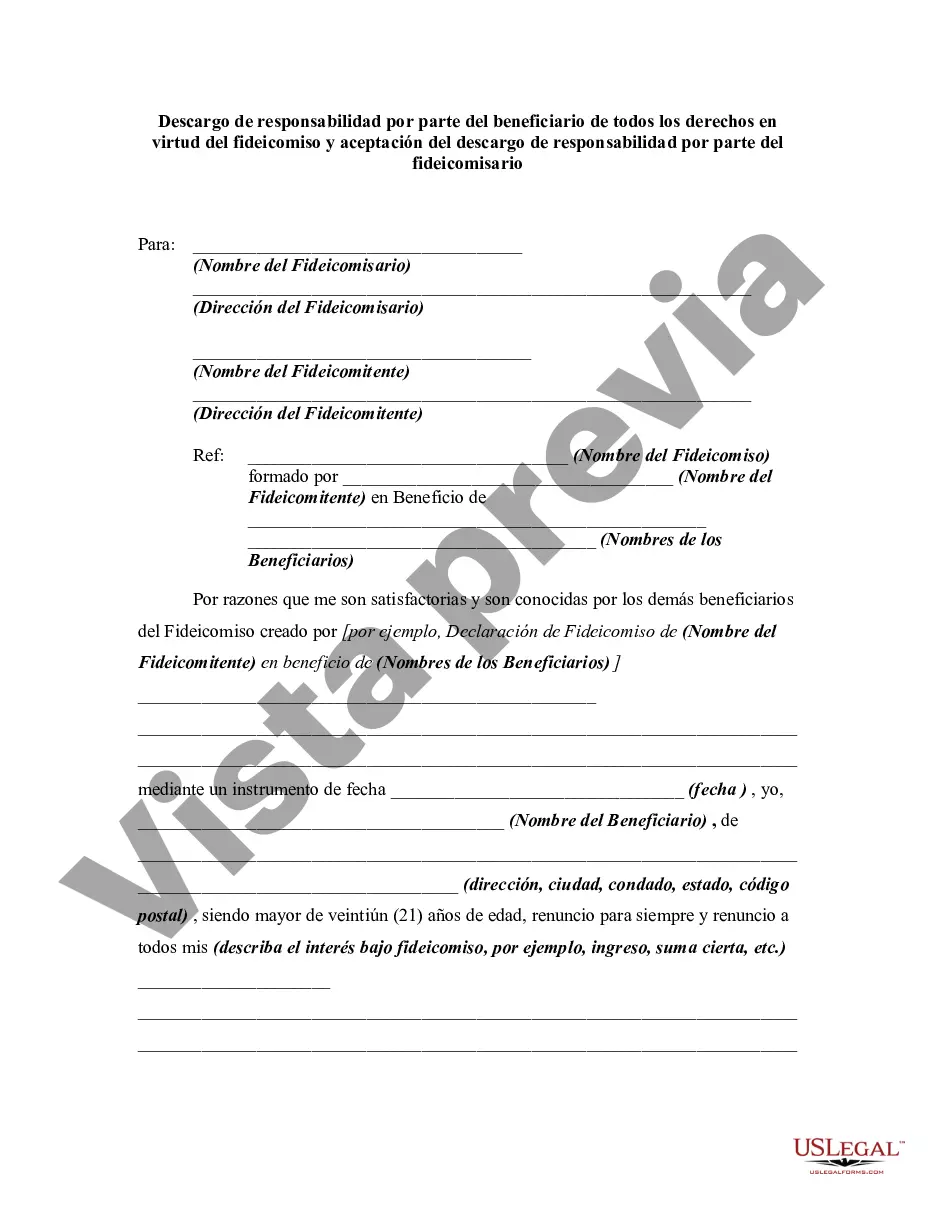

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which he/she refuses to accept an estate which has been conveyed to him/her. In this instrument, the beneficiary of a trust is disclaiming any rights he/she has in the trust.

