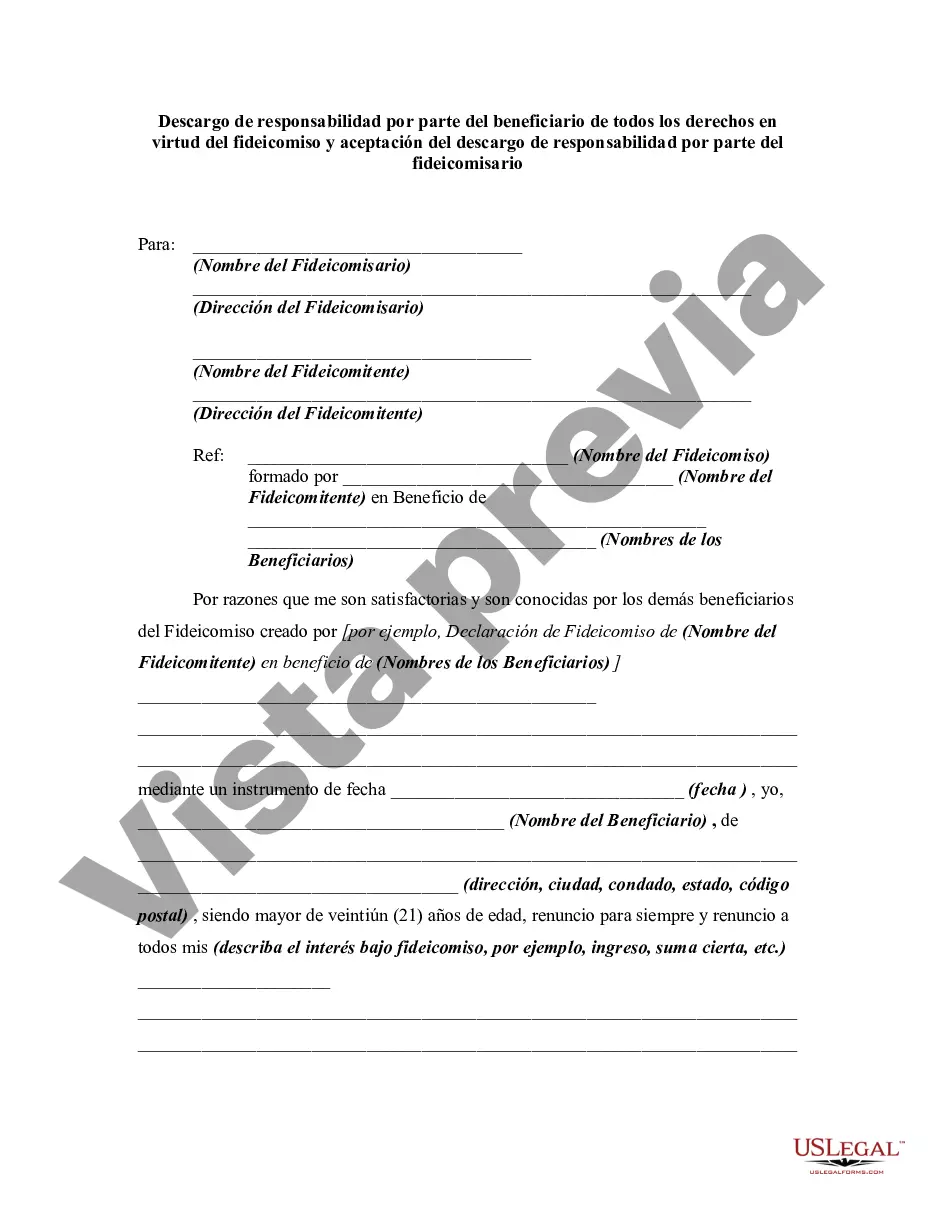

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which he/she refuses to accept an estate which has been conveyed to him/her. In this instrument, the beneficiary of a trust is disclaiming any rights he/she has in the trust.

Title: Understanding the Stockton California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee Introduction: In the legal realm of Stockton, California, a common practice in the field of trusts involves a particular document called the Stockton California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. This legal instrument establishes the beneficiary's decision to disclaim or renounce their rights, interests, or responsibilities as a beneficiary in a trust. In this article, we will provide a detailed explanation of this disclaimer, its relevance, and various types that might exist. 1. What is a Stockton California Disclaimer? A Stockton California Disclaimer refers to a legal document that allows a beneficiary of a trust to formally decline their rights, interests, or duties under the trust. By signing this disclaimer, the beneficiary voluntarily waives their entitlements, thereby providing opportunities to redirect ownership of trust assets or pass them directly to other beneficiaries or heirs. 2. The Importance and Benefits of a Stockton California Disclaimer: — Flexibility: A disclaimer offers flexibility in estate planning, enabling the beneficiary to redirect assets to alternative heirs, either within the same generation or a subsequent one. — Tax Efficiency: Disclaiming an inheritance can have significant tax advantages for both the beneficiary and the trust, as it may lead to a reduced tax liability or avoidance of estate taxes. — Asset Protection: In some cases, disclaiming assets can protect them from creditors or potential lawsuits, as the disclaimed assets are considered never to have been part of the beneficiary's estate. 3. Stockton California Disclaimer by Beneficiary of all Rights under Trust: This type of disclaimer by a beneficiary renounces all rights, interests, or responsibilities related to a trust. It allows the beneficiary to refuse their claim to assets, benefits, or distributions, effectively eliminating any further involvement with the trust. 4. Acceptance of Disclaimer by Trustee: The acceptance of the disclaimer by the trustee is a critical component. The trustee must provide formal acceptance to ensure the disclaimer's validity and enforceability. Acceptance typically occurs through written acknowledgment or consent from the trustee. Conclusion: The Stockton California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is an essential legal tool utilized in trust-related matters within Stockton, California. It grants beneficiaries the ability to disclaim their rights, interests, and responsibilities in a trust, allowing for increased flexibility, tax efficiency, and asset protection. By understanding the different aspects of this disclaimer, beneficiaries and trustees can make informed decisions when navigating trusts and estate planning in Stockton, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.