A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which he/she refuses to accept an estate which has been conveyed to him/her. In this instrument, the beneficiary of a trust is disclaiming any rights he/she has in the trust.

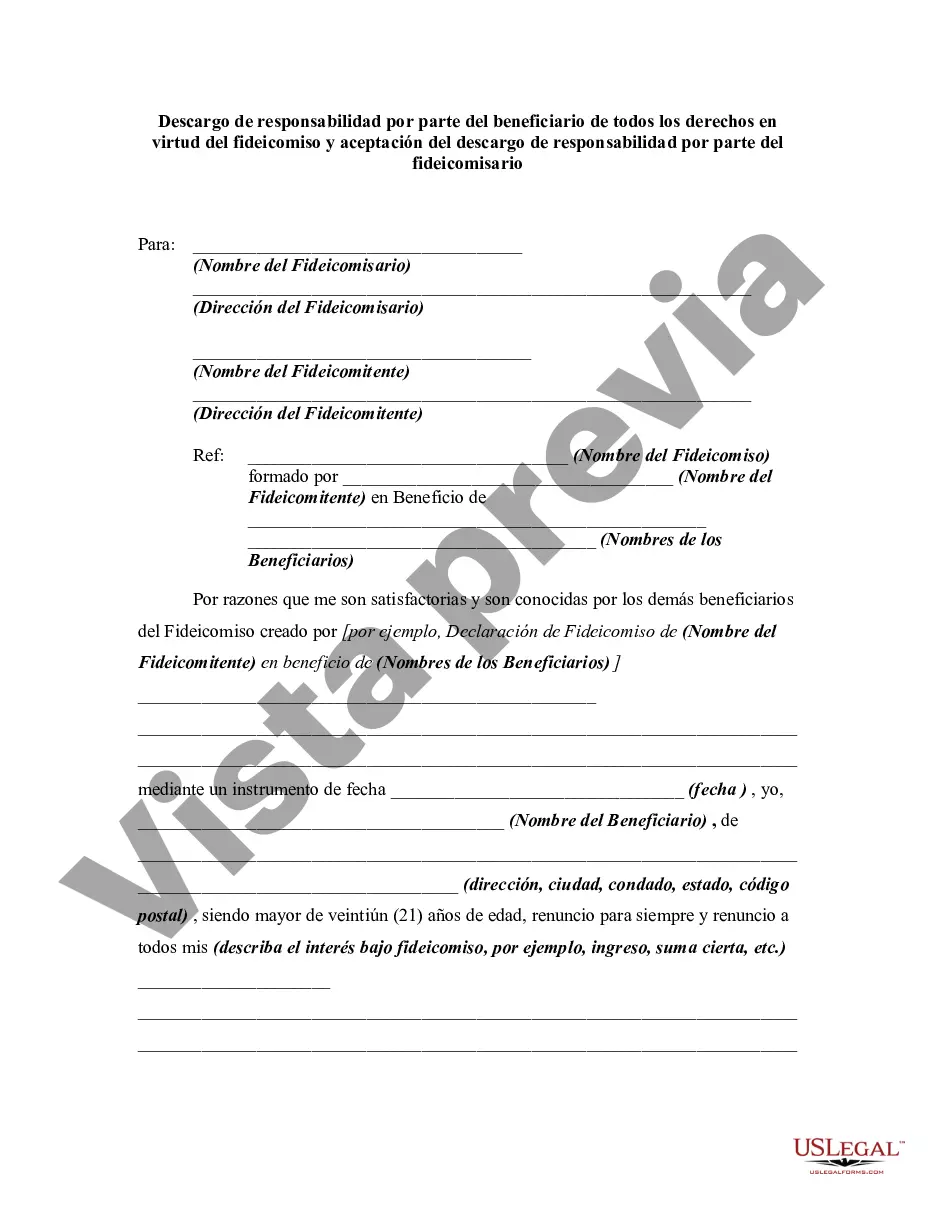

A San Diego California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal document that outlines the relinquishment of certain rights and responsibilities by a beneficiary under a trust. The disclaimer is made by the beneficiary to disclaim or renounce their entitlement to specific assets and benefits that they would otherwise be entitled to receive. In this legal instrument, the beneficiary openly declares their intention not to accept any interest or rights to the assets held by the trust. By doing so, the beneficiary waives their right to receive distributions, income, or any other benefits from the trust. The disclaimer also ensures that the beneficiary is not liable for any debts, obligations, or taxes associated with the trust. The role of the trustee is crucial in this process, as they must also accept the beneficiary's disclaimer. Acceptance by the trustee signifies their agreement to fully release the beneficiary from any obligations and to duly administer the trust assets without interference from the disclaiming party. It is important to note that there can be different types of San Diego California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. These variations may include: 1. Full Disclaimer: This type of disclaimer occurs when a beneficiary renounces all their entitlements and rights conferred upon them by the trust. By doing so, they effectively remove themselves entirely from the trust's operations and disbursements. 2. Partial Disclaimer: In some cases, a beneficiary may choose to disclaim only certain assets or benefits provided by the trust, while accepting others. This allows the beneficiary to selectively forgo specific assets or responsibilities while retaining others. 3. Qualified Disclaimer: A qualified disclaimer is one that meets specific legal requirements outlined by the Internal Revenue Service (IRS), ensuring that there are no adverse tax consequences for the disclaiming beneficiary. This type of disclaimer allows the assets to pass to other beneficiaries or heirs, as if the disclaiming beneficiary had never been entitled to them. In conclusion, a San Diego California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is an essential legal document that enables a beneficiary to formally decline their rights to assets and benefits under a trust. The trustee plays a vital role in accepting this disclaimer, ensuring a smooth administration and distribution of the trust's assets.A San Diego California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal document that outlines the relinquishment of certain rights and responsibilities by a beneficiary under a trust. The disclaimer is made by the beneficiary to disclaim or renounce their entitlement to specific assets and benefits that they would otherwise be entitled to receive. In this legal instrument, the beneficiary openly declares their intention not to accept any interest or rights to the assets held by the trust. By doing so, the beneficiary waives their right to receive distributions, income, or any other benefits from the trust. The disclaimer also ensures that the beneficiary is not liable for any debts, obligations, or taxes associated with the trust. The role of the trustee is crucial in this process, as they must also accept the beneficiary's disclaimer. Acceptance by the trustee signifies their agreement to fully release the beneficiary from any obligations and to duly administer the trust assets without interference from the disclaiming party. It is important to note that there can be different types of San Diego California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. These variations may include: 1. Full Disclaimer: This type of disclaimer occurs when a beneficiary renounces all their entitlements and rights conferred upon them by the trust. By doing so, they effectively remove themselves entirely from the trust's operations and disbursements. 2. Partial Disclaimer: In some cases, a beneficiary may choose to disclaim only certain assets or benefits provided by the trust, while accepting others. This allows the beneficiary to selectively forgo specific assets or responsibilities while retaining others. 3. Qualified Disclaimer: A qualified disclaimer is one that meets specific legal requirements outlined by the Internal Revenue Service (IRS), ensuring that there are no adverse tax consequences for the disclaiming beneficiary. This type of disclaimer allows the assets to pass to other beneficiaries or heirs, as if the disclaiming beneficiary had never been entitled to them. In conclusion, a San Diego California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is an essential legal document that enables a beneficiary to formally decline their rights to assets and benefits under a trust. The trustee plays a vital role in accepting this disclaimer, ensuring a smooth administration and distribution of the trust's assets.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.