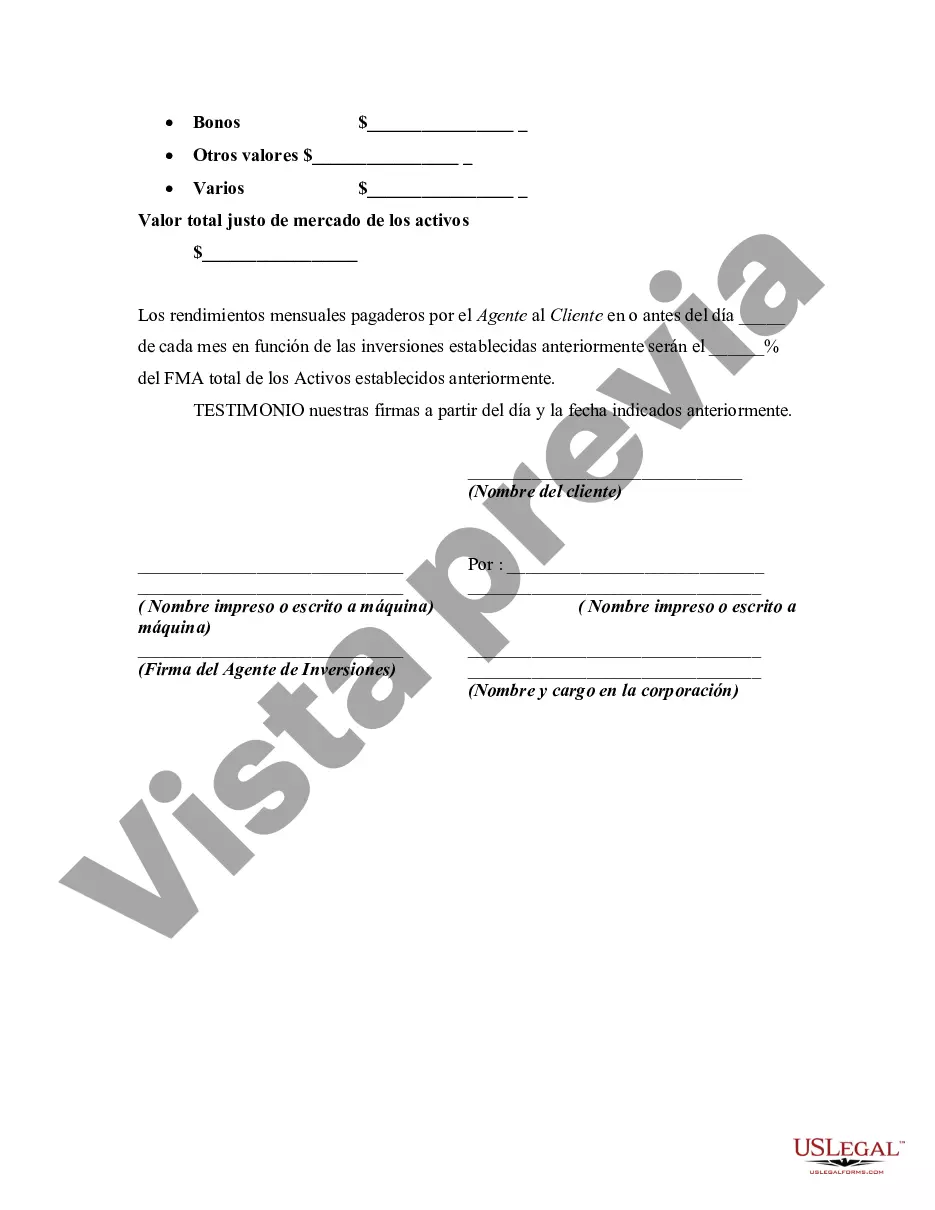

This form is an agreement between an independent investment agent (or consultant) and a corporation whereby the investment agent actually holds the investments as well as makes them for the client. We are assuming that the investment agent is duly licensed to perform this activity and will make any necessary filings with the state of California and the United States.

