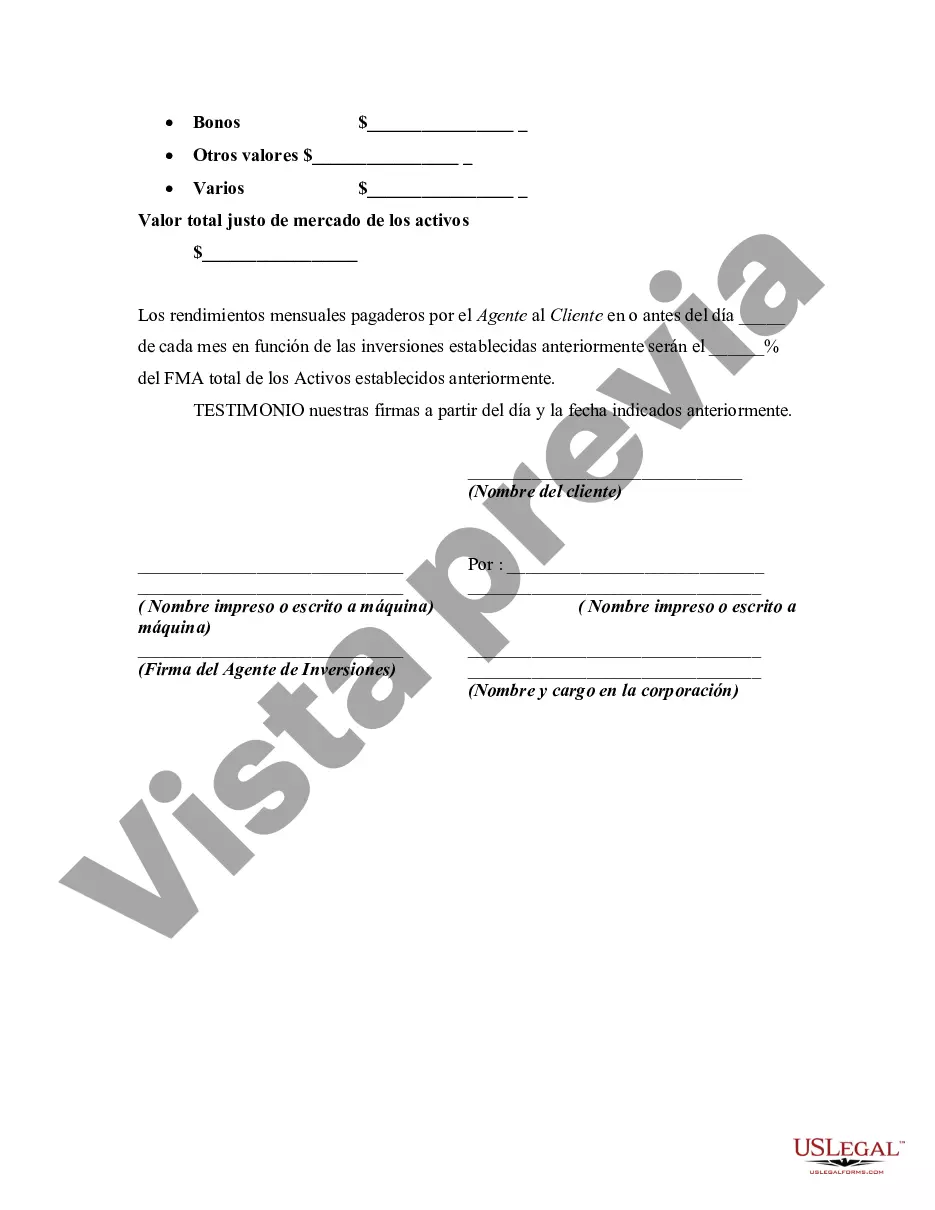

This form is an agreement between an independent investment agent (or consultant) and a corporation whereby the investment agent actually holds the investments as well as makes them for the client. We are assuming that the investment agent is duly licensed to perform this activity and will make any necessary filings with the state of California and the United States.

The Chula Vista California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client is a legal document that outlines the terms and conditions between an investment agent and their client. This agreement provides a framework within which the agent can conduct investment transactions on behalf of the client. Keywords: Chula Vista California, Agreement for Services, Investment Agent, Purchase and Sell Investments, Benefit of Client Types of Chula Vista California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client: 1. Individual Investor Agreement: This type of agreement is used when an individual seeks the services of an investment agent to manage their personal investment portfolio. The agreement outlines the scope of services, investment objectives, and compensation structure. 2. Corporate Investor Agreement: In cases where corporations or businesses require investment advisory services, this agreement is drafted. It establishes the responsibilities and obligations of the investment agent in handling the company's investments while prioritizing the client's best interests. 3. Retirement Account Agreement: This agreement pertains specifically to the management of retirement accounts, such as Individual Retirement Accounts (IRA) or 401(k) accounts. It addresses the unique considerations associated with retirement investments and outlines the agent's role in maximizing the client's long-term growth while adhering to retirement guidelines. 4. Trust Agreement: When investments are held within a trust structure, a Trust Agreement is utilized. This type of agreement specifies how the investment agent will manage the assets on behalf of the trust and its beneficiaries, ensuring compliance with the terms and objectives set forth by the trust document. 5. Non-Profit Organization Agreement: Non-profit organizations, such as foundations or endowments, may enter into an agreement with an investment agent to effectively manage their funds. This agreement outlines the responsibilities of the agent in investing and preserving the organization's assets to further their charitable mission. Regardless of the specific type of Chula Vista California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client, these agreements typically cover essential elements such as the agent's fiduciary duty, investment objectives, fee structure, authority to buy or sell investments, risk management, and termination provisions. It is crucial for both parties to carefully review and understand the terms stated in the agreement to ensure a transparent and mutually beneficial relationship.The Chula Vista California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client is a legal document that outlines the terms and conditions between an investment agent and their client. This agreement provides a framework within which the agent can conduct investment transactions on behalf of the client. Keywords: Chula Vista California, Agreement for Services, Investment Agent, Purchase and Sell Investments, Benefit of Client Types of Chula Vista California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client: 1. Individual Investor Agreement: This type of agreement is used when an individual seeks the services of an investment agent to manage their personal investment portfolio. The agreement outlines the scope of services, investment objectives, and compensation structure. 2. Corporate Investor Agreement: In cases where corporations or businesses require investment advisory services, this agreement is drafted. It establishes the responsibilities and obligations of the investment agent in handling the company's investments while prioritizing the client's best interests. 3. Retirement Account Agreement: This agreement pertains specifically to the management of retirement accounts, such as Individual Retirement Accounts (IRA) or 401(k) accounts. It addresses the unique considerations associated with retirement investments and outlines the agent's role in maximizing the client's long-term growth while adhering to retirement guidelines. 4. Trust Agreement: When investments are held within a trust structure, a Trust Agreement is utilized. This type of agreement specifies how the investment agent will manage the assets on behalf of the trust and its beneficiaries, ensuring compliance with the terms and objectives set forth by the trust document. 5. Non-Profit Organization Agreement: Non-profit organizations, such as foundations or endowments, may enter into an agreement with an investment agent to effectively manage their funds. This agreement outlines the responsibilities of the agent in investing and preserving the organization's assets to further their charitable mission. Regardless of the specific type of Chula Vista California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client, these agreements typically cover essential elements such as the agent's fiduciary duty, investment objectives, fee structure, authority to buy or sell investments, risk management, and termination provisions. It is crucial for both parties to carefully review and understand the terms stated in the agreement to ensure a transparent and mutually beneficial relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.