Riverside California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee In estate planning, the Riverside California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal document used to disclaim or renounce certain property rights or interests in a trust. This disclaimer allows a beneficiary to decline their entitlements to specific assets, which will then pass to an alternate beneficiary or follow the terms of the trust document. The Riverside California Disclaimer by Beneficiary is a vital tool for beneficiaries of trusts who may wish to refuse their inheritance due to various reasons, including tax implications, personal financial planning, or avoiding certain legal responsibilities associated with the assets. By disclaiming these rights, beneficiaries can protect their interests and ensure the assets pass according to the trust provisions. When a beneficiary decides to utilize the Riverside California Disclaimer, it is important to understand its implications and the necessary steps involved. Here is a step-by-step guide to navigating the process: 1. Consultation with an Attorney: Before taking any action, it is highly recommended consulting with an experienced estate planning attorney familiar with Riverside, California laws. They will provide guidance based on the individual's unique circumstances and help determine whether a disclaimer is the appropriate course of action. 2. Review Trust Document: The beneficiary must thoroughly review the trust instrument to understand the specific provisions, rights, and interests they stand to disclaim. It is essential to ensure that the disclaimer conforms to the trust's terms, as any deviation could result in unintended consequences. 3. Timely Execution: According to the Riverside, California laws, a beneficiary must execute the disclaimer within a specific timeframe. The disclaimer should be in writing, signed by the beneficiary, and notarized to be legally binding. 4. Delivery to Trustee: The beneficiary must deliver the executed disclaimer to the trustee responsible for administering the trust. It is crucial to follow the trust document's instructions regarding the delivery method and ensure proper documentation and proof of delivery are retained. 5. Trustee's Acceptance: Once the trustee receives the disclaimer, they must accept it explicitly in writing. The trust document may specify the timeframe within which the acceptance should occur. The trustee's acceptance legally finalizes the beneficiary's disclaimer, and the assets will then pass according to the trust's terms. It is important to note that there are different types of Riverside California Disclaimers by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, with the most common being a full disclaimer and a partial disclaimer. 1. Full Disclaimer: In a full disclaimer, the beneficiary completely renounces their rights under the trust, disclaiming their inheritance entirely. This means the assets will bypass the beneficiary and pass to an alternative beneficiary or follow the trust's provisions for contingent beneficiaries. 2. Partial Disclaimer: A partial disclaimer allows a beneficiary to disclaim specific portions or assets within the trust while retaining other interests. This can be useful when certain assets may have adverse tax consequences or when the beneficiary wants to limit their personal liability regarding specific assets. In conclusion, the Riverside California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee provides beneficiaries with a legal mechanism to disclaim their rights and interests in a trust. Consulting with an attorney knowledgeable in Riverside's laws is crucial to ensure compliance with the necessary steps and proper execution of the disclaimer. By utilizing this powerful tool, beneficiaries can effectively manage their inheritance while safeguarding their financial well-being.Riverside California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee In estate planning, the Riverside California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal document used to disclaim or renounce certain property rights or interests in a trust. This disclaimer allows a beneficiary to decline their entitlements to specific assets, which will then pass to an alternate beneficiary or follow the terms of the trust document. The Riverside California Disclaimer by Beneficiary is a vital tool for beneficiaries of trusts who may wish to refuse their inheritance due to various reasons, including tax implications, personal financial planning, or avoiding certain legal responsibilities associated with the assets. By disclaiming these rights, beneficiaries can protect their interests and ensure the assets pass according to the trust provisions. When a beneficiary decides to utilize the Riverside California Disclaimer, it is important to understand its implications and the necessary steps involved. Here is a step-by-step guide to navigating the process: 1. Consultation with an Attorney: Before taking any action, it is highly recommended consulting with an experienced estate planning attorney familiar with Riverside, California laws. They will provide guidance based on the individual's unique circumstances and help determine whether a disclaimer is the appropriate course of action. 2. Review Trust Document: The beneficiary must thoroughly review the trust instrument to understand the specific provisions, rights, and interests they stand to disclaim. It is essential to ensure that the disclaimer conforms to the trust's terms, as any deviation could result in unintended consequences. 3. Timely Execution: According to the Riverside, California laws, a beneficiary must execute the disclaimer within a specific timeframe. The disclaimer should be in writing, signed by the beneficiary, and notarized to be legally binding. 4. Delivery to Trustee: The beneficiary must deliver the executed disclaimer to the trustee responsible for administering the trust. It is crucial to follow the trust document's instructions regarding the delivery method and ensure proper documentation and proof of delivery are retained. 5. Trustee's Acceptance: Once the trustee receives the disclaimer, they must accept it explicitly in writing. The trust document may specify the timeframe within which the acceptance should occur. The trustee's acceptance legally finalizes the beneficiary's disclaimer, and the assets will then pass according to the trust's terms. It is important to note that there are different types of Riverside California Disclaimers by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, with the most common being a full disclaimer and a partial disclaimer. 1. Full Disclaimer: In a full disclaimer, the beneficiary completely renounces their rights under the trust, disclaiming their inheritance entirely. This means the assets will bypass the beneficiary and pass to an alternative beneficiary or follow the trust's provisions for contingent beneficiaries. 2. Partial Disclaimer: A partial disclaimer allows a beneficiary to disclaim specific portions or assets within the trust while retaining other interests. This can be useful when certain assets may have adverse tax consequences or when the beneficiary wants to limit their personal liability regarding specific assets. In conclusion, the Riverside California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee provides beneficiaries with a legal mechanism to disclaim their rights and interests in a trust. Consulting with an attorney knowledgeable in Riverside's laws is crucial to ensure compliance with the necessary steps and proper execution of the disclaimer. By utilizing this powerful tool, beneficiaries can effectively manage their inheritance while safeguarding their financial well-being.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.