The Carlsbad California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client is a legally binding contract that outlines the terms and conditions between an investment agent and a client in Carlsbad, California. This agreement governs the agent's responsibilities, rights, and obligations when purchasing and selling investments on behalf of the client. Keywords: Carlsbad California, Agreement, Services, Investment Agent, Agent, Purchase, Sell, Investments, Benefit, Client. Types of Carlsbad California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client may include: 1. Basic Agreement: The basic agreement establishes the general terms and conditions of the relationship between the investment agent and the client. It outlines the agent's scope of authority, responsibilities, and the client's objectives for investing. 2. Financial Services Agreement: This type of agreement specifically focuses on the financial services provided by the investment agent. It may cover services like investment advisory, portfolio management, or financial planning. 3. Limited Power of Attorney Agreement: In some cases, the client may grant a limited power of attorney to the investment agent. This agreement will define the extent of the agent's authority to make investment decisions and execute transactions on behalf of the client. 4. Fee Agreement: The fee agreement details the compensation structure between the investment agent and the client. It may include commissions, fees, or expenses associated with the purchase and sale of investments. 5. Discretionary Managed Account Agreement: This type of agreement grants the investment agent discretionary authority over the client's investment portfolio. The agreement specifies the agent's responsibilities, investment parameters, and reporting requirements. 6. Custodial Agreement: If the investment agent holds the client's investments in custody, a custodial agreement may be established. This agreement outlines the custodian's responsibilities, reporting, and the client's access to their holdings. 7. Non-Disclosure Agreement: In some scenarios, the parties may enter into a non-disclosure agreement to protect confidential information shared during the course of their relationship. This agreement ensures the confidentiality of sensitive investment strategies, proprietary data, or client-specific information. It is important to note that the exact titles and types of agreements may vary, but the underlying purpose remains to establish the terms and conditions of the investment agent-client relationship in Carlsbad, California.The Carlsbad California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client is a legally binding contract that outlines the terms and conditions between an investment agent and a client in Carlsbad, California. This agreement governs the agent's responsibilities, rights, and obligations when purchasing and selling investments on behalf of the client. Keywords: Carlsbad California, Agreement, Services, Investment Agent, Agent, Purchase, Sell, Investments, Benefit, Client. Types of Carlsbad California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client may include: 1. Basic Agreement: The basic agreement establishes the general terms and conditions of the relationship between the investment agent and the client. It outlines the agent's scope of authority, responsibilities, and the client's objectives for investing. 2. Financial Services Agreement: This type of agreement specifically focuses on the financial services provided by the investment agent. It may cover services like investment advisory, portfolio management, or financial planning. 3. Limited Power of Attorney Agreement: In some cases, the client may grant a limited power of attorney to the investment agent. This agreement will define the extent of the agent's authority to make investment decisions and execute transactions on behalf of the client. 4. Fee Agreement: The fee agreement details the compensation structure between the investment agent and the client. It may include commissions, fees, or expenses associated with the purchase and sale of investments. 5. Discretionary Managed Account Agreement: This type of agreement grants the investment agent discretionary authority over the client's investment portfolio. The agreement specifies the agent's responsibilities, investment parameters, and reporting requirements. 6. Custodial Agreement: If the investment agent holds the client's investments in custody, a custodial agreement may be established. This agreement outlines the custodian's responsibilities, reporting, and the client's access to their holdings. 7. Non-Disclosure Agreement: In some scenarios, the parties may enter into a non-disclosure agreement to protect confidential information shared during the course of their relationship. This agreement ensures the confidentiality of sensitive investment strategies, proprietary data, or client-specific information. It is important to note that the exact titles and types of agreements may vary, but the underlying purpose remains to establish the terms and conditions of the investment agent-client relationship in Carlsbad, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.